Don’t ask any question now just try to understand how I trade in live market

Yesterday sell 14700 than 14600 than 14800 market come down sell sell 15 k call going up sell 14400 put Getting some profit buy protection 14450 pe 14950 ce now u know ur max loss now wait or do adjustment with sell upar side ce or pe it\u2019s practical knowledge not books knowledge pic.twitter.com/J5sPGClVUZ

— itrade(DJ) (@ITRADE191) May 16, 2021

More from itrade(DJ)

More from Optionslearnings

14 "must-try" trading strategies you can start using today: 🧵

Collaborated with @niki_poojary

We'll break these into portions of:

1. Intraday Trading Techniques

2. Positional Trading Techniques

3. Indicator Applications

1/ 6 Intraday Strategies 🧵

How to Filter Stocks for Intraday

How you can filter stocks for Intraday trades - \U0001f9f5

— Sheetal Rijhwani (@RijhwaniSheetal) August 15, 2021

As a kid, we would do homework before school the next day - you have to do homework here too. A specific sector performs on a particular day and studying things a day before will help you spot that particular sector. (1/11)

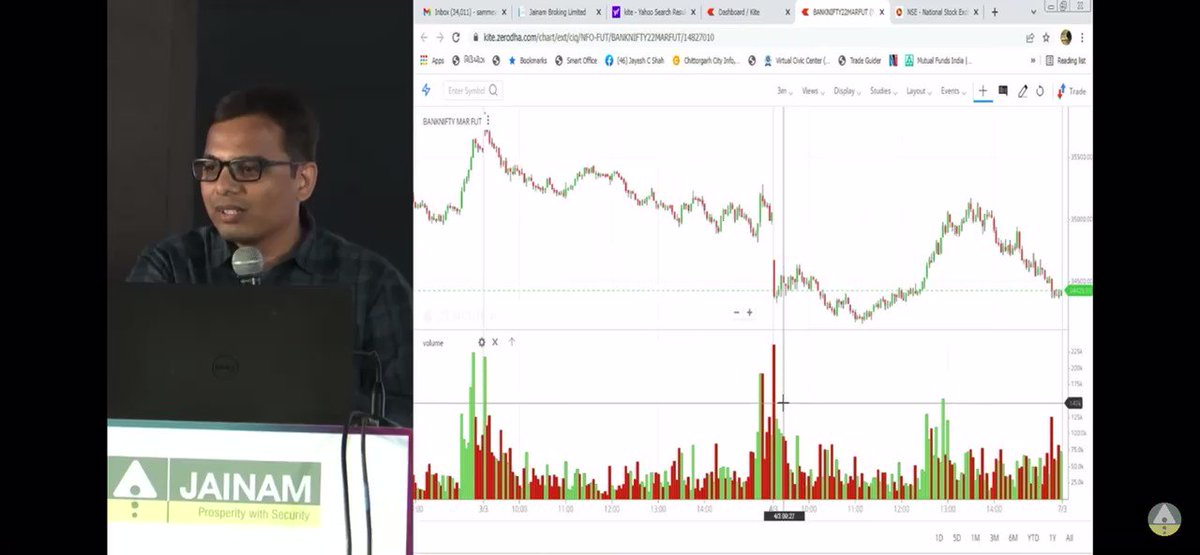

2/ Intraday BNF strangle based on OI data. 🧵

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

3/ A few setups to make intraday trading easy.

A few setups/strategies that can make your intraday trading easy. I follow them personally:

— Sheetal Rijhwani (@RijhwaniSheetal) September 12, 2021

Add these stocks in your watchlist for next few days -

-If a stock closed exactly at resistance with good volumes or it has been consolidating near resistance for a long time. (1/10)

@SarangSood Sarang bhai according to you what number of vix is ideal for option buyers and what is that for option sellers? And is there any common number which is ideal for both?

— Dhaval bhatt (@Dhavalb55011726) July 14, 2021

You May Also Like

Ironies of Luck https://t.co/5BPWGbAxFi

— Morgan Housel (@morganhousel) March 14, 2018

"Luck is the flip side of risk. They are mirrored cousins, driven by the same thing: You are one person in a 7 billion player game, and the accidental impact of other people\u2019s actions can be more consequential than your own."

I’ve always felt that the luckiest people I know had a talent for recognizing circumstances, not of their own making, that were conducive to a favorable outcome and their ability to quickly take advantage of them.

In other words, dumb luck was just that, it required no awareness on the person’s part, whereas “smart” luck involved awareness followed by action before the circumstances changed.

So, was I “lucky” to be born when I was—nothing I had any control over—and that I came of age just as huge databases and computers were advancing to the point where I could use those tools to write “What Works on Wall Street?” Absolutely.

Was I lucky to start my stock market investments near the peak of interest rates which allowed me to spend the majority of my adult life in a falling rate environment? Yup.

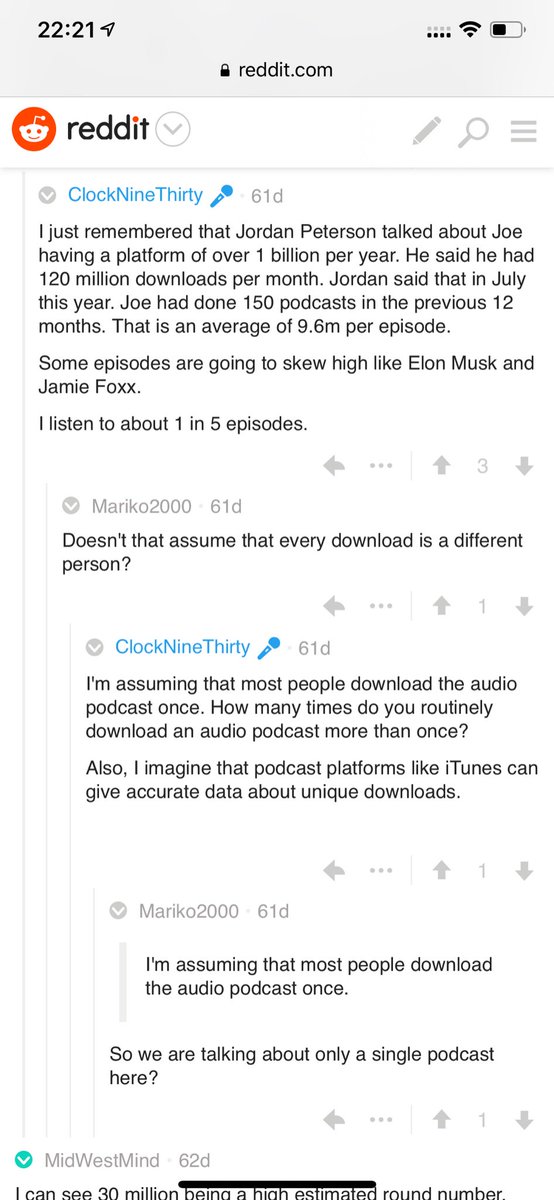

Independent and 100% owned by Joe, no networks, no middle men and a 100M+ people audience.

👏

https://t.co/RywAiBxA3s

Joe is the #1 / #2 podcast (depends per week) of all podcasts

120 million plays per month source https://t.co/k7L1LfDdcM

https://t.co/aGcYnVDpMu