• Daily charts S/R

• 75 min charts S/R

• Intraday trend

• Always play directional

• Never trades in strategies

A THREAD:

— Aditya Todmal (@AdityaTodmal) November 28, 2020

7 FREE OPTION TRADING COURSES FOR BEGINNERS.

Been getting lot of dm's from people telling me they want to learn option trading and need some recommendations.

Here I'm listing the resources every beginner should go through to shorten their learning curve.

(1/10)

The absolute best 15 scanners which experts are using.

— Aditya Todmal (@AdityaTodmal) January 29, 2021

Got these scanners from the following accounts:

1. @Pathik_Trader

2. @sanjufunda

3. @sanstocktrader

4. @SouravSenguptaI

5. @Rishikesh_ADX

Share for the benefit of everyone.

12 TRADING SETUPS which experts are using.

— Aditya Todmal (@AdityaTodmal) February 7, 2021

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

Curated tweets on How to Sell Straddles

— Aditya Todmal (@AdityaTodmal) February 21, 2021

Everything covered in this thread.

1. Management

2. How to initiate

3. When to exit straddles

4. Examples

5. Videos on Straddles

Share if you find this knowledgeable for the benefit of others.

A thread about STBT options selling,

— Jig's Patel (@jigspatel1988) July 17, 2021

The purpose is simple to capture overnight theta decay,

Generally, ppl sell ATM straddle with hedge or sell naked options,

But I am using Today\u2019s price action for selling options in STBT,

(1/n)

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

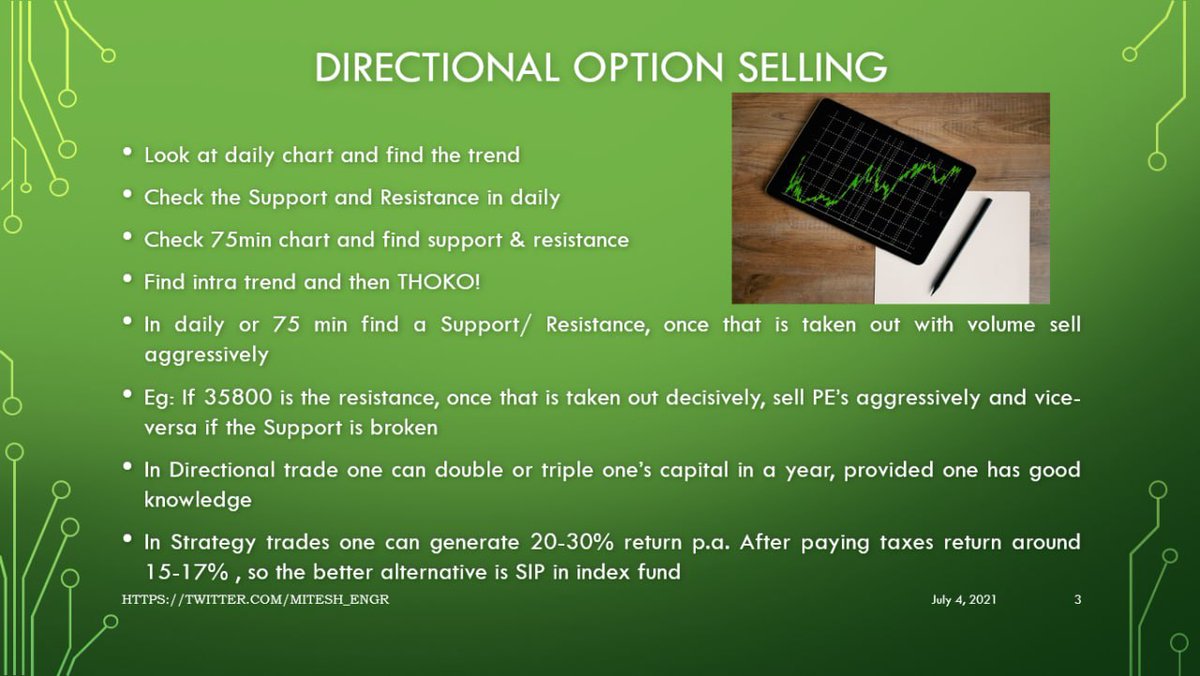

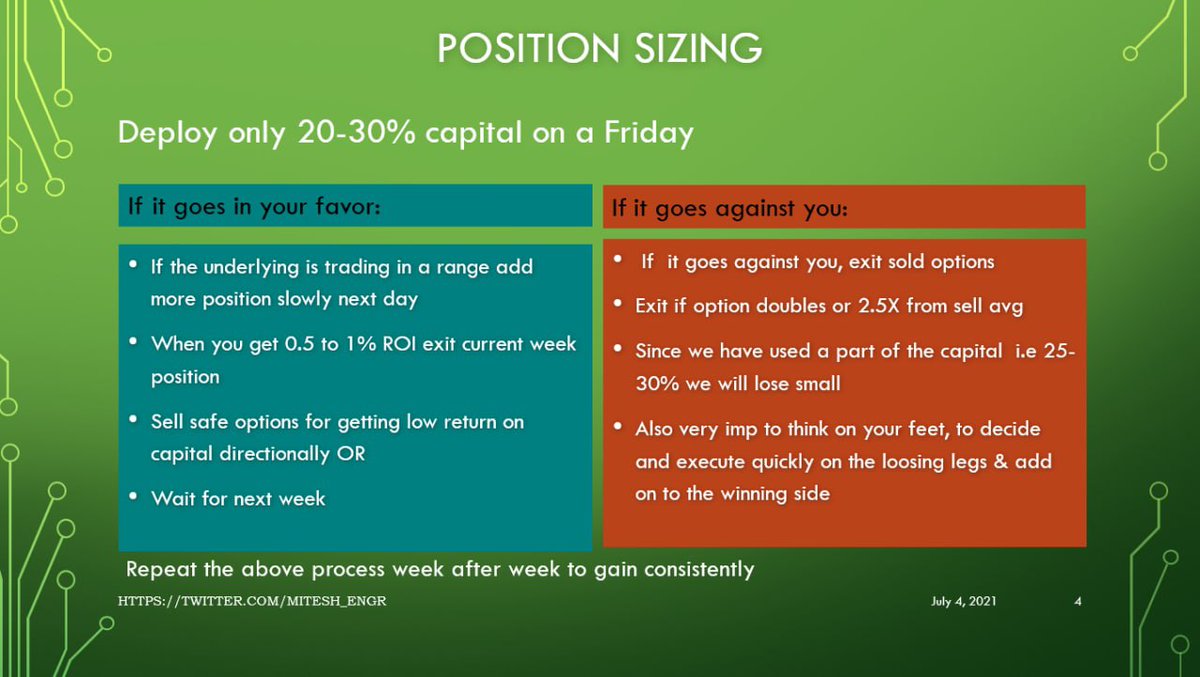

How to sell option?

— Mitesh Patel (@Mitesh_Engr) January 30, 2021

Here let me explain through simple math.

Say BN at 30000

30000 straddle trading at combine premium 800 ( based on current volatility)

Put at 400

Call at 400

You don\u2019t know direction. Sold both.

If move will not come than both will decrease gradually.