Never trade with loan amount.

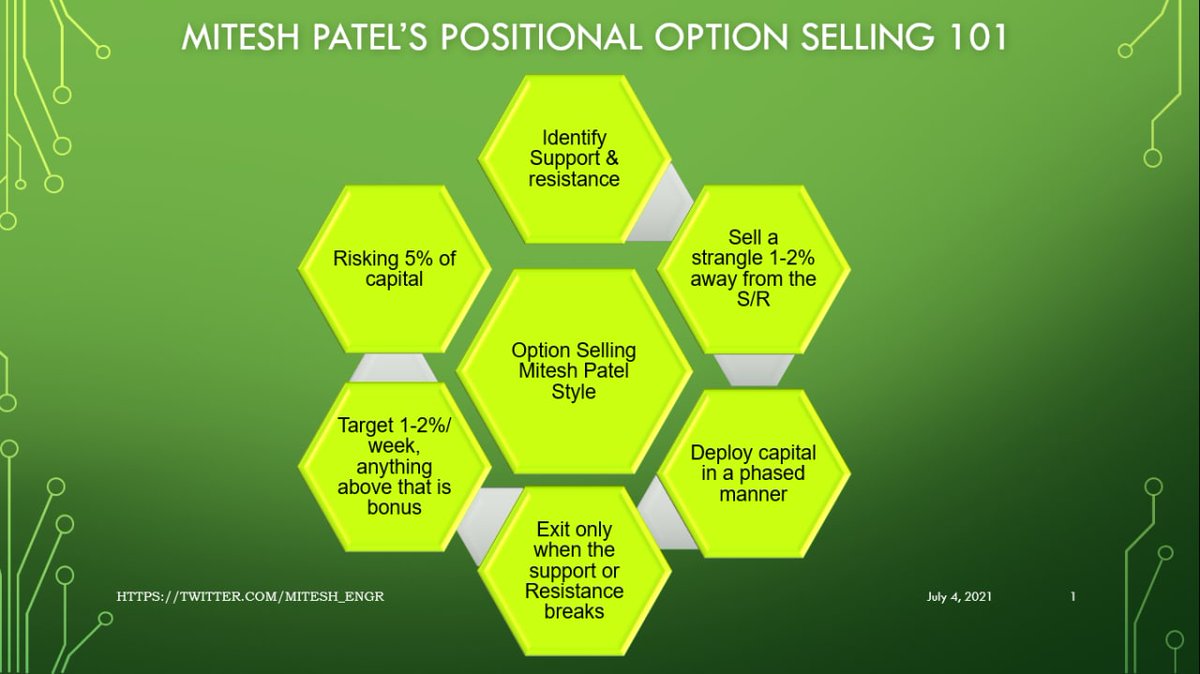

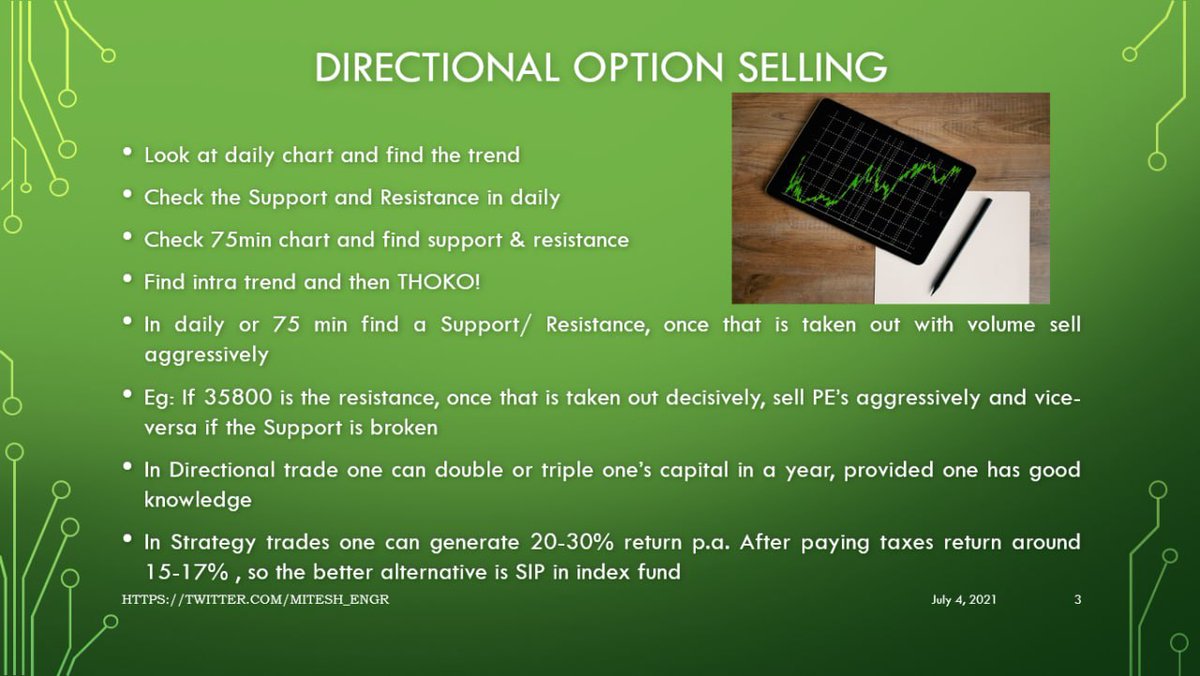

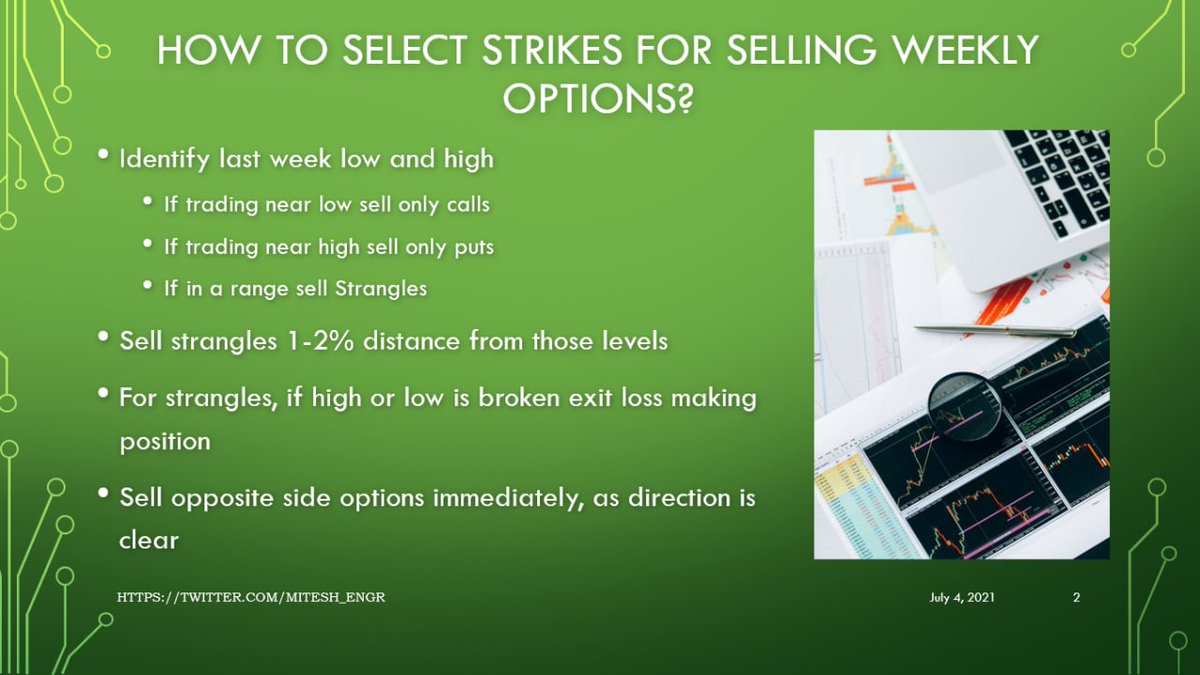

My trading is very simple. Selling option based on support and resistance. Time frame: Daily and 75 min.

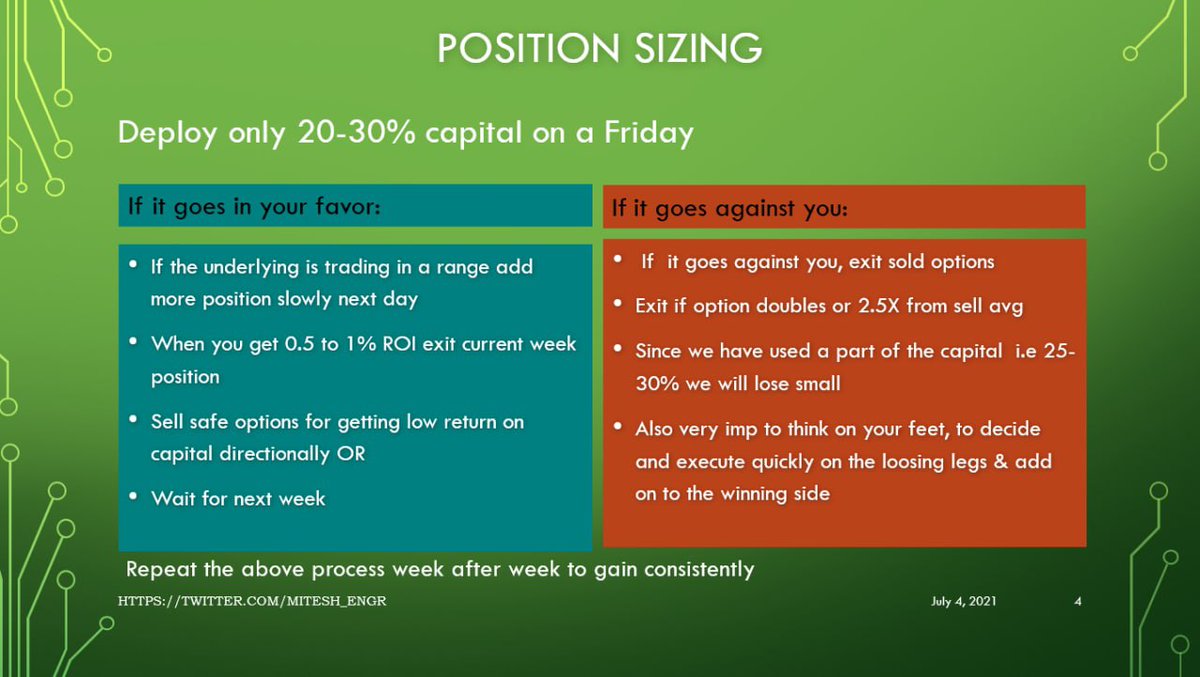

Keep distance of 1-2% from S & R so one has chance to exit or adjust if trade goes against.

And last one my tgt is 4% pm. Above it bonus.

Dear Nitesh can you share some idea how you makes successful trade. Please I am in a big loss since I started my journey of stock market in 2017. Then I took 15 lac loan and everything is vanished. Now I am in so much struggle to pay the EMI

— Ganesh (@Eshan70302504) May 30, 2021

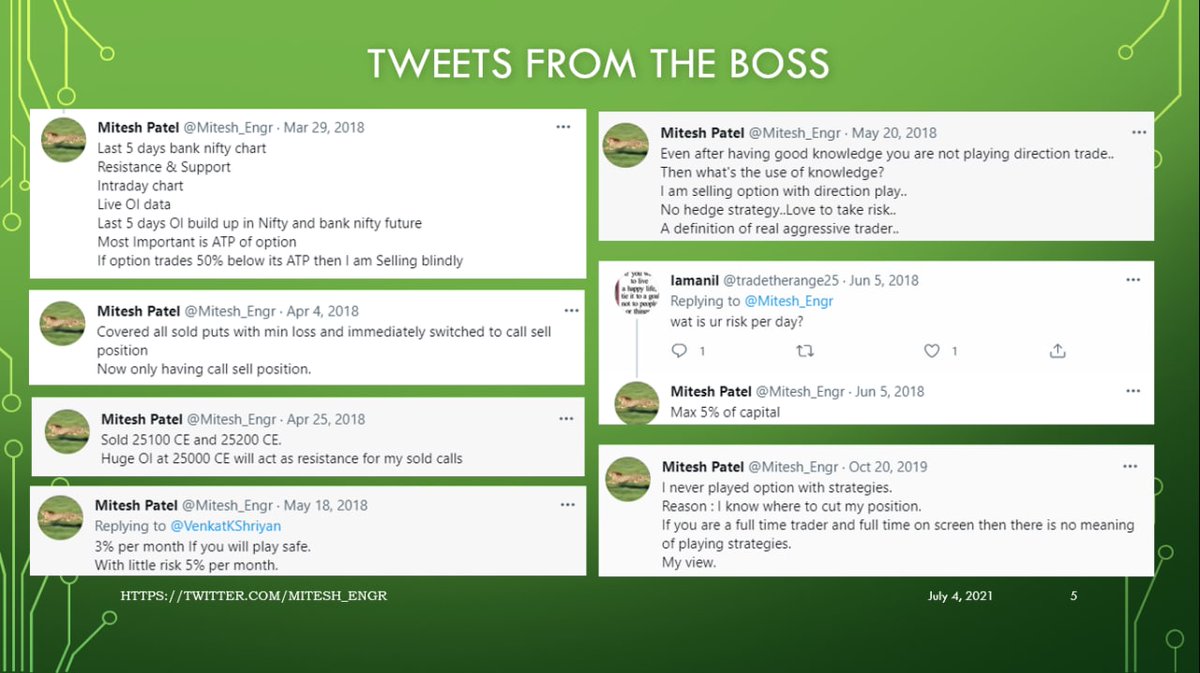

More from Mitesh Patel

How many are believing only in simple trading system?

— Mitesh Patel (@Mitesh_Engr) April 3, 2021

This is my simple trading.

I don\u2019t have any magic.

— Mitesh Patel (@Mitesh_Engr) January 7, 2021

Next week I will prefer to sell put in between strike 30500-31000 as shown in pic. Will manage upto 31000.

If breaks 31000 as first down support then will exit put nearby 31000 strike and will sell

31500 call ( will act as resistance again )

Simple hai na pic.twitter.com/hPLIMq3tSe

Future trading I am recommending to only those who have at least 25L capital to control risk management.

If less capital then do with cash or option writing.

Boss is always Boss @Mitesh_Engr

— Aditya Todmal (@AdityaTodmal) July 31, 2021

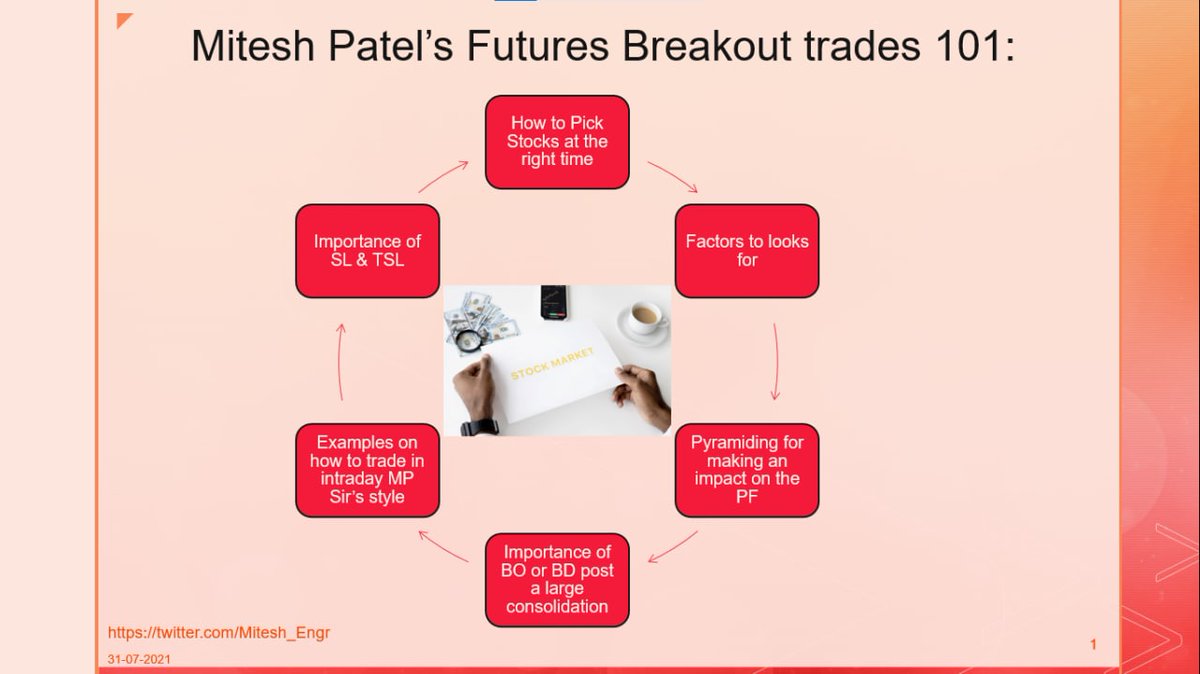

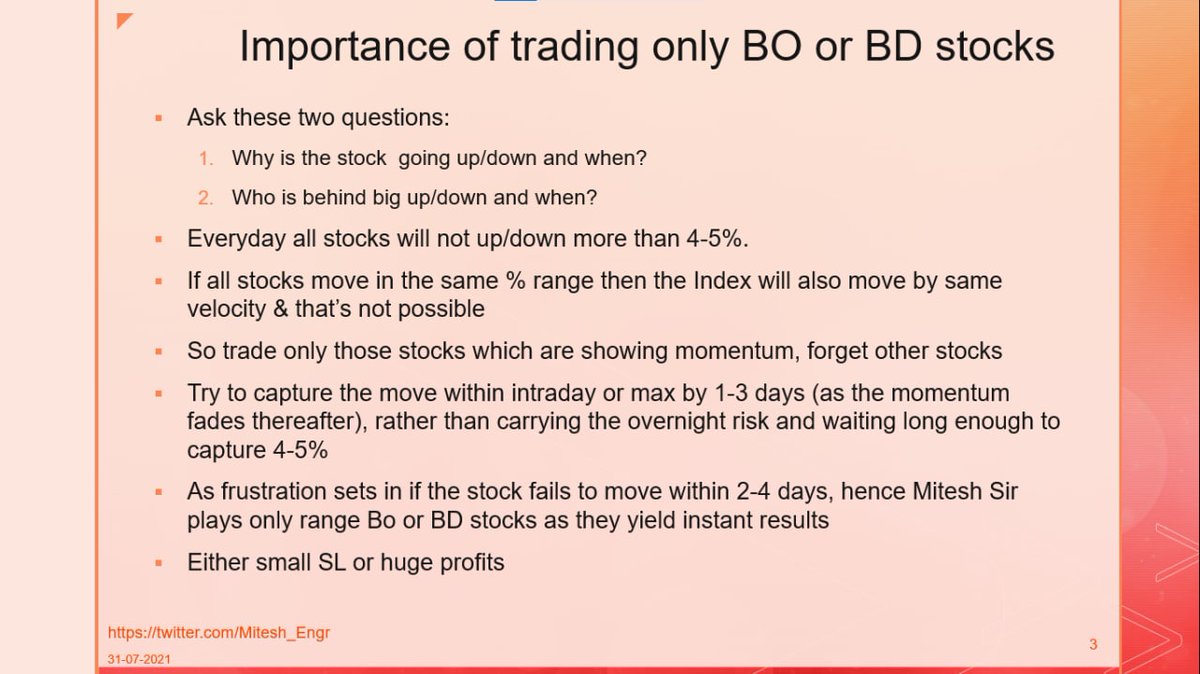

Mitesh Sir's FUTURES BREAKOUT TRADES 101:

\u2022 How to pick stocks at right time?

\u2022 What to look for?

\u2022 Importance of BO post consolidation

\u2022 How to manage SL

\u2022 How to get huge profits

\u2022 Multiple Examples

In collaboration with @niki_poojary pic.twitter.com/7uXRgsLgtN

More from Mplearnings

How I am playing expiry trades.

Catch me if you can @Mitesh_Engr

— Nikita Poojary (@niki_poojary) July 17, 2021

Time for a\U0001f9f5

Mitesh Sir's EXPIRY Option Selling 101:

\u2022 What to look for?

\u2022 Strike Selection & Ratios

\u2022 SL mgmt

\u2022 Avoiding freezes

\u2022 Monthy Expiry

\u2022 Event days

\u2022 How he would have traded last expiry?

In collaboration with @AdityaTodmal pic.twitter.com/9uN2vQQ4hc

You May Also Like

If everyone was holding bitcoin on the old x86 in their parents basement, we would be finding a price bottom. The problem is the risk is all pooled at a few brokerages and a network of rotten exchanges with counter party risk that makes AIG circa 2008 look like a good credit.

— Greg Wester (@gwestr) November 25, 2018

The benign product is sovereign programmable money, which is historically a niche interest of folks with a relatively clustered set of beliefs about the state, the literary merit of Snow Crash, and the utility of gold to the modern economy.

This product has narrow appeal and, accordingly, is worth about as much as everything else on a 486 sitting in someone's basement is worth.

The other product is investment scams, which have approximately the best product market fit of anything produced by humans. In no age, in no country, in no city, at no level of sophistication do people consistently say "Actually I would prefer not to get money for nothing."

This product needs the exchanges like they need oxygen, because the value of it is directly tied to having payment rails to move real currency into the ecosystem and some jurisdictional and regulatory legerdemain to stay one step ahead of the banhammer.