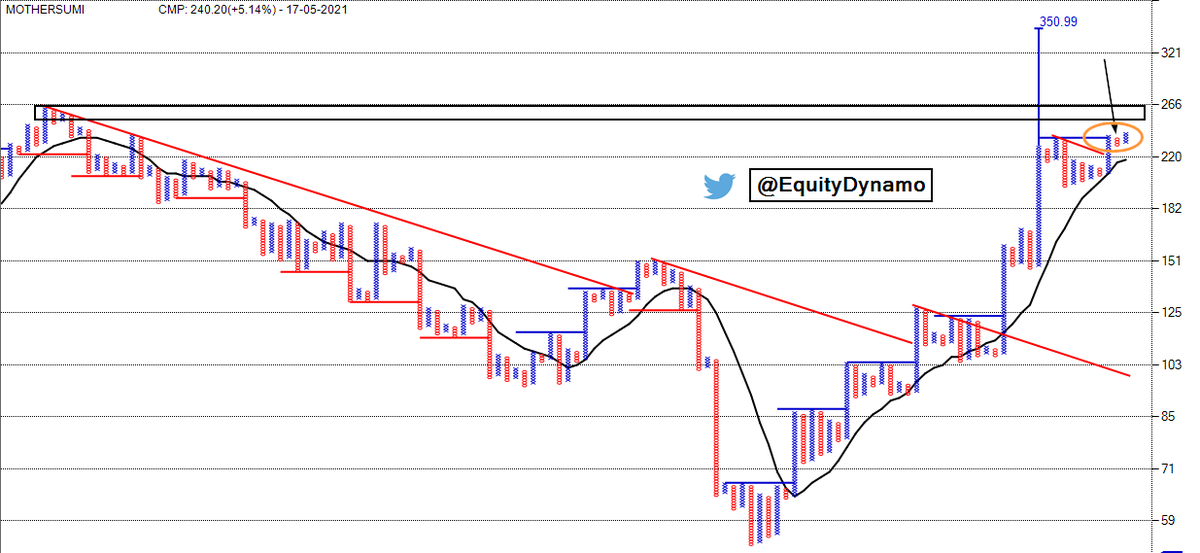

#MothersonSumi Breakout, retest and ready to Break out again 👌 https://t.co/QtgR3G9lSA

Yes,#Mothersonsumi #TataMotors #MindaIndustries my top picks in Autos @Twinkleinvest

— Dare2Dream (@Dare2Dr10109801) May 18, 2021

More from Dare2Dream

#Graphite Could now be heading to 880 / 900 levels. https://t.co/qO6QzoYrBt

#Metals All in one place#Sail \U0001f680 #TataSteel\U0001f680 #Vedl\U0001f6eb #Jswsteel\U0001f680\U0001f680 #Graphite\U0001f680 #Heg\U0001f680

— Dare2Dream (@Dare2Dr10109801) April 29, 2021

Very shortly I expect #Hindcopper as well, still at the launch pad. #Vedl #Hindalco yet to pick up pace.@caniravkaria https://t.co/eeOxZ7WWvo

More from Motherson

#MothersonSumi above 241, the stock could head to previous ATH around 260 levels. Beyond that bigger targets open up. In my view, the stock has resumed its next up trend. https://t.co/mG4Q0N1lyL

#MothersonSumi Breaking out@caniravkaria pic.twitter.com/lpcR1J8r7H

— Dare2Dream (@Dare2Dr10109801) May 12, 2021

You May Also Like

I’m torn on how to approach the idea of luck. I’m the first to admit that I am one of the luckiest people on the planet. To be born into a prosperous American family in 1960 with smart parents is to start life on third base. The odds against my very existence are astronomical.

I’ve always felt that the luckiest people I know had a talent for recognizing circumstances, not of their own making, that were conducive to a favorable outcome and their ability to quickly take advantage of them.

In other words, dumb luck was just that, it required no awareness on the person’s part, whereas “smart” luck involved awareness followed by action before the circumstances changed.

So, was I “lucky” to be born when I was—nothing I had any control over—and that I came of age just as huge databases and computers were advancing to the point where I could use those tools to write “What Works on Wall Street?” Absolutely.

Was I lucky to start my stock market investments near the peak of interest rates which allowed me to spend the majority of my adult life in a falling rate environment? Yup.

Ironies of Luck https://t.co/5BPWGbAxFi

— Morgan Housel (@morganhousel) March 14, 2018

"Luck is the flip side of risk. They are mirrored cousins, driven by the same thing: You are one person in a 7 billion player game, and the accidental impact of other people\u2019s actions can be more consequential than your own."

I’ve always felt that the luckiest people I know had a talent for recognizing circumstances, not of their own making, that were conducive to a favorable outcome and their ability to quickly take advantage of them.

In other words, dumb luck was just that, it required no awareness on the person’s part, whereas “smart” luck involved awareness followed by action before the circumstances changed.

So, was I “lucky” to be born when I was—nothing I had any control over—and that I came of age just as huge databases and computers were advancing to the point where I could use those tools to write “What Works on Wall Street?” Absolutely.

Was I lucky to start my stock market investments near the peak of interest rates which allowed me to spend the majority of my adult life in a falling rate environment? Yup.