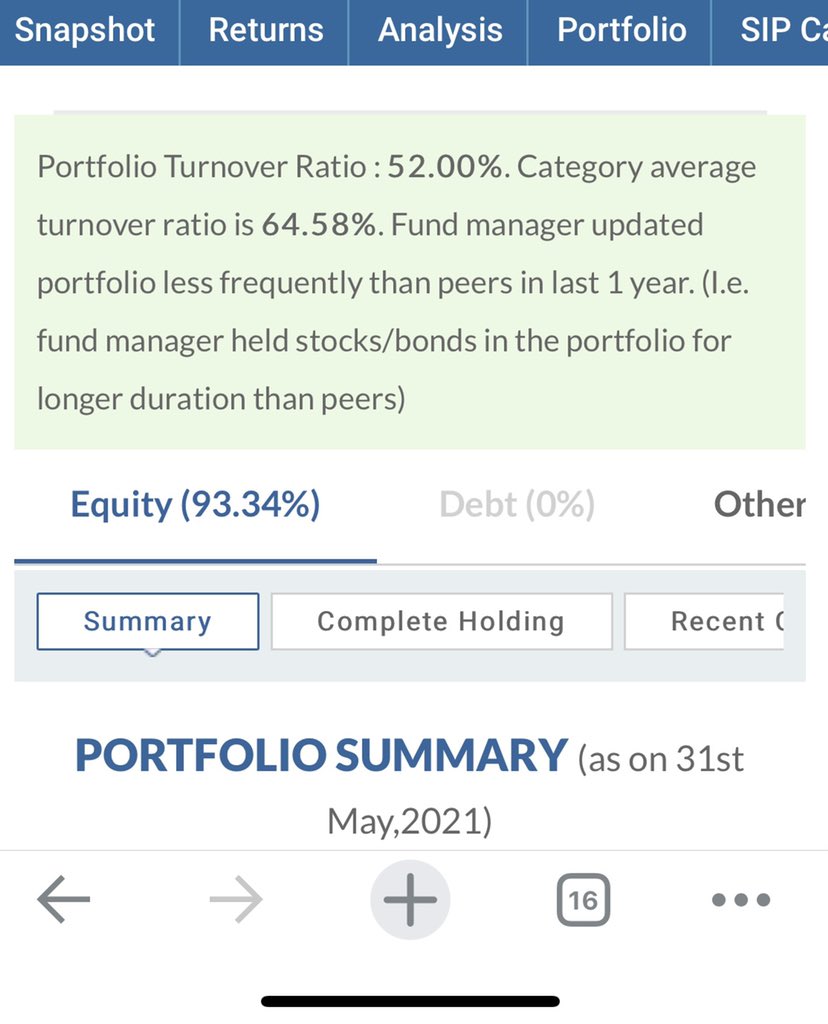

no one looks at tax-efficient way of looking at returns along with risk is taken/ churn happened.

In my view, different stocks play different roles in a portfolio at any given point in time.

If you had frozen the March 2020 Portfolio of PPFAS flexicap as it is then in 2 years, their domestic folio beats overseas by 2.5:1

Link later in the thread

#PPFAS

no one looks at tax-efficient way of looking at returns along with risk is taken/ churn happened.

IEX is now 2.5-3X (though not part of Indian portfolio)

including dividend, ITC has beaten up amazon since then

More from Mfs

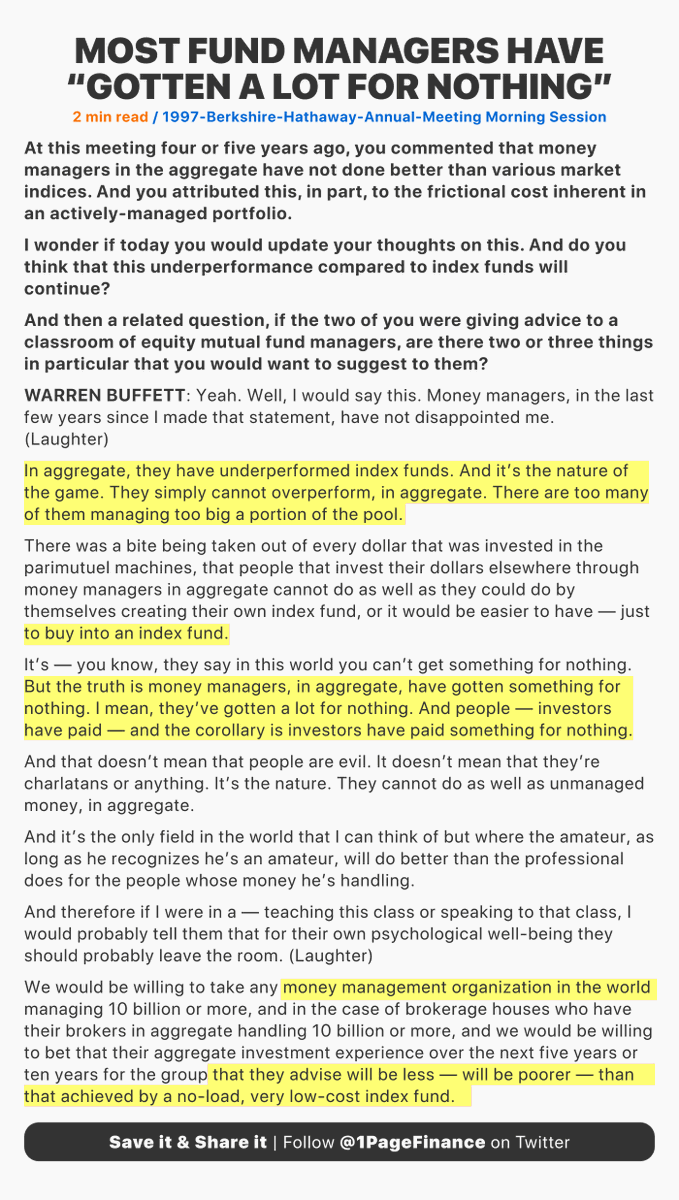

A financial advisor that charges an annual fee of 1% on assets under management

Essentially takes 50% of your dividend income, if your portfolio yields 2%

That's substantially worse than the highest rate on qualified dividends of 23.80% today

Few understand this

I agree with this

Essentially takes 50% of your dividend income, if your portfolio yields 2%

That's substantially worse than the highest rate on qualified dividends of 23.80% today

Few understand this

I agree with this

After 34 years in the business, I just can\u2019t get my head around how an adviser can justify charging a client any more that $2,000 per year for financial advice, and 0.25% per year for asset management if needed. There may be outliers that cost more, but those are the expectation.

— Rick Ferri (@Rick_Ferri) June 15, 2021