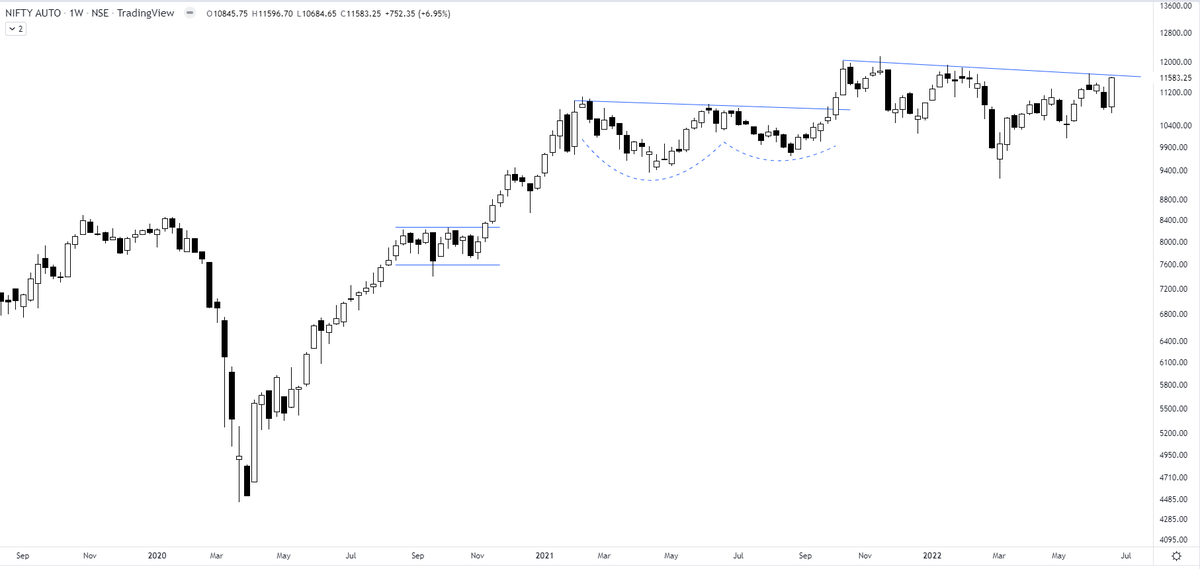

More from The_Chartist 📈

This exercise will tell you about your inherent strengths & weaknesses. 👇👇

How to record a trading journal (TJ) & what to analyze?

— The_Chartist \U0001f4c8 (@charts_zone) December 14, 2021

What is in a TJ?

Buy Date

Stock Name

The time frame you analyzed (D/W/M)

Long/Short?

Buy Price

SL

Sell Price

Risk took (% of capital)

Sell date

No. of days held

P/L

P/L as % of capital

Buy Reason?

Invested capital/trade pic.twitter.com/WnrvmYuOV0

More from Mcdowell

#USL #Unitedspirits #DIAGEO Shared daily chart for reference \U0001f447

— Pranay Prasun (@PranayPrasun) May 27, 2022

Here breakout candle is supported by volume https://t.co/MXsPJMNHDF pic.twitter.com/rTLQhfCXfg

You May Also Like

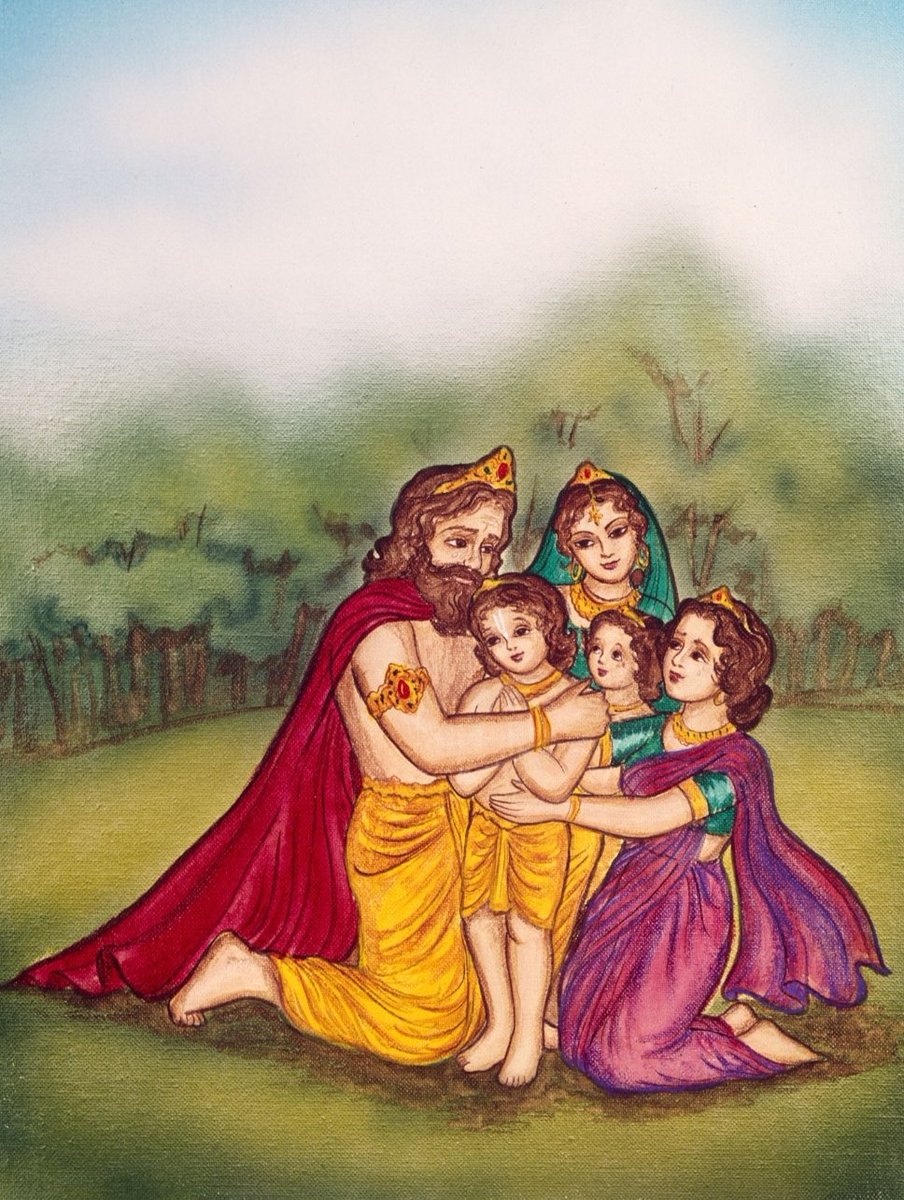

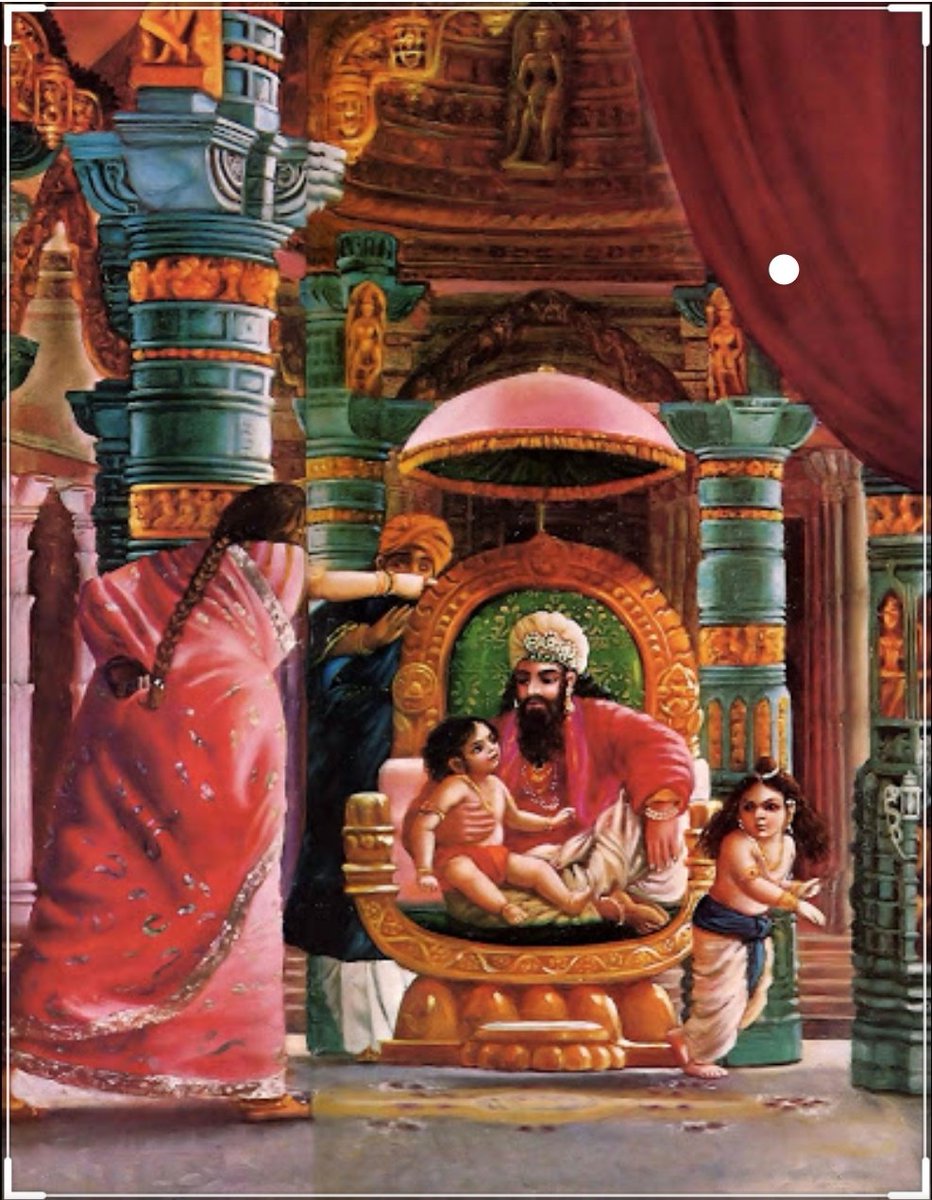

Once upon a time there was a Raja named Uttānapāda born of Svayambhuva Manu,1st man on earth.He had 2 beautiful wives - Suniti & Suruchi & two sons were born of them Dhruva & Uttama respectively.

#talesofkrishna https://t.co/E85MTPkF9W

Prabhu says i reside in the heart of my bhakt.

— Right Singh (@rightwingchora) December 21, 2020

Guess the event. pic.twitter.com/yFUmbfe5KL

Now Suniti was the daughter of a tribal chief while Suruchi was the daughter of a rich king. Hence Suruchi was always favored the most by Raja while Suniti was ignored. But while Suniti was gentle & kind hearted by nature Suruchi was venomous inside.

#KrishnaLeela

The story is of a time when ideally the eldest son of the king becomes the heir to the throne. Hence the sinhasan of the Raja belonged to Dhruva.This is why Suruchi who was the 2nd wife nourished poison in her heart for Dhruva as she knew her son will never get the throne.

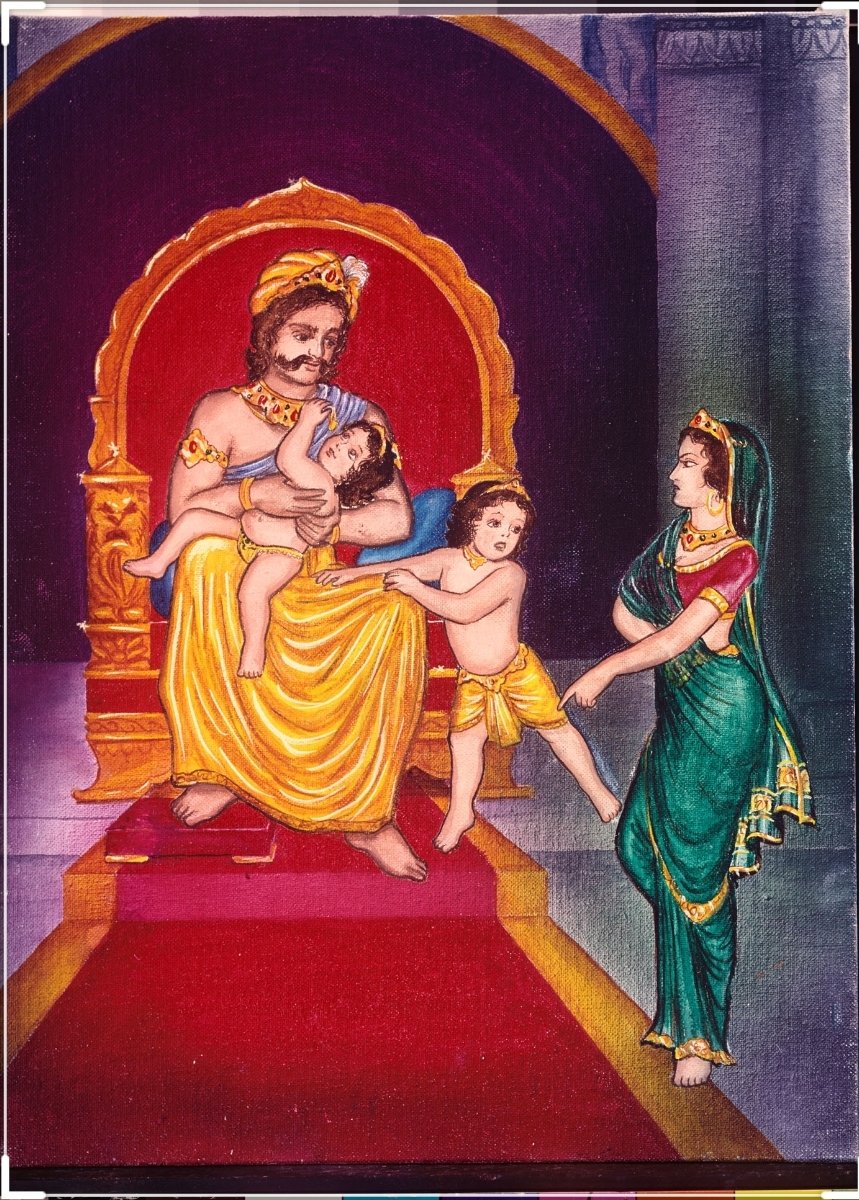

One day when Dhruva was just 5 years old he went on to sit on his father's lap. Suruchi, the jealous queen, got enraged and shoved him away from Raja as she never wanted Raja to shower Dhruva with his fatherly affection.

Dhruva protested questioning his step mother "why can't i sit on my own father's lap?" A furious Suruchi berated him saying "only God can allow him that privilege. Go ask him"

If everyone was holding bitcoin on the old x86 in their parents basement, we would be finding a price bottom. The problem is the risk is all pooled at a few brokerages and a network of rotten exchanges with counter party risk that makes AIG circa 2008 look like a good credit.

— Greg Wester (@gwestr) November 25, 2018

The benign product is sovereign programmable money, which is historically a niche interest of folks with a relatively clustered set of beliefs about the state, the literary merit of Snow Crash, and the utility of gold to the modern economy.

This product has narrow appeal and, accordingly, is worth about as much as everything else on a 486 sitting in someone's basement is worth.

The other product is investment scams, which have approximately the best product market fit of anything produced by humans. In no age, in no country, in no city, at no level of sophistication do people consistently say "Actually I would prefer not to get money for nothing."

This product needs the exchanges like they need oxygen, because the value of it is directly tied to having payment rails to move real currency into the ecosystem and some jurisdictional and regulatory legerdemain to stay one step ahead of the banhammer.