VWAP for intraday Trading Part -1

— Learn to Trade (@learntotrade365) August 28, 2021

A small thread PART -2 will be released tomorrow

Traders show your support by like & retweet to benefit all@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @ArjunB9591 @CAPratik_INDIAN @RajarshitaS @Stockstudy8 @vivbajaj @Prakashplutus pic.twitter.com/y8bwisM4hB

Mega learning thread . This contain some of my shared thread which might help in your trading.

Show your support by like and retweet so it can benefit many traders.

YouTube channel - https://t.co/pUUwDNoLQ5

Telegram channel - https://t.co/in1lvrigH9

#sharemarket

VWAP for intraday Trading Part -2

— Learn to Trade (@learntotrade365) August 29, 2021

A small thread.

PART 1 - https://t.co/ooxepHpYKL

Traders show your support by like & retweet to benefit all@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @RajarshitaS @Puretechnicals9 @AnandableAnand @Anshi_________ @ca_mehtaravi pic.twitter.com/4c3t9Jv7ui

Multi support & resistance for intraday trading

— Learn to Trade (@learntotrade365) September 4, 2021

A small thread

Traders show your support by like & retweet to benefit maximum traders@Puretechnicals9 @AnandableAnand @Abhishekkar_ @ProdigalTrader @nakulvibhor @Stockstudy8 @RajarshitaS @Stockstudy8 @vivbajaj pic.twitter.com/UmAWGU1GCW

Price Action pattern for intraday trading

— Learn to Trade (@learntotrade365) September 11, 2021

A small thread

Traders show your support by like & retweet to benefit maximum traders@Puretechnicals9 @AnandableAnand @Abhishekkar_ @ProdigalTrader @nakulvibhor @RajarshitaS @Rishikesh_ADX @Stockstudy8 @vivbajaj pic.twitter.com/HNKyJLyvS1

Playlist of Learning videos related to Trading via @YouTube

— Learn to Trade (@learntotrade365) August 15, 2021

Playlist 1 - https://t.co/sCmG4SRVUv

Playlist 2- https://t.co/RS1UpXZrz5

Playlist 3 - https://t.co/sGFc3wO1Db

One of the simplest process to understand direction of banknifty & trade along with the trend using simple patterns.

— Learn to Trade (@learntotrade365) August 7, 2021

A small thread

Retweet to reach maximum traders@Mitesh_Engr @ITRADE191 @ProdigalTrader @Puretechnicals9 @MarketScientist @TraderLogical @CAPratik_INDIAN

Mega thread \U0001f447

— Learn to Trade (@learntotrade365) July 31, 2021

Retweet to reach maximum traders@Mitesh_Engr @ITRADE191 @Puretechnicals9 @Rishikesh_ADX @kapildhama @CAPratik_INDIAN @ProdigalTrader @jatankothari @PatilBankNifty @vivbajaj @RajarshitaS @SuccessIsMyJob @candleseye pic.twitter.com/puXCXNnFU3

Retail traders STOPLOSS location which Big players are aware of the location

— Learn to Trade (@learntotrade365) July 25, 2021

A small thread

Retweet to reach maximum traders@Mitesh_Engr @ITRADE191 @AdityaTodmal @Puretechnicals9 @hjyadav @Singh7575 @Rishikesh_ADX pic.twitter.com/tz4DDC59aE

Process to read Charts of Banknifty for Intraday trading to plan trades & identify direction based on the price auction

— Learn to Trade (@learntotrade365) July 18, 2021

A small thread

Retweet to reach maximum traders@Mitesh_Engr @ITRADE191 @ProdigalTrader @AdityaTodmal @Puretechnicals9 @hjyadav @Singh7575 @Rishikesh_ADX

10 Retail newbie traders common mistakes

— Learn to Trade (@learntotrade365) May 8, 2021

A small thread.

Retweet to reach maximum traders and if anyone doing this same mistakes which is mentioned below STOP doing from now.@caniravkaria @hjyadav @rohanshah619 @KillerTrader_ @Traderknight007 @Mitesh_Engr @SandeepKrJainTS

Trading Reality about Telegram call provider - CHEATING activity

— Learn to Trade (@learntotrade365) May 23, 2021

A small thread@ProdigalTrader @caniravkaria @rohanshah619 @Mitesh_Engr @hjyadav @PatilBankNifty @ca_mehtaravi @RajarshitaS @SandeepKrJainTS @TraderMindset @sanstocktrader

Retweet to avoid trader from this TRAP

Learning Web series for Traders

— Learn to Trade (@learntotrade365) October 2, 2021

Price Action Trading - Part 1

Small thread /Video

Video link - https://t.co/7V2pz0aCdx

Traders support by like & retweet to benefit all@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @RajarshitaS @Stockstudy8 @vivbajaj @Prakashplutus https://t.co/ZKBMSEZkTl pic.twitter.com/wm4jqoU7Eg

Learning Web series for Traders

— Learn to Trade (@learntotrade365) October 3, 2021

Price Action Trading - Part 2

Part 2 Video link - https://t.co/nf1mFRd9Gi

Part 1 Video link - https://t.co/7V2pz0aCdx@Puretechnicals9 @ProdigalTrader @sahneydeepak @RajarshitaS @Stockstudy8 @vivbajaj @Prakashplutus @hjyadav @PAVLeader https://t.co/m9fcTPcxYg pic.twitter.com/4cHLVlWr3u

Happy New Year

— Learn to Trade (@learntotrade365) January 1, 2022

TREND FOLLOWING - Part 1

Twitter Thread\U0001f9f5

I have tried my best to share about Trend Following.

Traders show your support by

RETWEET & like to benefit all@hjyadav @ITRADE191 @ProdigalTrader @nakulvibhor @PAlearner @RajarshitaS @AnandableAnand @Puretechnicals9 pic.twitter.com/4fAn53ltKx

TREND FOLLOWING - Part 2

— Learn to Trade (@learntotrade365) January 9, 2022

Part 1 - https://t.co/cBIlmiP25A

Twitter Thread\U0001f9f5

Traders show your support by

RETWEET to benefit all@hjyadav @ITRADE191 @kuttrapali26 @nakulvibhor @PAlearner @Puretechnicals9 @caniravkaria @indian_stockss @technovestor https://t.co/jAg2hjpxWs pic.twitter.com/QmYZo5kwxX

Understanding Buyers vs Sellers using

— Learn to Trade (@learntotrade365) March 19, 2022

candlesticks PART-1

Mini Thread \U0001f9f5 #trading #StockMarketindia

Traders show your support by Retweet to benefit maximum traders@Mitesh_Engr @ITRADE191 @hjyadav @nakulvibhor @RajarshitaS @chartmojo @ca_mehtaravi pic.twitter.com/0XVw0zNOFP

Trend Following System Part -1

— Learn to Trade (@learntotrade365) April 15, 2022

Mini learning thread \U0001f9f5

Traders show your support for the free learning content by Retweet to benefit maximum traders

49 more twitter thread to go

1/12#trading @ITRADE191 @caniravkaria @ca_mehtaravi @chartmojo @DillikiBiili @VVVStockAnalyst pic.twitter.com/ssSCrEHdIw

More from Learn to Trade

After more than 8 years of market experience i am sharing these effective intraday strategies.

Spend few minutes of your time to understand

Thread 🧵 RT for wider reach

Scroll down👇

1/8

Intraday Strategy 1 - VWAP & Pivot Based

Vwap & Pivot Points - Trading Zones for intraday directional traders

— Learn to Trade (@learntotrade365) September 10, 2022

Intraday Trading strategy for Trend followers \U0001f9f5

Support us by RETWEET this tweet to reach and benefit most traders so it can help them to gain knowledge

Scroll down \U0001f447 pic.twitter.com/L6HHsXQZpV

Intraday Strategy 2 - Price Action strategy without

Price Action Trading ( Without Indicators)

— Learn to Trade (@learntotrade365) August 20, 2022

Intraday Trading strategy for all Directional traders.

Intraday Trading Strategy Thread \U0001f9f5

Support us by RETWEET to reach and benefit maximum traders

Scroll down \U0001f447 pic.twitter.com/AVsKmWroMc

Intraday Strategy 3 - Price Based

Highly effective Trading strategy which can help to follow the trend & ride the direction in BANKNIFTY ( Without Indicators)

— Learn to Trade (@learntotrade365) October 1, 2022

For Option Buyers, Option Sellers & all Directional traders

Simple strategy help to make more profits

Retweet this thread \U0001f9f5 to reach many traders pic.twitter.com/dKxVmgntz3

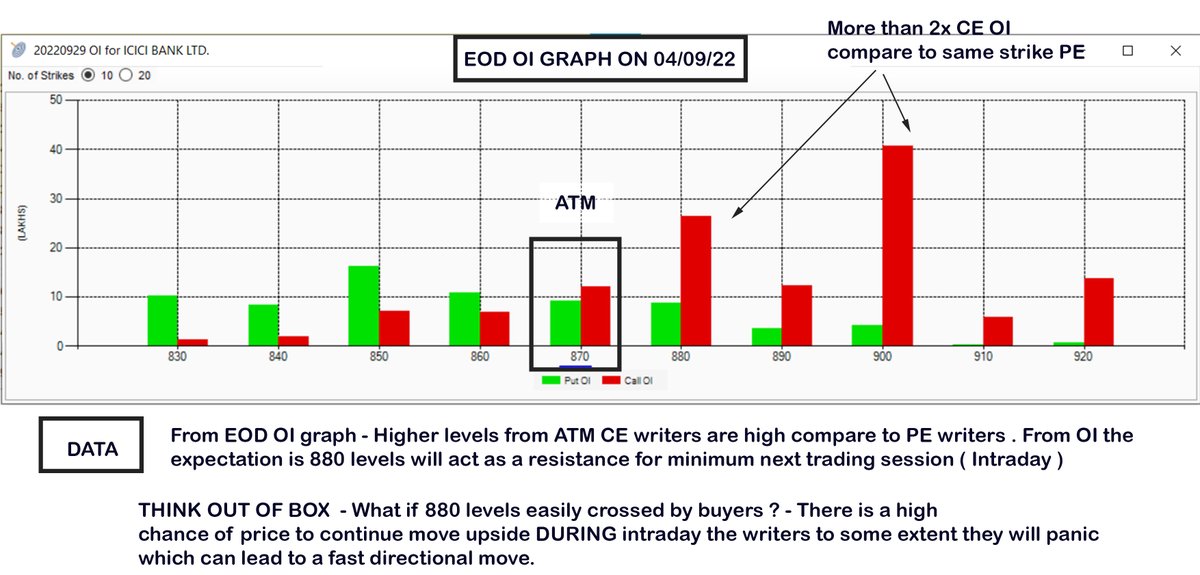

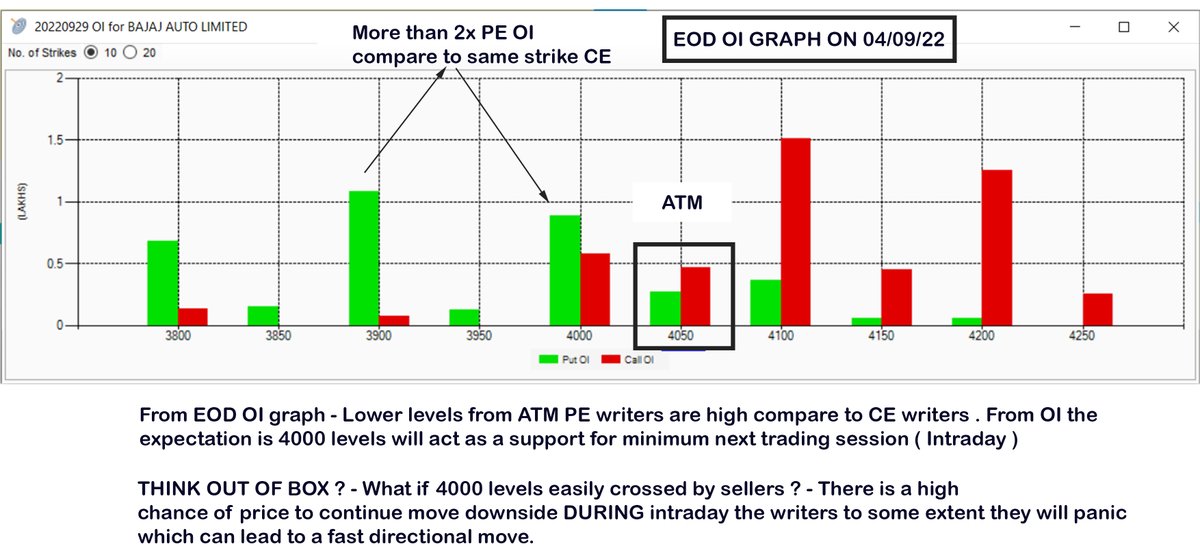

Intraday Strategy 4 - Open Interest based

Whether OI works for intraday trading ?

— Learn to Trade (@learntotrade365) September 25, 2022

Whether OI useful ?

No one has a exact answer. But one effective way to make use OI in a very different perspective - OUT OF THE BOX from Traditional method

Read the full thread \U0001f9f5

Kindly RETWEET & share so it can reach many traders pic.twitter.com/IFx13oISRW

Whether OI useful ?

No one has a exact answer. But one effective way to make use OI in a very different perspective - OUT OF THE BOX from Traditional method

Read the full thread 🧵

Kindly RETWEET & share so it can reach many traders

I do Live Market session every Monday to Friday by 09:00 a.m to 01:00 pm . Also i share important support /resistance levels of Banknifty & Nifty on the Telegram Channel. FOLLOW US @learntotrade365

Join the Telegram Channel - https://t.co/VU0bCGAX9s

Scroll down 👇

This is a EOD OI graph of ICICIBANK. Here i am trying to focus on strike price which has more than 2x OI comparing CE vs PE of individual strikes.

Below 880 strike CE vs PE in which 880 CE has 2x more OI (more writers) compare to 880 pe.

Read the message in the image

Scroll 👇

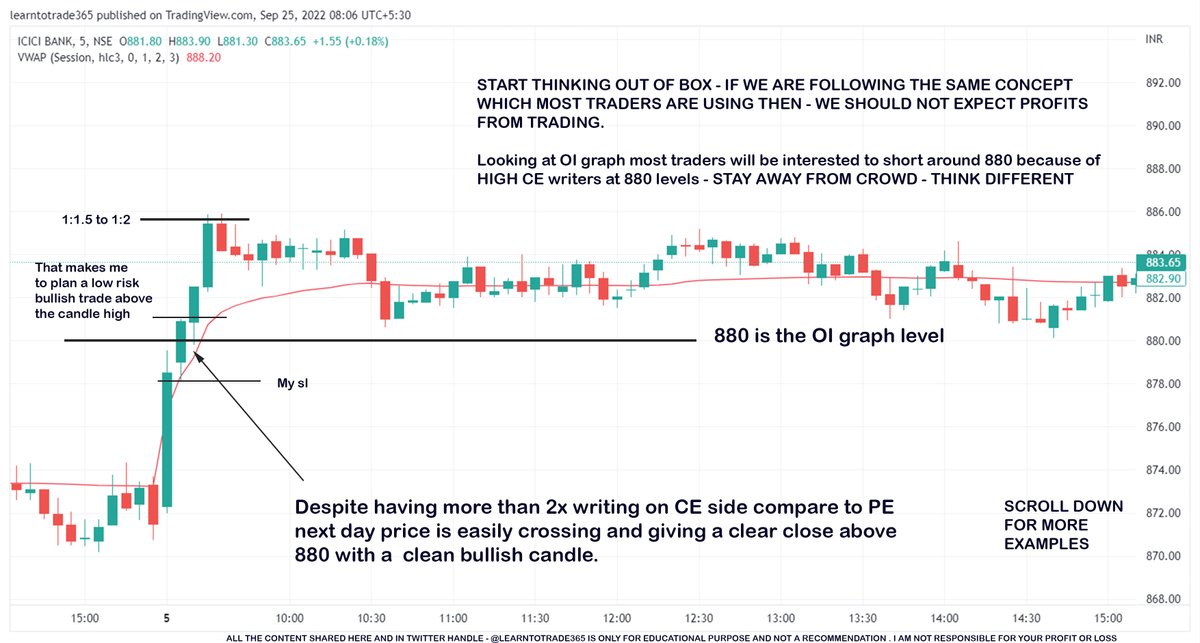

From the above OI graph of EOD 04/09 NOW refer the chart below of the same ICICIBANK for 05 sep

Main focus is not to take 880 levels as resistance just because of more CE OI. My focus if 880 is easily crossing and closing above it to open a bullish opportunity

Scroll👇

EOD OI graph of Bajaj Auto. Here i am trying to focus on strike price which has more than or equal 2x OI comparing CE vs PE of individual strikes.

Below 4000 strike CE vs PE in which 4000 PE has 2x more OI compare to 4000 CE.

Read the content in the below image

Scroll👇

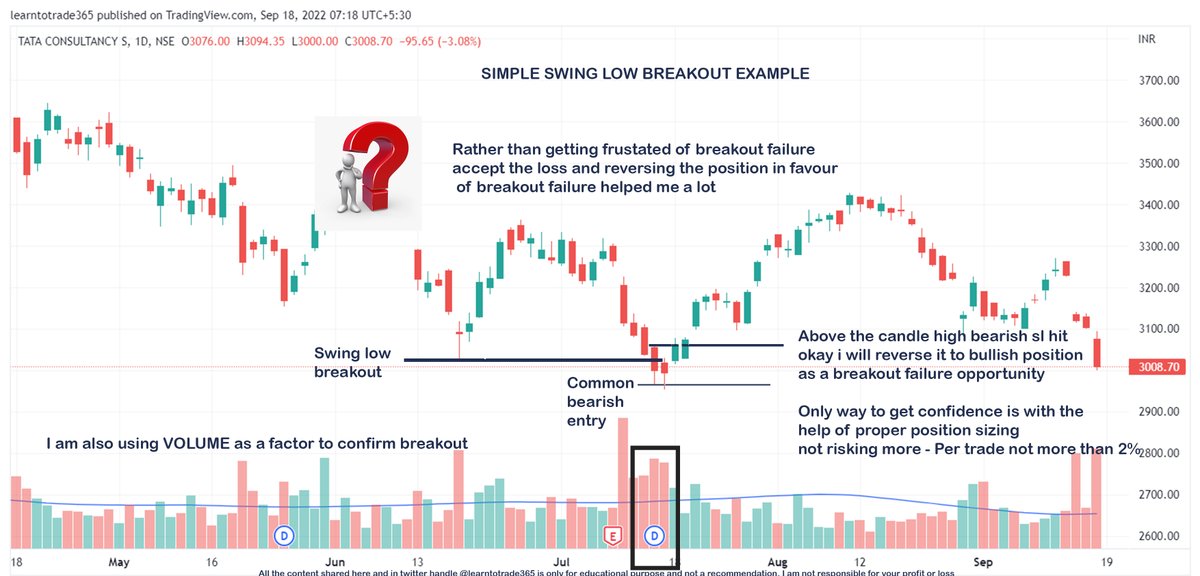

Here in this Thread 🧵 a effective technique i use to trade both breakout & false breakout

It will take 5 minutes to read

Kindly RETWEET this tweet if you find the content useful so it can reach and benefit many traders

Scroll down 👇

I do daily Live Market session via Youtube Live ( Monday to Friday morning 9:00 a.m to 01:00 p.m.

Follow us @learntotrade365 . Join the Telegram Channel for live market updates

https://t.co/VU0bCGjU7s

Scroll down 👇

Main problem most breakout traders face is false breakout. So if we understand other side of breakout trading false breakout can also be used as a trading opportunity . Read this thread i have shared few examples.

Chart example - 1

Scroll down👇

Rather getting confused whether the breakout will be a success or failure - look in perspective of double opportunity

Chart example -2

Scroll down 👇

Breakout trading using simple Swing levels. Below example is about making use of false breakout as a trade opportunity. Controlled position sizing can only help a trader to become profitable

Chart example 3

Scroll down 👇

For Option Buyers, Option Sellers & all Directional traders

Simple strategy help to make more profits

Retweet this thread 🧵 to reach many traders

I also do Intraday Live Market sessions on all Trading days ( Monday to Friday 09:00 a.m to 01:00 p.m) - Follow us @learntotrade365

Join the Telegram channel - https://t.co/VU0bCGAX9s

Scroll down 👇

My approach here is to focus on Low risk High Reward strategy with simple 1st 15 Minutes High & Low. You can personally do your testing.

Chart 1 Scroll down 👇

Trading involves both profit & loss. But still becoming a profitable traders is a skill of proper position sizing. Good position sizing is fix your losses and taking quantity according to the STOPLOSS

Chart -2 Scroll down👇

Everyone want to make money from trading but ultimately traders who's main focus is on following the PRICE with risk management end up making big money from trading

Focus on Price. Rest is Noise

Chart 3 Scroll down 👇

You May Also Like

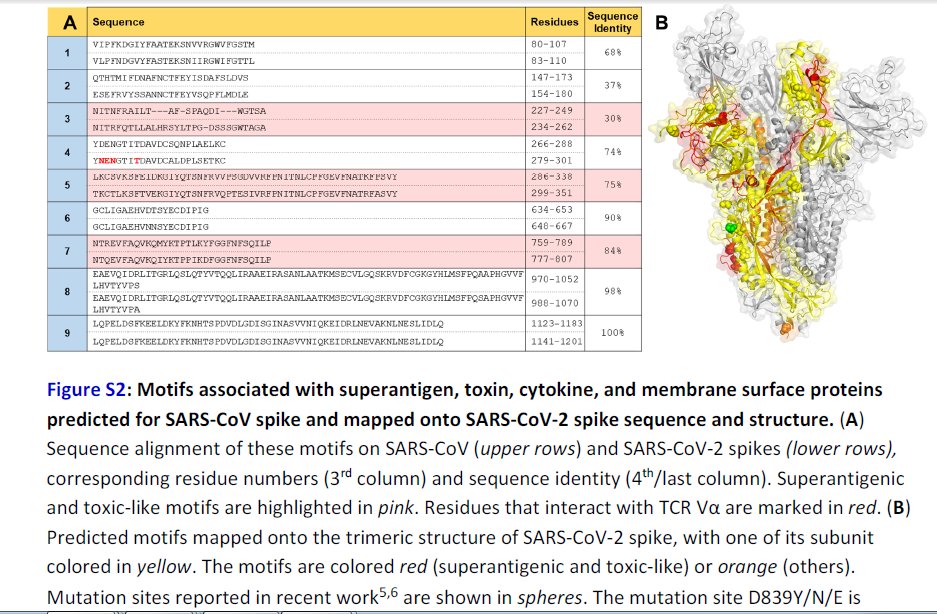

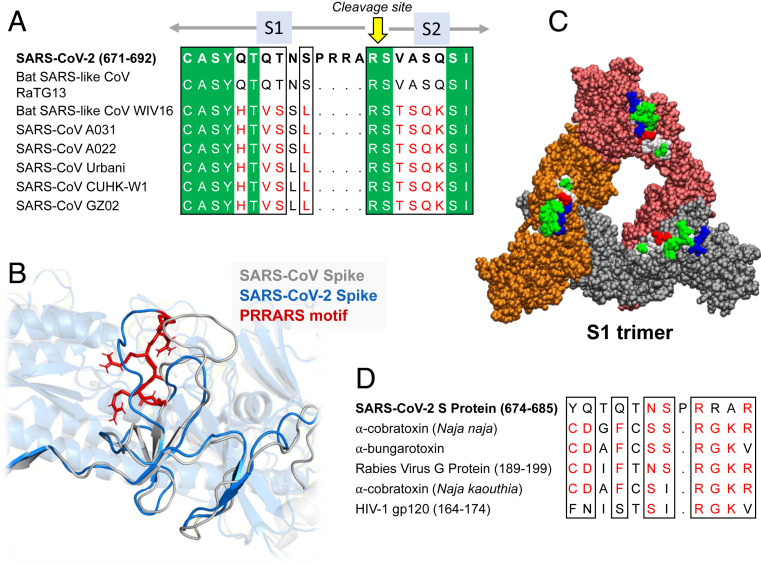

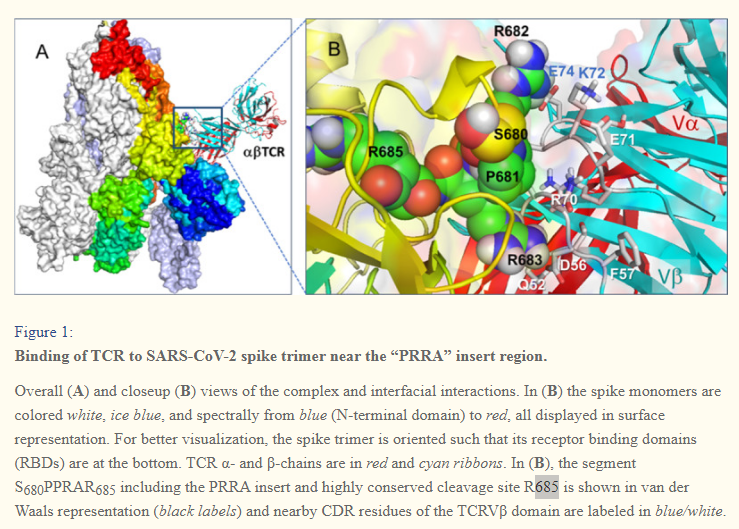

Further Examination of the Motif near PRRA Reveals Close Structural Similarity to the SEB Superantigen as well as Sequence Similarities to Neurotoxins and a Viral SAg.

The insertion PRRA together with 7 sequentially preceding residues & succeeding R685 (conserved in β-CoVs) form a motif, Y674QTQTNSPRRAR685, homologous to those of neurotoxins from Ophiophagus (cobra) and Bungarus genera, as well as neurotoxin-like regions from three RABV strains

(20) (Fig. 2D). We further noticed that the same segment bears close similarity to the HIV-1 glycoprotein gp120 SAg motif F164 to V174.

https://t.co/EwwJOSa8RK

In (B), the segment S680PPRAR685 including the PRRA insert and highly conserved cleavage site *R685* is shown in van der Waals representation (black labels) and nearby CDR residues of the TCRVβ domain are labeled in blue/white

https://t.co/BsY8BAIzDa

Sequence Identity %

https://t.co/BsY8BAIzDa

Y674 - QTQTNSPRRA - R685

Similar to neurotoxins from Ophiophagus (cobra) & Bungarus genera & neurotoxin-like regions from three RABV strains

T678 - NSPRRA- R685

Superantigenic core, consistently aligned against bacterial or viral SAgs