Laurus Labs - ⭕️⭕️⭕️

still no selling whatsoever. A strong point to accumulate further as the risk is minimum. at 20 EMA. Selling candles have fewer volumes.

More from Steve Nison

Explained you same concept with Elxsi. The real test of a strong Breakout is that the big hand will not give you another chance to buy the share at the breakout level. They will absorb all the selling of weak hands. I mean "STRONG breakout". https://t.co/7fxFqGQl3p

Tata Elxsi ---

— Steve Nison (@nison_steve) June 30, 2021

In the last 10 minutes, all the selling was absorbed despite intraday positions being squared off (if not converted). will wait for the EOD data. However, the chart structure is extremely strong. https://t.co/pci7GCDBEO pic.twitter.com/1NBD9V3mKc

Borosil Renewables - Patterns like these must be looked at carefully and must be kept on the radar. Herein price is contracting which generally signifies shifting of hands (from weak to strong). If you go wrong, the risk is limited in these. pic.twitter.com/iqyoeslZjy

— Steve Nison (@nison_steve) July 12, 2021

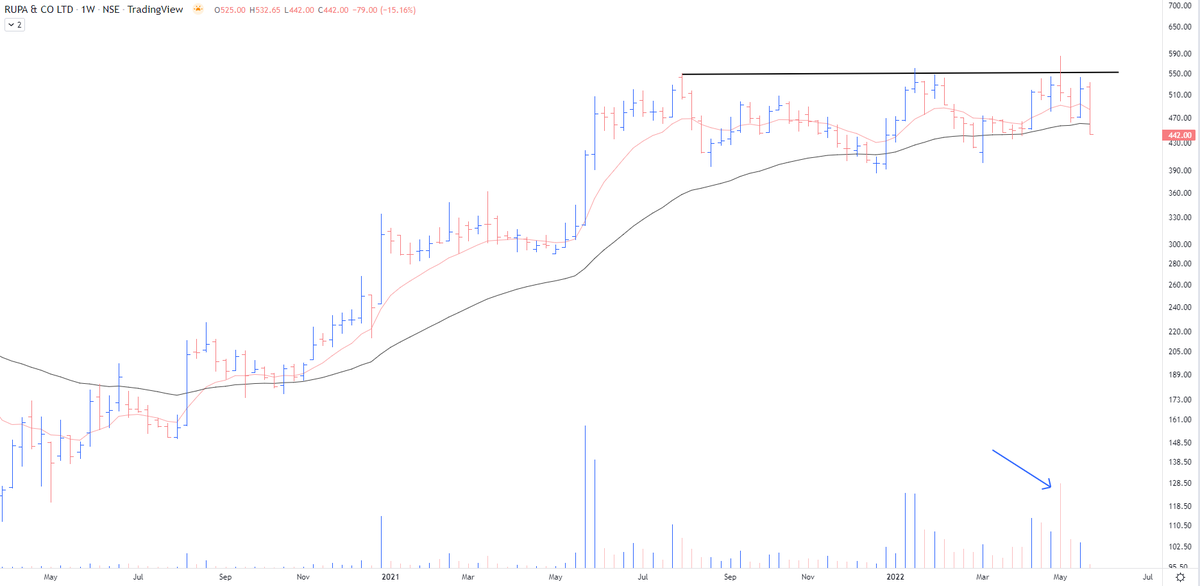

Fresh case - RUPA https://t.co/nqq5nI1wLU

Respect your stop losses in the stocks that have gone down today with heavy volumes even on a strong day.

— The_Chartist \U0001f4c8 (@charts_zone) March 17, 2022

VTL pic.twitter.com/3pJ9XngCDL

More from Lauruslabs

You May Also Like

Those who exited at 1500 needed money. They can always come back near 969. Those who exited at 230 also needed money. They can come back near 95.

Those who sold L @ 660 can always come back at 360. Those who sold S last week can be back @ 301

Sir, Log yahan.. 13 days patience nhi rakh sakte aur aap 2013 ki baat kar rahe ho. Even Aap Ready made portfolio banakar bhi de do to bhi wo 1 month me hi EXIT kar denge \U0001f602

— BhavinKhengarSuratGujarat (@IntradayWithBRK) September 19, 2021

Neuland 2700 se 1500 & Sequent 330 to 230 kya huwa.. 99% retailers/investors twitter par charcha n EXIT\U0001f602

Like company moats, your personal moat should be a competitive advantage that is not only durable—it should also compound over time.

Characteristics of a personal moat below:

I'm increasingly interested in the idea of "personal moats" in the context of careers.

— Erik Torenberg (@eriktorenberg) November 22, 2018

Moats should be:

- Hard to learn and hard to do (but perhaps easier for you)

- Skills that are rare and valuable

- Legible

- Compounding over time

- Unique to your own talents & interests https://t.co/bB3k1YcH5b

2/ Like a company moat, you want to build career capital while you sleep.

As Andrew Chen noted:

People talk about \u201cpassive income\u201d a lot but not about \u201cpassive social capital\u201d or \u201cpassive networking\u201d or \u201cpassive knowledge gaining\u201d but that\u2019s what you can architect if you have a thing and it grows over time without intensive constant effort to sustain it

— Andrew Chen (@andrewchen) November 22, 2018

3/ You don’t want to build a competitive advantage that is fleeting or that will get commoditized

Things that might get commoditized over time (some longer than

Things that look like moats but likely aren\u2019t or may fade:

— Erik Torenberg (@eriktorenberg) November 22, 2018

- Proprietary networks

- Being something other than one of the best at any tournament style-game

- Many "awards"

- Twitter followers or general reach without "respect"

- Anything that depends on information asymmetry https://t.co/abjxesVIh9

4/ Before the arrival of recorded music, what used to be scarce was the actual music itself — required an in-person artist.

After recorded music, the music itself became abundant and what became scarce was curation, distribution, and self space.

5/ Similarly, in careers, what used to be (more) scarce were things like ideas, money, and exclusive relationships.

In the internet economy, what has become scarce are things like specific knowledge, rare & valuable skills, and great reputations.