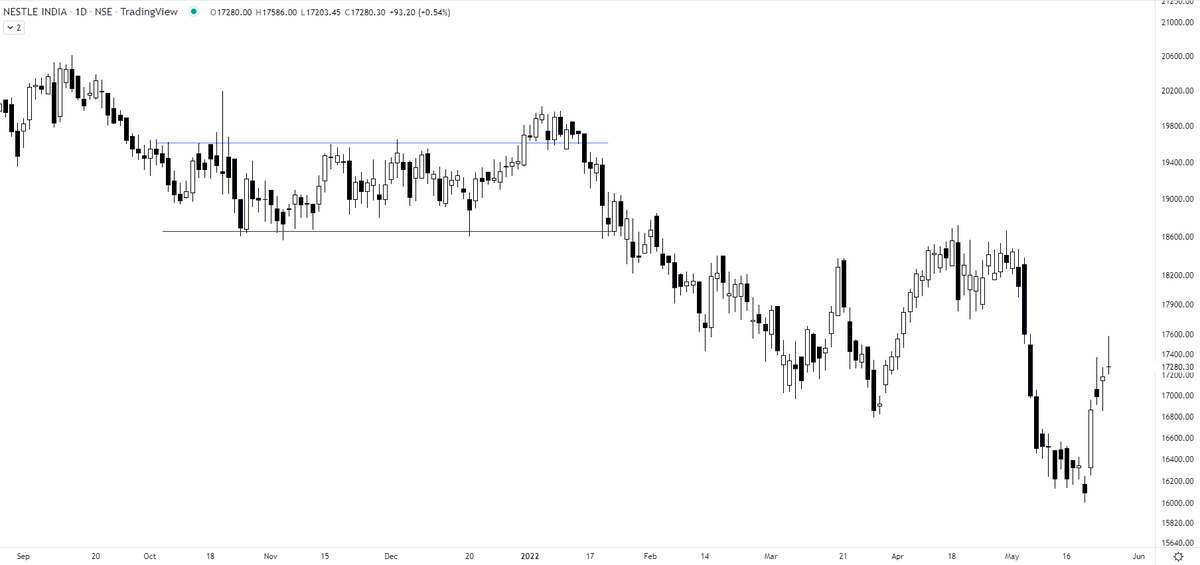

Jubilant Food

The major sell-off on huge volumes couldn't take it below Mar 7th low. The sell-off to my best analysis is capitulation wherein even the last bull has sold. I don't see any further selling pressure.

The risk is till March 7th low. The gap will act as a minor Res.

More from The_Chartist 📈

Jubilant Ingrevia - Key learning?

It is important to analyse the strength of the breakout. If the price does not continues the move in 1 or 2 sessions and candles show long upper wicks, it is better to bring the SL closer. Distribution sign.

Will be helpful in next breakouts. https://t.co/AtZOj4bKeT

It is important to analyse the strength of the breakout. If the price does not continues the move in 1 or 2 sessions and candles show long upper wicks, it is better to bring the SL closer. Distribution sign.

Will be helpful in next breakouts. https://t.co/AtZOj4bKeT

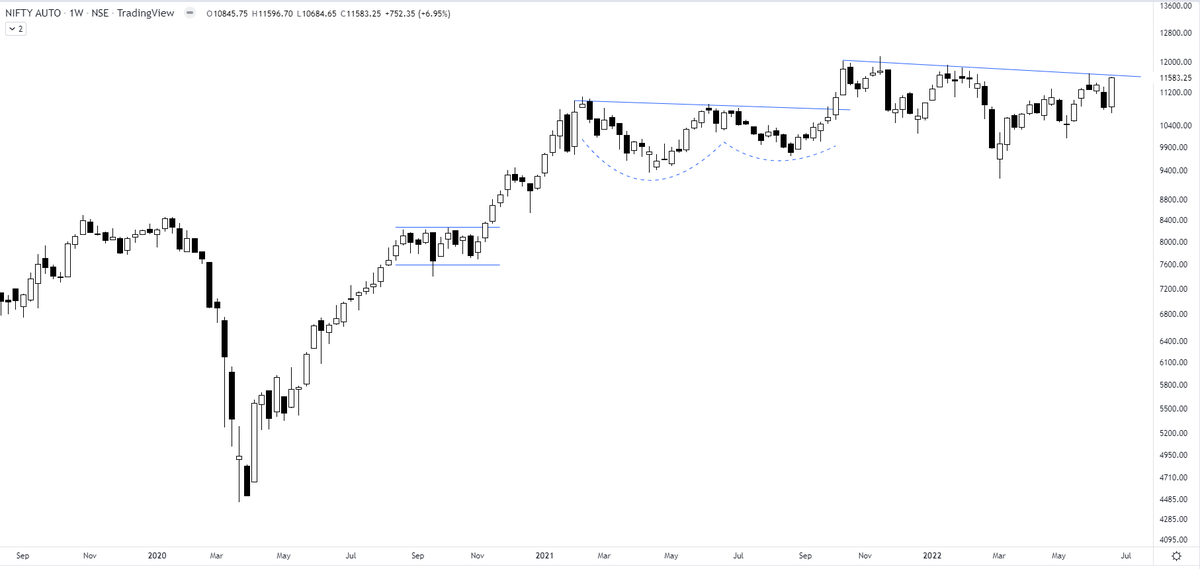

Learning: Strong breakout

— The_Chartist \U0001f4c8 (@nison_steve) July 2, 2021

1. Breakout candle will have no upper shadow or extremely less compared to the body

2. Volumes will be high (to avoid retailers to enter & also big hand absorbing all the selling)

3. Pullbacks will be rare/very less

4. Happens after a long consolidation pic.twitter.com/YTHDOnEdxo