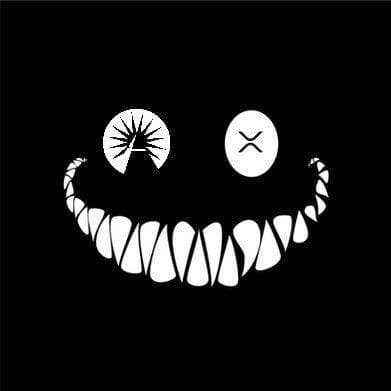

#jubilantfoodworks @ 2443, an "abc" correction is "almost" done fm 4575

Holding 2500 & moving past 2615 would be the 1st sign of reversal attempt

Only +ve factor "Highly oversold"-meant for aggressive traders

Conservative traders wait for some "Bull candle" formation in Day t/f https://t.co/NbwmqJxo0W

sir view on jubilant food works pls

— om namo venkatesaya (@being__trader) March 21, 2022

More from Van Ilango (JustNifty)

You could choose to make yr entries IF in Hour t/f, it closes above mid point, 13Sma- Your choice

Elliott wave alerted to termination of "ABC" correction at 2540-2550; Now, with "i" & "ii" almost done, would be looking for "iii"rd https://t.co/rSbLlguwp1

Bollinger band has been a trusted guide with the settings of 13sma & 2 std deviation. Add to it 5 & 8 smas and it works in all time frames.

— Van Ilango (JustNifty) (@JustNifty) September 29, 2020

Start from week & Day for investments; Hour & 5 minute for intraday.

Experiment initially; you'll still need other tools to read the mkt\U0001f600\U0001f64f pic.twitter.com/yEkHiDHiha

Only 2 signals - Buy & Sell

There is no stop loss in this system.

There could be some wild swings in prices like on "Budget Day" - In such a scenario, Keep 30 - 50 points below 21Sma to avoid big DD

It's a SAR system

how to take stop loss..? low of prev candle?

— ABHINAV JAIN (@abhijain017) February 9, 2022

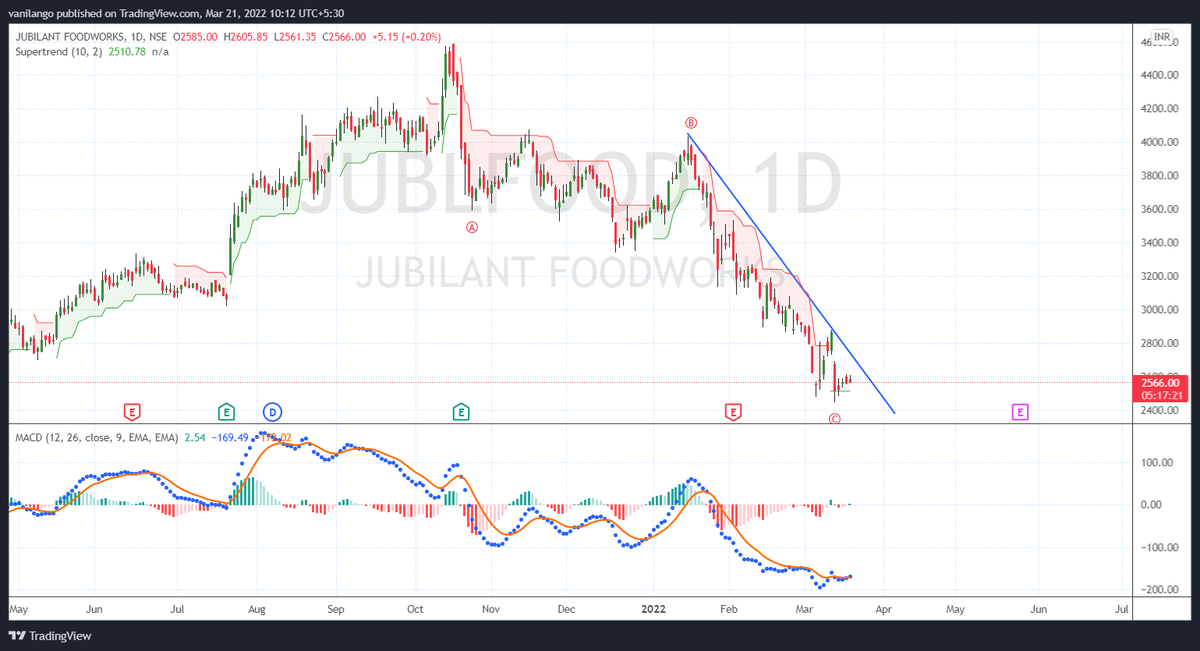

I'll go with 5th is getting done soon.

There is one more possibility that 3rd wave is sub-dividing !!

IF so it must hold last rise #retracement https://t.co/a6BBHIWrZk

ROLEX RINGS

— manav (@manav1418) June 24, 2022

Elliot counts (possible scenario's)

Which wave count is correct as per you\U0001f64f

please guide....!!@nakulvibhor @nishkumar1977 @JustNifty @piyushchaudhry @KrunallThakkar pic.twitter.com/h97J8Ycuf5

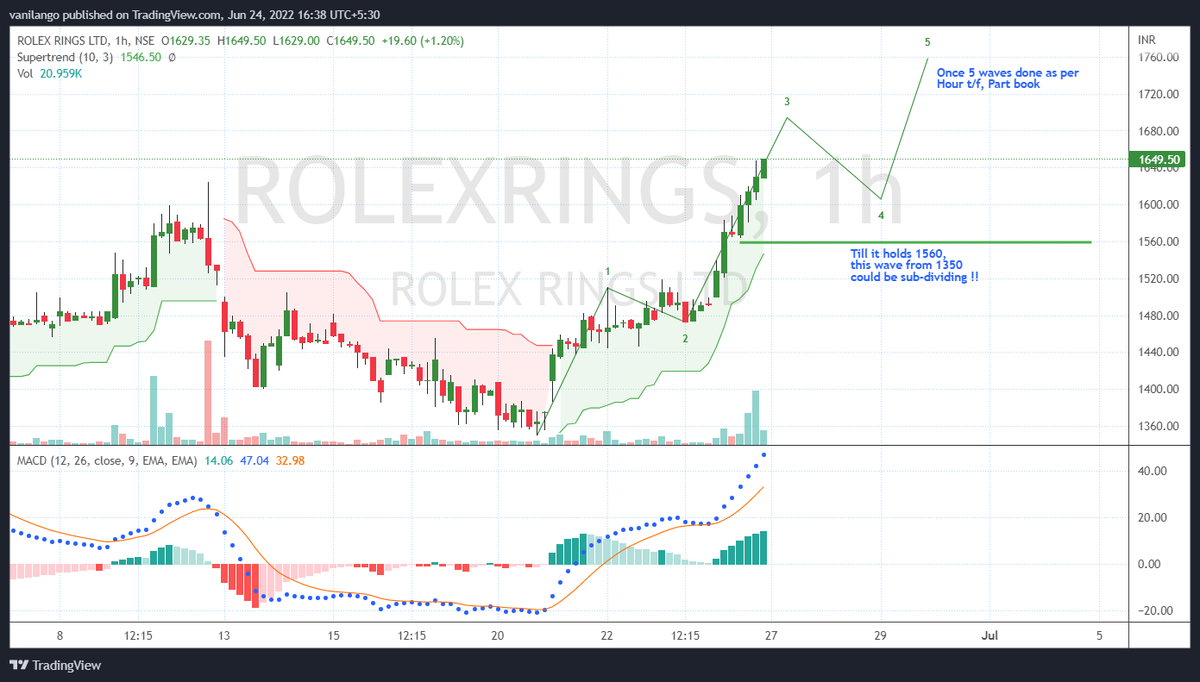

More from Jublfood

~ capitulation move

~ no further selling left

~ a major TL validated on a weekly scale

~ highest R:R ratio

With such capitulation & tight SL = capital put in was 30%

Risk = 50, Reward = 350

Jubilant Food https://t.co/M1vLYEsngf

The selling climax is accompanied by volume bars of such magnitude that I highlighted in the chart. In almost all cases, they signify that even the last bull has thrown in the towel & there is no further selling left. Will observe in this case.

— The_Chartist \U0001f4c8 (@charts_zone) March 15, 2022

Jubilant Food pic.twitter.com/j7bGSdhkRW

You May Also Like

One of those strategies which I like is Iron Fly✈️

Few important points on Iron fly stategy

This is fixed loss🔴 defined stategy ,so you are aware of your losses . You know your risk ⚠️and breakeven points to exit the positions.

Risk is defined , so at psychological🧠 level you are at peace🙋♀️

How to implement

1. Should be done on Tuesday or Wednesday for next week expiry after 1-2 pm

2. Take view of the market ,looking at daily chart

3. Then do weekly iron fly.

4. No need to hold this till expiry day .

5.Exit it one day before expiry or when you see more than 2% within the week.

5. High vix is preferred for iron fly

6. Can be executed with less capital of 3-5 lakhs .

https://t.co/MYDgWkjYo8 have R:2R so over all it should be good.

8. If you are able to get 6% return monthly ,it means close to 100% return on your capital per annum.

I believe that @ripple_crippler and @looP_rM311_7211 are the same person. I know, nobody believes that. 2/*

Today I want to prove that Mr Pool smile faces mean XRP and price increase. In Ripple_Crippler, previous to Mr Pool existence, smile faces were frequent. They were very similar to the ones Mr Pool posts. The eyes also were usually a couple of "x", in fact, XRP logo. 3/*

The smile XRP-eyed face also appears related to the Moon. XRP going to the Moon. 4/*

And smile XRP-eyed faces also appear related to Egypt. In particular, to the Eye of Horus. https://t.co/i4rRzuQ0gZ 5/*