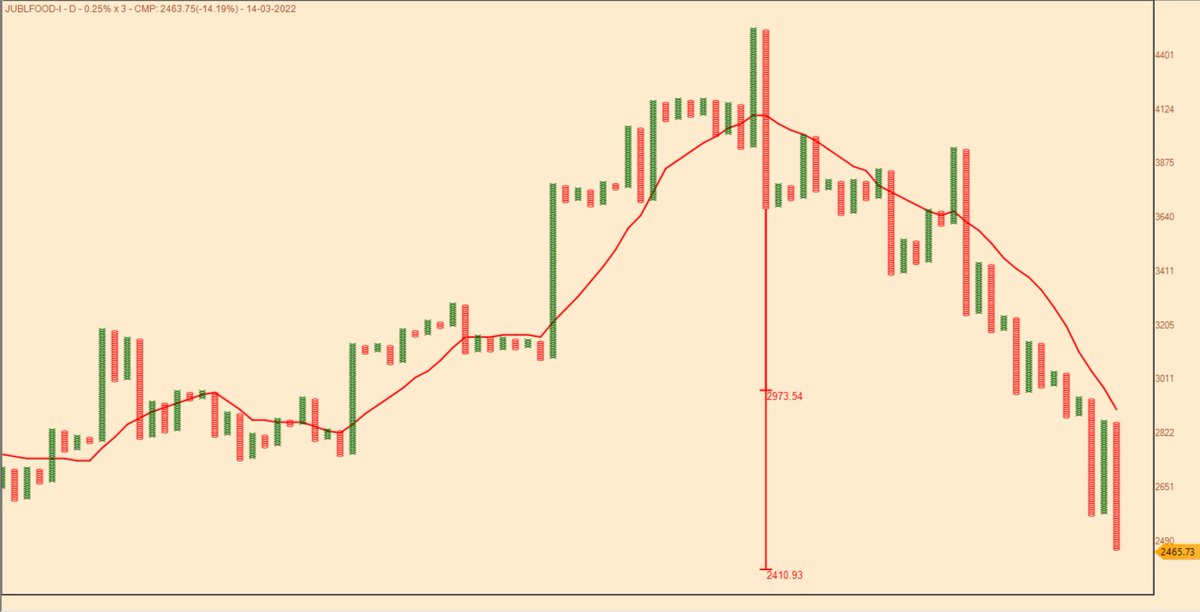

Jubilant Foodworks - Super-strong uptrend. The perfect trait of a marathon runner- Those holding the stock will find it difficult to digest the profits and those intending to buy will always find it expensive. :)

More from The_Chartist 📈

Syngene - Same concept. Price contraction. Shift from weak to strong hands through repeated volatility contractions. I can well write one whole page explanation on it. Look at the volume pump today. A big hand will never let you ride with him. Make sure you are there at the party https://t.co/RN8sQYzdBg pic.twitter.com/AShKWnQeJt

— Steve Nison (@nison_steve) July 15, 2021

Borosil Renewables - Patterns like these must be looked at carefully and must be kept on the radar. Herein price is contracting which generally signifies shifting of hands (from weak to strong). If you go wrong, the risk is limited in these. pic.twitter.com/iqyoeslZjy

— Steve Nison (@nison_steve) July 12, 2021

Russell 2000

It is better if you spend considerable time learning these concepts. https://t.co/caBHOO4Owa

TRAPS? In a false breakout, the price breaks out of the range & comes back within the range. A trap is one step ahead, price not only comes back within the range but breaks down in the opposite direction. It traps the initial longs who didn't close their positions

— The_Chartist \U0001f4c8 (@charts_zone) January 22, 2022

Russell 2000 pic.twitter.com/txzjdnStzc

More from Jublfood

Double Top Buy & T20 Pattern - Bullish above 4058.33 daily close on 1% Box Size chart. https://t.co/DPEehZwkS4

JUBLFOOD

— Saket Reddy (@saketreddy) June 24, 2020

Achieved the second target of 1820 today, now near the first target of 1780!

Got a nice 15-20% move till now.

Trailing stop loss is the best thing one can do now! https://t.co/YidPZamyxz

You May Also Like

Covering one of the most unique set ups: Extended moves & Reversal plays

Time for a 🧵 to learn the above from @iManasArora

What qualifies for an extended move?

30-40% move in just 5-6 days is one example of extended move

How Manas used this info to book

The stock exploded & went up as much as 63% from my price.

— Manas Arora (@iManasArora) June 22, 2020

Closed my position entirely today!#BroTip pic.twitter.com/CRbQh3kvMM

Post that the plight of the

What an extended (away from averages) move looks like!!

— Manas Arora (@iManasArora) June 24, 2020

If you don't learn to sell into strength, be ready to give away the majority of your gains.#GLENMARK pic.twitter.com/5DsRTUaGO2

Example 2: Booking profits when the stock is extended from 10WMA

10WMA =

#HIKAL

— Manas Arora (@iManasArora) July 2, 2021

Closed remaining at 560

Reason: It is 40+% from 10wma. Super extended

Total revenue: 11R * 0.25 (size) = 2.75% on portfolio

Trade closed pic.twitter.com/YDDvhz8swT

Another hack to identify extended move in a stock:

Too many green days!

Read

When you see 15 green weeks in a row, that's the end of the move. *Extended*

— Manas Arora (@iManasArora) August 26, 2019

Simple price action analysis.#Seamecltd https://t.co/gR9xzgeb9K