On an almost daily basis I see journalism about (never by) trans people repeating and spreading inaccurate information or responding to a partially imagined reality. It goes without saying that any discussion about trans rights needs to begin with facts!

More from Journalism

Instead of attacking those of us raising it, why aren’t mainstream “liberal” journalists on here as outraged as we are about how many senior Democratic Party figures seem to have been compromised by Chinese spies?

Genocide is non-negotiable

#TAGG 🧿

See examples:

1) Dem Senator Feinstein’s staffer for 20 years outed as a Chinese spy

Does nobody else find it fascinating that Senator Dianne Feinstein\u2019s (D) staffer for 20 years has been outed as a Chinese spy

— Maajid \u0623\u0628\u0648 \u0639\u0645\u0651\u0627\u0631 (@MaajidNawaz) November 10, 2020

Feinstein\u2019s husband invests in Dominion, the software used to count the disputed ballots.

Surely, that\u2019s news, no?

CBS local:https://t.co/iJ8mUfYJKB

2) Dem Eric Swallwell caught in a female Chinese spy’s snare:

.@SpeakerPelosi (D) has named Representative Eric Swallwell (D), who only last month was caught in a relationship with a Chinese spy https://t.co/Ikx38ELKaB as one of her impeachment managers against President Trump (https://t.co/Qb7CMtx6cW)

— Maajid \u0623\u0628\u0648 \u0639\u0645\u0651\u0627\u0631 (@MaajidNawaz) January 13, 2021

See how far the rot has spread

3) Dem Senator Boxer registers as a foreign agent for Chinese surveillance firm:

Scoop: Biden\u2019s inaugural committee will refund a donation from former Sen. Barbara Boxer after the California Democrat registered as a foreign agent for a Chinese surveillance firm accused of abetting the country\u2019s mass internment of Uighur Muslimshttps://t.co/smnSaRCcW9

— Axios (@axios) January 12, 2021

3) Dem Hunter Biden allegedly invests in Megvii, a firm accused of helping to round up Uyghurs using A+++ facial recognition technology

megvii, a company that hunter biden invests in supplies technology for \u201ca china-wide surveillance program called the skynet project, which uses more than 20m closed-circuit tv cameras to monitor citizens\u201d

— Maajid \u0623\u0628\u0648 \u0639\u0645\u0651\u0627\u0631 (@MaajidNawaz) September 29, 2020

thank you for your integrity @buzzfeedhttps://t.co/GEXaMbGnTu#TAGG \U0001f9ff pic.twitter.com/SNkvsZzkSU

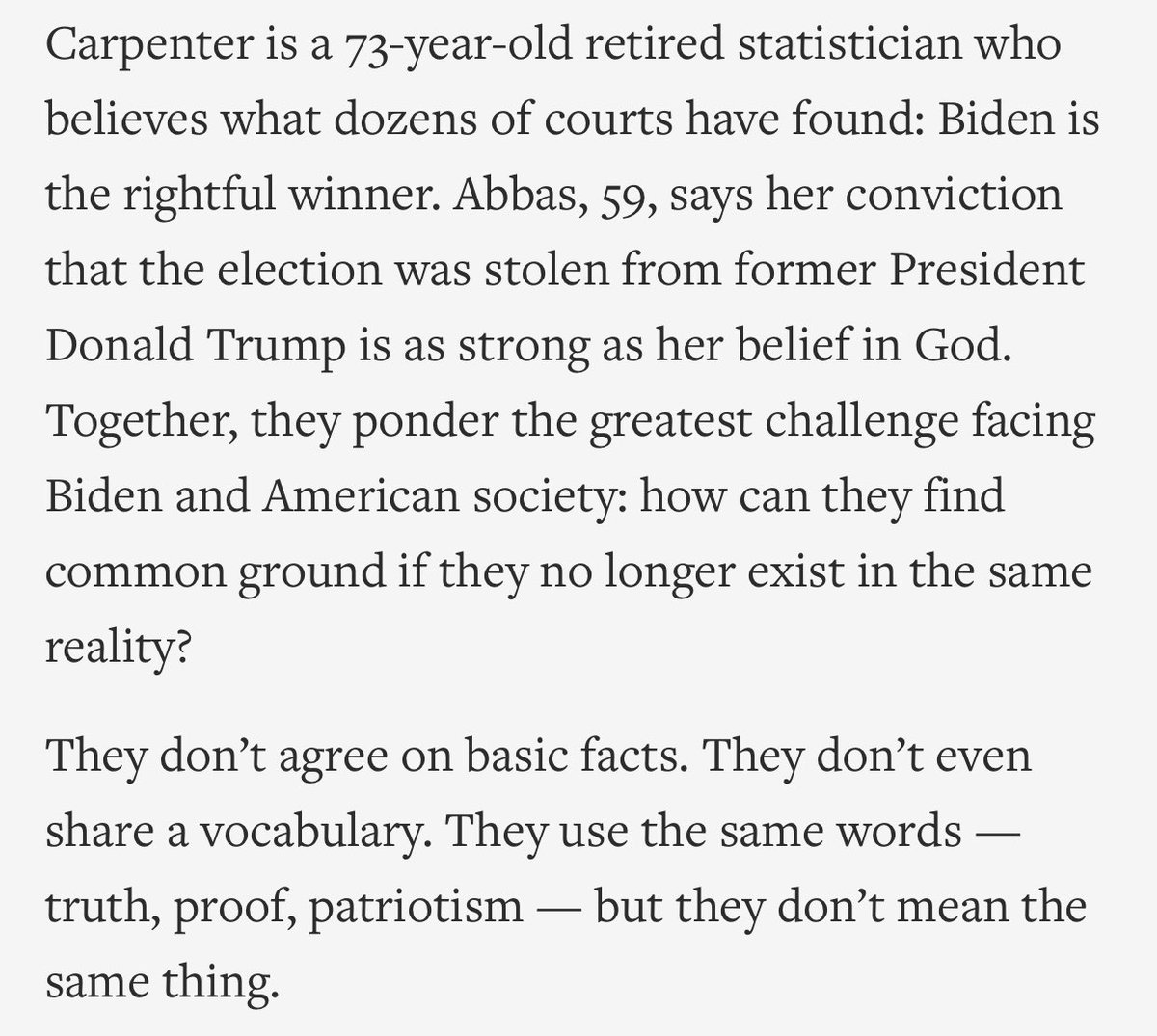

She thinks the election was stolen from Donald Trump. He believes what dozens of courts and officials have found: that Joe Biden is the rightful winner. They're trying to find common ground but wonder whether they \u2013 and the nation \u2013 can do it. https://t.co/oM5XrAevkl

— The Associated Press (@AP) January 24, 2021

Look at this. This treats both views as legitimate. Fucking garbage.

Have you learned nothing?! This is such bullshit. Why the fuck do I even bother trying to push back on bad journalism? No one in positions of power ever listen.

I used to think that bad journalism was mostly the result of honest mistakes, but the past few years have really hammered home for me how much it is intentional trash. Shame on @AP for that bullshit. Shame on @ABC for letting Rand Paul rant about his election conspiracy theories.

Seriously, @AP @ClaireGalofaro @JulietLinderman? You didn’t even bother to note that this lady’s delusions are false.

You May Also Like

I'll begin with the ancient history ... and it goes way back. Because modern humans - and before that, the ancestors of humans - almost certainly originated in Ethiopia. 🇪🇹 (sub-thread):

The famous \u201cLucy\u201d, an early ancestor of modern humans (Australopithecus) that lived 3.2 million years ago, and was discovered in 1974 in Ethiopia, displayed in the national museum in Addis Ababa \U0001f1ea\U0001f1f9 pic.twitter.com/N3oWqk1SW2

— Patrick Chovanec (@prchovanec) November 9, 2018

The first likely historical reference to Ethiopia is ancient Egyptian records of trade expeditions to the "Land of Punt" in search of gold, ebony, ivory, incense, and wild animals, starting in c 2500 BC 🇪🇹

Ethiopians themselves believe that the Queen of Sheba, who visited Israel's King Solomon in the Bible (c 950 BC), came from Ethiopia (not Yemen, as others believe). Here she is meeting Solomon in a stain-glassed window in Addis Ababa's Holy Trinity Church. 🇪🇹

References to the Queen of Sheba are everywhere in Ethiopia. The national airline's frequent flier miles are even called "ShebaMiles". 🇪🇹