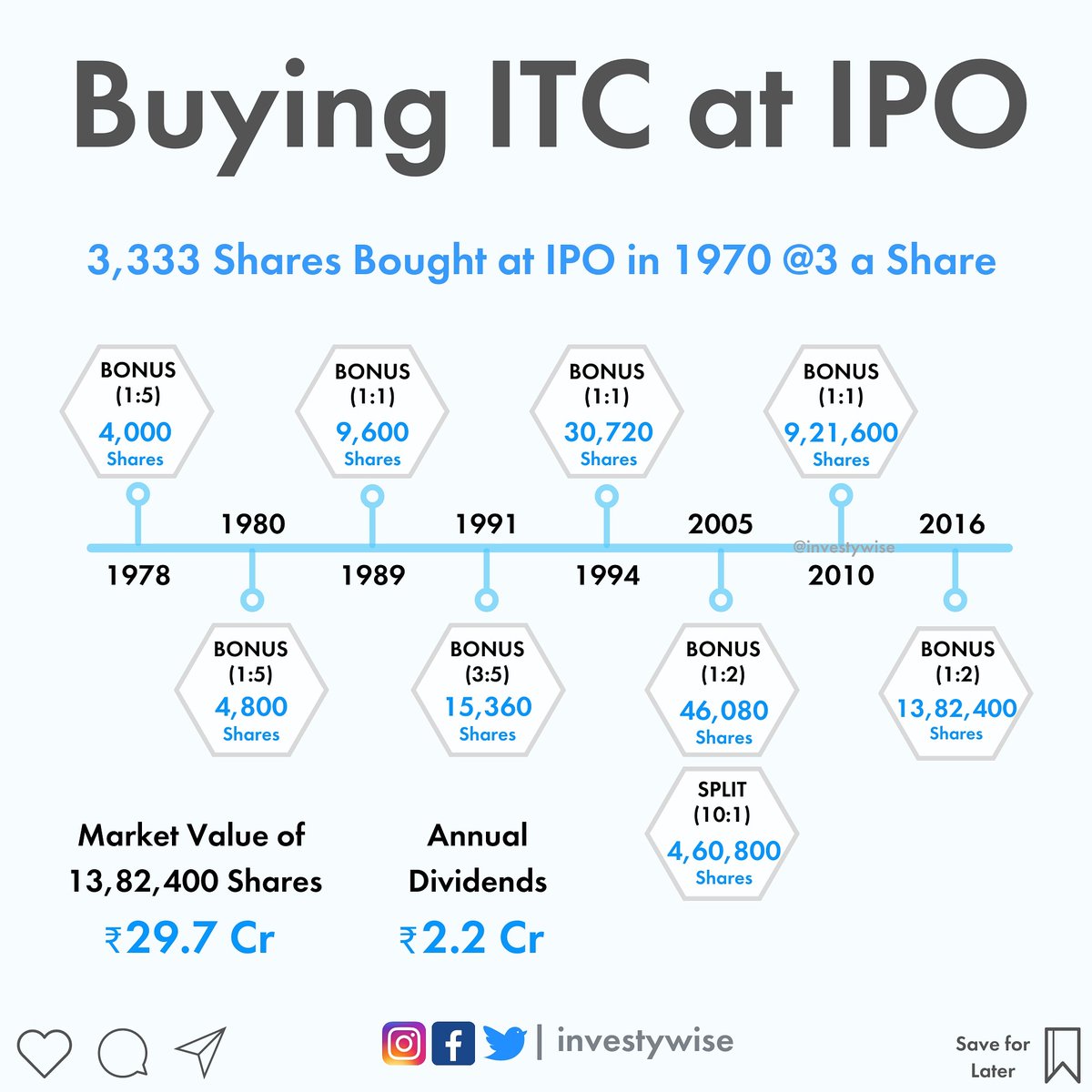

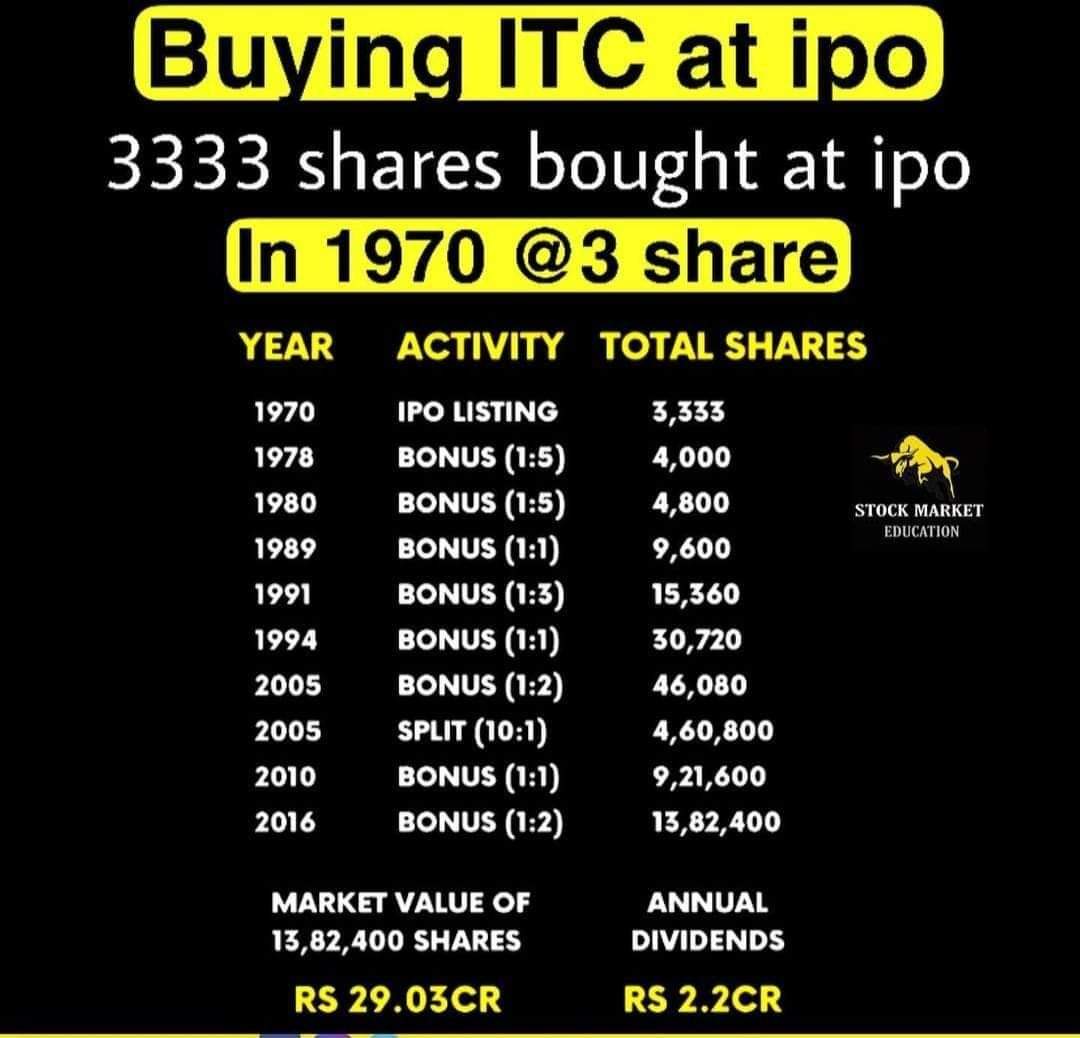

#ITC Is this last leg of downside or game over?🙆

Key points : 👇

~ RSI breakout retest in weekly chart

~ HH &HL pattern ,Price action still bullish

~ Huge support as per ratio chart.

#CNXFMCG #Nifty

#ITC I drilled further by #CNXFMCG index

— Pranay Prasun (@PranayPrasun) July 3, 2021

Keypoints :

~ Near huge support as per weekly chart

~ #RSI Breakout retest #Ratiochart

Conclusion : Bounceback expected

Timeframe : Weekly , So please avoid daily movement .@piyushchaudhry @gogrithekhabri @Deishma @pratyush_rohit https://t.co/PKbi7mdoam pic.twitter.com/MUWBSX2LlB

More from Pranay Prasun

Rounding Bottom pattern 🧐 https://t.co/EONRI5MOSZ

#Maithanalloys

— Pranay Prasun (@PranayPrasun) May 3, 2021

Highlighted this gem on 21st March at 560 level for big target.\U0001f918

Added to my portfolio after breakout (660 level)

Go through below thread for more details \U0001f447 https://t.co/IPRYa7pLlV

3. #powergrid

— Pranay Prasun (@PranayPrasun) April 2, 2022

~Already gave multiyear breakout and doubled too\U0001f525

~Bullish price action but looks like overbought to me as per weekly/monthly chart

~Slope height is getting reduced.Near to top

Verdict : Consolidation expected in near term. pic.twitter.com/VVVA8mzR1F