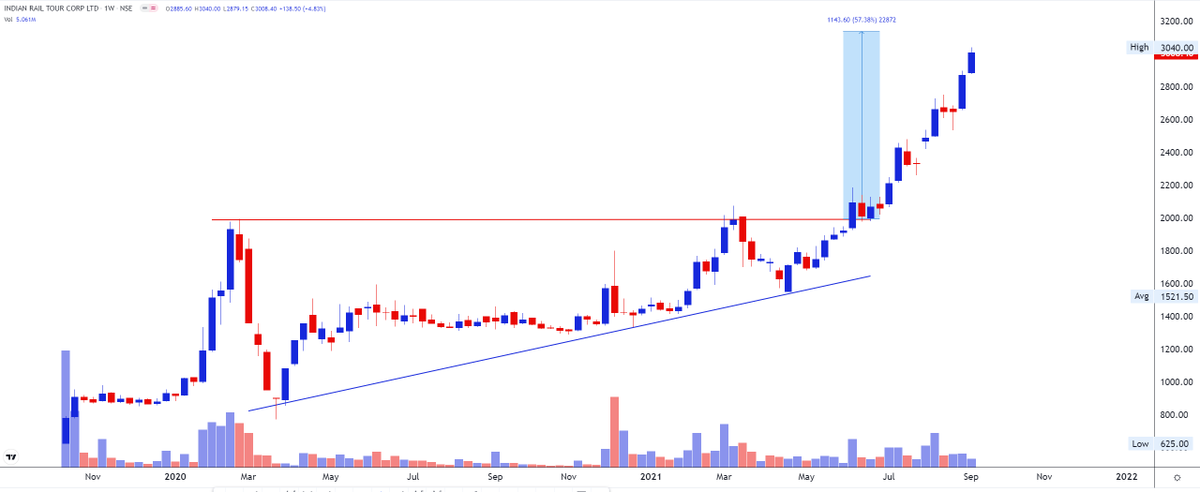

irctc

approching upper trendine , might took a small pause or need to break resistance with good volumes

target was 2900 , made high 2897 , with just 3 points short.

booking some positions as reached near resistance , will add near supportive trendline,

holding rest for 3600 https://t.co/2H0myGPgu5

Itctc

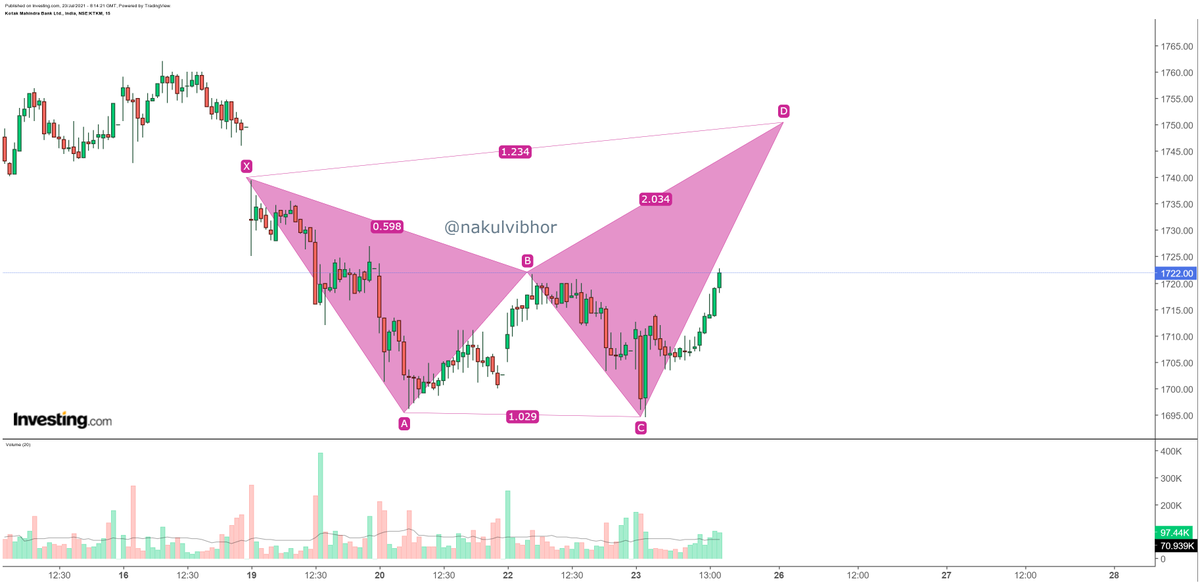

— Vibhor Varshney (@nakulvibhor) September 2, 2021

Entered 2800 \u2705

Heading towards 2900 target

Then 3600

Holding personally in folio \U0001f44d https://t.co/jd2OOQTSLs

More from Vibhor Varshney

Hits 599 ✅✅

Picked on 1st jan 2021

387 to 600

55% returns with a investment call ✅✅

213 points in nearly 7 months

Wipro is a long term stock, not a trading stock

Buy and forget types

Target 625 - 675 - 729

One can add now too

🙌🏻

Wipro

— Vibhor Varshney (@nakulvibhor) June 14, 2021

Picked on 1st jan 2021

387 to 562

45% returns with a investment call \u2705\u2705

175 points in nearly 6 months

Wipro is a long term stock, not a trading stock

Buy and forget types

Target 599 - 625

One can add now too

\U0001f64c\U0001f3fb https://t.co/wfvPZ2eZkW

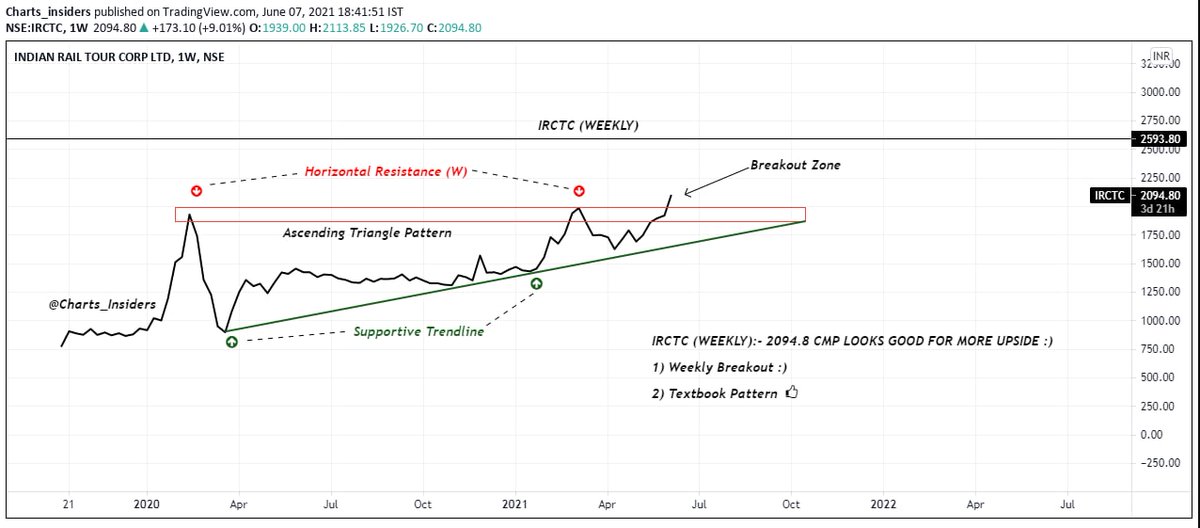

More from Irctc

1. Still 200/400 point movement left as per Ascending Triangle Pattern.

2. Stock perfectly moved according to the classic pattern.

3. Next level to watch now 3500-4000

4. Support near 2600-2800 https://t.co/VrUhS85Rml

NSE:IRCTC 1775 +2.78%

— Mr. Chartist (@Mr_Chartist) February 26, 2021

-Cup and Handle breakout

-Support at 1600/1650

-Next levels at 1900/2000/2100++#TA pic.twitter.com/LxpPTI0rB6

You May Also Like

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020