🕵️♂️ How Google's PageRank algorithm works

The PageRank algorithm gives each page a rating of its

importance, which is a recursively defined measure of importance, based on if important pages link to it.

It's recursive because the importance of a page refers back to the importance of other pages that link to it

Here's how it works in practice:

1⃣ We start with some pages and crawl them for links

2⃣ Each page has 1/N points (where N as the total number of pages)

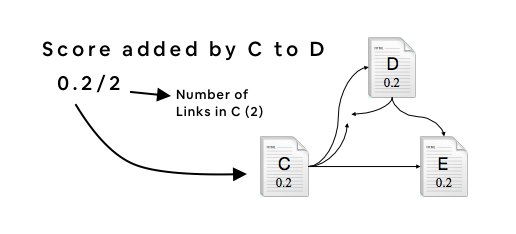

3⃣ Add points to each page for the amount of links to it, divided by the number

of links emanating from the sources of these links