I recently bought health insurance for few family members. The kind of person I'm, this meant an uncontrollable spiral into research

I read through at-least

- 15 policy documents,

- handbooks+circulars published by IRDAI (the regulatory authority),

- and several blogs

**10 things to remember while buying health insurance**

Now the fun part

The room rent across major Insurers is generally capped to 1% of Sum Insured(SI) per day; which means if your SI is 5 lakh, the insurer WON'T pay more than 5k/day

ICU room charges are generally capped to 2% of SI; which means if your SI is 5 lakh, the insurer will NOT pay more than 10k/day

If you have had experience with ICU charges, 10k/day is nothing for ICU

Say you have a SI of 5 lakh, and you had opted for a room within admissible range (5k/day)

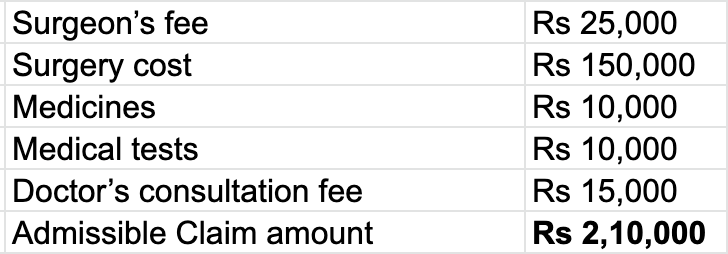

Imagine on the day of discharge, you are presented with the final bill as shown

Each of the line items gets reduced in "proportion" of (5/8) = (admissible/actual room rent)

Tragic and funny

You need to be very careful about Co-pay especially if you are buying Insurance for Senior citizens, or folks with critical illness

What that means is, if your admissible claim amount is say 3 lakh, for a Co-pay of 10%, you will have to put up 30k; if claim amount is 5 lakh, you will have to put up 50k. You get the idea

Unfortunate as it is, when she buys an insurance, she CAN'T claim any costs towards hospitalisations@Diabetes till she has waited for at-least

Also, the waiting period differs across diseases & Insurers

**What I did - I looked for a policy that gave me 2 years as waiting period; most insurers give a standard 4 year waiting period

**Make a list of all the pre-existing diseases(PED)/critical diseases specific to the person being insured and factor in the waiting period for those specific diseases

This means, the day I exit my org, the policy expires. Worst, the reverse countdown that had started on my waiting period gets reset!

Fortunately, there's an easy way to tackle this

**Porting - Moving to a new Insurer

Migration - Moving to a new policy within the same Insurer

So say for a family of 3 (1 kid, husband and wife), the total SI could be 5 lakh, which can be claimed by any of the 3 members

On demise of the primary policyholder, the policy ceases to exist for all other members, and they have to buy a new policy at the existing market rates

Many Insurers reward you a 5% CB for every claim free year though I did see policies going as high as 25%

% of CB is important if you are buying insurance early on and also if you are fit. Why?

Say you have an individual insurance with cover of 5 lakh. If you get hospitalised for a medical emergency, and your total expense was 8 lakh, you will have to pay...

Now say everything remains the same, in addition, you also had a top-up policy with a deductible of 5 lakh.

This time, the remaining 3 lakh (claim amount above deductible) will be covered by your top-up policy

ALWAYS go for policies that have "cashless" mode & ALWAYS check for hospitals around you that are included in the PPN.

You May Also Like

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0