https://t.co/Lchqz8WGw0

Sharing 2 my personal fav stock filtering publically now in real time to get stock for watchlist, but analysis before taking trade.

1. Range

https://t.co/Lchqz8WGw0

Thanks!

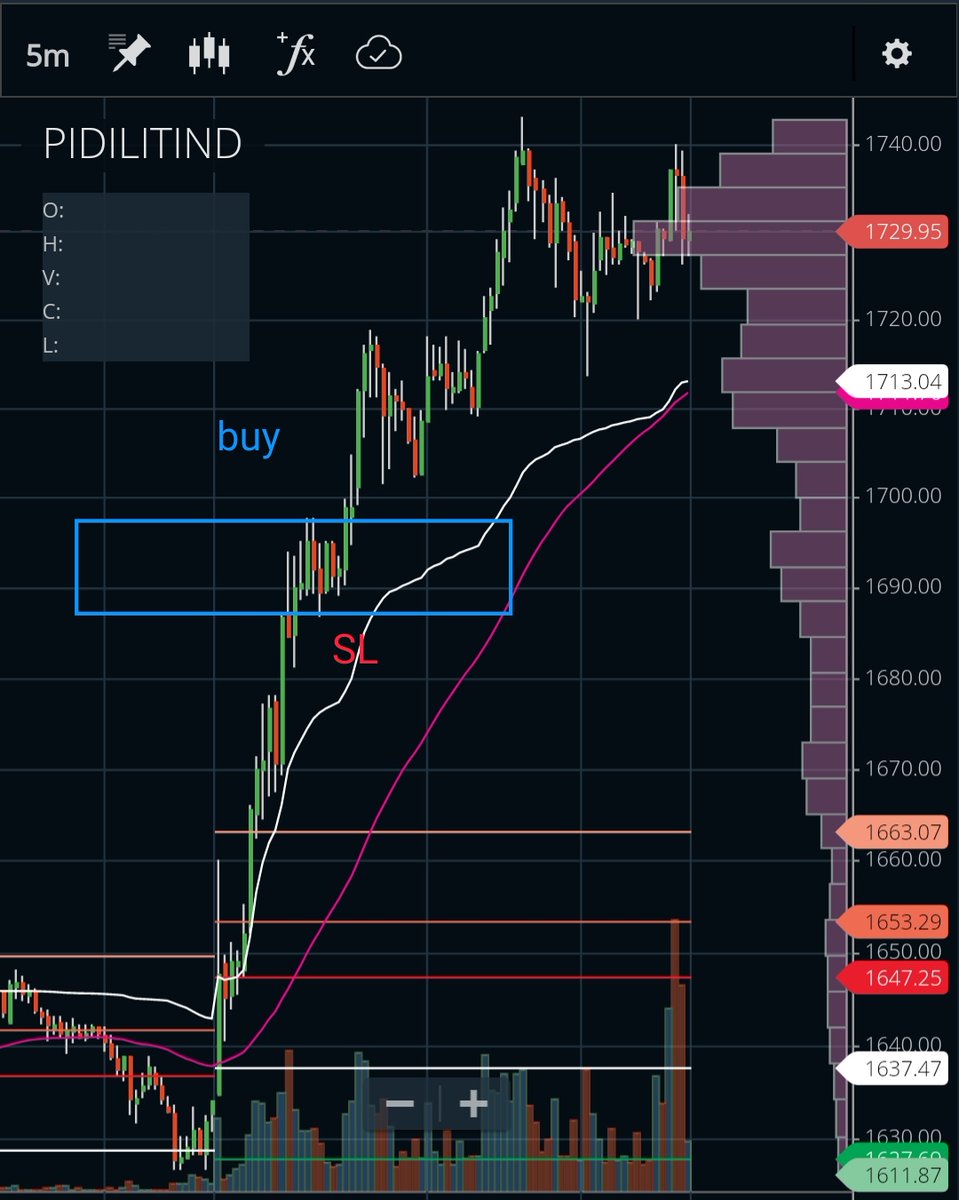

So once i see gud bo then i can take trade.

https://t.co/QgNQdu4Xbw

https://t.co/rq45EUdw2L

If u r doing intra simply buy aggresive bo or trendline break near to vwap. And trail once in Profit.

Orientcem .....Volume Breakout Candidate pic.twitter.com/74D0T5AGZl

— DON LEON (@donleon52) December 17, 2020

Short term fno trend reversal stocks for intraday to small tf swing. Please do the technical analysis at ur end bcoz sometimes even bearish stock u will face. Thats why not shared earlier, please wait atleast HH HL formation. https://t.co/oD5MjgJ5PS

— SanJeet Kumar \U0001f426 (@sanjufunda) January 29, 2021

https://t.co/ahrFSPzwiz

Momentum Stocks Picking:

— SanJeet Kumar \U0001f426 (@sanjufunda) July 22, 2021

Result Script + Move more than 1.5ATR move either side.

That's it enter whenever see low risk in direction.

One more thing want to rectify; scanner just give you watchlist not trade; According ur technical judgement trade it, before using it just observed few days as well.

You May Also Like

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020