Ion Exchange (India) is engaged in a wide range of solutions across the water cycle from pre-treatment to process water treatment, waste water treatment, recycle, zero liquid discharge, sewage treatment, packaged drinking water, sea water desalination.

Ion Exchange (India) is engaged in a wide range of solutions across the water cycle from pre-treatment to process water treatment, waste water treatment, recycle, zero liquid discharge, sewage treatment, packaged drinking water, sea water desalination.

The company operated under three business segments; Engineering segment, Chemicals segment & Consumer Products. Based in Mumbai, the company has seven manufacturing & assembly facilities across India, and one each in Bangladesh, UAE, Bahrain and Indonesia.

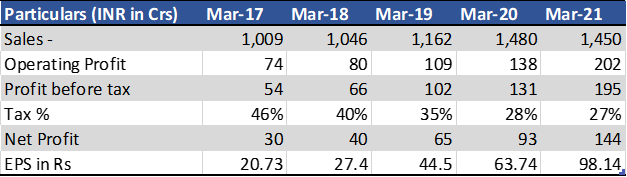

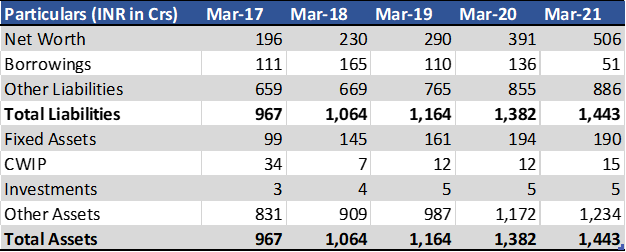

In FY21:

The overall Sales fell by 2%

6% decline in chemicals

14% fall in consumer products

Engineering had a 0.2% growth

Even after fall in Sales Operating Profits grew by almost 50% YoY (Margin 13.96%)

Net Profit Margin of 9.89%

The margins improved based on increased degree of utilization of the clinical setup & improved efficiencies from increased scale of operations

There was favorable movement in raw material prices

The long-term debt reduced from INR 18.8 Cr. to INR 8 Cr

The company grabbed a Letter of Award and Contract from the government for rural drinking water supply to 1,000 villages in two districts of Uttar Pradesh worth INR 1,000 Cr

Expecting to setup a greenfield plant for its resin facility (Capex INR 100Cr+)

Order book of the company stands solid with INR 662 Cr. for Engineering projects, INR 5.4 Cr. for the Sri Lanka Project and INR 6000 Cr. for the Bid Pipeline

Increase their spending on R&D to add additional product lines

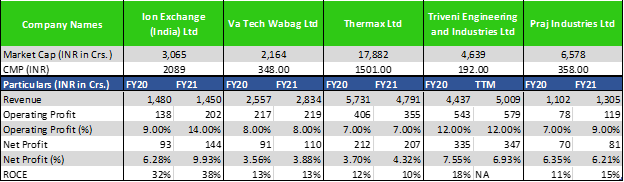

The primary competitor of Ion Exchange is VA Tech Wabag providing similar waste water treatment solutions.

Other peers like Thermax Ltd, Triveni Engineering & and Praj Industries Ltd have their water business segment constitute very low % of their revenue

More from Iex

although a must-have portfolio stock. Faced resistance right at the upper channel boundary. Volumes high. Any retracement back to the lower boundary will be an opportunity to accumulate. https://t.co/5uDsUXsbPP

IEX - the resistance turning support. Kindly review, please. @nishkumar1977 @suru27 @rohanshah619 @indian_stockss @sanstocktrader @BissaGauravB @RajarshitaS @PAVLeader @Rishikesh_ADX @VijayThk @Investor_Mohit @TrendTrader85 pic.twitter.com/7CCzmee5If

— Steve Nison (@nison_steve) December 18, 2020

You May Also Like

Covering one of the most unique set ups: Extended moves & Reversal plays

Time for a 🧵 to learn the above from @iManasArora

What qualifies for an extended move?

30-40% move in just 5-6 days is one example of extended move

How Manas used this info to book

The stock exploded & went up as much as 63% from my price.

— Manas Arora (@iManasArora) June 22, 2020

Closed my position entirely today!#BroTip pic.twitter.com/CRbQh3kvMM

Post that the plight of the

What an extended (away from averages) move looks like!!

— Manas Arora (@iManasArora) June 24, 2020

If you don't learn to sell into strength, be ready to give away the majority of your gains.#GLENMARK pic.twitter.com/5DsRTUaGO2

Example 2: Booking profits when the stock is extended from 10WMA

10WMA =

#HIKAL

— Manas Arora (@iManasArora) July 2, 2021

Closed remaining at 560

Reason: It is 40+% from 10wma. Super extended

Total revenue: 11R * 0.25 (size) = 2.75% on portfolio

Trade closed pic.twitter.com/YDDvhz8swT

Another hack to identify extended move in a stock:

Too many green days!

Read

When you see 15 green weeks in a row, that's the end of the move. *Extended*

— Manas Arora (@iManasArora) August 26, 2019

Simple price action analysis.#Seamecltd https://t.co/gR9xzgeb9K

Why is this the most powerful question you can ask when attempting to reach an agreement with another human being or organization?

A thread, co-written by @deanmbrody:

Next level tactic when closing a sale, candidate, or investment:

— Erik Torenberg (@eriktorenberg) February 27, 2018

Ask: \u201cWhat needs to be true for you to be all in?\u201d

You'll usually get an explicit answer that you might not get otherwise. It also holds them accountable once the thing they need becomes true.

2/ First, “X” could be lots of things. Examples: What would need to be true for you to

- “Feel it's in our best interest for me to be CMO"

- “Feel that we’re in a good place as a company”

- “Feel that we’re on the same page”

- “Feel that we both got what we wanted from this deal

3/ Normally, we aren’t that direct. Example from startup/VC land:

Founders leave VC meetings thinking that every VC will invest, but they rarely do.

Worse over, the founders don’t know what they need to do in order to be fundable.

4/ So why should you ask the magic Q?

To get clarity.

You want to know where you stand, and what it takes to get what you want in a way that also gets them what they want.

It also holds them (mentally) accountable once the thing they need becomes true.

5/ Staying in the context of soliciting investors, the question is “what would need to be true for you to want to invest (or partner with us on this journey, etc)?”

Multiple responses to this question are likely to deliver a positive result.