1. Heikin-Ashi, also called Heiken-Ashi, is translated as an "average bar" in Japanese.

2. The Heikin Ashi strategy is a useful tool used in identifying market trends and

predicting the future prices of assets.

2/N

ULTIMATE GUIDE TO 21 and 200 Moving Average

— JayneshKasliwal (@JayneshKasliwal) November 14, 2021

SUNDAY THREAD \U0001f516

A trend Following System That will Help You Improve Trading immensely.

RETWEET AND SHARE \U0001f504@kuttrapali26 @AmitabhJha3 #stocks #StockMarket

1/n

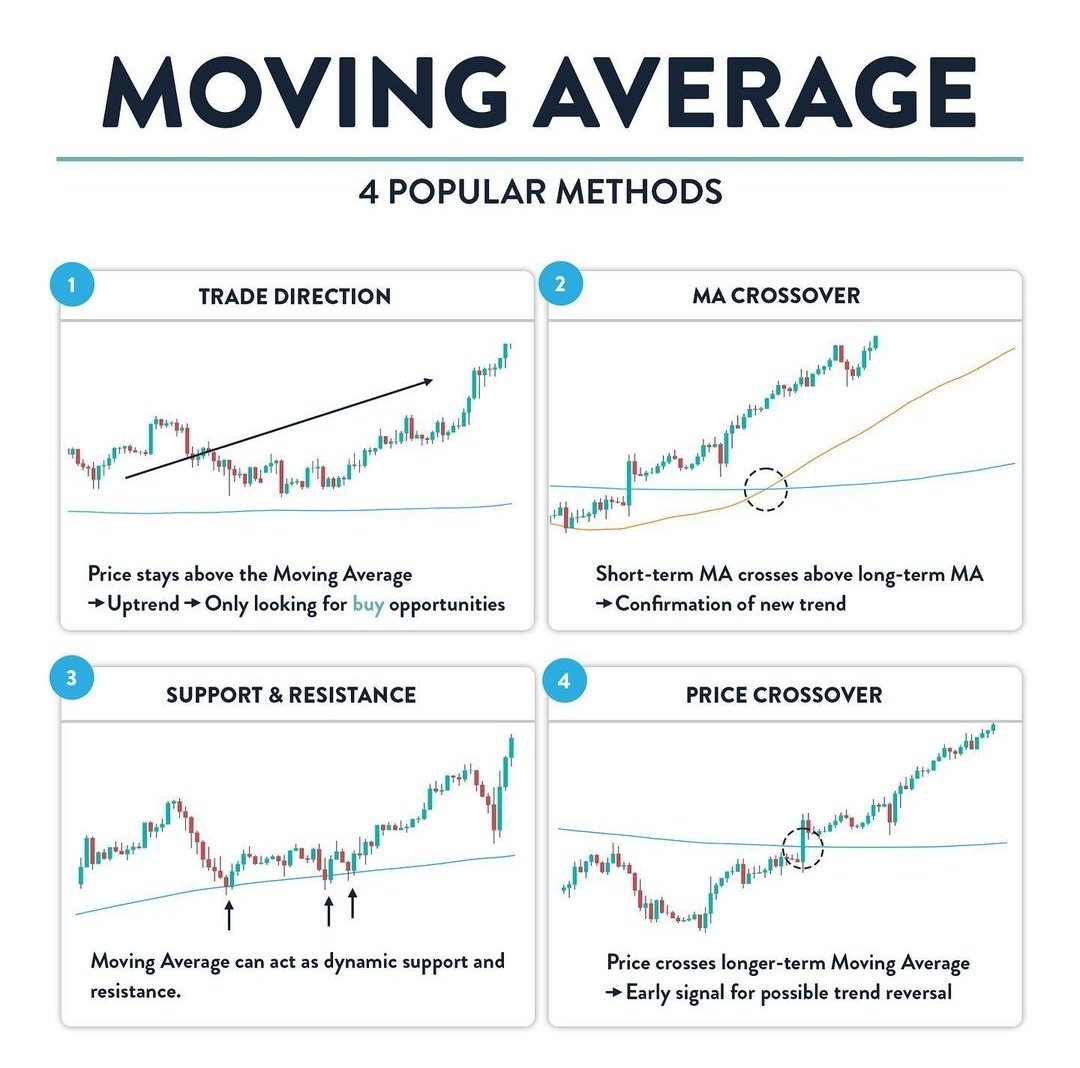

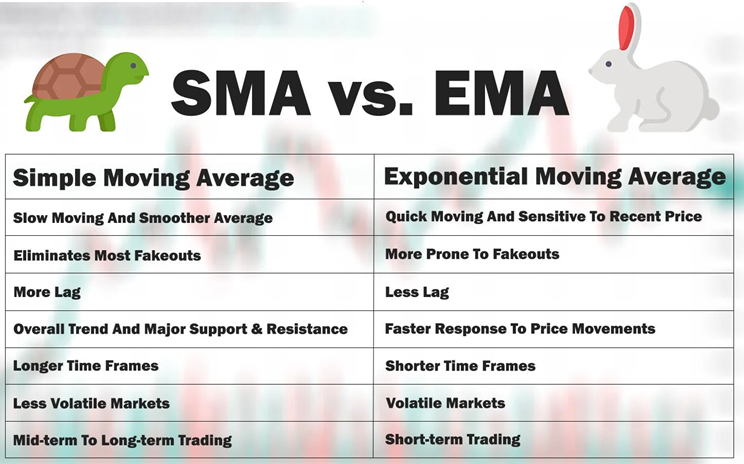

The Ultimate Guide to moving averages !

— JayneshKasliwal (@JayneshKasliwal) November 30, 2021

A mega thread to understand the Use of 21 , 50 and 200 ema.

4 Effective uses of Exponential Moving Averages !

Retweet and Share \U0001f504#stockmarkets #nifty @kuttrapali26 @caniravkaria

A Thread on indicator : ADX

— JayneshKasliwal (@JayneshKasliwal) January 1, 2022

Average Directional Index a Quick Guide

Retweet Share !@Techno_Charts

1/n pic.twitter.com/wRvQo5JNKN

A Mega Thread on RELATIVE STRENGTH

— JayneshKasliwal (@JayneshKasliwal) January 10, 2022

A method to improve

Stock Selection and Conviction in trades

Retweet \U0001f504And Follow @JayneshKasliwal

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0