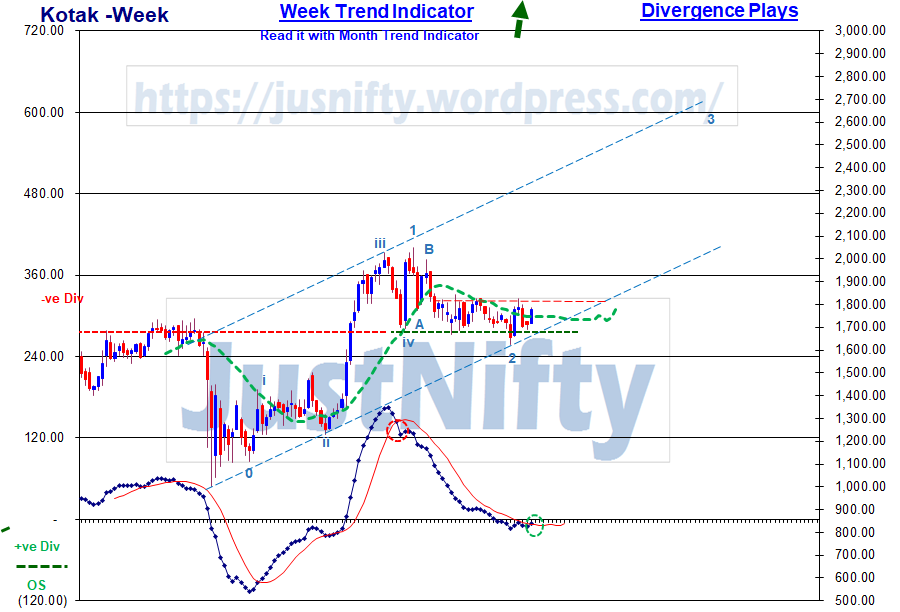

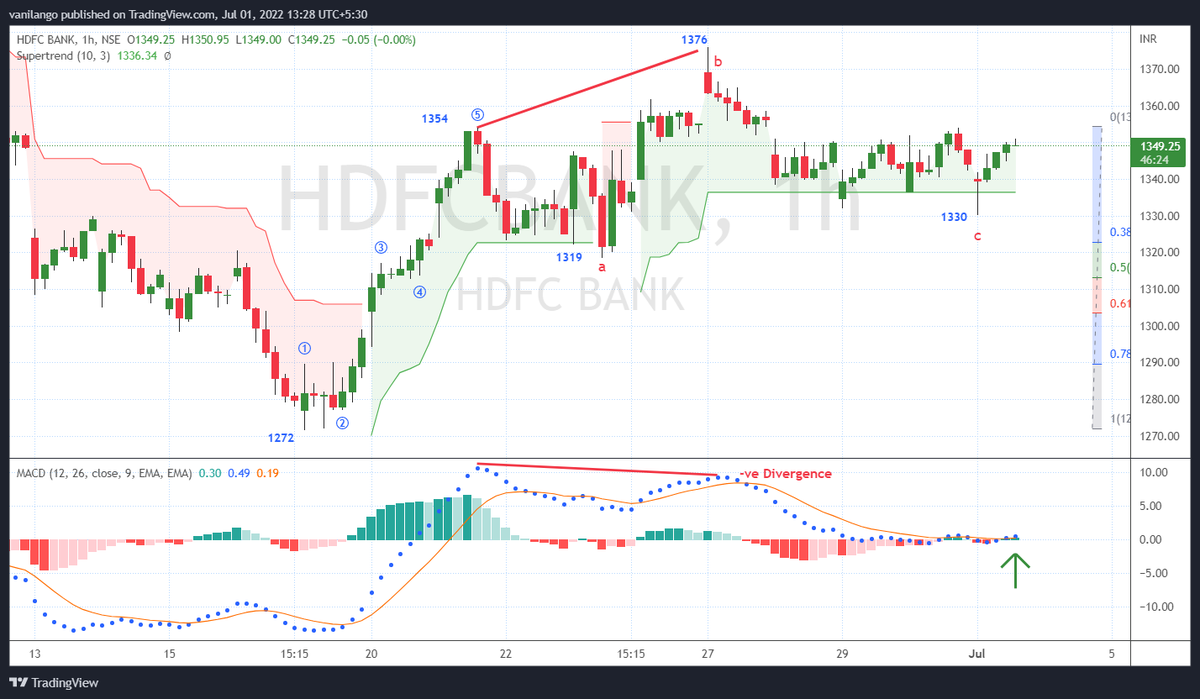

#Hdfcbank

IF holds 1340, likely to move past 1376 to 1415-1425. https://t.co/Rx2C2u2PpE

King your views on hdfc bank?

— Anshul Garg (@AnshulG82959391) July 1, 2022

More from Van ilango (JustNifty)

Have patience; let the market reveal it's hand.

You ask me or any other persons, they'll tell you their subjective view however unbiased they attempt to be.

It is their view and not necessarily the market's.

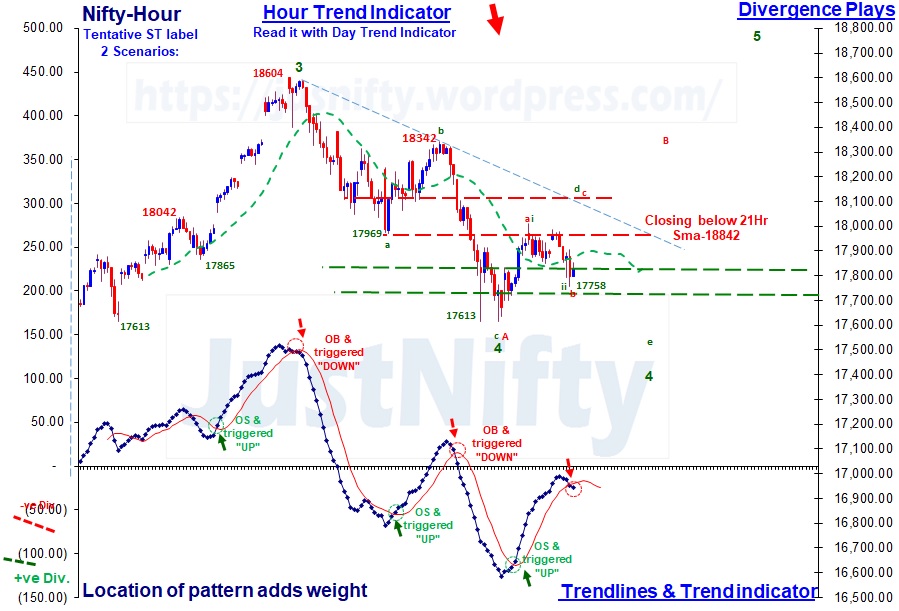

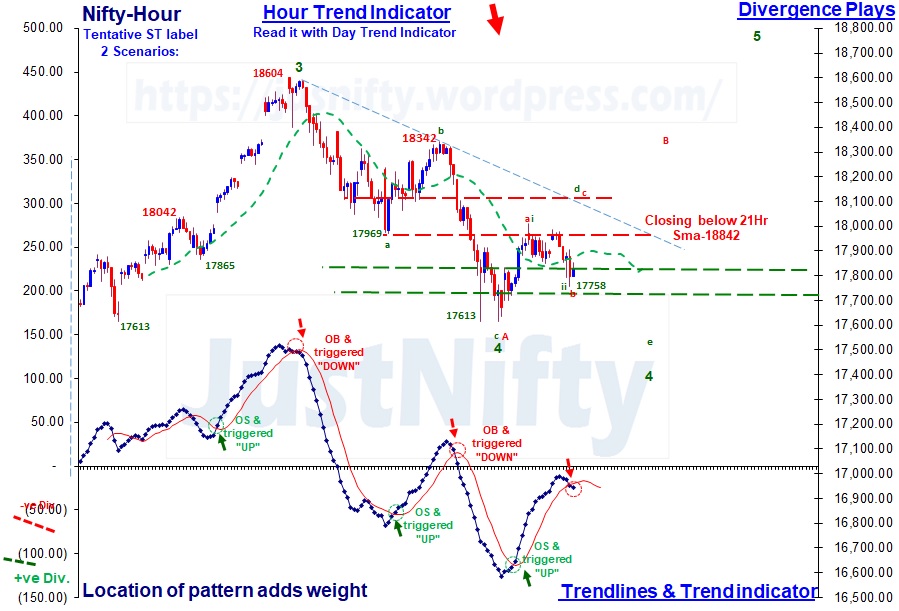

My subjective view is labelled in the charts.

Follow #Priceaction https://t.co/37iXFtWPzU

You ask me or any other persons, they'll tell you their subjective view however unbiased they attempt to be.

It is their view and not necessarily the market's.

My subjective view is labelled in the charts.

Follow #Priceaction https://t.co/37iXFtWPzU

Currently reading the book you put on your website. Also, from this if we consider 18600 as 5 th wave end of Nifty ideally it's doing the 1st 12345 of downtrend, of which do e already 1234, currently going towards 5 which I believe should go below 100% of 4th retracement wave

— de soloist \U0001f1ee\U0001f1f3 (@ChakiArijit) November 4, 2021

Blue line(13Sma)moves below Red line(26Sma), SELL triggers

Only 2 signals - Buy & Sell

There is no stop loss in this system.

There could be some wild swings in prices like on "Budget Day" - In such a scenario, Keep 30 - 50 points below 21Sma to avoid big DD

It's a SAR system

Only 2 signals - Buy & Sell

There is no stop loss in this system.

There could be some wild swings in prices like on "Budget Day" - In such a scenario, Keep 30 - 50 points below 21Sma to avoid big DD

It's a SAR system

how to take stop loss..? low of prev candle?

— ABHINAV JAIN (@abhijain017) February 9, 2022