He said if you even mentioned his name, all days off were canceled due to prep.

I really wish someone would call my Dad, a retired Capitol Hill police officer (37yrs), to talk about the difference in preparation. The stories he’s telling me about prep for Farrakhan and others vs why yesterday happened the way it did is mind blowing.

cc @JoyAnnReid

He said if you even mentioned his name, all days off were canceled due to prep.

He said what makes it so bad is that the folks yesterday had weapons. And they knew that it was going to be a 50-50 chance that something could go wrong.

He said because of who they were and because of who called them down there, they didn’t prepare...

He said who those people represented made a difference. Just like who Black Lives Matter represents makes a difference.

Him last year thoughts on police killings:https://t.co/owjMLeqhZj

My dad was a police officer on Capitol Hill for 35yrs.

— Eunique\u2019s Playing #CultureTags (@eunique) June 13, 2020

After seeing that video from ATL PD this am I thought I\u2019d share my dad talking about what he did when he saw someone drunk while he was working.

The difference in outcomes is my dad knew his role was to HELP. pic.twitter.com/0LyNsfwrex

More from Government

You May Also Like

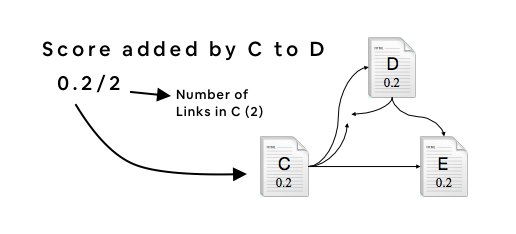

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020