What my simple analysis showed was the decadal breakout in making in #Gold along with the outperformance over S&P500 #SPX

Result?

1850$ to 2070$

Updated chart https://t.co/l6pEGD7r6D

Most interesting chart:

— The_Chartist \U0001f4c8 (@charts_zone) February 12, 2022

Orange line = Gold

Blue Curve = Gold/S&P 500

Previously the ratio crossed 50 days MA in Feb' 20 with Gold giving a breakout on the charts. The previous cross of 50 days MA didn't result in gold breaking out. pic.twitter.com/HRG1fvsILp

More from The_Chartist 📈

Reminded me of my Borosil renewables chart of last year in July.

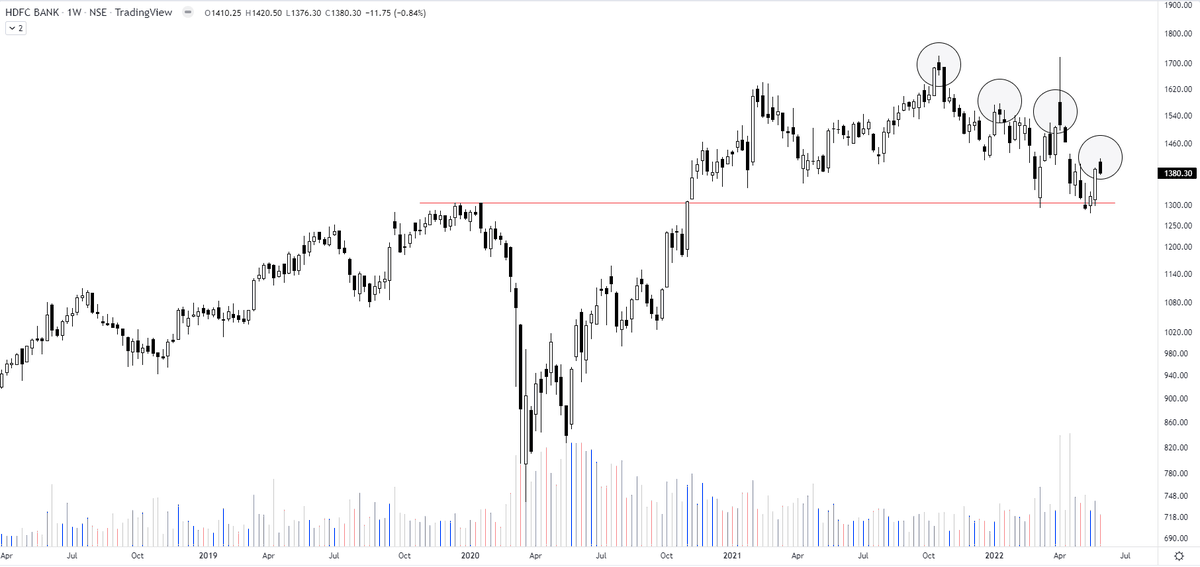

AWL - look at the ranges of contraction on the chart https://t.co/2XMhqZQu8X

AWL - look at the ranges of contraction on the chart https://t.co/2XMhqZQu8X

Borosil Renewables - Patterns like these must be looked at carefully and must be kept on the radar. Herein price is contracting which generally signifies shifting of hands (from weak to strong). If you go wrong, the risk is limited in these. pic.twitter.com/iqyoeslZjy

— The_Chartist \U0001f4c8 (@charts_zone) July 12, 2021

More from Gold

90% of my savings were in equity, debt was never attractive! Last few months have taught me the imp of diversification!

Gold - through SGBs was my move on diversifying! Holder since Jan'20 - so far so good!

A🧵on talk given by @PositiveGamma on Investing in Gold!

(1/16)

Link to the here - https://t.co/NxEkVKZi2H

MMTC PAMP is where Krishna worked before Setu and he was also responsible for launching Digi Gold at PayTM!

1) Why Gold?

1.1 Diversification - Volatility & Returns not tied to market conditions - diff. from financial assets.

(2/16)

1.2 Safe Haven - High value asset, easy to transport! Large value - limited space. Liquid and easy to convert to cash across the world.

1.3 Hedge against inflation and currency depreciation! (Depreciation of Rupee is a major factor behind Gold returns in India)

(3/16)

1.4 Upside in Tail Risk - Confidence in currencies & financial systems is low, gold can see upside in scenarios like this!

1.5 Upside on Demand/Supply - Constant Demand - Supply is stable!

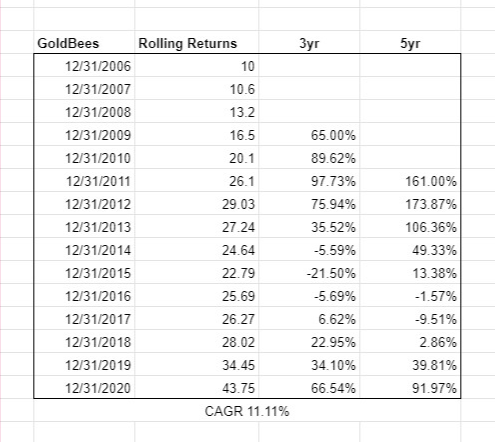

2) Gold - Indian Context - Better returns compared to other asset classes...

(4/16)

... specially in the last 2-3 years. Gold has done well both in low inflation & high inflation returns. So both real (ex. inflation) & nominal returns have been good!

3) How much to Allocate?

3.1 Diversification/Inflation Hedge - 10-20%

3.2 Tail Risk/Safe Haven - 5-20%

(5/16)

Gold - through SGBs was my move on diversifying! Holder since Jan'20 - so far so good!

A🧵on talk given by @PositiveGamma on Investing in Gold!

(1/16)

Link to the here - https://t.co/NxEkVKZi2H

MMTC PAMP is where Krishna worked before Setu and he was also responsible for launching Digi Gold at PayTM!

1) Why Gold?

1.1 Diversification - Volatility & Returns not tied to market conditions - diff. from financial assets.

(2/16)

1.2 Safe Haven - High value asset, easy to transport! Large value - limited space. Liquid and easy to convert to cash across the world.

1.3 Hedge against inflation and currency depreciation! (Depreciation of Rupee is a major factor behind Gold returns in India)

(3/16)

1.4 Upside in Tail Risk - Confidence in currencies & financial systems is low, gold can see upside in scenarios like this!

1.5 Upside on Demand/Supply - Constant Demand - Supply is stable!

2) Gold - Indian Context - Better returns compared to other asset classes...

(4/16)

... specially in the last 2-3 years. Gold has done well both in low inflation & high inflation returns. So both real (ex. inflation) & nominal returns have been good!

3) How much to Allocate?

3.1 Diversification/Inflation Hedge - 10-20%

3.2 Tail Risk/Safe Haven - 5-20%

(5/16)