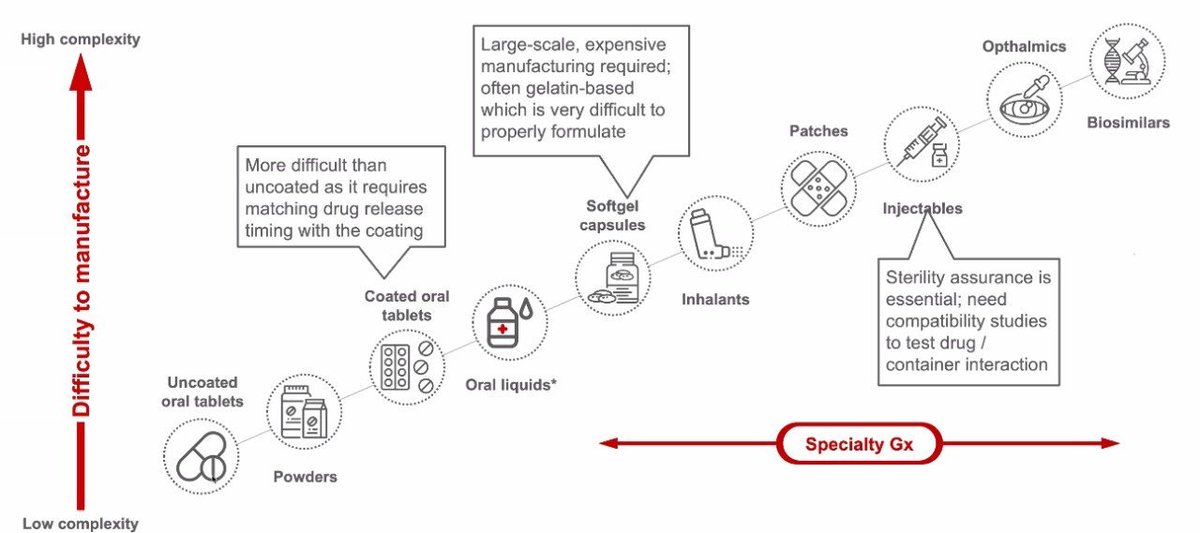

Pharma learnings 101:

Higher the difficulty to manufacture, Lower the competition, Higher the pricing power.

Higher the regulatory oversight, the Bigger is the moat for those who comply.

#PharmawithJST

More from ᴀɴɪsʜ ᴍᴏᴏɴᴋᴀ

More from Genericlearnings

This topic is for everyone, whether you manage your money yourself or through your advisor, it will go a long way in managing your finances.

Do re-tweet & help us educate retail investors (1/n)

Subscribe to our YouTube for some interesting educational content around Personal Finance - https://t.co/jvgNEDWiAZ

And you can also join our Telegram channel for regular updates – https://t.co/Ekz6I8pDGt (2/n)

(1) Lets start with Life Insurance

Term Insurance is the best way to take an insurance cover & probably the only product to buy in life insurance. Make sure u disclose all the necessary information before taking the insurance. Smoking, Alcohol, any pre-existing deceases etc(3/n)

Have atleast 10-15 times of your annual income as insurance cover

But there are variants of term insurance that you should avoid (4/n)

(A) Term plan with return of premium

For a non-smoker born on the 1st Jan 1985 & policy term 39 years (till age 75), the regular premium for a 1-cr term insurance is 22,157 (inclusive of GST) but with returns of premium is 42670 (inclusive of GST). An increase of 20,513 (5/n)

You May Also Like

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

Here are the setups from @Pathik_Trader Sir first.

1. Open Drive (Intraday Setup explained)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

Bactesting results of Open Drive

Already explained strategy of #opendrive

— Pathik (@Pathik_Trader) May 27, 2020

Backtested results in 30 stocks and nifty, banknifty.

Success ratio : approx 40-45%

RR average 1:2

Entry as per strategy

Stoploss = Open level

Exit 3:15 PM Or SL

39 months 14 months -ve, 25 +ve

Yearly all 4 years +ve performance. pic.twitter.com/nGqhzMKGVy

2. Two Price Action setups to get good long side trade for intraday.

1. PDC Acts as Support

2. PDH Acts as

So today we will discuss two more price action setups to get good long side trade for intraday.

— Pathik (@Pathik_Trader) June 20, 2020

1. PDC Acts as Support

2. PDH Acts as Support

Example of PDC/PDH Setup given

#nifty

— Pathik (@Pathik_Trader) June 23, 2020

This is how it created long setup by taking support at PDC.

hopefully shared setup on last weekend helped. pic.twitter.com/2mduSUpMn5