Bonds are issued by governments and corporations when they want to raise money. By buying a bond, investor is giving the issuer a loan, and issuer agrees to pay the investor back the face value of the loan on a specific date, and to pay periodic interest as well.

A Thread 🧵on how bond yields impact stock market ?

Must read for beginners in #StockMarket.

(RT to maximize reach.)

#Bonds #BondYields #StockMarket #Investing

Bonds are issued by governments and corporations when they want to raise money. By buying a bond, investor is giving the issuer a loan, and issuer agrees to pay the investor back the face value of the loan on a specific date, and to pay periodic interest as well.

Bond yield, on the other hand, is the return that an investor gets on that bond or on a particular government security.

#Investing #StockMarket #Bonds

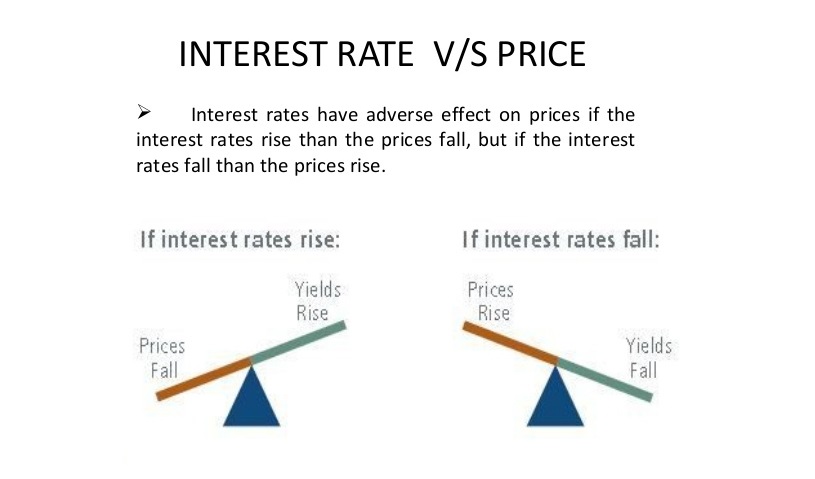

A fall/rise in interest rates in an economy pushes up/pulls down bond prices. However, bond yields fall/rise in this situation.

Rise in bond yields denotes higher interest rates in economy. This increases borrowing costs for companies & consumers. This ultimately reduces overall demand in economy & negatively impacts #StockMarket.

More from Genericlearnings

Perhaps you have the idea that calling me " 1 lot Nandy" is somehow derogatory and a easy poke at me. Allow me to explain why I look at this moniker as a badge of honour

I have traded 1 lot continuously twice in my life. The first in 2003 after I blew up on my INFY trade. I traded 1 lot ACC fut consistently and made 50k in a month

The 2nd time in 2013. When I suffered continuous losses for 5-6 months due to a variety of psychological issues. Then I traded 1 lot Nifty options consistently for 3 months. After that 2 lots for next 1 month and slowly increased

I have shared these two incidents on my various interveiws and regularly share this in detail with my handholding students when I talk about trading psychology.

This logic of trading 1 lot to iron out trading issues I learnt from the interview of Anthony Saliba, who traded 1 lot in options for 6 months. BTW, Saliba was the only options trader to have been profiled on the original Market Wizards ( I read his interview and used his logic)

Sir itseems people call you as "one lot Nandy".. Is it true?

— Bittu (@nanoobittu) July 16, 2021

I have traded 1 lot continuously twice in my life. The first in 2003 after I blew up on my INFY trade. I traded 1 lot ACC fut consistently and made 50k in a month

The 2nd time in 2013. When I suffered continuous losses for 5-6 months due to a variety of psychological issues. Then I traded 1 lot Nifty options consistently for 3 months. After that 2 lots for next 1 month and slowly increased

I have shared these two incidents on my various interveiws and regularly share this in detail with my handholding students when I talk about trading psychology.

This logic of trading 1 lot to iron out trading issues I learnt from the interview of Anthony Saliba, who traded 1 lot in options for 6 months. BTW, Saliba was the only options trader to have been profiled on the original Market Wizards ( I read his interview and used his logic)

You May Also Like

So friends here is the thread on the recommended pathway for new entrants in the stock market.

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Old is Gold....

— Professor (@DillikiBiili) January 23, 2020

this Bharti Airtel chart is a true copy of the Wyckoff Pattern propounded in 1931....... pic.twitter.com/tQ1PNebq7d