Reactionaries are like, "ah, I see that you post constantly and passionately about minimum wage, but riddle me this: have you considered that some people I don't respect or care about might benefit from this?"

https://t.co/MajgcRiPVF

Here\u2019s the thing with the $15 minimum wage debate: it should be a $25 minimum wage debate

— metal dot txt (@metaltxt) January 16, 2021

More from For later read

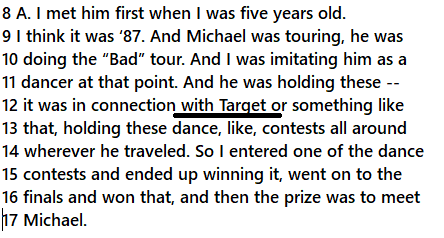

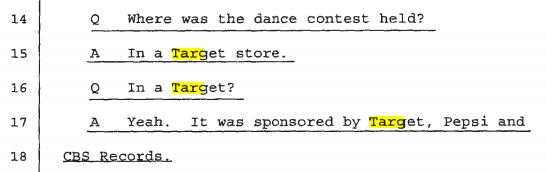

I’ve asked Byers to clarify, but as I read this tweet, it seems that Bret Stephens included an unredacted use of the n-word in his column this week to make a point, and the column got spiked—maybe as a result?

Four times. The column used the n-word (in the context of a quote) four times. https://t.co/14vPhQZktB

For context: In 2019, a Times reporter was reprimanded for several incidents of racial insensitivity on a trip with high school students, including one in which he used the n-word in a discussion of racial slurs.

That incident became public late last month, and late last week, after 150 Times employees complained about how it had been handled, the reporter in question resigned.

In the course of all that, the Times' executive editor said that the paper does not "tolerate racist language regardless of intent.” This was the quote that Bret Stephens was pushing back against in his column. (Which, again, was deep-sixed by the paper.)

Stephens goes on in his column (which never saw light of day) to cite famous Lee Atwater quote that uses racial slur, and which NYT has cited \u201cat least seven times.\u201d

— Dylan Byers (@DylanByers) February 11, 2021

"Is this now supposed to be a scandal?\u201d he asks.

...

Four times. The column used the n-word (in the context of a quote) four times. https://t.co/14vPhQZktB

That is correct. In his draft he quotes Atwater using the word (4 times) and he does not redact it.

— Dylan Byers (@DylanByers) February 11, 2021

For context: In 2019, a Times reporter was reprimanded for several incidents of racial insensitivity on a trip with high school students, including one in which he used the n-word in a discussion of racial slurs.

That incident became public late last month, and late last week, after 150 Times employees complained about how it had been handled, the reporter in question resigned.

In the course of all that, the Times' executive editor said that the paper does not "tolerate racist language regardless of intent.” This was the quote that Bret Stephens was pushing back against in his column. (Which, again, was deep-sixed by the paper.)

You May Also Like

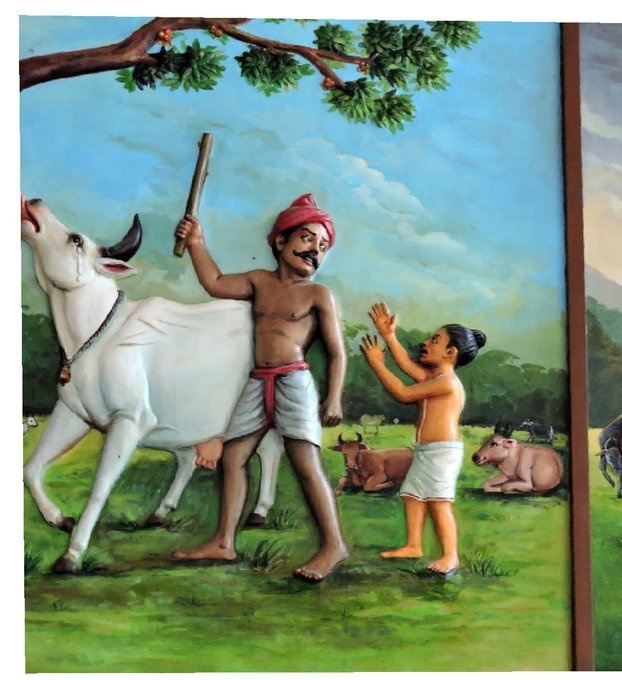

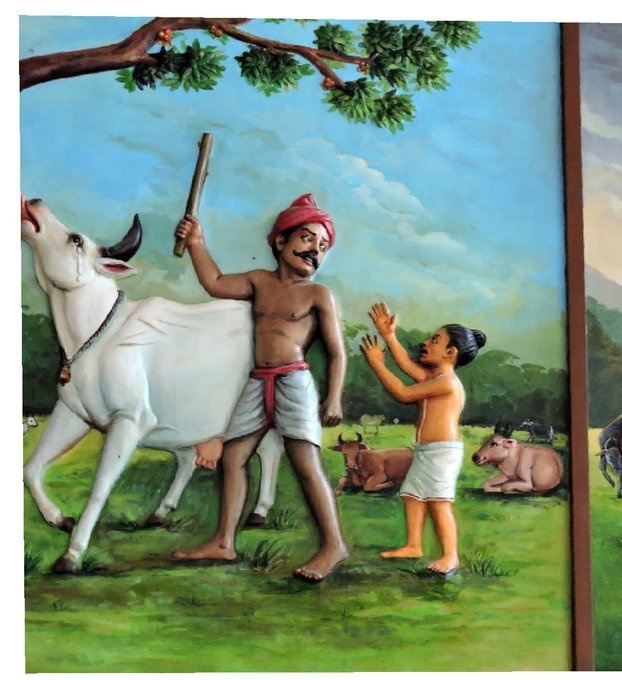

#sculpture #story -

Chandesha-Anugraha Murti - One of the Sculpture in Brihadeshwara Temple at Gangaikonda Cholapuram - built by Raja Rajendra Chola I

This Sculpture depicts Bhagwan Shiva along with Devi Paravathi blessing Chandeshwara - one of the 63 Nayanmars.

#Thread

Chandeshwara/Chandikeshwara is regarded as custodian of Shiva Temple's wealth&most of Shiva temples in South India has separate sannathi for him.

His bhakti for Bhagwan Shiva elevated him as one of foremost among Nayanmars.

He gave importance to Shiva Pooja&protection of cows.

There are series of paintings, illustrating the #story of Chandikeshwar in the premises of

Sri Sathiyagireeswarar #Temple at Seinganur,near Kumbakonam,TN

Chandikeshwara's birth name

is Vichara sarman.He was born in the village of Senganur on the banks of River Manni.

His Parent names were Yajnathatan and Pavithrai.

Vichara Sarman was a gifted child and he learnt Vedas and Agamas at a very young age.

He was very devout and would always think about Bhagwan Shiva.

One day he saw a cowherd man brutally assaulting a cow,Vichara Sarman could not tolerate this. He spoke to cowherd: ‘Do you not know that the cow is worshipful & divine? All gods & Devas reside in https://t.co/ElLcI5ppsK it is our duty to protect cows &we should not to harm them.

Chandesha-Anugraha Murti - One of the Sculpture in Brihadeshwara Temple at Gangaikonda Cholapuram - built by Raja Rajendra Chola I

This Sculpture depicts Bhagwan Shiva along with Devi Paravathi blessing Chandeshwara - one of the 63 Nayanmars.

#Thread

Chandeshwara/Chandikeshwara is regarded as custodian of Shiva Temple's wealth&most of Shiva temples in South India has separate sannathi for him.

His bhakti for Bhagwan Shiva elevated him as one of foremost among Nayanmars.

He gave importance to Shiva Pooja&protection of cows.

There are series of paintings, illustrating the #story of Chandikeshwar in the premises of

Sri Sathiyagireeswarar #Temple at Seinganur,near Kumbakonam,TN

Chandikeshwara's birth name

is Vichara sarman.He was born in the village of Senganur on the banks of River Manni.

His Parent names were Yajnathatan and Pavithrai.

Vichara Sarman was a gifted child and he learnt Vedas and Agamas at a very young age.

He was very devout and would always think about Bhagwan Shiva.

One day he saw a cowherd man brutally assaulting a cow,Vichara Sarman could not tolerate this. He spoke to cowherd: ‘Do you not know that the cow is worshipful & divine? All gods & Devas reside in https://t.co/ElLcI5ppsK it is our duty to protect cows &we should not to harm them.