Categories Finance

Also, the answer to a few questions including:

Yesterday’s Value That Company!

Also, Why am I so dumb?

Finally, Why listen to me? 🤷♂️

Here we go!

A few years ago, I get a call from an acquaintance (we have several mutual good friends). He’s running a fast growing consumer finance company and needs cash...

It isn’t “I need $5 Million by Friday” but it’s close...

How fast are they growing? By the time we are negotiating the deal a week or 10 day later, the ask is up to $10 Million...

We did a little time travel yesterday on Value That Company, and I put you back in my shoes 3 years ago...

(Answer shortly)... https://t.co/mNFNGgHiMI

It is time... For reasons that will be clear tomorrow, we are going into the archives for the first 2021 edition of Value That Company!

— Matt Willes (@SkolCapital) January 12, 2021

Today: Consumer Finance

TTM: 217 M Rev; 12.7 M EBITDA

Prior year: 97 M Rev; -4.4 M EBITDA

2 yr ago: 23 M Rev; -2.9 M EBITDA

More details: https://t.co/rn8lbARa4V

The business is fascinating, but also extremely sensitive to assumptions, underwriting, etc...

Management is good, but also very aggressive which I’m not sure I love...

Worse, we don’t have the time to really dig into the numbers as extensively as I’d like... https://t.co/np5UPBmjnu

Ok, stealing my thunder from tomorrow, BUT:

— Matt Willes (@SkolCapital) January 12, 2021

5% of customers never make even 1 payment: 100% loss rate

24% default before maturity: 15% loss rate

32% payoff < 90 days: 7% avg ROI

11% payoff > 90 days: 91% ROI

28% go full term: 121% ROI

For a naked option to make money, it's better if IV rises or at least stays flat.

Rule 3 : DO NOT run or trade everything that moves. Focus on a few stocks and master them. When a move comes, make the max out of that move.

— Subhadip Nandy (@SubhadipNandy16) October 14, 2021

Example : in this crazy mkt, I did not even trade TataMotors this week. Stayed focussed on ITC and it gave good returns https://t.co/41wkugZg1I

This is a thread I wrote on IV, IVR etc

IV - A thread

— Subhadip Nandy (@SubhadipNandy16) September 20, 2018

In financial mathematics, implied volatility of an option contract is

that value of the volatility of the underlying instrument which, when

input in an option pricing model ) will return a theoretical value equal to the current market price of the option (1/n)

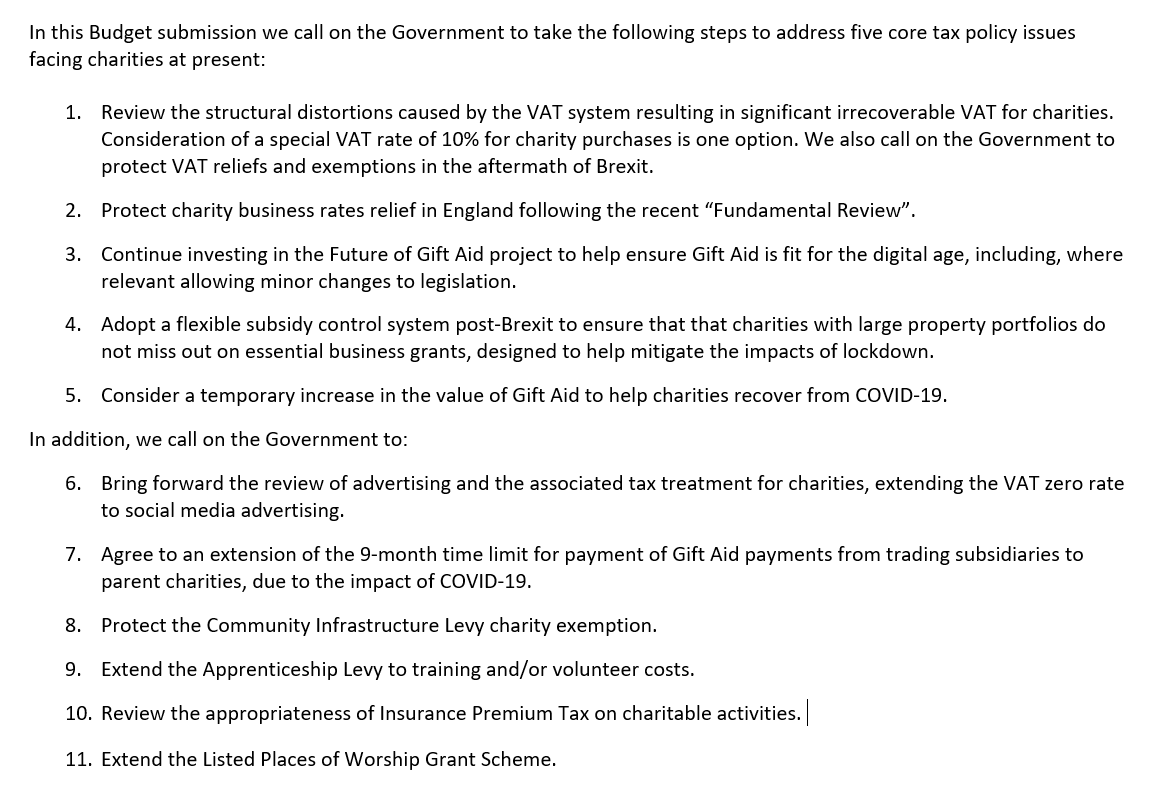

As many others I'm still working through the detail of the agreement & all the annexes. But some initial thoughts based on my first read & associated documents. My overriding feeling is that it is pretty much exactly as expected in many parts & largely a balanced deal. 1/

— Raoul Ruparel (@RaoulRuparel) December 27, 2020

First, we shouldn't look at this through the lens of UK having trade deficit with EU in goods & surplus in services. That is too simplistic. EU accounts for a large proportion of UK's goods trade so zero tariff zero quota is beneficial for UK as well for the EU. 2/

Similarly, having a very thin deal on services & financial services is also bad for EU. Belief in some quarters than business will simply move from UK to EU in these areas. But its not that simple. Will be costs & duplication while some business just won't make sense any more 3/

We also shouldn't forget that while services is the largest part of our economy, it is inherently much more domestically focused. Furthermore, the single market in services is less integrated than that in goods so there are already some non tariff barriers to contend with 4/

It is also important to remember how we got here. Services was ultimately deprioritised under the previous Govt Chequers approach. This was because the Govt was seeking frictionless trade in goods. 5/