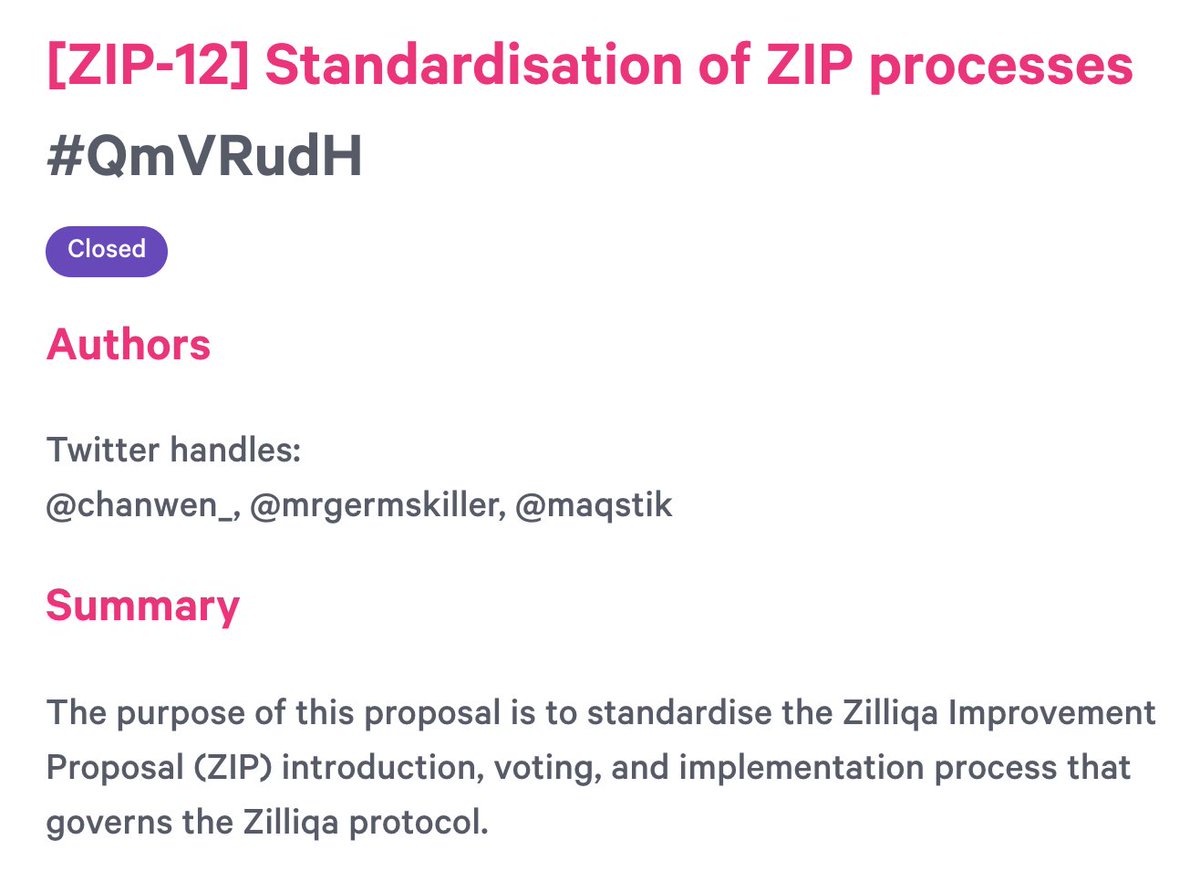

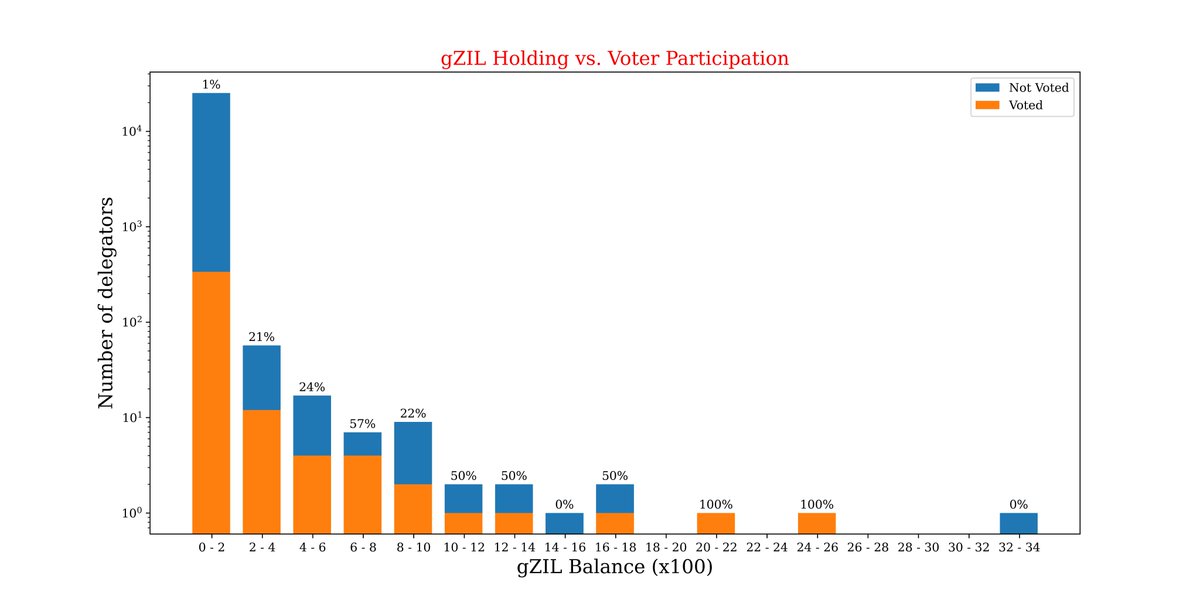

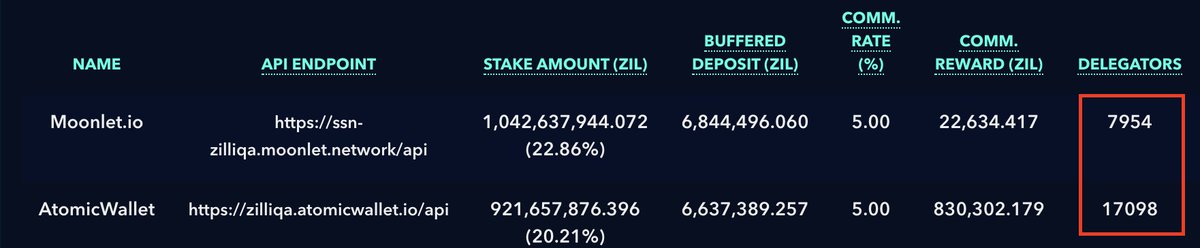

Voting on the first $ZIL governance proposal has just ended. The proposal has passed with a resounding YES, which means that the community has now agreed on the rules for future decision making.

Time to analyze, introspect and see how to make this better next time. A thread 👇

More from Finance

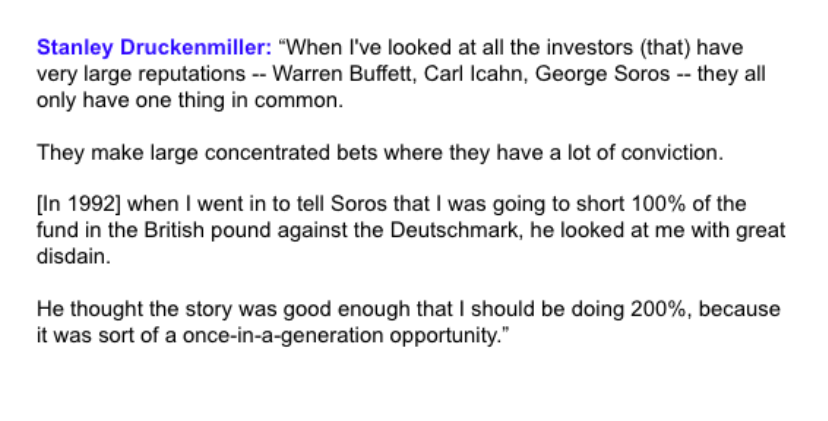

As the DeFi bull market continues, some brutally honest tips for new founders fundraising in crypto.

👇

1/ The discount you offer to strategic investors is both to account for the risk of an unlaunched product, but also as compensation for continued value add and support.

So make sure you know the investor will support you and not leave you on read once the docs are signed!

2/ Having someone on your cap table/ token allocation is as important as hiring.

You wouldn't hire someone just because they are influencers on Twitter- you do your reference checks and find evidence of value add from other companies the investor has invested in.

3/ Don't trust, verify.

Many investors will promise you the world when they're trying to get on your cap table.

Talk to founders they backed to see how much of it is bullshit. Ask them about how the investor was there for them during hard times.

4/ Don't just go for "name brand" funds because you want the brand.

Sure, it's great validation, but optimize for fit, not vanity.

However, I do think many well-known VCs are good actors, especially those with roots in successful trad VCs. They have a rep for a reason!

👇

Equity/ownership is a force. Getting it in the hands of the right people generously will drive alignment and execution.

— Joey Santoro (@Joey__Santoro) January 21, 2021

It is a joyful and serious responsibility \U0001f332

1/ The discount you offer to strategic investors is both to account for the risk of an unlaunched product, but also as compensation for continued value add and support.

So make sure you know the investor will support you and not leave you on read once the docs are signed!

2/ Having someone on your cap table/ token allocation is as important as hiring.

You wouldn't hire someone just because they are influencers on Twitter- you do your reference checks and find evidence of value add from other companies the investor has invested in.

3/ Don't trust, verify.

Many investors will promise you the world when they're trying to get on your cap table.

Talk to founders they backed to see how much of it is bullshit. Ask them about how the investor was there for them during hard times.

4/ Don't just go for "name brand" funds because you want the brand.

Sure, it's great validation, but optimize for fit, not vanity.

However, I do think many well-known VCs are good actors, especially those with roots in successful trad VCs. They have a rep for a reason!

Having made over 1000 boxes for vulnerable families in Cambridge via @RedHenCambridge (thanks to our customers 🙏🏽) My thoughts on the £30 box thing. Lots of factors at play here. 1/

If the pics in this @BootstrapCook thread are true and correct then the Govt/taxpayers & families in need are getting absolutely SHAFTED 👇🏽 2/

There are some mitigating circumstances. A £30 box won’t ever contain £30 (retail) worth of food - people aren’t factoring in

-the cost of the box

-paying someone to fill it

-rent & rates

-& most expensive the *transport/distribution*

3/

If you’re doing the above at scale. Delivering *across the UK* it’s not cheap BUT IMHO there should be at LEAST £20 worth of groceries in a £30 box. To get more value they need more fresh produce. Just carrots & apples is terrible. 4/

I’m gonna put my rep on the line here & say something about these big national catering companies whose names I’ve seen mentioned. They are an ASSHOLE to deal with & completely shaft small businesses like mine with their terms which is why I won’t deal with them. 5/

If the pics in this @BootstrapCook thread are true and correct then the Govt/taxpayers & families in need are getting absolutely SHAFTED 👇🏽 2/

Hi all. I\u2019ve been sent LOTS of photos of the food parcels that have replaced the \xa330 vouchers and asked what I would do with them. I\u2019m replying with advice privately because to do so publicly would look like justifying these ill thought through, offensively meagre scraps /1.

— Jack Monroe (@BootstrapCook) January 11, 2021

There are some mitigating circumstances. A £30 box won’t ever contain £30 (retail) worth of food - people aren’t factoring in

-the cost of the box

-paying someone to fill it

-rent & rates

-& most expensive the *transport/distribution*

3/

If you’re doing the above at scale. Delivering *across the UK* it’s not cheap BUT IMHO there should be at LEAST £20 worth of groceries in a £30 box. To get more value they need more fresh produce. Just carrots & apples is terrible. 4/

I’m gonna put my rep on the line here & say something about these big national catering companies whose names I’ve seen mentioned. They are an ASSHOLE to deal with & completely shaft small businesses like mine with their terms which is why I won’t deal with them. 5/