How Does Zero Cost EMI work?

What is the catch here? How do Companies involved make money here?

A Thread🧵👇

Please "RT" if you like the thread.

The catch is - it is more to do with marketing and sales than finance.

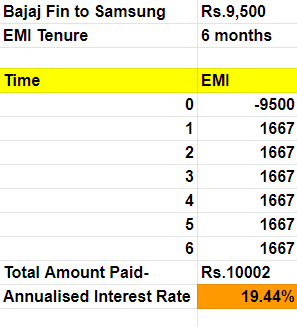

Samsung will cut out a deal with Bajaj Finance. It will provide a 5% discount to Bajaj Fin. So Bajaj Fin will pay Samsung Rs.9500 while it will receive 10k from the customer

Here comes the Cash Flow Wizardry:

As months pass by, Bajaj receives EMIs, the outstanding amount decreases and so does the interest on it. It deploys these EMIs to give another loan and so on. On annualized basis, it earns 19.44% !!

More from Finance

/THREAD/

1. Review your expenses and make a budget

It will help you see where you overspend, make a plan to save, pay down debt and start

Budgeting, the 50-30-20 rule, and the envelope method

— Kostas \U0001f468\u200d\U0001f4bc \U0001f4c8 \U0001f4b8 (@itsKostasWithK) January 6, 2021

Your first step towards financial independence

/THREAD/ pic.twitter.com/Tmuc3Itca5

2. Set your investing and retirement goals

How much do you need to support yourself in retirement and when do you want to

The most important number for your retirement: The 4% rule

— Kostas \U0001f468\u200d\U0001f4bc \U0001f4c8 \U0001f4b8 (@itsKostasWithK) January 7, 2021

What Is the Four Percent Rule?

/THREAD/ pic.twitter.com/8n1R1UZI5c

3. The earlier you start investing, the better.

Here's why and how time and compounding can become your

The Miracle of Compound Interest and the Rule of 72

— Kostas \U0001f468\u200d\U0001f4bc \U0001f4c8 \U0001f4b8 (@itsKostasWithK) January 2, 2021

//THREAD// pic.twitter.com/AOqd3kL6cn

4. Invest in an index fund

It's easy, safe, cheap, and the best choice for a beginner in investing, with not much time for

Jack Bogle, the Father of Indexing

— Kostas \U0001f468\u200d\U0001f4bc \U0001f4c8 \U0001f4b8 (@itsKostasWithK) January 8, 2021

How John "Jack" Bogle's creation impacted investors more than Bill Gates, Steve Jobs, and Warren Buffett combined

/THREAD/ pic.twitter.com/4wPi8x3cXn

You May Also Like

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

Here are the setups from @Pathik_Trader Sir first.

1. Open Drive (Intraday Setup explained)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

Bactesting results of Open Drive

Already explained strategy of #opendrive

— Pathik (@Pathik_Trader) May 27, 2020

Backtested results in 30 stocks and nifty, banknifty.

Success ratio : approx 40-45%

RR average 1:2

Entry as per strategy

Stoploss = Open level

Exit 3:15 PM Or SL

39 months 14 months -ve, 25 +ve

Yearly all 4 years +ve performance. pic.twitter.com/nGqhzMKGVy

2. Two Price Action setups to get good long side trade for intraday.

1. PDC Acts as Support

2. PDH Acts as

So today we will discuss two more price action setups to get good long side trade for intraday.

— Pathik (@Pathik_Trader) June 20, 2020

1. PDC Acts as Support

2. PDH Acts as Support

Example of PDC/PDH Setup given

#nifty

— Pathik (@Pathik_Trader) June 23, 2020

This is how it created long setup by taking support at PDC.

hopefully shared setup on last weekend helped. pic.twitter.com/2mduSUpMn5