But Democratic leadership has, once again, folded to Republicans without attempting to fight for us.

Senate Democrats just killed the push today for $2000 checks.

A few Senators--namely Sanders and Markey--wanted to hold up the NDAA as leverage to push for a vote on $2000.

Democratic leadership rejected this--including Vice President elect Harris.

But Democratic leadership has, once again, folded to Republicans without attempting to fight for us.

a.) Find another leverage against McConnell and Senate Republicans

b.) Take McConnells offer on the combined bill of $2000 checks and Trump wishlist items

This is precisely why Sanders & Markey wanted to hold it up as leverage.

Dem leadership better have a Plan B if they are serious about helping people.

But I ask how she proposes to actually get Senate Republicans to agree to $2000 payments when McConnell refused a clean bill, and while shooting down potential leverage on this today

And they wouldn’t have to resort to holding up the NDAA as leverage to do so.

Which is why it’s incredibly important for Georgians to vote for Warnock and Ossoff in the upcoming runoff election.

More from Finance

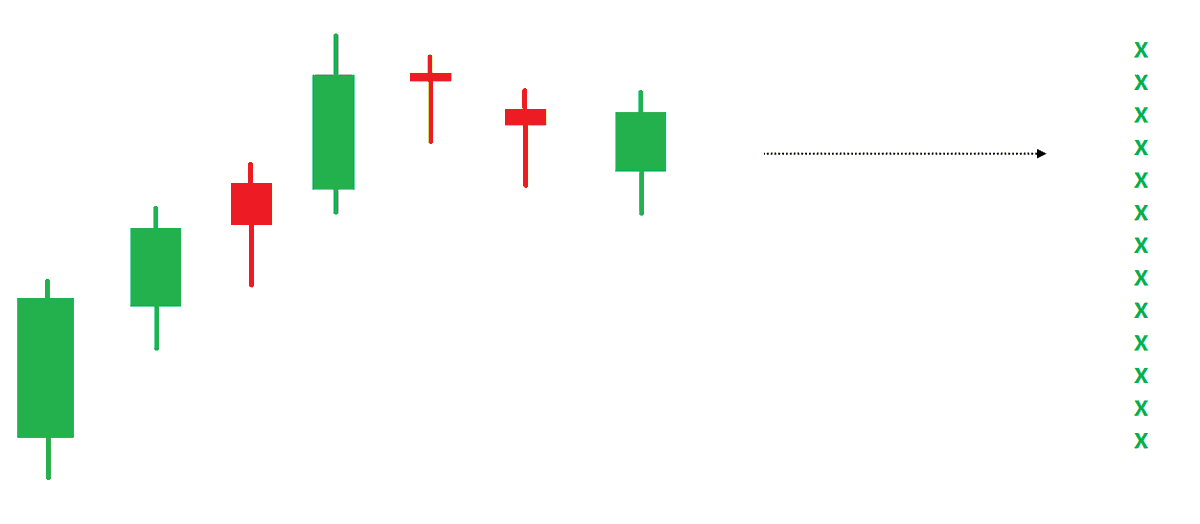

Thread: P&F Super Pattern

An effective price pattern defined using properties of P&F charts.

#Superpattern #Pointandfigure #Definedge

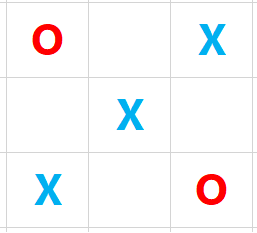

Point & Figure is an oldest charting method where price is plotted vertically, and the chart moves only when price moves. It is a different way of looking at the price, the objective box-value and reversal value offers advantage of identifying objective price patterns.

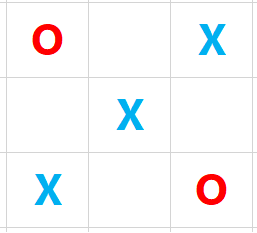

When price is moving up, it is plotted in a column of 'X'. When it is going down, it is plotted in a column of ‘O’. Normally, three-box reversal criteria is used to define the trend & reversal. Unlike a bar or candle, the P&F column can have multiple sessions in it.

Link to know more about the subject:

https://t.co/2xtLAVPBvm

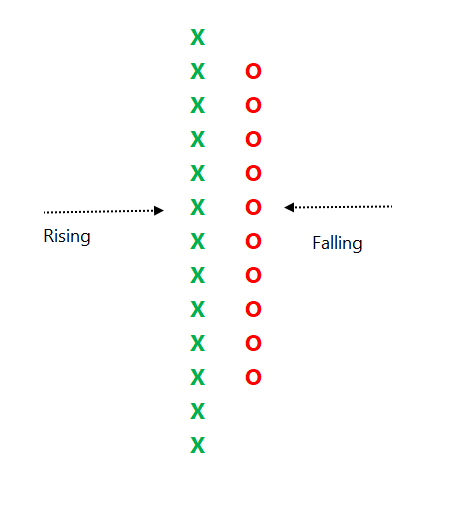

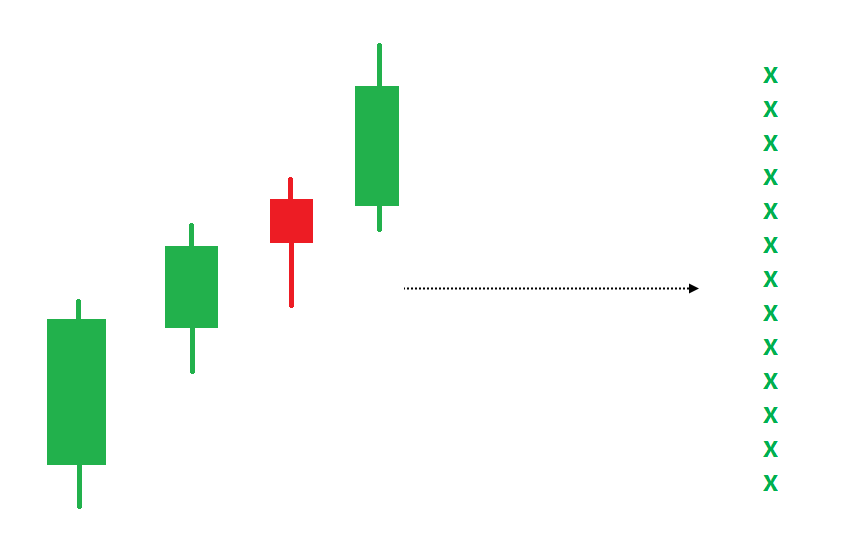

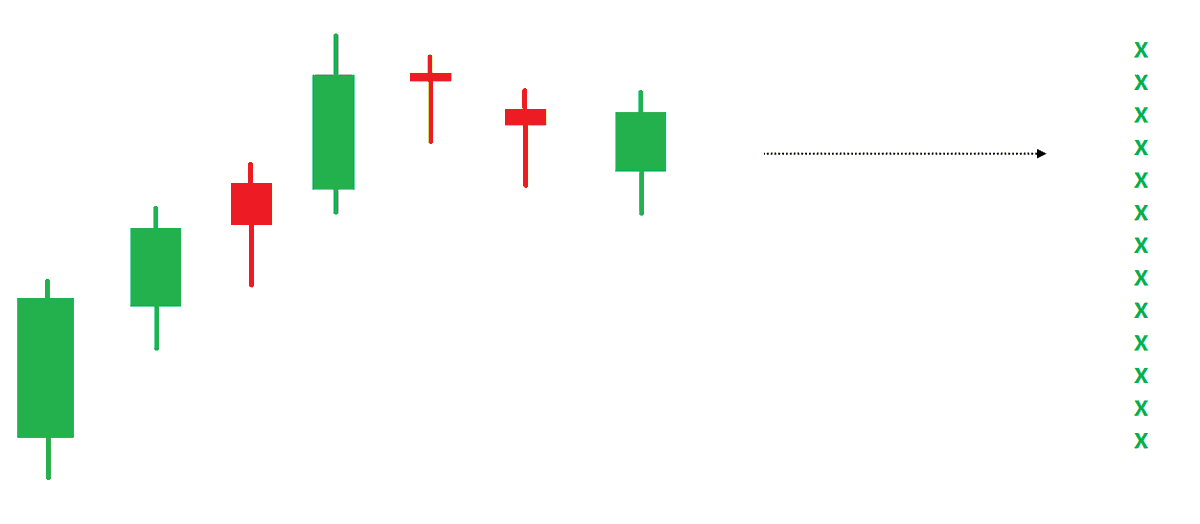

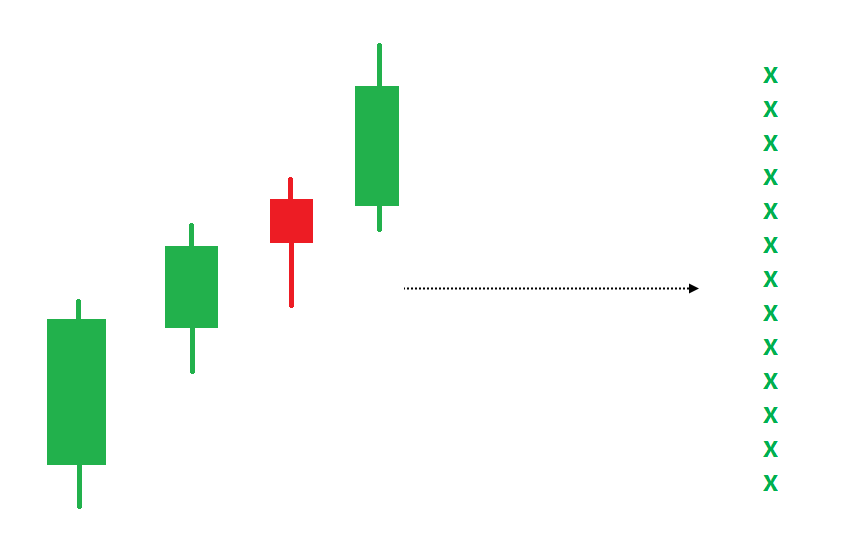

See below chart. Price is in a strong uptrend, P&F chart would produce a long of column of 'X' with more number of boxes in it.

If such a trend is followed by some time bars without meaningful price correct, P&F chart would not move, and it will remain in column of 'X' in such a scenario.

An effective price pattern defined using properties of P&F charts.

#Superpattern #Pointandfigure #Definedge

Point & Figure is an oldest charting method where price is plotted vertically, and the chart moves only when price moves. It is a different way of looking at the price, the objective box-value and reversal value offers advantage of identifying objective price patterns.

When price is moving up, it is plotted in a column of 'X'. When it is going down, it is plotted in a column of ‘O’. Normally, three-box reversal criteria is used to define the trend & reversal. Unlike a bar or candle, the P&F column can have multiple sessions in it.

Link to know more about the subject:

https://t.co/2xtLAVPBvm

See below chart. Price is in a strong uptrend, P&F chart would produce a long of column of 'X' with more number of boxes in it.

If such a trend is followed by some time bars without meaningful price correct, P&F chart would not move, and it will remain in column of 'X' in such a scenario.

** MEGA THREAD ON Cryptocurrencies/Blockchain**

I wanted to know the best resources to learn about cryptocurrencies and blockchain for someone with zero knowledge. I asked Twitter, and Twitter answered.

This thread is a compilation of the best resources I was recommended. 👇👇

Let's start with ** BOOKS **

The first thing you should do before you pick up any book:

Learn about Bitcoin & Ethereum by reading the respective whitepapers.

- [Bitcoin white paper](https://t.co/cErOaFn6QL) by Satoshi Nakamoto

- [Ethereum White paper] (https://t.co/0g5kYCGJGq) by Vitalik Buterin

Even if you are not tech savvy, you can get a good grasp about how blockchain functions from these papers.

1) *The Basics of Bitcoins and Blockchains: An Introduction to Cryptocurrencies and the Technology that Powers Them* by Antony Lewis

This book covers topics such as the history of Bitcoin, the Bitcoin blockchain, and Bitcoin buying, selling, and mining.

It also answers how payments are made and how transactions are kept secure.

Other cryptocurrencies and cryptocurrency pricing are examined, answering how one puts a value on cryptocurrencies and digital tokens.

I wanted to know the best resources to learn about cryptocurrencies and blockchain for someone with zero knowledge. I asked Twitter, and Twitter answered.

This thread is a compilation of the best resources I was recommended. 👇👇

Let's start with ** BOOKS **

The first thing you should do before you pick up any book:

Learn about Bitcoin & Ethereum by reading the respective whitepapers.

- [Bitcoin white paper](https://t.co/cErOaFn6QL) by Satoshi Nakamoto

- [Ethereum White paper] (https://t.co/0g5kYCGJGq) by Vitalik Buterin

Even if you are not tech savvy, you can get a good grasp about how blockchain functions from these papers.

1) *The Basics of Bitcoins and Blockchains: An Introduction to Cryptocurrencies and the Technology that Powers Them* by Antony Lewis

This book covers topics such as the history of Bitcoin, the Bitcoin blockchain, and Bitcoin buying, selling, and mining.

It also answers how payments are made and how transactions are kept secure.

Other cryptocurrencies and cryptocurrency pricing are examined, answering how one puts a value on cryptocurrencies and digital tokens.

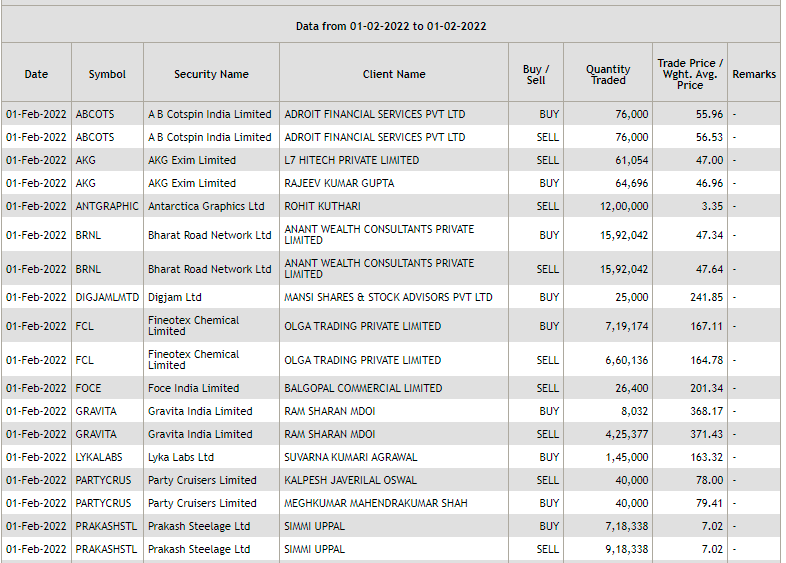

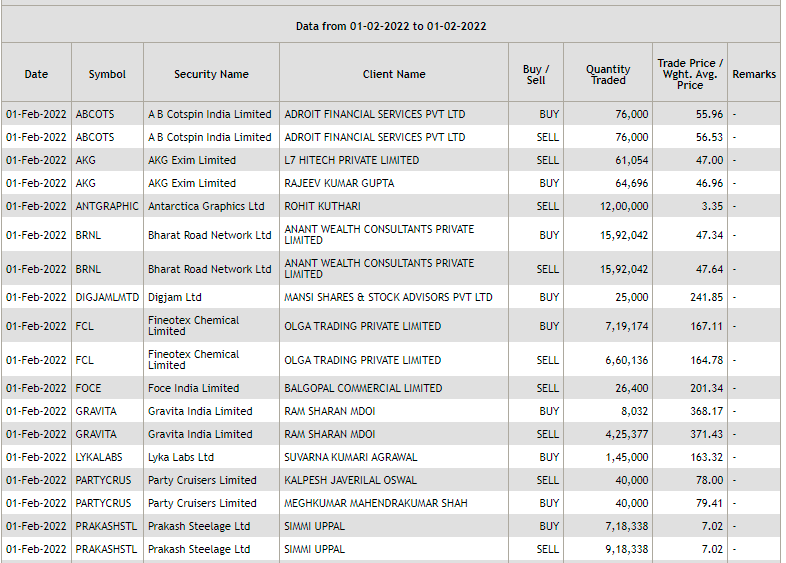

A 🧵on the basics of block and bulk deals.

Block and bulk deals are large purchases of stocks by investment banks, mutual funds, hedge funds, pension funds, FIIs, and promoters. Tracking block and bulk deals can help give you a sense of what these large players are thinking.

A single transaction where shares more than Rs 10 crores or the number of shares traded are more than 5 lakh is considered a block deal.

Block deals are carried out in separate trading windows. This trading window operates in two shifts of 15 minutes each:

Morning trading window from 8:45 AM to 9:00 AM.

Afternoon trading window from 2:05 PM to 2:20 PM

Block deals happen in different windows to reduce volatility and sudden price movements. Given that they are traded in a separate window, they do not show up on the volume charts.

Brokers facilitating the transaction are required to inform the exchange. You can track bulk and block deals on NSE & BSE:

https://t.co/pwTyzWTnUL

https://t.co/g9BbHiEag3

Block and bulk deals are large purchases of stocks by investment banks, mutual funds, hedge funds, pension funds, FIIs, and promoters. Tracking block and bulk deals can help give you a sense of what these large players are thinking.

A single transaction where shares more than Rs 10 crores or the number of shares traded are more than 5 lakh is considered a block deal.

Block deals are carried out in separate trading windows. This trading window operates in two shifts of 15 minutes each:

Morning trading window from 8:45 AM to 9:00 AM.

Afternoon trading window from 2:05 PM to 2:20 PM

Block deals happen in different windows to reduce volatility and sudden price movements. Given that they are traded in a separate window, they do not show up on the volume charts.

Brokers facilitating the transaction are required to inform the exchange. You can track bulk and block deals on NSE & BSE:

https://t.co/pwTyzWTnUL

https://t.co/g9BbHiEag3

You May Also Like

Trump is gonna let the Mueller investigation end all on it's own. It's obvious. All the hysteria of the past 2 weeks about his supposed impending firing of Mueller was a distraction. He was never going to fire Mueller and he's not going to

Mueller's officially end his investigation all on his own and he's gonna say he found no evidence of Trump campaign/Russian collusion during the 2016 election.

Democrats & DNC Media are going to LITERALLY have nothing coherent to say in response to that.

Mueller's team was 100% partisan.

That's why it's brilliant. NOBODY will be able to claim this team of partisan Democrats didn't go the EXTRA 20 MILES looking for ANY evidence they could find of Trump campaign/Russian collusion during the 2016 election

They looked high.

They looked low.

They looked underneath every rock, behind every tree, into every bush.

And they found...NOTHING.

Those saying Mueller will file obstruction charges against Trump: laughable.

What documents did Trump tell the Mueller team it couldn't have? What witnesses were withheld and never interviewed?

THERE WEREN'T ANY.

Mueller got full 100% cooperation as the record will show.

BREAKING: President Donald Trump has submitted his answers to questions from special counsel Robert Mueller

— Ryan Saavedra (@RealSaavedra) November 20, 2018

Mueller's officially end his investigation all on his own and he's gonna say he found no evidence of Trump campaign/Russian collusion during the 2016 election.

Democrats & DNC Media are going to LITERALLY have nothing coherent to say in response to that.

Mueller's team was 100% partisan.

That's why it's brilliant. NOBODY will be able to claim this team of partisan Democrats didn't go the EXTRA 20 MILES looking for ANY evidence they could find of Trump campaign/Russian collusion during the 2016 election

They looked high.

They looked low.

They looked underneath every rock, behind every tree, into every bush.

And they found...NOTHING.

Those saying Mueller will file obstruction charges against Trump: laughable.

What documents did Trump tell the Mueller team it couldn't have? What witnesses were withheld and never interviewed?

THERE WEREN'T ANY.

Mueller got full 100% cooperation as the record will show.