Some interesting snippets from @MotilalOswalLtd 25th Wealth Creation Study:

(A Short thread)

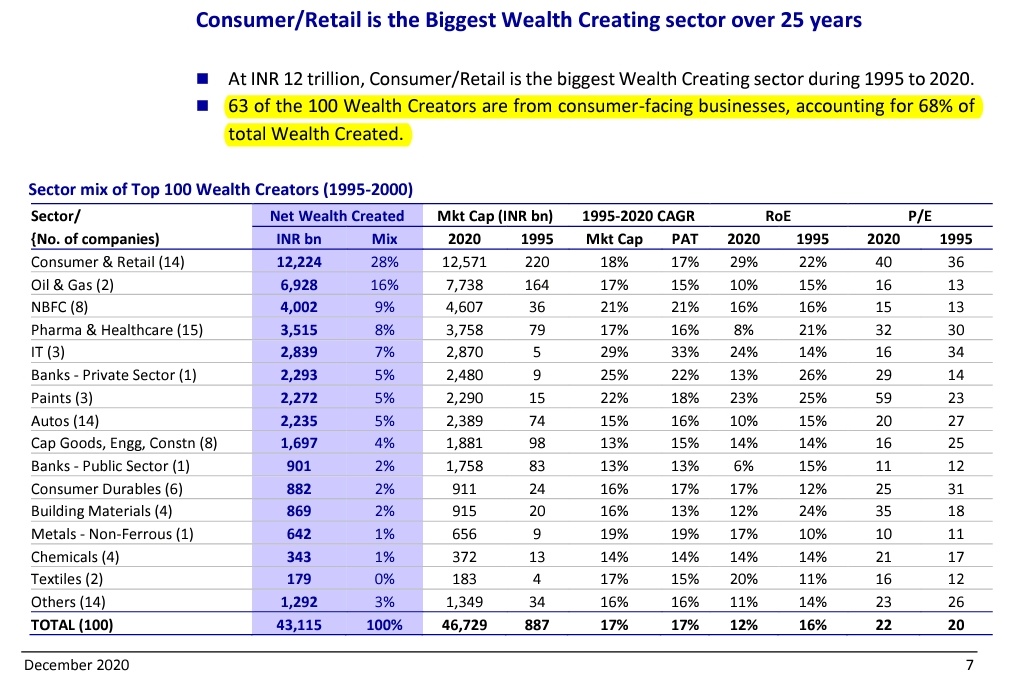

1. Consumer/Retail is the biggest wealth-creating sector over 25 years.

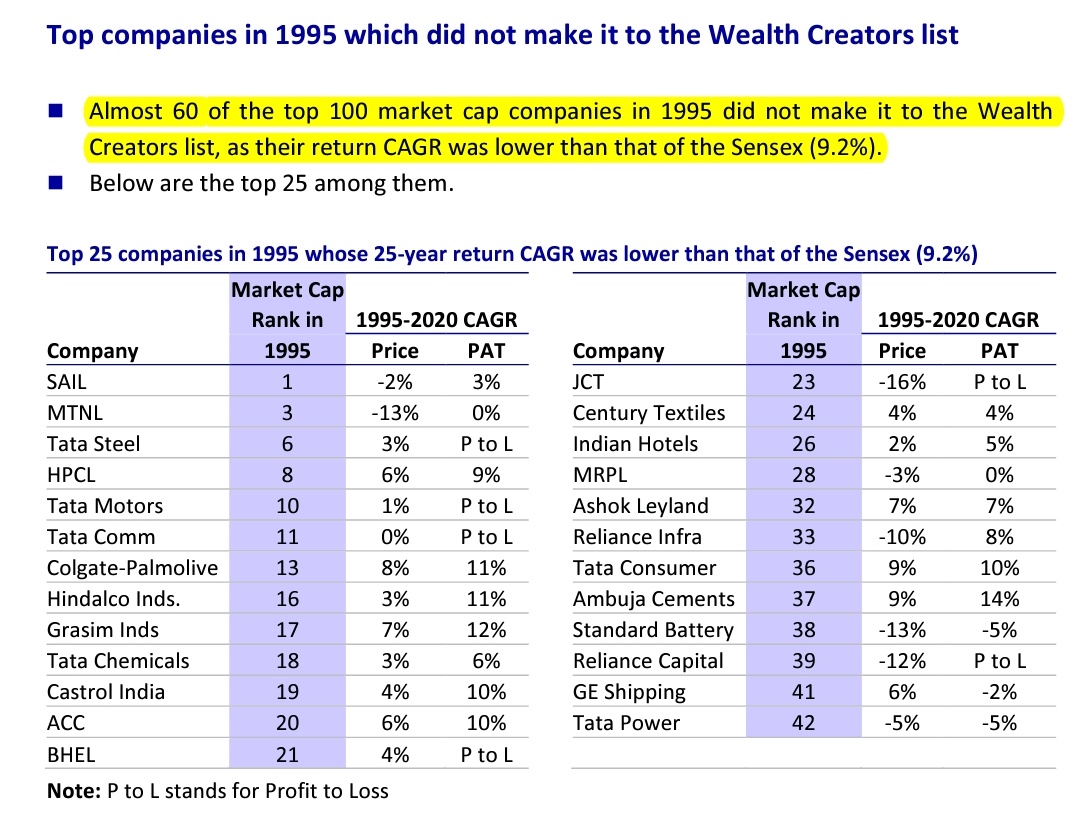

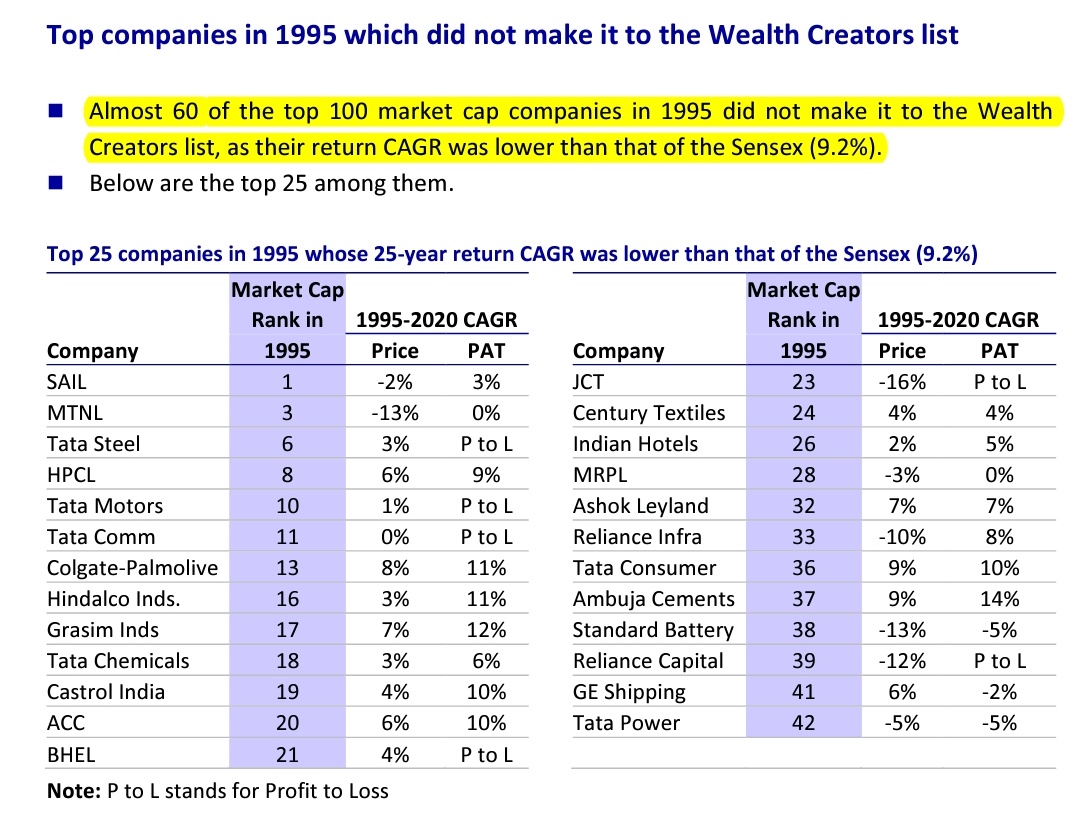

1. Forget markets, Think stocks.

2. Too much money chasing too few stocks.

3. Speed thrills, but at times kills, drive with caution.

4. Quality biz + Steady earnings growth + Reasonable valuation = Consistent Wealth Creation.

More from Finance

• 8 powerful ways to use Twitter

• Power of Stocks

• 14 Trading Strategies

• Basics of Derivatives (3 parts)

• Technical Analysis for all sectors

• Tweets of the week

• Books on Futures

All the Top 10 tweets threads I have ever posted to date:

Every week, I post a thread with the top ten tweets.

— Aditya Todmal (@AdityaTodmal) January 7, 2022

People seem to enjoy these a lot.

\U0001f9f5 Here's a list of all of them in order of appearance: \U0001f9f5

Basics of Derivatives Part 1:

\U0001d401\U0001d41a\U0001d42c\U0001d422\U0001d41c\U0001d42c \U0001d428\U0001d41f \U0001d403\U0001d41e\U0001d42b\U0001d422\U0001d42f\U0001d41a\U0001d42d\U0001d422\U0001d42f\U0001d41e\U0001d42c

— Nikita Poojary (@niki_poojary) January 8, 2022

\u2022 What is a derivative

\u2022 Various derivative products

\u2022 Participants in derivatives market

\u2022 Uses of derivative instruments

\u2022 Beta & hedge ratio

\u2022 Option Greeks

Time for a Thread \U0001f9f5

Curated in collaboration with @AdityaTodmal pic.twitter.com/x6IHoQubOT

8 powerful ways to use Twitter:

Most of the Trading community doesn\u2019t know how to use Twitter effectively.

— Aditya Todmal (@AdityaTodmal) January 15, 2022

Here are 8 powerful ways to use Twitter: \U0001f9f5

Collaborated with @niki_poojary pic.twitter.com/TuZt72PIzd

Basics of Derivatives Part 2:

\U0001d401\U0001d41a\U0001d42c\U0001d422\U0001d41c\U0001d42c \U0001d428\U0001d41f \U0001d403\U0001d41e\U0001d42b\U0001d422\U0001d42f\U0001d41a\U0001d42d\U0001d422\U0001d42f\U0001d41e\U0001d42c - \U0001d40f\U0001d41a\U0001d42b\U0001d42d \U0001d408\U0001d408

— Nikita Poojary (@niki_poojary) January 15, 2022

\u2022 How options can be used

\u2022 How to trade in options & exit strategy- buyers

\u2022 Imp of theta decay

\u2022 How to trade in options & exit strategy -sellers

Time for a Thread\U0001f9f5

Curated in collaboration with@AdityaTodmal pic.twitter.com/Ebd99afDKB