The old conservative versus liberal thing, or the left/right division has been completely obliterated, and sometimes directly reversed. Originally, those on the right were defenders of the status quo, which meant they were fine with the world being run by bankers and aristocrats.

More from Goldstein

More from Finance

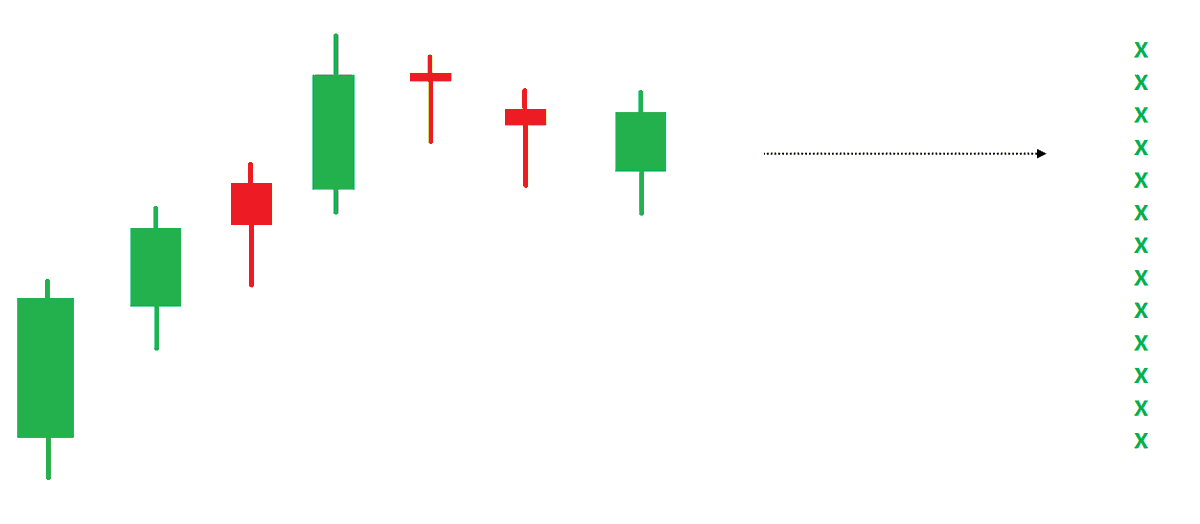

An effective price pattern defined using properties of P&F charts.

#Superpattern #Pointandfigure #Definedge

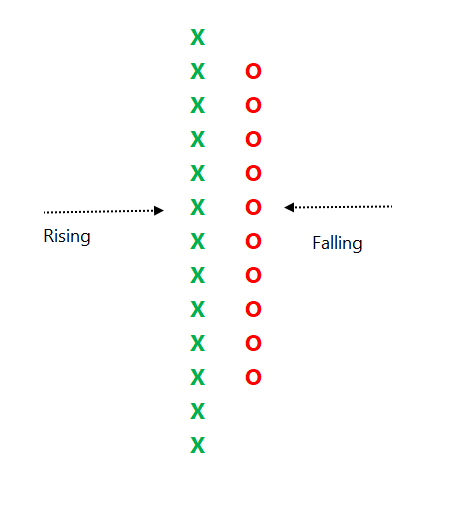

Point & Figure is an oldest charting method where price is plotted vertically, and the chart moves only when price moves. It is a different way of looking at the price, the objective box-value and reversal value offers advantage of identifying objective price patterns.

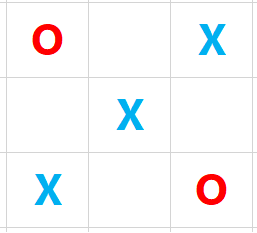

When price is moving up, it is plotted in a column of 'X'. When it is going down, it is plotted in a column of ‘O’. Normally, three-box reversal criteria is used to define the trend & reversal. Unlike a bar or candle, the P&F column can have multiple sessions in it.

Link to know more about the subject:

https://t.co/2xtLAVPBvm

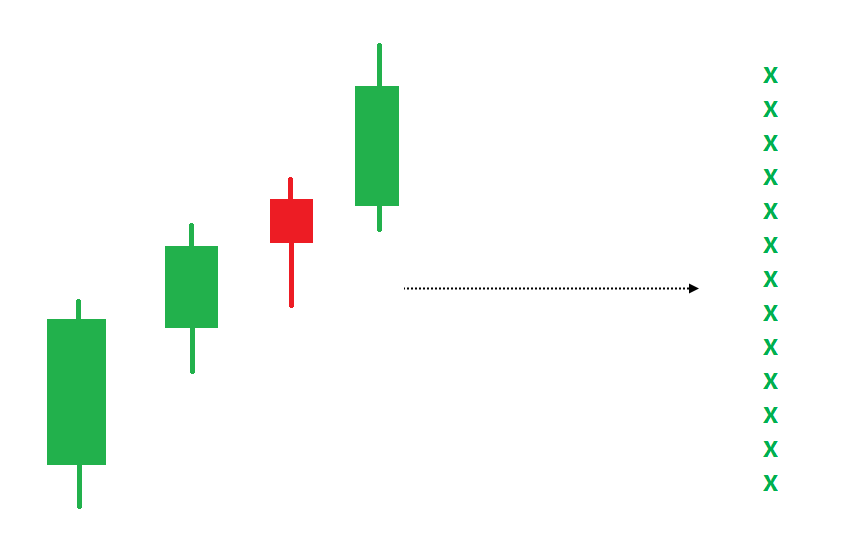

See below chart. Price is in a strong uptrend, P&F chart would produce a long of column of 'X' with more number of boxes in it.

If such a trend is followed by some time bars without meaningful price correct, P&F chart would not move, and it will remain in column of 'X' in such a scenario.

Even after investing for 14 years, I uncover new insights every time I reread his letters.

Recently, I reread his letters from 1977 to 2020 for a third time.

Here are my key insights:

1. Moat is NEVER stagnant

A company's competitive position either grows stronger or weaker each day.

Widening the moat must always take precedence over short-term targets.

2. Commodity businesses

A business without moat will have its returns competed away.

Regardless of improvement, your competitors will quickly copy your advantage away.

Where returns on capital is dismal, reinvestment will only destroy value.

3. The flywheel effect

Buffett was preaching about the flywheel effect before it became cool.

Back then, newspapers were similar to today's platform businesses like Amazon, Meta, and App Store.

More readers beget more advertisers beget more readers.

4. Operating leverage

Companies with high fixed costs and low variable costs will see earnings rise faster than revenue.

However, it cuts both ways.

It becomes a disaster when revenue is declining.

Check out my article on how operating leverage works: https://t.co/Nv747oBAK0

I credit Fintwit for my learnings.

Here's 10 key concepts every investor must know:

1. $$ needed to retire

2. Researching a business

3. Reading annual reports

4. Reading earnings calls

5. Criteria of a multi bagger

(Read on...)

6. Holding a multi bagger

7. Economic moats

8. When to buy a stock

9. Earnings vs cashflow

10. Traits of quality companies

Here's my 10 favourite threads on these concepts:

1. How much $$ do you need to retire

Before you start, you must know the end game.

To meet your retirement goals...

How much $$ do you need in your portfolio?

10-K Diver does a good job explaining what's a safe withdrawl rate.

Hint: It's NOT

1/

— 10-K Diver (@10kdiver) July 25, 2020

Get a cup of coffee.

In this thread, I'll help you work out how much money you need to retire.

2. Research a business

Your investment returns are a lagging indicator.

Instead, your research skills are the leading predictor of your results.

Conclusion?

To be a good investor, you must be a great business researcher.

Start with

1/ Thoughts on Research Process

— Mostly Borrowed Ideas (@borrowed_ideas) September 27, 2021

I was invited to present my research process at a college in the US. I am sharing all ten slides here. pic.twitter.com/z0tjZcogfH

3. Reading annual reports

This is the bread and butter of a good business analyst.

You cannot just listen to opinions from others.

You must learn to deep dive a business and make your own judgments.

Start with the 10k.

Ming Zhao explains it

\U0001f9d0How to Read 10Ks Like a Hedge Fund\U0001f9d0

— Ming Zhao (@FabiusMercurius) May 7, 2021

\u201cFundamentals don\u2019t matter anymore!\u201d I\u2019ve heard this a lot lately on Fintwit.\U0001f644

But, for those who\u2019ve diversify beyond $GME and $DOGE, here\u2019s a primer on what metrics fundamental buy-side PMs look at and why:

(real examples outlined)

\U0001f447 pic.twitter.com/tLlNRvpnDK

You May Also Like

A thread 👇

https://t.co/xj4js6shhy

Entrepreneur\u2019s mind.

— James Clear (@JamesClear) August 22, 2020

Athlete\u2019s body.

Artist\u2019s soul.

https://t.co/b81zoW6u1d

When you choose who to follow on Twitter, you are choosing your future thoughts.

— James Clear (@JamesClear) October 3, 2020

https://t.co/1147it02zs

Working on a problem reduces the fear of it.

— James Clear (@JamesClear) August 30, 2020

It\u2019s hard to fear a problem when you are making progress on it\u2014even if progress is imperfect and slow.

Action relieves anxiety.

https://t.co/A7XCU5fC2m

We often avoid taking action because we think "I need to learn more," but the best way to learn is often by taking action.

— James Clear (@JamesClear) September 23, 2020