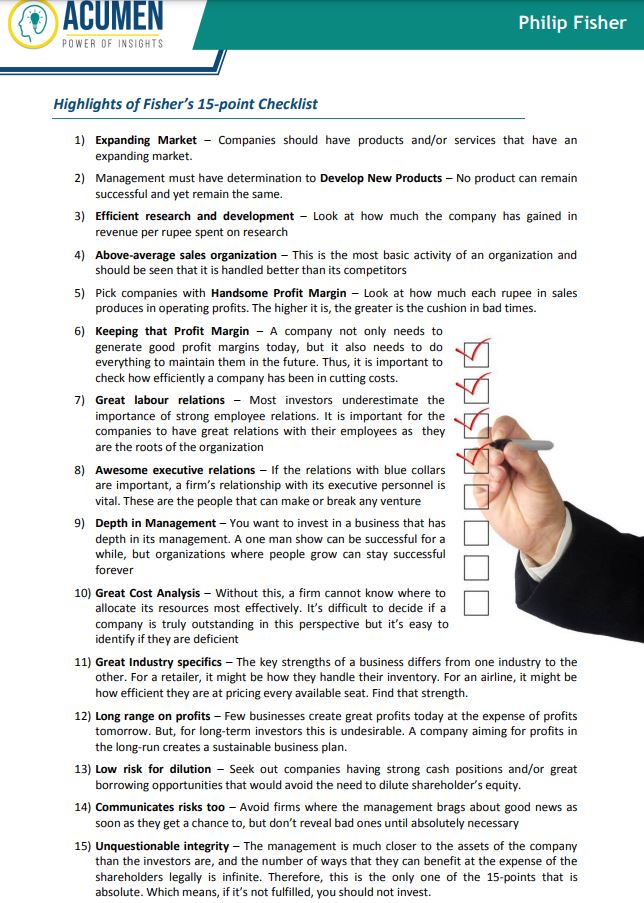

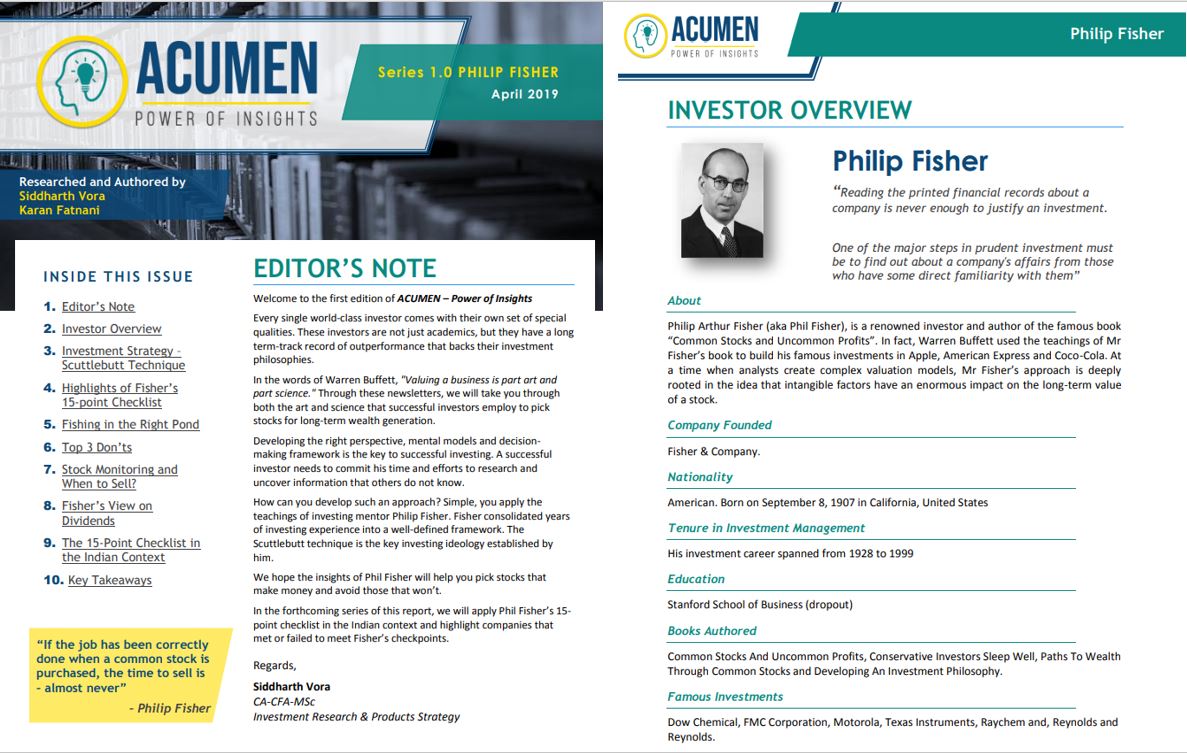

Insights from Philip Fisher. One of the best docs I came across for individual investors.

Phenomenal effort by @SiddharthVoraPL @PLIndiaOnline 👏👏

cc: @dmuthuk @Gautam__Baid @saxena_puru

https://t.co/K19gWk9TFO

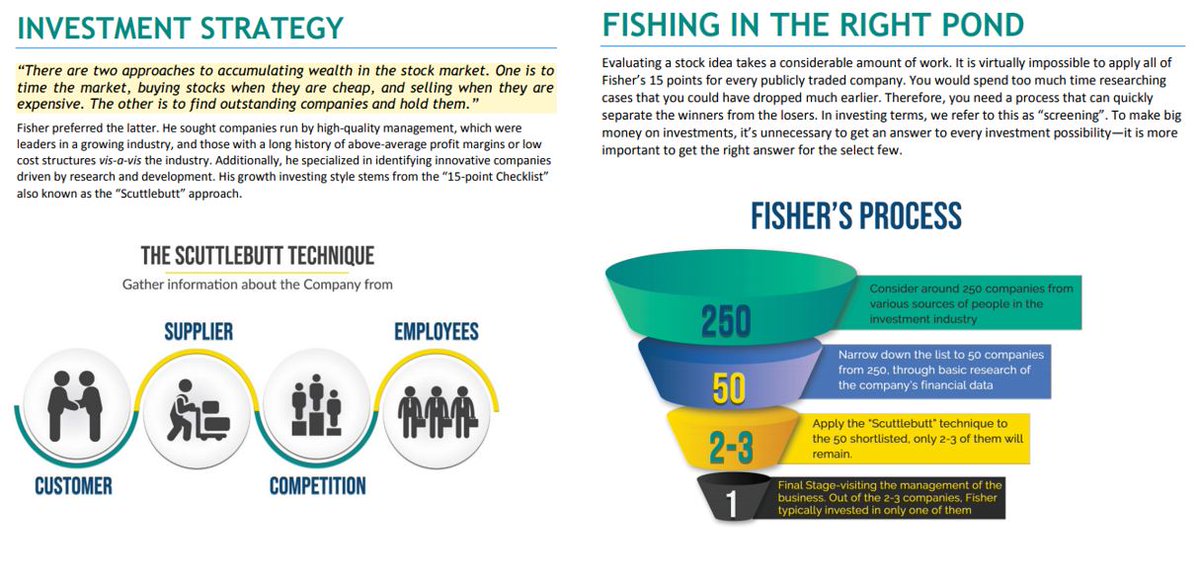

Full scale scuttlebutt is not possible for individual investors (lack of time, resources, contacts), but with efficient search & communication online (tuning out the noise), there are still some ways to do good research.

More from Ram Bhupatiraju

For any Learning machines out there, here are a list of my fav online investing resources. Feel free to add yours.

Let's dive in.

⬇️⬇️⬇️

Investing Services

✔️ @themotleyfool - @TMFStockAdvisor & @TMFRuleBreakers services

✔️ @7investing

✔️ @investing_city

https://t.co/9aUK1Tclw4

✔️ @MorningstarInc Premium

✔️ @SeekingAlpha Marketplaces (Check your area of interest, Free trials, Quality, track record...)

General Finance/Investing

✔️ @morganhousel

https://t.co/f1joTRaG55

✔️ @dollarsanddata

https://t.co/Mj1owkzRc8

✔️ @awealthofcs

https://t.co/y81KHfh8cn

✔️ @iancassel

https://t.co/KEMTBHa8Qk

✔️ @InvestorAmnesia

https://t.co/zFL3H2dk6s

✔️

Tech focused

✔️ @stratechery

https://t.co/VsNwRStY9C

✔️ @bgurley

https://t.co/NKXGtaB6HQ

✔️ @CBinsights

https://t.co/H77hNp2X5R

✔️ @benedictevans

https://t.co/nyOlasCY1o

✔️

Tech Deep dives

✔️ @StackInvesting

https://t.co/WQ1yBYzT2m

✔️ @hhhypergrowth

https://t.co/kcLKITRLz1

✔️ @Beth_Kindig

https://t.co/CjhLRdP7Rh

✔️ @SeifelCapital

https://t.co/CXXG5PY0xX

✔️ @borrowed_ideas

Investing websites/blogs that I shared during the @FintwitSummit last weekend. With some minor changes and lot of additional commentary in the thread below. ⬇️⬇️

My investing diet 🗒️

✔️Zero Financial TV.

✔️Very little Market & Stock prices commentary/content.

✔️Lot of Company produced presentations/statements.

✔️ Lot of Investing Podcasts (thread some other time).

✔️Lot of below awesome content whenever I find time.

Tech : Have to start with my favorite sector

✅ @stratechery

For deeper understanding of Platforms and Aggregators.

https://t.co/VsNwRStY9C

✅ @benedictevans

Phenomenal essays related to

✅ @adam_hartung

Extremely good if you are into following & investing in strong/durable trends.

https://t.co/IOE1pmkqbi

✅ @BaillieGifford

Mind blowing, if you're into extremely patient and visionary style of

✅ @StackInvesting

Must read if you love the combination of Software + Investing

https://t.co/WQ1yBYzT2m

✅ @hhhypergrowth

Phenomenal writing if you love technical deep dives into SaaS

https://t.co/kcLKITRLz1

✅ @Beth_Kindig

Sharp Tech focused

cc: @dmuthuk @Gautam__Baid

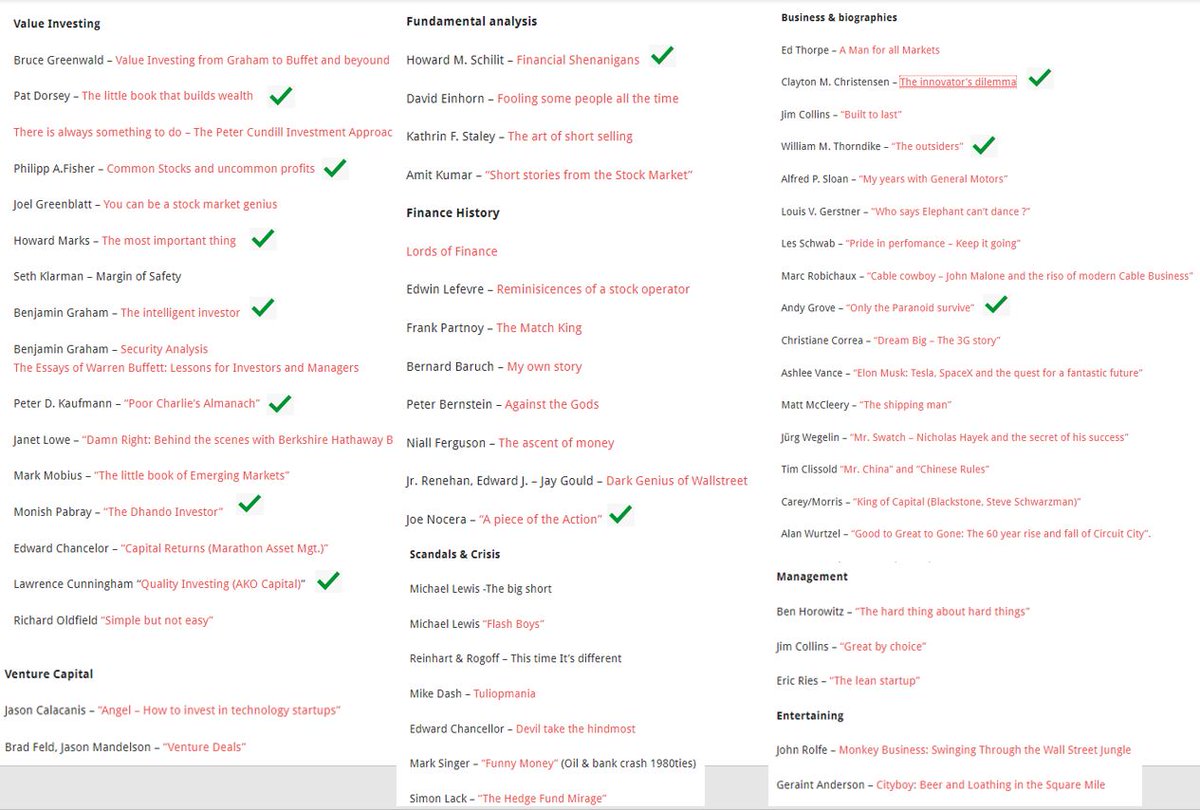

(Some of the pages might open in German. Use the Translate to English option on the

List 👇

Some of my fav summaries from the list.

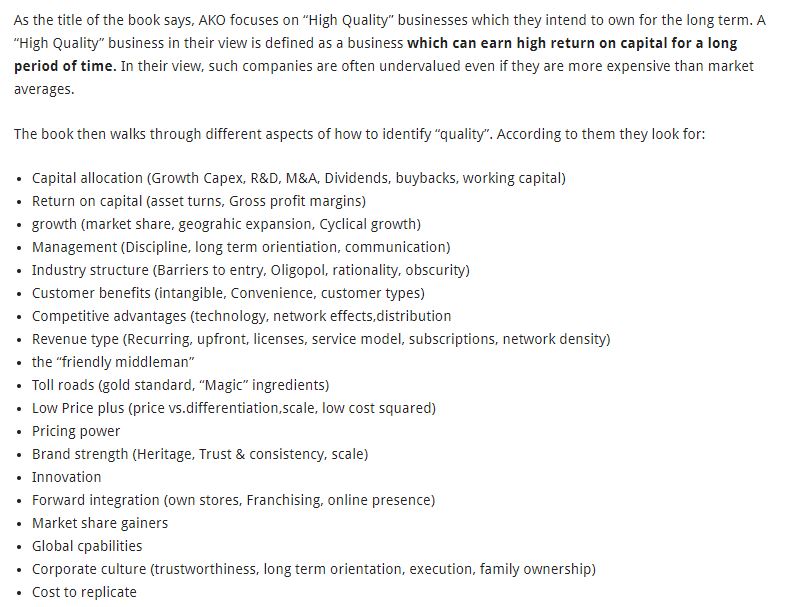

✔️Quality Investing - Lawrence Cunningham

https://t.co/pmVQFPlWby

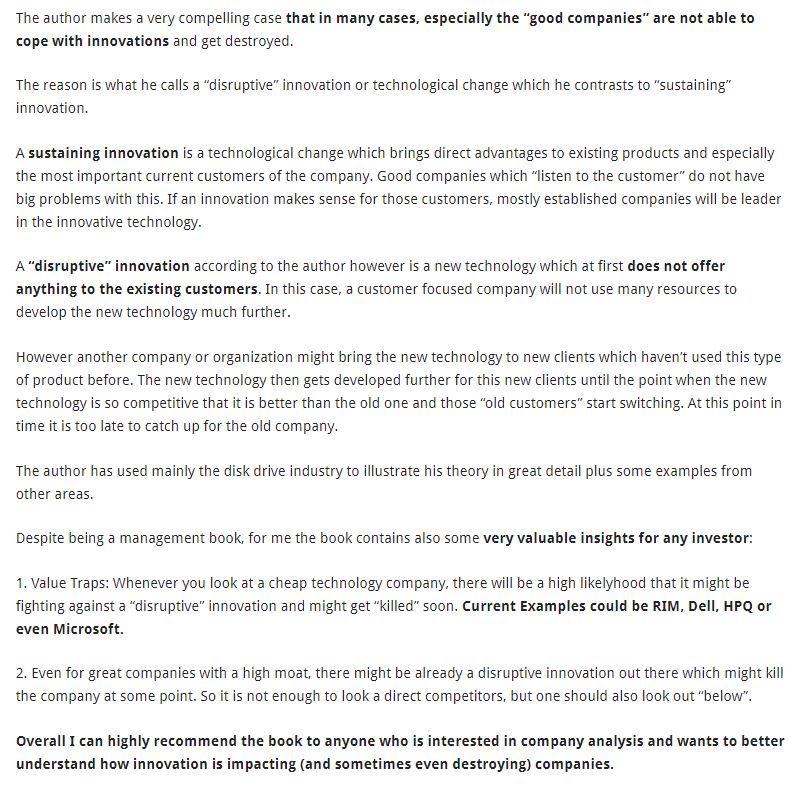

✔️The Innovator's Dilemma – Clayton Christensen

https://t.co/VazvMPEE7D

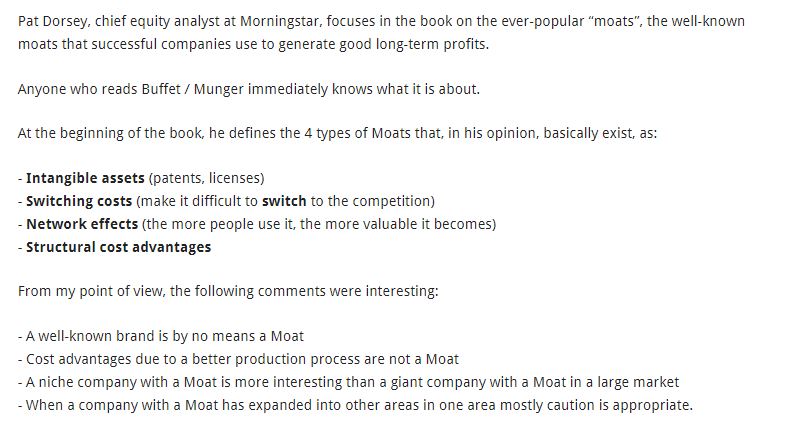

✔️The Little Book That Builds Wealth - Pat Dorsey

https://t.co/sMJspTTQcA

More from Equity

You May Also Like

Like company moats, your personal moat should be a competitive advantage that is not only durable—it should also compound over time.

Characteristics of a personal moat below:

I'm increasingly interested in the idea of "personal moats" in the context of careers.

— Erik Torenberg (@eriktorenberg) November 22, 2018

Moats should be:

- Hard to learn and hard to do (but perhaps easier for you)

- Skills that are rare and valuable

- Legible

- Compounding over time

- Unique to your own talents & interests https://t.co/bB3k1YcH5b

2/ Like a company moat, you want to build career capital while you sleep.

As Andrew Chen noted:

People talk about \u201cpassive income\u201d a lot but not about \u201cpassive social capital\u201d or \u201cpassive networking\u201d or \u201cpassive knowledge gaining\u201d but that\u2019s what you can architect if you have a thing and it grows over time without intensive constant effort to sustain it

— Andrew Chen (@andrewchen) November 22, 2018

3/ You don’t want to build a competitive advantage that is fleeting or that will get commoditized

Things that might get commoditized over time (some longer than

Things that look like moats but likely aren\u2019t or may fade:

— Erik Torenberg (@eriktorenberg) November 22, 2018

- Proprietary networks

- Being something other than one of the best at any tournament style-game

- Many "awards"

- Twitter followers or general reach without "respect"

- Anything that depends on information asymmetry https://t.co/abjxesVIh9

4/ Before the arrival of recorded music, what used to be scarce was the actual music itself — required an in-person artist.

After recorded music, the music itself became abundant and what became scarce was curation, distribution, and self space.

5/ Similarly, in careers, what used to be (more) scarce were things like ideas, money, and exclusive relationships.

In the internet economy, what has become scarce are things like specific knowledge, rare & valuable skills, and great reputations.