We still have 10 million fewer jobs than we did in February. Clawing the rest back at +245k per month will take basically forever. If this is the second half of the recovery, it's going to be grim

Payrolls in November rose a mere +245k. That's the sort of number you might see in a "normal" month, and definitely not what you're hoping for in the snapback from a covid-induced shutdown.

THE RECOVERY IS STALLING.

We still have 10 million fewer jobs than we did in February. Clawing the rest back at +245k per month will take basically forever. If this is the second half of the recovery, it's going to be grim

The virus is back, which hobbles the service sector, and stimulus has basically petered out, leaving the economy with little help. It doesn't have to be this way.

- State governments cut -243k jobs in March-May, and now an additional 134k since September.

- Local governments cut -1255k jobs March-May, and -187k since Sept.

And more cuts are ahead.

https://t.co/4RHutW5Q4E

Put another way: I don\u2019t think we should interpret jobs numbers or other economic data now the way we did in the 08-10 recession and recovery. Jobs (at least some jobs) going up when COVID is out of control is a failure of public health policy, not a success of economic policy.

— Dan Hirschman (@asociologist) December 4, 2020

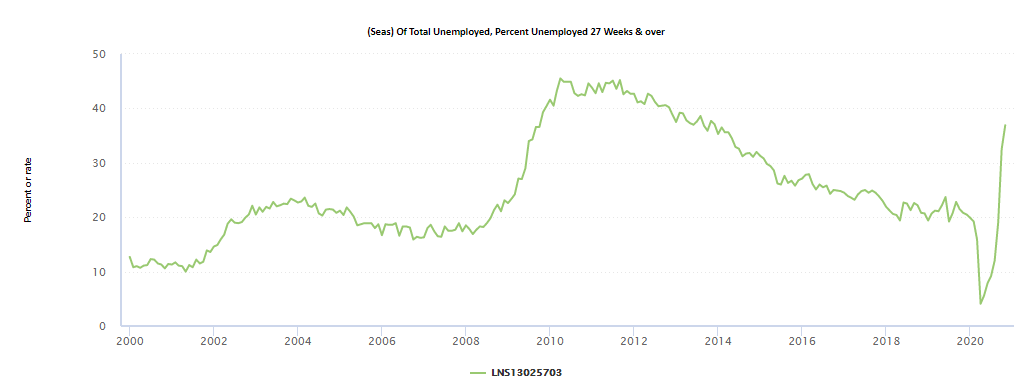

The first act was firms re-opening and recalling furloughed workers.

The second act is harder: Millions lost their jobs permanently & there aren't many new opportunities opening up for them.

The second act is a grim slog.

https://t.co/tLb6uYhe9f

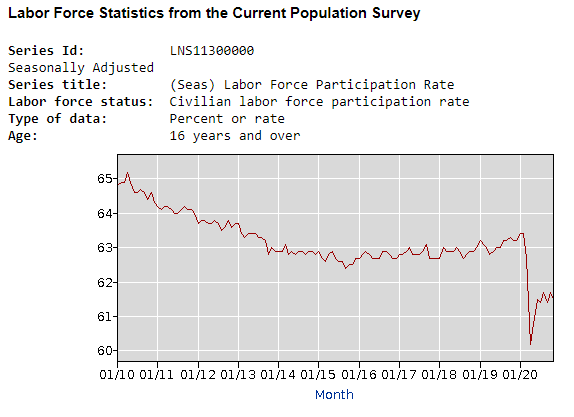

The unemployment rate fell from 6.9% to 6.7% in November. BUT... labor force participation fell so the employment rate fell.

— Jason Furman (@jasonfurman) December 4, 2020

My measure of the "realistic" unemployment rate actually rose.

And the "full recall" unemployment rate rose.

Blog coming, a little on this now. pic.twitter.com/SbgA9VQorB

As people lose contact with the labor market, they lose connections, skills, and hope.

How many job reports like this will it take before the people arguing there is a trade off between health and the economy admit that getting control of the virus is critical for fixing the economy?

— Austan Goolsbee (@Austan_Goolsbee) December 4, 2020

[*Narrator: he already knew the answer to this question*]

More from Economy

I can't tell if I'm agreeing or disagreeing with @jc_econ.

There is no relationship b/w deficits & interest rates in the US & many other advanced economies. Centuries of dynamic institution building underpin our reserve currency status that allows rates to be a function of economic fundamentals, flows & policy not credit risk 1/3

— Dr. Julia Coronado (@jc_econ) January 26, 2021

Increasing government spending or reducing taxes increases demand (or reduces saving). This raises the price of loanable funds or the interest rate.

In a dynamic context, more demand means a stronger economy, the central bank raises interest rates sooner, and long rates rise.

(As an aside, we are not close to the United States needing to worry about credit risk and the risks are more overstated than understated in most other advanced economies too. But credit risk is not always & everywhere irrelevant, just look at the UK in 1976 or Canada in 1994.)

Interest rates have fallen over the last 20 yrs while debt has risen. This does not necessarily mean that debt rising causes interest rates to fall. It could also mean that other things have happened at he same time that pushed down interest rates more than debt pushed them up.

The suspects for these "other things" include slower productivity growth, slower popln growth, higher inequality, less investment, etc. All of which either increase the supply of saving or reduce the demand for investment, reducing the equilibrium interest rate.

You May Also Like

I'll begin with the ancient history ... and it goes way back. Because modern humans - and before that, the ancestors of humans - almost certainly originated in Ethiopia. 🇪🇹 (sub-thread):

The famous \u201cLucy\u201d, an early ancestor of modern humans (Australopithecus) that lived 3.2 million years ago, and was discovered in 1974 in Ethiopia, displayed in the national museum in Addis Ababa \U0001f1ea\U0001f1f9 pic.twitter.com/N3oWqk1SW2

— Patrick Chovanec (@prchovanec) November 9, 2018

The first likely historical reference to Ethiopia is ancient Egyptian records of trade expeditions to the "Land of Punt" in search of gold, ebony, ivory, incense, and wild animals, starting in c 2500 BC 🇪🇹

Ethiopians themselves believe that the Queen of Sheba, who visited Israel's King Solomon in the Bible (c 950 BC), came from Ethiopia (not Yemen, as others believe). Here she is meeting Solomon in a stain-glassed window in Addis Ababa's Holy Trinity Church. 🇪🇹

References to the Queen of Sheba are everywhere in Ethiopia. The national airline's frequent flier miles are even called "ShebaMiles". 🇪🇹