Delta Corp - i have added some quantity will add more if it retests otherwise i will let it go!!

Here is the EW chart

cheers https://t.co/fAgOxvE4a3

Delta Corp - Good structure with good volume

— Moneyspinners - Work Hard Dream Big!! (@Jai0409) March 21, 2022

cheers pic.twitter.com/E6Q9ehwHvz

More from Moneyspinners - Work Hard Dream Big!!

I love this company biz, would accumulate at lower levels

cheers https://t.co/02SWIrNcay

KPIT - Major wave 2 is in progress, will hold it with stop loss 555!!

— Moneyspinners - Work Hard, Dream Big!! (@Jai0409) April 15, 2022

cheers https://t.co/VykwxWxLpb

A good portfolio stock for this calender year!!

here is the technical chart with approximate lengths

cheers https://t.co/b5plJ1EqxT

In the power sector - recent entries

— Moneyspinners - Work Hard, Dream Big!! (@Jai0409) April 5, 2022

-Tata Power

-Borosil Renewables

will share EW charts, stay tuned

cheers

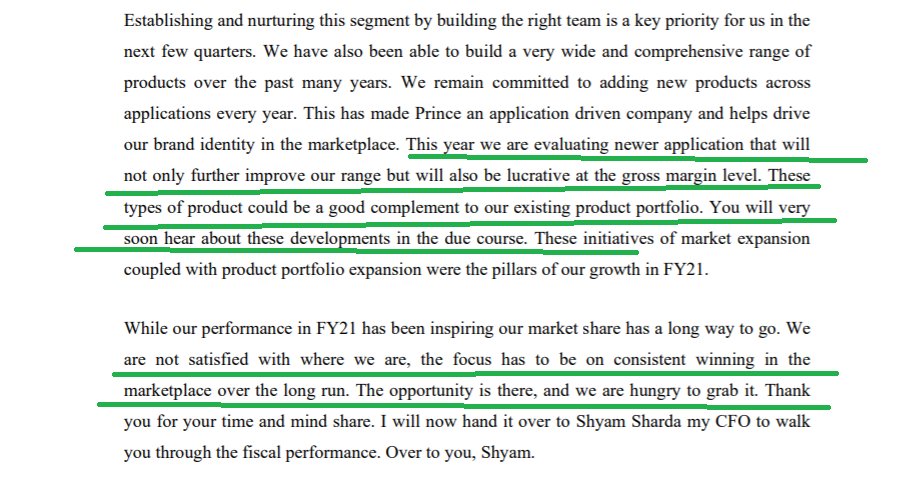

a lot of info avail in Q4 concall.

66% rev come from plumbing & SWR

Realty, govt programs-jaal ka naal, irrigation.etc will augur well

I Will post an updated chart with subwaves once it comes out of channel

Snippets & best report from soic👇 https://t.co/ru6xpHdJ8h

A detailed blog on Prince Pipes and what makes a Pipe company successful with comparison across the industry: by @badola_arjun

— Intrinsic Compounding (@soicfinance) July 23, 2021

Link to read\U0001f517: https://t.co/N58Fp4pOdL pic.twitter.com/EpiVwayEuS

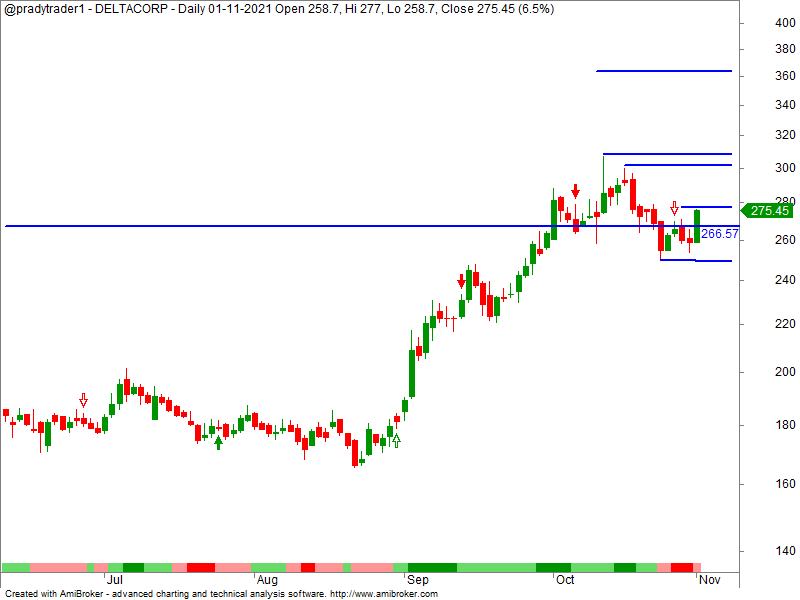

More from Deltacorp

Now above Fibonacci retracement

0.618%(268) and likely move higher towards next Fibonacci retracement level

0.786(327 ) and than ATH cross.

#Probability

DELTACORP

— Waves_Perception(Dinesh Patel) Stock Market FARMER (@idineshptl) August 13, 2020

116

Just a perspective pic.twitter.com/Qymzx8VfsR

You May Also Like

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Old is Gold....

— Professor (@DillikiBiili) January 23, 2020

this Bharti Airtel chart is a true copy of the Wyckoff Pattern propounded in 1931....... pic.twitter.com/tQ1PNebq7d

Those who exited at 1500 needed money. They can always come back near 969. Those who exited at 230 also needed money. They can come back near 95.

Those who sold L @ 660 can always come back at 360. Those who sold S last week can be back @ 301

Sir, Log yahan.. 13 days patience nhi rakh sakte aur aap 2013 ki baat kar rahe ho. Even Aap Ready made portfolio banakar bhi de do to bhi wo 1 month me hi EXIT kar denge \U0001f602

— BhavinKhengarSuratGujarat (@IntradayWithBRK) September 19, 2021

Neuland 2700 se 1500 & Sequent 330 to 230 kya huwa.. 99% retailers/investors twitter par charcha n EXIT\U0001f602