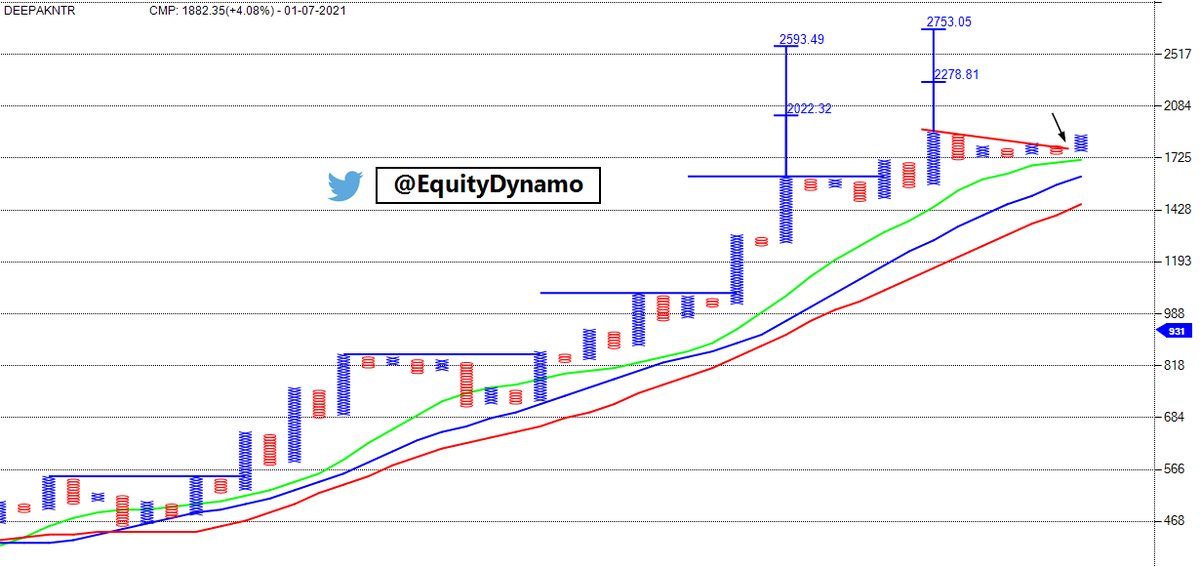

#DEEPAKNTR-2405

#DEEPAKNTR -1904

— MaRkET WaVES (DINESH PATEL ) Stock Market FARMER (@idineshptl) May 5, 2021

View valid till 1597 not violated. #Perspective pic.twitter.com/yDAwsPoj52

More from MaRkET WaVES (DINESH PATEL ) Stock Market FARMER

Either entry only above 1600 or let it

correct towards 987...

#Update

#CDSL -1050

— MaRkET WaVES (DINESH PATEL ) Stock Market FARMER (@idineshptl) July 9, 2021

Now above 2.618% and objective is to move higher towards 3.618%

4.236% and 4.618%....

What will Drag lower this stock price \U0001f602 ?

Only if you can sell your holding

Means Verticle rise ?

Than why it decline from (486-180.)#Observation #Perspective pic.twitter.com/evxYOjH8Qv

More from Deepaknitrate

Explained you same concept with Elxsi. The real test of a strong Breakout is that the big hand will not give you another chance to buy the share at the breakout level. They will absorb all the selling of weak hands. I mean "STRONG breakout". https://t.co/7fxFqGQl3p

Tata Elxsi ---

— Steve Nison (@nison_steve) June 30, 2021

In the last 10 minutes, all the selling was absorbed despite intraday positions being squared off (if not converted). will wait for the EOD data. However, the chart structure is extremely strong. https://t.co/pci7GCDBEO pic.twitter.com/1NBD9V3mKc

@MD_ABNSTOCKS

#DeepakNtr #StockToWatch

— Team MD&ABN (@team_md_abn) July 5, 2021

Entry - any dip towards 1875 is a buy

A counter will become weak if it closes below 1710 in a daily time frame.

A possible upside level is 2355 pic.twitter.com/IPlHPvBXFI

The poll saw highest interest in Agro-chemicals.

— Multipie (@MultipieSocial) June 25, 2021

So today we visualize the 10 year change in market cap of key agrochem and fertilizer companies. #MultipieVisuals

Which one do you like? pic.twitter.com/sNMzmEXCJz

#deepaknitrite

MOSL initiates on Deepak Nitrite pic.twitter.com/vkfW47qraT

— Darshan Mehta (@darshanvmehta1) June 30, 2021

#deepaknitrite

Deepak Nitrite was ignored at 250, 400, 600, 800, 1200, 1600 and now at 1800.

— LearnLifeWealthTravel | Dream Big, Think Growth !! (@AnyBodyCanFly) June 30, 2021

Review why you ignored this and other such names in past.... If you understand this well, you may correct your ignorance atleast as of today.#investing #BePositive

#DeepakNitrite

#DeepakNitrite valuation is most attractive in the space...

— jeevan patwa (@jeevanpatwa) June 30, 2021

growth will be most explosive in the space... pic.twitter.com/8VYdWwFApY

#deepaknitrite

#deepaknitrite stands out well against all this chem pack in valuations \U0001f447

— Sakir saiyed (@sakir_saiyed_) June 30, 2021

ROE : 39

ROCE : 40

P/S : 5.5

Quality management 5/5 \U0001f44f\U0001f44f pic.twitter.com/ubSvUri4KL

You May Also Like

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020