HELEN by Georgette Heyer (Tweet Read #2)

Part I - The Child

Chapter I

II

MILDRED, Mrs Beazley, came on the evening of the following day. (1/14)

“Oh, James!” she said, and her hushed voice irritated him, “My poor James! Dear Kitty! my only sister! the shock!” Tears choked her; she clung to his hands. (3/14)

She was shocked to hear him speak so levelly. She had always thought him cold and unfeeling. “I can’t believe it!” she said. “I can’t! I can’t! She was always so full of life!” (4/14)

“If only I had been here!” For a time she sobbed, muffled, into her handkerchief, while he stood with his back to her, staring out of the window. “To me—such a blow! You’re so brave—I can’t understand it. What you must have gone through!” (5/14)

“A girl.”

“She’s alive?”

“Oh yes,” Marchant said indifferently.

“A girl! Yet another blow! Poor Jim! Oh, poor man!”

“No. It doesn’t matter. Kitty was glad.” (7/14)

“It wouldn’t have made any difference.” (8/14)

He fidgeted, jingling the money in his pockets, wishing that he could say something to make her stop. (9/14)

“Oh, thank you, Carter,” she said. (11/14)

“Dinner! I have hardly eaten all day. I haven’t the heart. I’ll go and take my hat off, Jim.”

“Mrs Sims has instructed Lucy to wait on you, Madam. You have only to ring.” (12/14)

“Your bath is ready, sir, and your clothes are laid out.”

“Thanks. I suppose someone is looking after the nurse?” (13/14)

“That’s all right, then. I’m afraid you’ve had a lot of trouble today.”

“No, sir, indeed,” Carter said impassively. (14/14)

More from Culture

I believe that @ripple_crippler and @looP_rM311_7211 are the same person. I know, nobody believes that. 2/*

Today I want to prove that Mr Pool smile faces mean XRP and price increase. In Ripple_Crippler, previous to Mr Pool existence, smile faces were frequent. They were very similar to the ones Mr Pool posts. The eyes also were usually a couple of "x", in fact, XRP logo. 3/*

The smile XRP-eyed face also appears related to the Moon. XRP going to the Moon. 4/*

And smile XRP-eyed faces also appear related to Egypt. In particular, to the Eye of Horus. https://t.co/i4rRzuQ0gZ 5/*

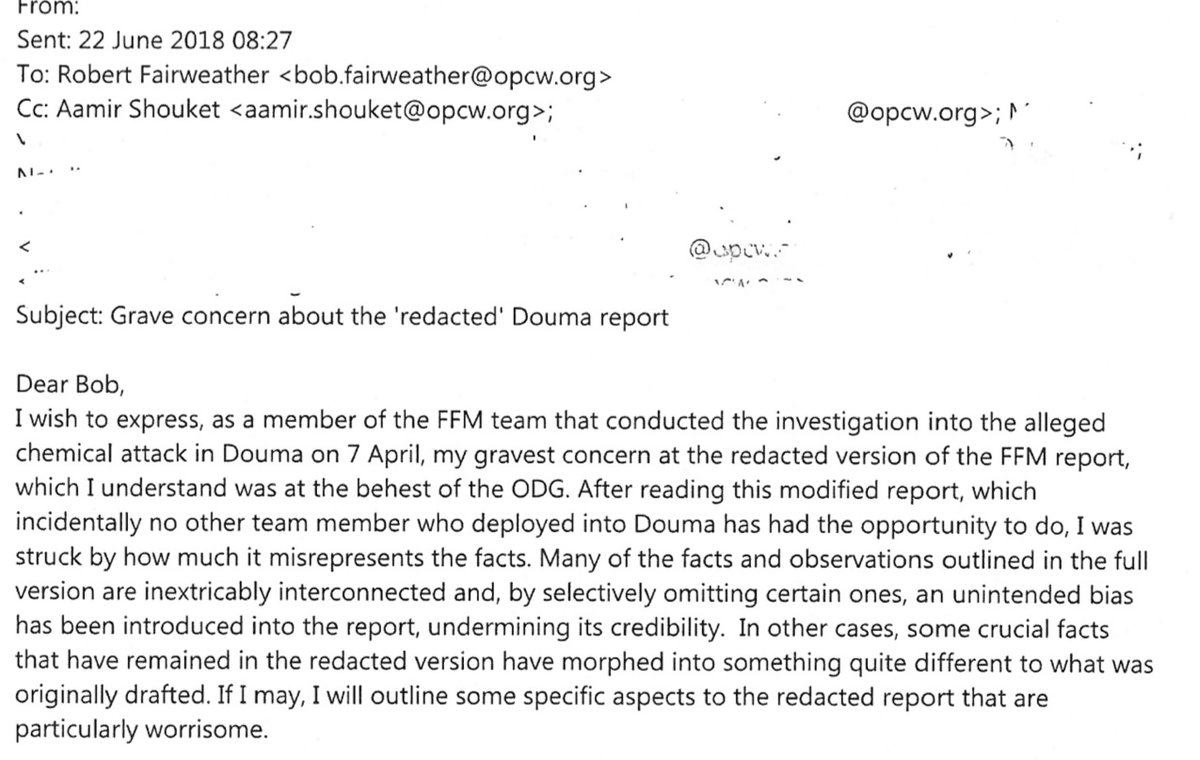

@BloomsburyBooks, to coverup the @OPCW #Douma controversy, promote US and UK gov. war narratives, and whitewash fraudulent conduct within the OPCW, is an exercise in deception through omission. @BloomsburyPub @Tim_Hayward_

\u201cAllegations of our involvement with the intelligence services are of course false,\u201d says Bellingcat founder @EliotHiggins https://t.co/55V7sJV9or

— UnHerd (@unherd) February 15, 2021

1) 2000 words are devoted to the OPCW controversy regarding the alleged chemical weapon attack in #Douma, Syria in 2018 but critical material is omitted from the book. Reading it, one would never know the following:

2) That the controversy started when the original interim report, drafted and agreed by Douma inspection team members, was secretly modified by an unknown OPCW person who had manipulated the findings to suggest an attack had occurred. https://t.co/QtAAyH9WyX… @RobertF40396660

3) This act of attempted deception was only derailed because an inspector discovered the secret changes. The manipulations were reported by @ClarkeMicah

and can be readily observed in documents now available https://t.co/2BUNlD8ZUv….

4) @bellingcat's book also makes no mention of the @couragefoundation panel, attended by the @opcw's first Director General, Jose Bustani, at which an OPCW official detailed key procedural irregularities and scientific flaws with the Final Douma Report:

You May Also Like

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020