My 12 favourite quotes from Phil Fisher, from his wonderful book 'Common Stocks and Uncommon Profits'

Aside from Buffett/Munger, Fisher is the investor that has had the most influence on me and I would recommend his book to anyone:

"More money has probably been lost...

More from Culture

The Eye of Horus. 1/*

I believe that @ripple_crippler and @looP_rM311_7211 are the same person. I know, nobody believes that. 2/*

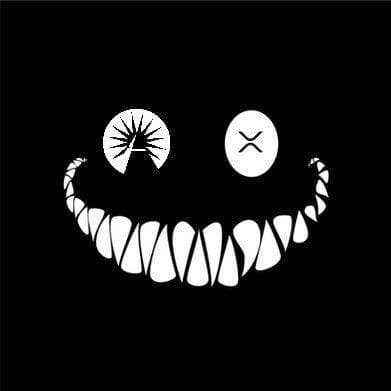

Today I want to prove that Mr Pool smile faces mean XRP and price increase. In Ripple_Crippler, previous to Mr Pool existence, smile faces were frequent. They were very similar to the ones Mr Pool posts. The eyes also were usually a couple of "x", in fact, XRP logo. 3/*

The smile XRP-eyed face also appears related to the Moon. XRP going to the Moon. 4/*

And smile XRP-eyed faces also appear related to Egypt. In particular, to the Eye of Horus. https://t.co/i4rRzuQ0gZ 5/*

I believe that @ripple_crippler and @looP_rM311_7211 are the same person. I know, nobody believes that. 2/*

Today I want to prove that Mr Pool smile faces mean XRP and price increase. In Ripple_Crippler, previous to Mr Pool existence, smile faces were frequent. They were very similar to the ones Mr Pool posts. The eyes also were usually a couple of "x", in fact, XRP logo. 3/*

The smile XRP-eyed face also appears related to the Moon. XRP going to the Moon. 4/*

And smile XRP-eyed faces also appear related to Egypt. In particular, to the Eye of Horus. https://t.co/i4rRzuQ0gZ 5/*