1/ A thread on Nexgen’s Arrow & the #uranium cycle ($NXE)

Can anyone tell me an estimated time frame that Nexgen could be permitted, start building their mine and be producing #uranium ??? @quakes99 @JekyllCapital @travmcph @NexGenEnergy $nxe

— Michael Pierce (@Big_U_Dawg) January 22, 2021

More from Crypto

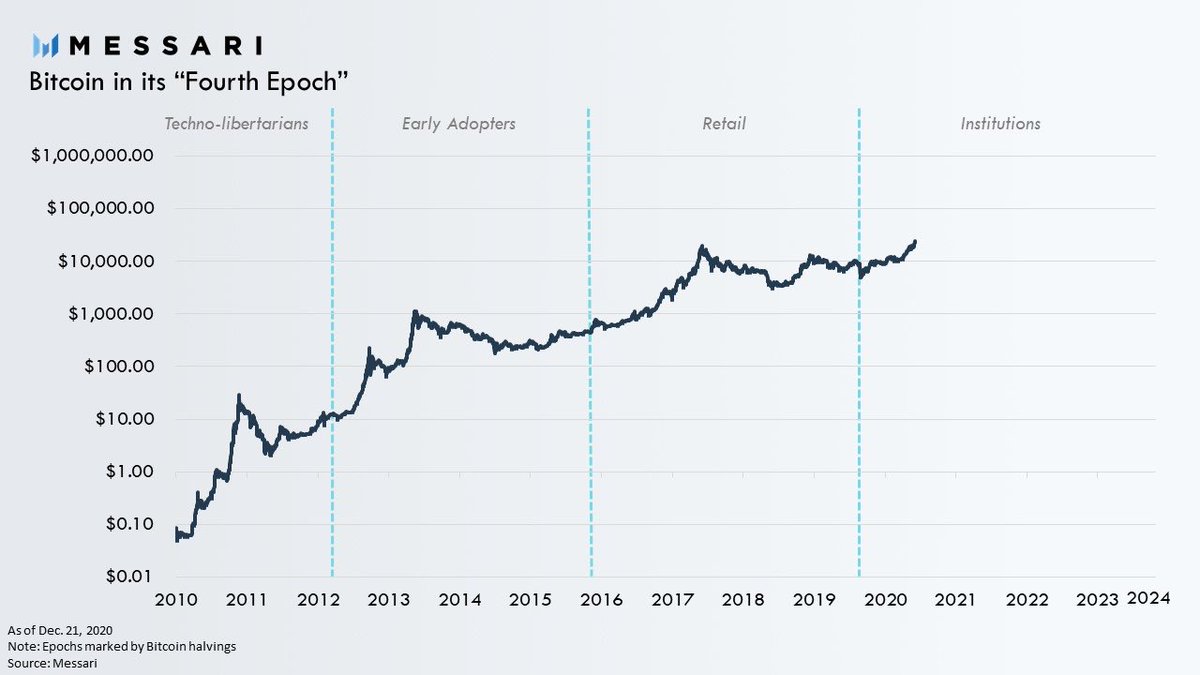

2020 will be remembered as the year the long fabled institutions finally arrived and #Bitcoin became a bonafide macroeconomic asset.

Below are the top highlights of each month for Bitcoin’s historic year.

1/

Bitcoin is now at all-time highs capping off an extremely successful year.

But it was by no means stable ride up.

2020 was a historically volatile year.

@YoungCryptoPM and I provided a detailed overview of every month of 2020 in all its

Jan.

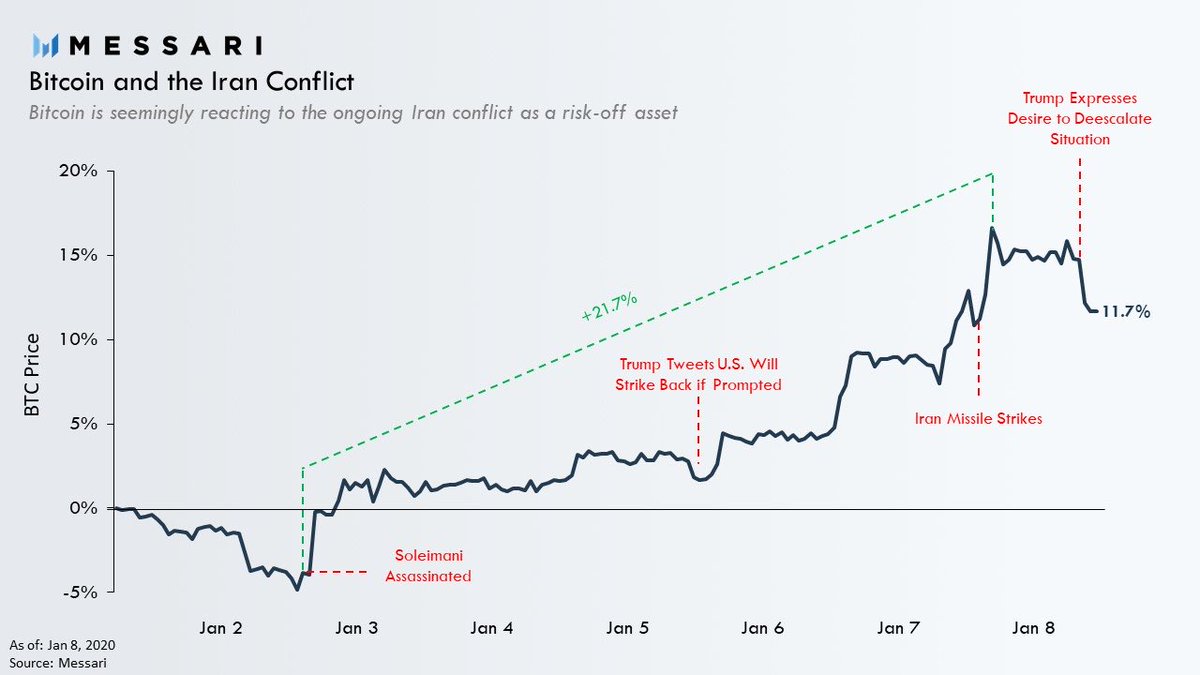

3 days into the new year the US assassinated Iran’s top general Soleimani.

BTC surprisingly reacted to the events behaving like a safe haven as the risk of war increased.

The events provided the first hints of BTC potentially having graduated to a legitimate macro asset.

Feb.

COVID-19 reached a tipping point causing markets to crash.

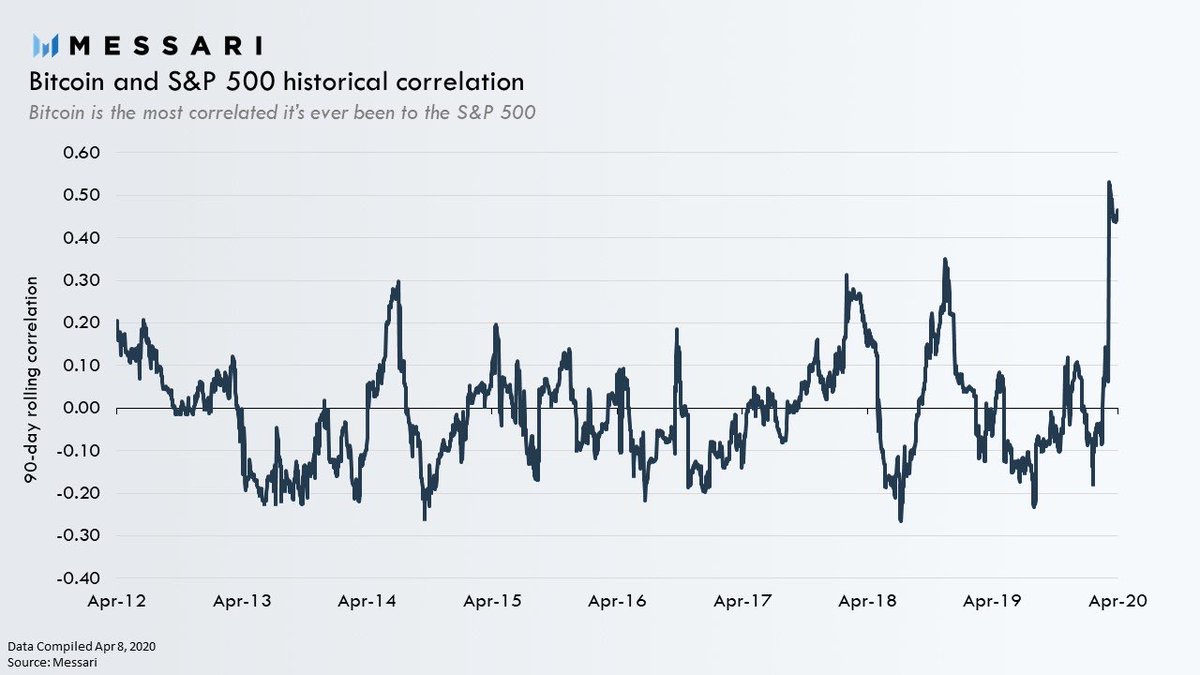

BTC’s correlation with the S&P 500 reached an ATH in the following weeks.

This is when everyone learned BTC was not a recession hedge, it was a hedge against inflation and loss of confidence in fiat currencies. https://t.co/JB7dJ3qp6M

1/ Figure I should get out ahead of this issue:

— Dan McArdle (@robustus) June 22, 2018

Bitcoin is a hedge against inflation & loss of confidence in fiat, NOT a hedge against a typical recession.

Mar.

Financial markets in free fall.

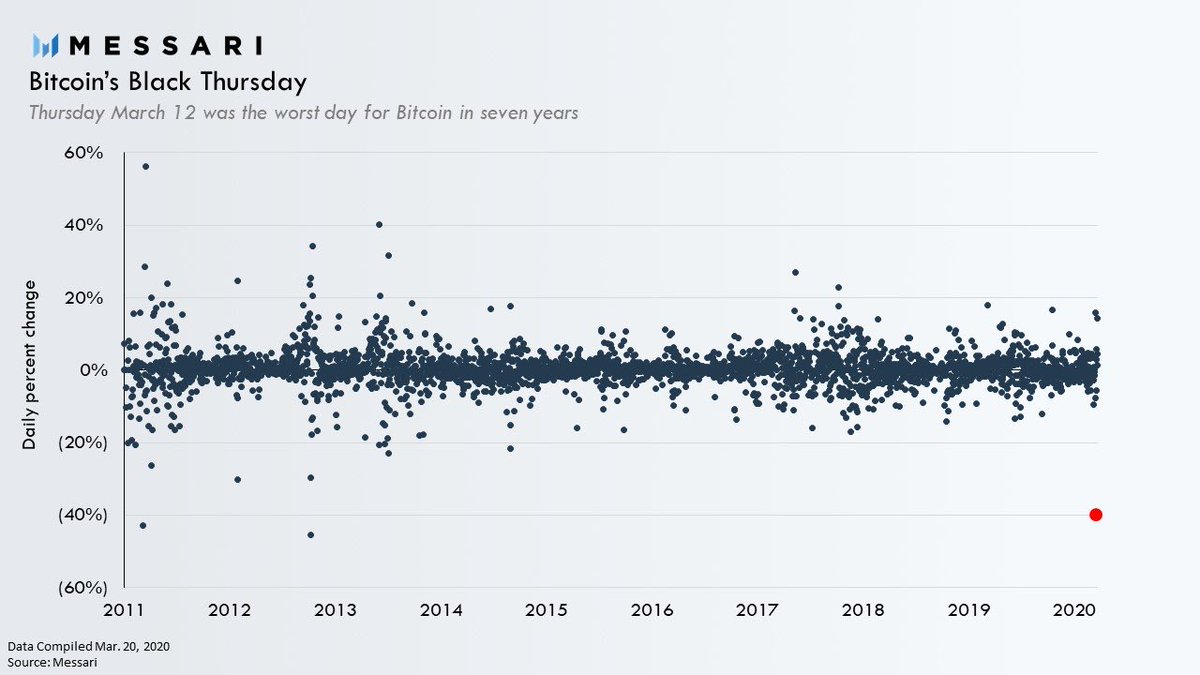

The liquidity crisis was so severe BTC experienced one of it’s worst days ever.

Now known as Black Thursday, on March 12, BTC plummeted as much as 50% to below $4,000 at its lowest point on the day.

BTC closed the day down 40%

The vast majority of its success was fueled by #DeFi.

Here's what happened in 5 Tweets 🔽

1) Governance Tokens 🪙

Projects gave complete ownership of billion dollar protocols to their users, often using retroactive airdrops.

Early adopters earned tokens for past usage, and token-based voting now dictates all technical

It pays to be a web3 power user.

— Coopahtroopa \U0001f525_\U0001f525 (@Cooopahtroopa) December 9, 2020

Five networks that issued retroactive airdrops to value added actors \U0001f4dd

2) Liquidity Mining ⛏️

Power users were the first to earn on-going distribution by providing liquidity.

$COMP sparked the wave, with $BAL coining the term a few weeks

BAL is live!

— Balancer Labs (@BalancerLabs) June 23, 2020

The 435k BAL for liquidity providers of the first three weeks of liquidity mining (145k per week) have just been sent out to the wallets used to provide liquidity on Balancer.https://t.co/pkXFzwzPVC

3) Yield Faming 🌾

Projects coupled liquidity mining and governance tokens to boost 'yields' by combining lending rates with an incentive layer.

APYs peaked as high as 1M% during 'DeFi summer', leading to a 'food coin' craze like $YAM and

Check out @Cooopahtroopa's latest post for all the #DeFi farmers out there \U0001f468\u200d\U0001f33e

— Zerion \U0001f3e6 (@zerion_io) June 26, 2020

Turns out @synthetix_io & @CurveFinance were ploughing the fields long before $COMP & $BAL came along.

Learn how to put your #crypto to work with this #yieldfarming 101 \U0001f4b8

\U0001f449 https://t.co/zYUKtqx3BK

4) Fair Launches ✅

Who needs investment when you can launch using yield farming?

@iearnfinance debuted $YFI with no formal funding, seeding a community treasury for self-sustainability.

The notion of a core team and community became one and the

2/ What is a Fair Launch?

— fair launch capital (@fairlaunchcap) August 26, 2020

A FL enables founders to bootstrap new crypto networks that are earned, owned, and governed by their community from the outset.

In this dynamic, everyone participates on equal footing\u2014there is no early access, pre-mine, or allocation of tokens.

Short version:

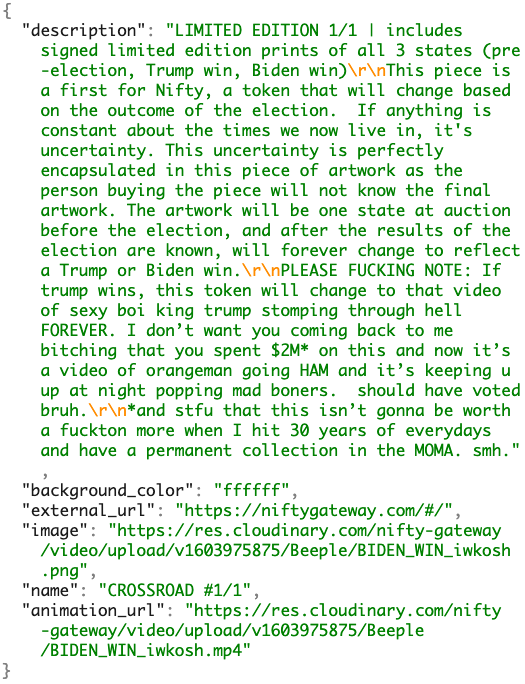

The NFT token you bought either points to a URL on the internet, or an IPFS hash. In most circumstances it references an IPFS gateway on the internet run by the startup you bought the NFT from.

Oh, and that URL is not the media. That URL is a JSON metadata file

Here's an example. This artwork is by Beeple and sold via Nifty:

https://t.co/TlJKH8kAew

The NFT token is for this JSON file hosted directly on Nifty's servers:

https://t.co/GQUaCnObvX

THAT file refers to the actual media you just "bought". Which in this case is hosted via a @cloudinary CDN, served by Nifty's servers again.

So if Nifty goes bust, your token is now worthless. It refers to nothing. This can't be changed.

"But you said some use IPFS!"

Let's look at the $65m Beeple, sold by Christies. Fancy.

https://t.co/1G9nCAdetk

That NFT token refers directly to an IPFS hash (https://t.co/QUdtdgtssH). We can take that IPFS hash and fetch the JSON metadata using a public gateway:

https://t.co/CoML7psBhF