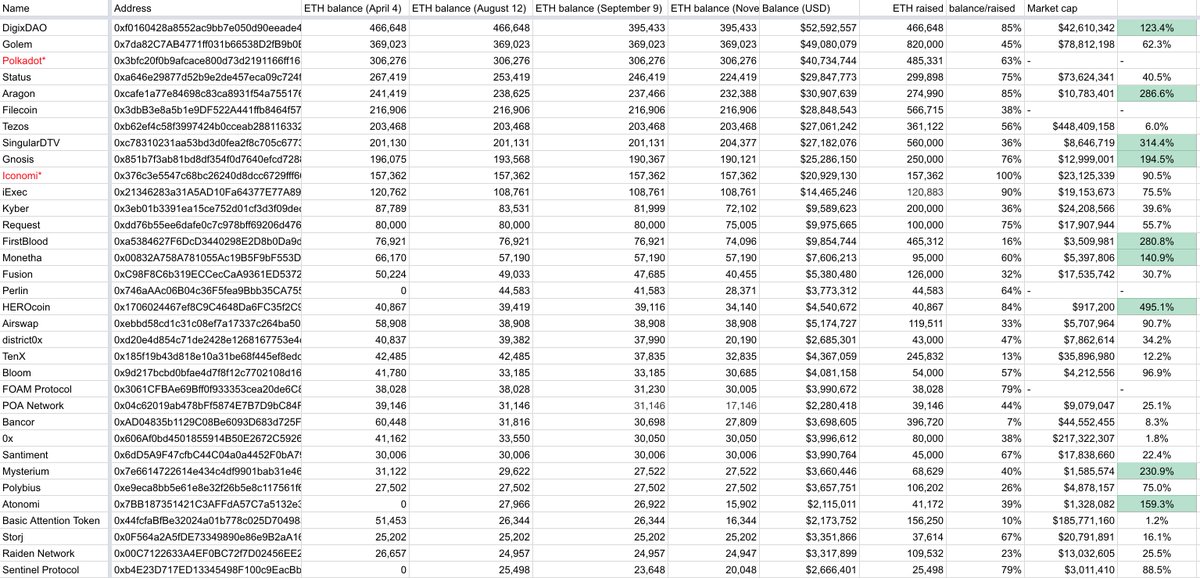

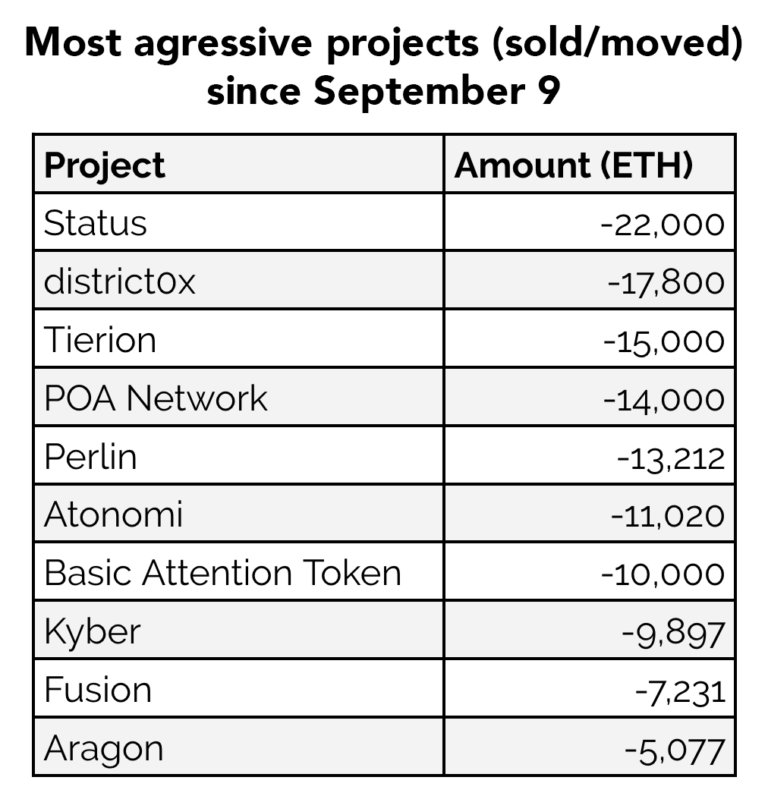

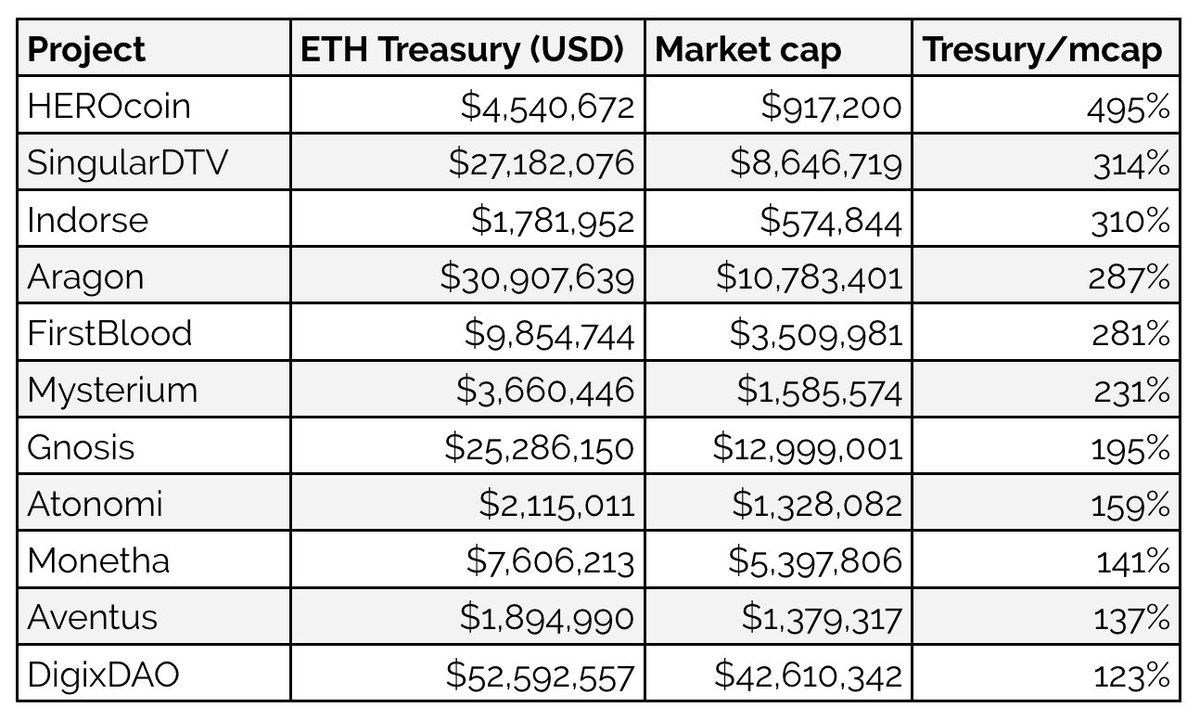

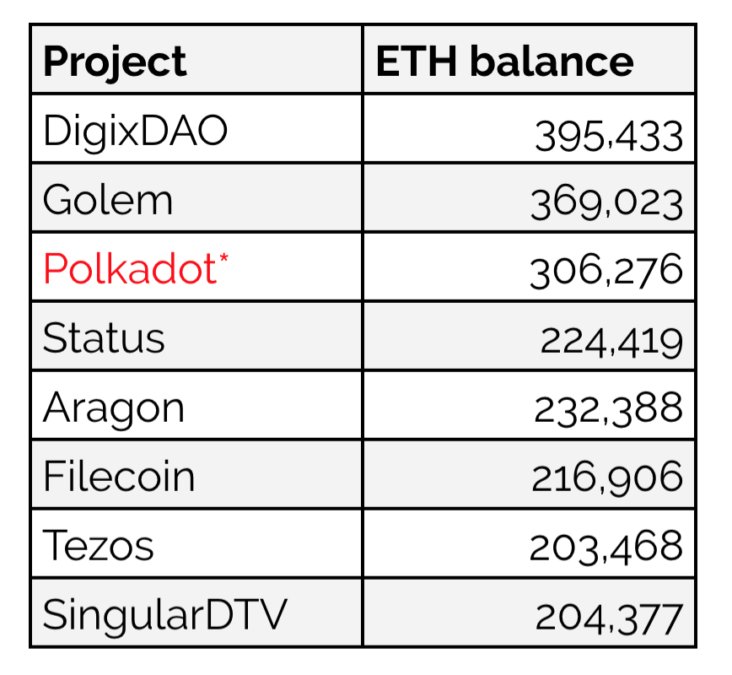

1/ ETH reached 18-month low today and there is this narrative that the price of is dropping because ICOs are liquidating their treasuries. Well, it’s completely wrong. Let’s look at the data!

https://t.co/yG0vecC7VT

More from Crypto

0/ The Great Crypto Reversal

Key difference between the '17 and roaring 20s in crypto is that back then everyone was aping a16z and Naval.

Today everyone apes 3AC wanting to be the next Degen.

'17 was an idealistic *saving the world* kind of thing

20s is *me against the world*

1/ The financialization of crypto means more volatility but pretty long ascend to the top.

Multi-year bull and an ATH surprising even to the biggest bulls as the infinite Cantillon "wealth" is pumped into crypto

Crypto becomes the ultimate Cantillon insider circle-jerk.

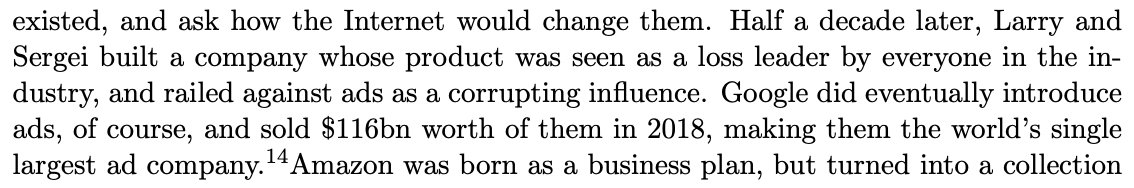

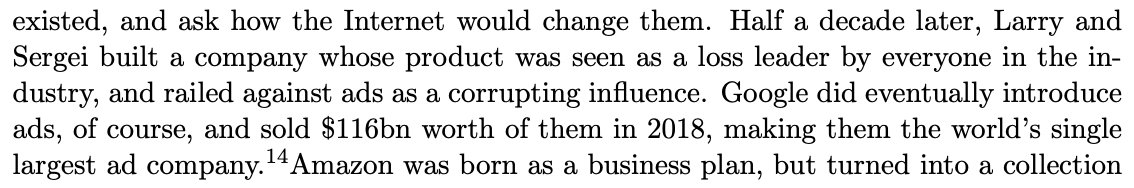

2/ This will be one the most iconic ideological reversals in history, comparable to Google who was firmly against advertising but turned into the most powerful ad company ever.

3/ This scenario reminds me of the 90s privatization period in the post-socialist countries.

The regime transition allowed the communist party elite to benefit from the wild west form of "capitalism" that ensued, transferring (and multiplying) their wealth into the new regime.

4/ We are far from Satoshi's original vision . But words and intentions of *prophets* were used to manipulate and corrupt all throughout human history and this time it is no

Key difference between the '17 and roaring 20s in crypto is that back then everyone was aping a16z and Naval.

Today everyone apes 3AC wanting to be the next Degen.

'17 was an idealistic *saving the world* kind of thing

20s is *me against the world*

1/ The financialization of crypto means more volatility but pretty long ascend to the top.

Multi-year bull and an ATH surprising even to the biggest bulls as the infinite Cantillon "wealth" is pumped into crypto

Crypto becomes the ultimate Cantillon insider circle-jerk.

2/ This will be one the most iconic ideological reversals in history, comparable to Google who was firmly against advertising but turned into the most powerful ad company ever.

3/ This scenario reminds me of the 90s privatization period in the post-socialist countries.

The regime transition allowed the communist party elite to benefit from the wild west form of "capitalism" that ensued, transferring (and multiplying) their wealth into the new regime.

4/ We are far from Satoshi's original vision . But words and intentions of *prophets* were used to manipulate and corrupt all throughout human history and this time it is no

At "forever" Cantillon insiders are infinitely wealthy. Everybody else lives in pods & eats what the livestock eats, or joins the harem or household staff of an infinitaire.

— Nick Szabo (@NickSzabo4) January 21, 2020

You May Also Like

Took me 5 years to get the best Chartink scanners for Stock Market, but you’ll get it in 5 mminutes here ⏰

Do Share the above tweet 👆

These are going to be very simple yet effective pure price action based scanners, no fancy indicators nothing - hope you liked it.

https://t.co/JU0MJIbpRV

52 Week High

One of the classic scanners very you will get strong stocks to Bet on.

https://t.co/V69th0jwBr

Hourly Breakout

This scanner will give you short term bet breakouts like hourly or 2Hr breakout

Volume shocker

Volume spurt in a stock with massive X times

Do Share the above tweet 👆

These are going to be very simple yet effective pure price action based scanners, no fancy indicators nothing - hope you liked it.

https://t.co/JU0MJIbpRV

52 Week High

One of the classic scanners very you will get strong stocks to Bet on.

https://t.co/V69th0jwBr

Hourly Breakout

This scanner will give you short term bet breakouts like hourly or 2Hr breakout

Volume shocker

Volume spurt in a stock with massive X times