Bitcoin recently hit $34,000 yesterday when as recent as October 10th, it was $11,000

Here’s some unsolicited advice: If you feel you have “bad luck” with investing; i.e. you feel that “if you buy Bitcoin today, the price of Bitcoin will drop”; don’t buy in.

Here’s why I say so

People that feel they have bad luck with investing often have 3 things in common:

1. Fear:

2. Because of

3. They make rash decisions: People that feel they have bad luck with investing are often those that make rash decisions with investing. The first decision of buying that asset/investment is the

They often don’t do research on the asset to understand how the asset works or what drives the asset. They often invest in things that are “popping” or doing well at a certain time.

They are often among the last people to jump on the

While Bitcoin’s bull run does not seem to have an end in sight, like all things that go up,

smaller folks hanging with the empty bag in their hands.

— Edna Jennifer (@JE_dna) December 17, 2020

Plus, who knows, the recent rise in price could be funded by some behind the scene actors looking to make a lot of profit and cash out.

If you MUST buy:

Don\u2019t throw all your money in at once. If you have 2,000 to invest,

More from Crypto

Share it with a friend who needs it!

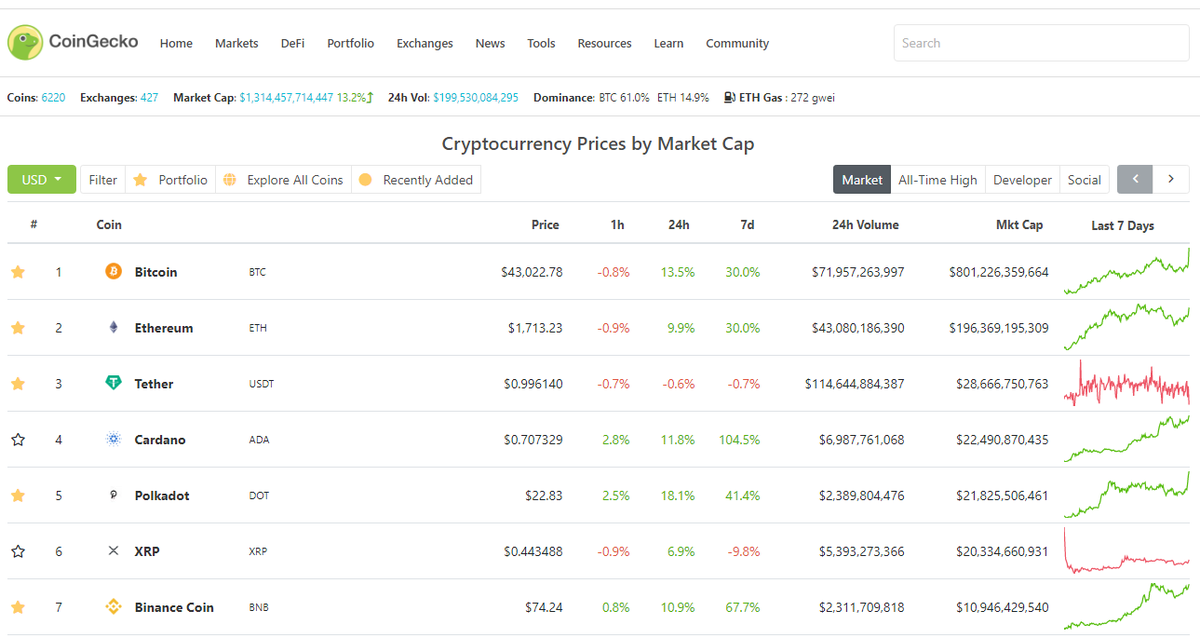

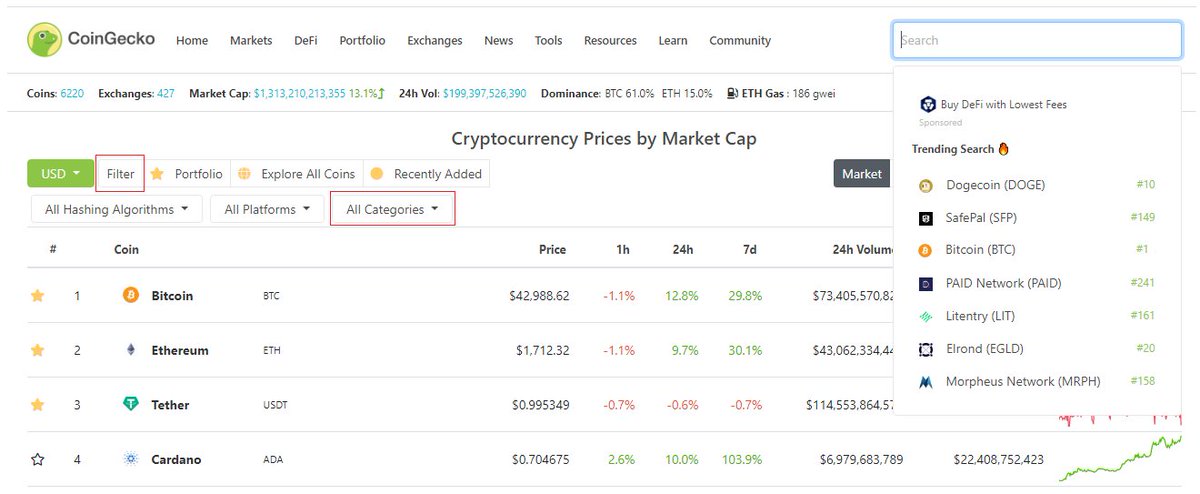

1/ Getting started with crypto and want to check prices/projects? https://t.co/LFnk4vukxj has info on just about every crypto you'll need :)

2/ Search over 6000+ cryptocurrencies available on the market. You can see what's trending in the space as well.

Researching by categories? Filter (left side) -> Select categories -> DeFi, DOT ecosystem, Exchange-based tokens, NFTs - anything!

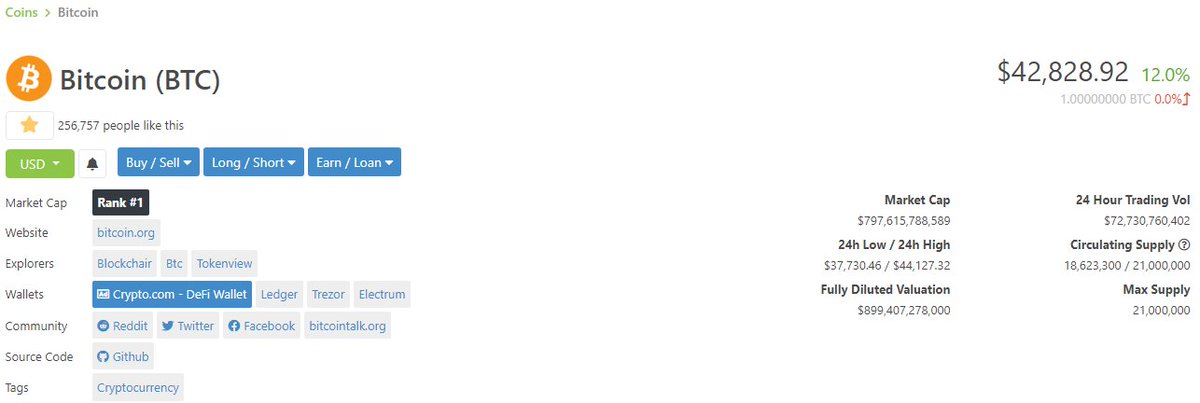

3/ Lets say you're looking at #Bitcoin https://t.co/g205lj03pG

At a glance you get:

- Price

- Mkt Capitalization (valuation)

- Circulating/Total supply

- 24h trading volume

- Links to websites, social media, block explorers

- Calculator

Next - check valuation?

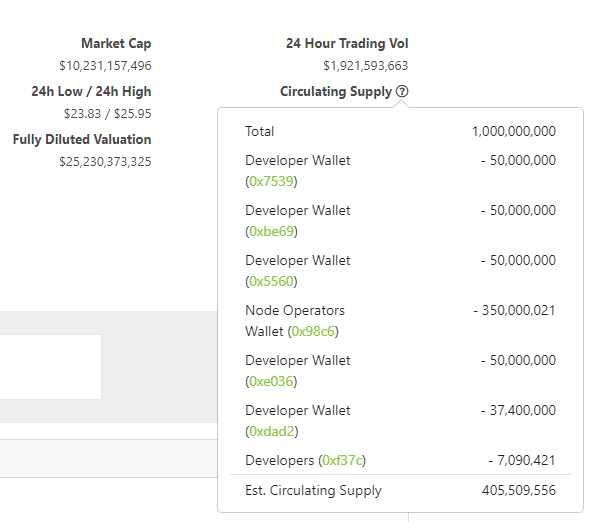

4/ Market cap is used to rank coins, and we'll show you how its calculated - Hover over Circulating Supply (?) for breakdown.

Note: used @chainlink as example here - https://t.co/Jc46fe79Ag

While MC is important also consider product fit, narrative, team, community etc.

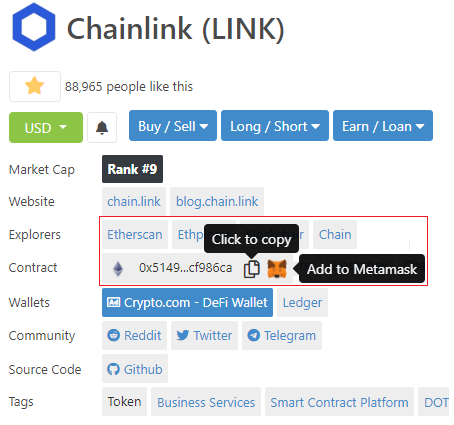

5/ If you're trading on AMMs like @Uniswap or @SushiSwap, you can copy the contract address directly to your clipboard.

Using @metamask_io? Add the token directly so it shows as one of the "Assets" that you own in the wallet.

See: https://t.co/94XihMf5oz

Introducing an effortless way to add tokens to your @metamask_io wallet \U0001f4e5

— CoinGecko (@coingecko) February 8, 2021

Skip the hassle of copying/pasting contract addresses to your wallet. Add an asset and it'll appear in your wallet with just a click - tap the \U0001f98a and try it out for yourself! pic.twitter.com/u26BA29ubs

Key difference between the '17 and roaring 20s in crypto is that back then everyone was aping a16z and Naval.

Today everyone apes 3AC wanting to be the next Degen.

'17 was an idealistic *saving the world* kind of thing

20s is *me against the world*

1/ The financialization of crypto means more volatility but pretty long ascend to the top.

Multi-year bull and an ATH surprising even to the biggest bulls as the infinite Cantillon "wealth" is pumped into crypto

Crypto becomes the ultimate Cantillon insider circle-jerk.

2/ This will be one the most iconic ideological reversals in history, comparable to Google who was firmly against advertising but turned into the most powerful ad company ever.

3/ This scenario reminds me of the 90s privatization period in the post-socialist countries.

The regime transition allowed the communist party elite to benefit from the wild west form of "capitalism" that ensued, transferring (and multiplying) their wealth into the new regime.

4/ We are far from Satoshi's original vision . But words and intentions of *prophets* were used to manipulate and corrupt all throughout human history and this time it is no

At "forever" Cantillon insiders are infinitely wealthy. Everybody else lives in pods & eats what the livestock eats, or joins the harem or household staff of an infinitaire.

— Nick Szabo (@NickSzabo4) January 21, 2020

To make this transition easy & understandable for everyone, we are answering most frequently asked questions here.

Ready? Go! 🔥

1/24

#DeFi #YieldFarming

Q1 - What are the benefits of holding the $VALUE token on the Ethereum Mainnet network? Give me reasons not to sell. Some are assuming that the VALUE token will be abandoned now that vBSWAP is being created. Can you clarify the use case for VALUE?

👉 $VALUE will always be a governance & profit receiving token of the whole ecosystem if staked in #vGov. With the new farming token on #BSC , gvVALUE holders will get extra rewards at BSC if they choose to bridge their gvVALUE to BSC & stake in gvVALUE-B/BUSD 98/2 pool.

Q2 - What do I need to do with my VALUE tokens that are staked in vGov? Is it OK to leave them in the vGov?

👉If you have VALUE but aren't staking in the vGov & you would like to participate in the BSC expansion, you will need to stake your VALUE in the vGov to receive gvVALUE.

If you are staking in vGov but don't see the correct gvVALUE amount in your wallet, go to vGov (https://t.co/udXn5IJtVx) to unlock your gvVALUE from the old contract. There will be a bridge from ETH to BSC to move gvVALUE and vUSD over.

You May Also Like

BREAKING: President Donald Trump has submitted his answers to questions from special counsel Robert Mueller

— Ryan Saavedra (@RealSaavedra) November 20, 2018

Mueller's officially end his investigation all on his own and he's gonna say he found no evidence of Trump campaign/Russian collusion during the 2016 election.

Democrats & DNC Media are going to LITERALLY have nothing coherent to say in response to that.

Mueller's team was 100% partisan.

That's why it's brilliant. NOBODY will be able to claim this team of partisan Democrats didn't go the EXTRA 20 MILES looking for ANY evidence they could find of Trump campaign/Russian collusion during the 2016 election

They looked high.

They looked low.

They looked underneath every rock, behind every tree, into every bush.

And they found...NOTHING.

Those saying Mueller will file obstruction charges against Trump: laughable.

What documents did Trump tell the Mueller team it couldn't have? What witnesses were withheld and never interviewed?

THERE WEREN'T ANY.

Mueller got full 100% cooperation as the record will show.