I write about something disappointing and sad that has happened to one of my friends.

1) Hello friends, how are you? My feed is a bullish sea. It's a festive time of year. Crypto has entered a bull market and people are making money left and right.

But what I'm writing about is not pleasant.

I write about something disappointing and sad that has happened to one of my friends.

https://t.co/Tf5vMEBXzD

https://t.co/MmSvGTeORQ

https://t.co/MTvhLXFXCd

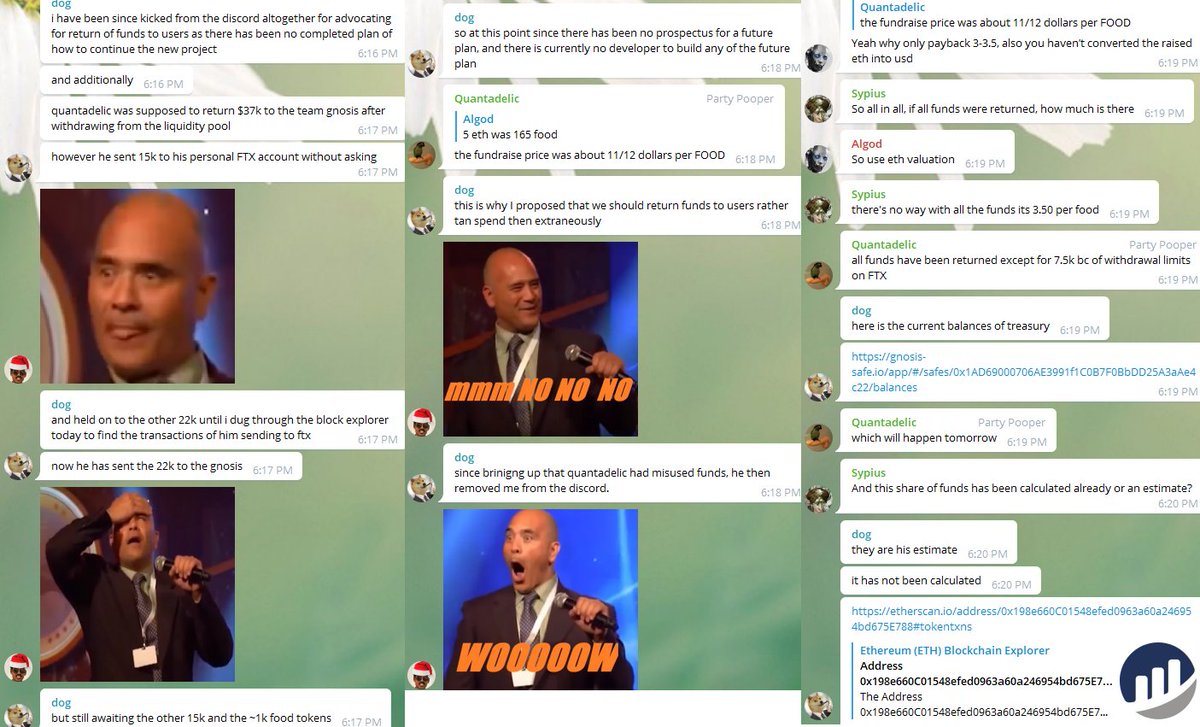

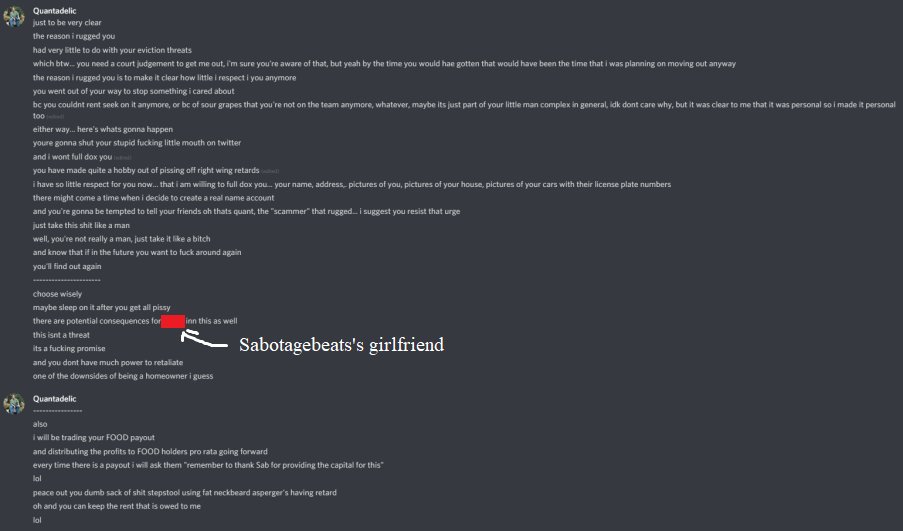

Sabotagebeats brought this to attention in the multisig channel which I was still privy to. The next day, Quantadelic returned, responded, and changed the multisig channel to read-only. Sabotage was banned from Discord.

Context was not provided. Up to this point project discussions and decision-making had largely taken place in private channels.

Wallet with unmoved USDT: https://t.co/v3ZgxEDDdQ

To be clear, the eviction notice issued by sabotagebeats was due to Quantadelic's failure to fulfill his duties as a tenant.

I am disappointed and saddened that this has happened to a friend of mine, and that the project has been such a failure.

Any contributions to the hardwood cockfund from now until February 1, 2021 will be donated to sabotagebeats.

More from Crypto

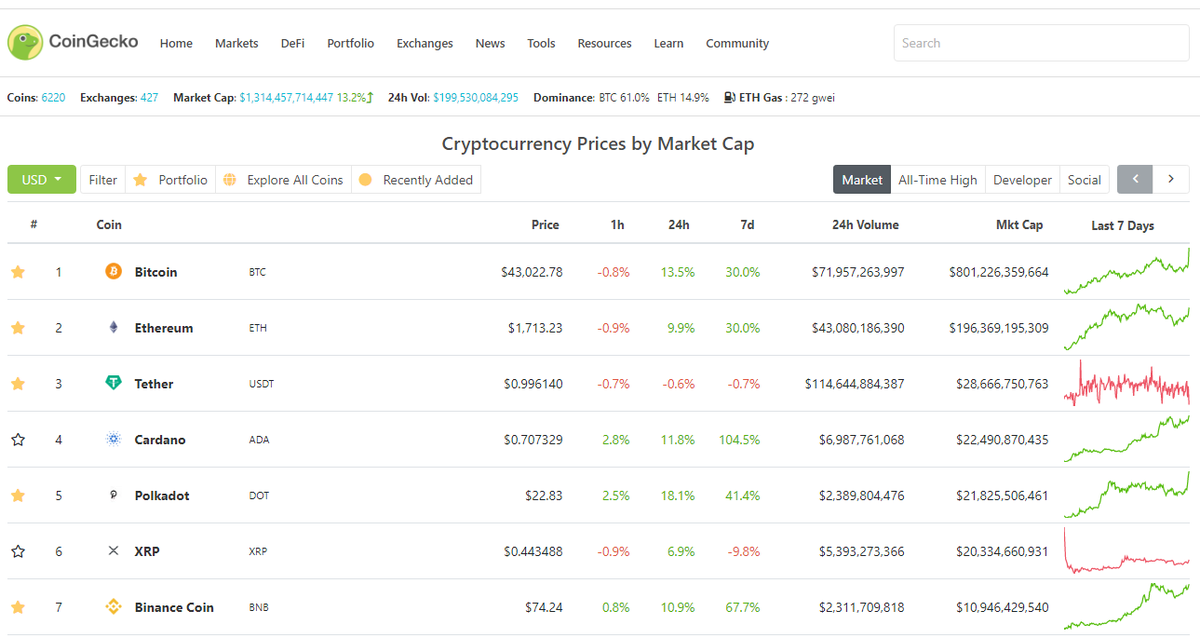

A primer on how to use @coingecko for your crypto data/research/trading needs.

Share it with a friend who needs it!

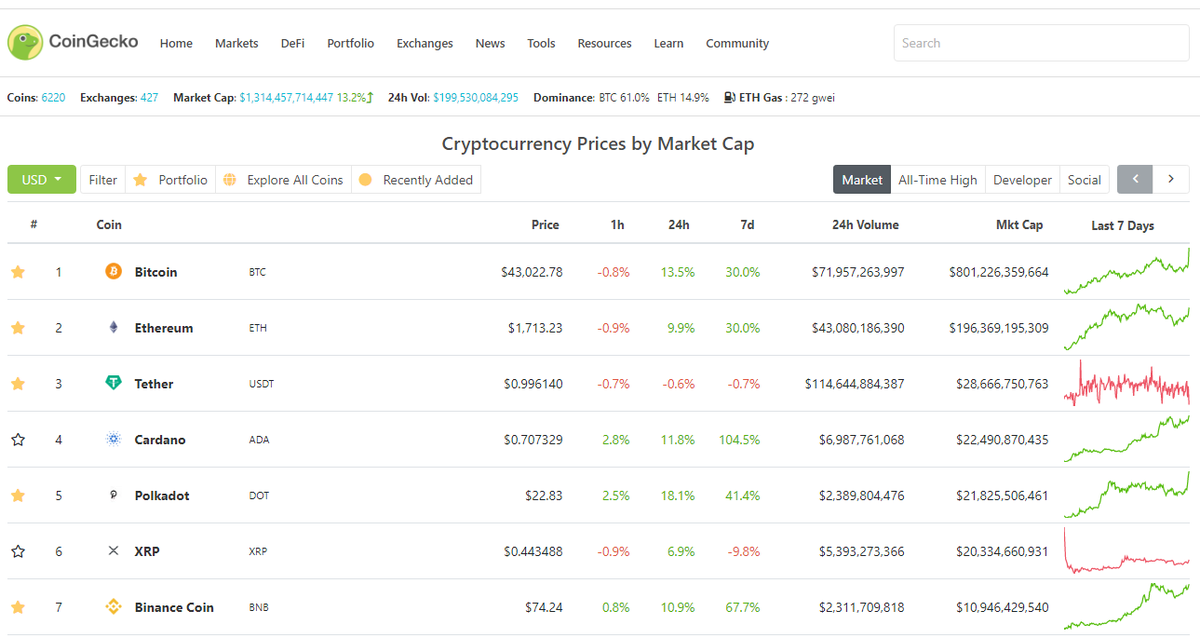

1/ Getting started with crypto and want to check prices/projects? https://t.co/LFnk4vukxj has info on just about every crypto you'll need :)

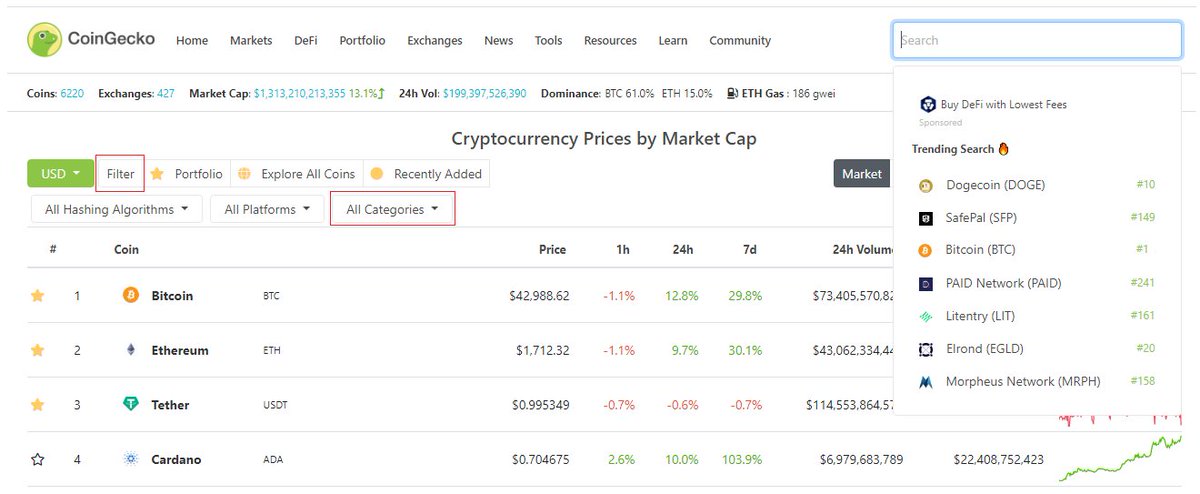

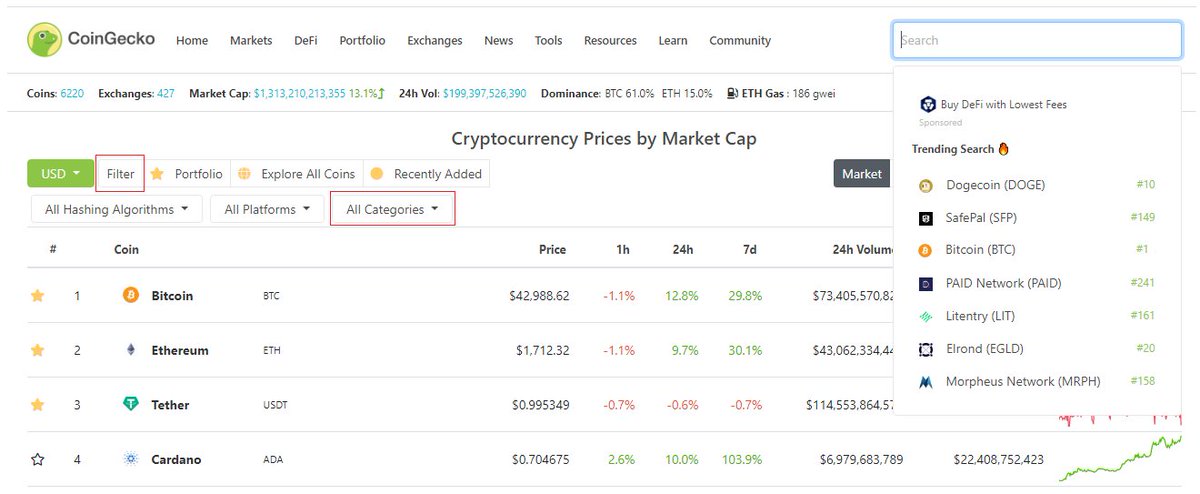

2/ Search over 6000+ cryptocurrencies available on the market. You can see what's trending in the space as well.

Researching by categories? Filter (left side) -> Select categories -> DeFi, DOT ecosystem, Exchange-based tokens, NFTs - anything!

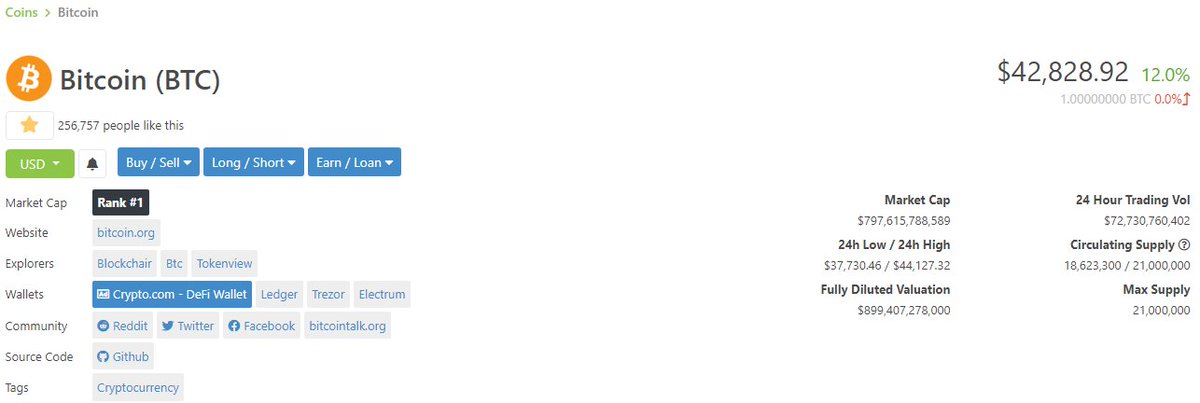

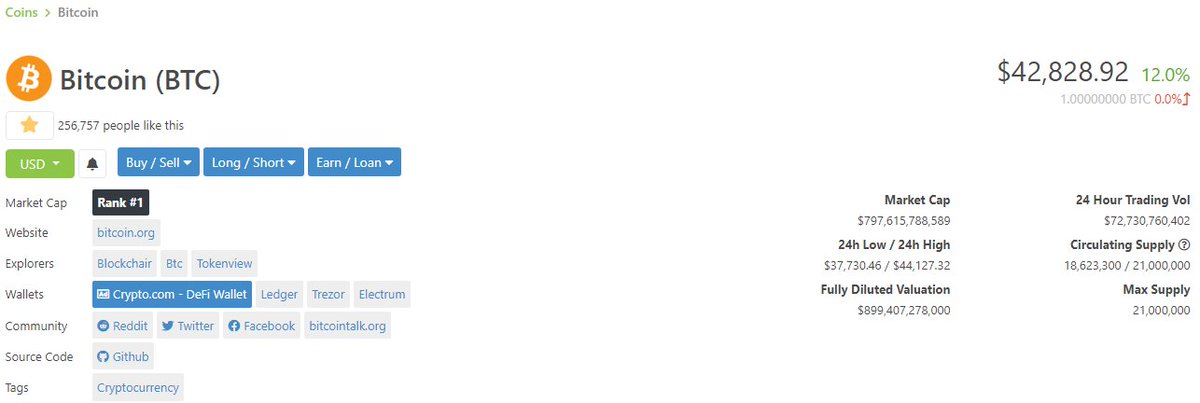

3/ Lets say you're looking at #Bitcoin https://t.co/g205lj03pG

At a glance you get:

- Price

- Mkt Capitalization (valuation)

- Circulating/Total supply

- 24h trading volume

- Links to websites, social media, block explorers

- Calculator

Next - check valuation?

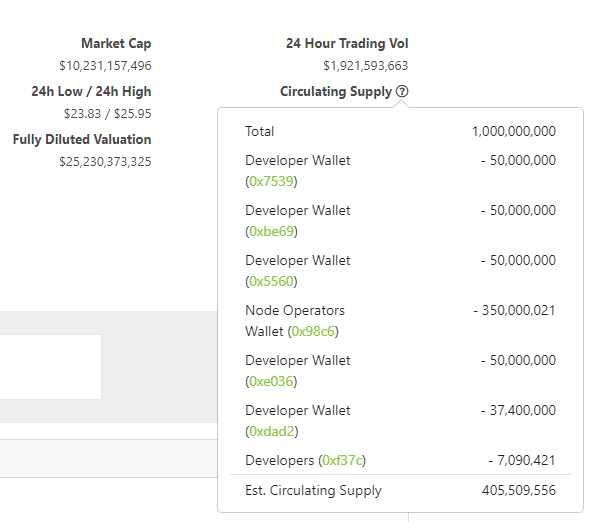

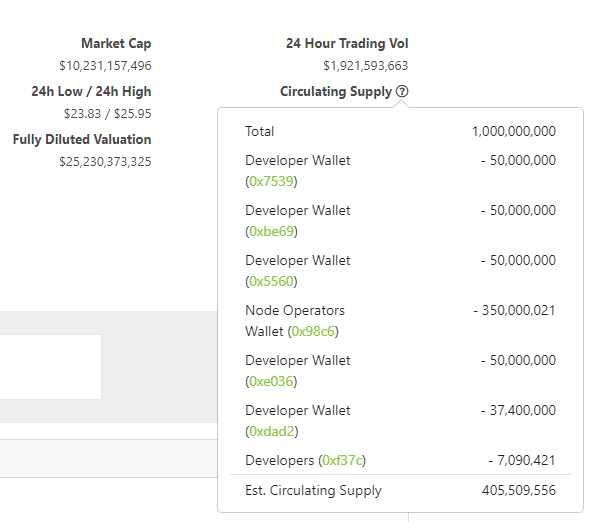

4/ Market cap is used to rank coins, and we'll show you how its calculated - Hover over Circulating Supply (?) for breakdown.

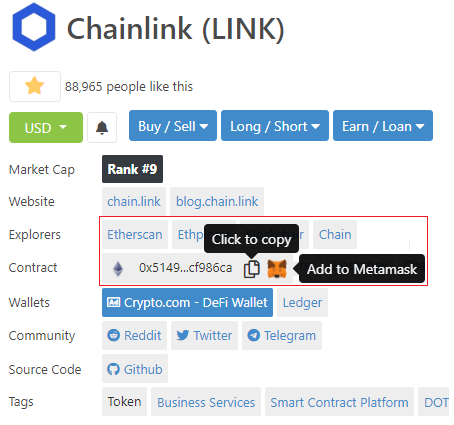

Note: used @chainlink as example here - https://t.co/Jc46fe79Ag

While MC is important also consider product fit, narrative, team, community etc.

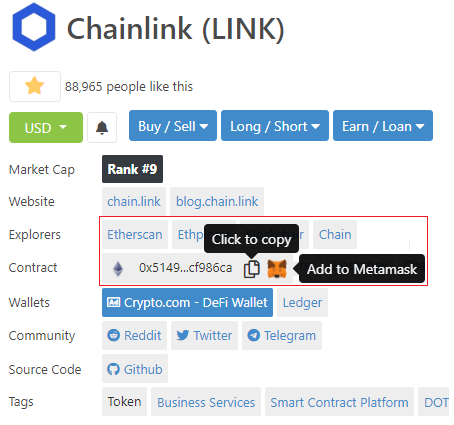

5/ If you're trading on AMMs like @Uniswap or @SushiSwap, you can copy the contract address directly to your clipboard.

Using @metamask_io? Add the token directly so it shows as one of the "Assets" that you own in the wallet.

See: https://t.co/94XihMf5oz

Share it with a friend who needs it!

1/ Getting started with crypto and want to check prices/projects? https://t.co/LFnk4vukxj has info on just about every crypto you'll need :)

2/ Search over 6000+ cryptocurrencies available on the market. You can see what's trending in the space as well.

Researching by categories? Filter (left side) -> Select categories -> DeFi, DOT ecosystem, Exchange-based tokens, NFTs - anything!

3/ Lets say you're looking at #Bitcoin https://t.co/g205lj03pG

At a glance you get:

- Price

- Mkt Capitalization (valuation)

- Circulating/Total supply

- 24h trading volume

- Links to websites, social media, block explorers

- Calculator

Next - check valuation?

4/ Market cap is used to rank coins, and we'll show you how its calculated - Hover over Circulating Supply (?) for breakdown.

Note: used @chainlink as example here - https://t.co/Jc46fe79Ag

While MC is important also consider product fit, narrative, team, community etc.

5/ If you're trading on AMMs like @Uniswap or @SushiSwap, you can copy the contract address directly to your clipboard.

Using @metamask_io? Add the token directly so it shows as one of the "Assets" that you own in the wallet.

See: https://t.co/94XihMf5oz

Introducing an effortless way to add tokens to your @metamask_io wallet \U0001f4e5

— CoinGecko (@coingecko) February 8, 2021

Skip the hassle of copying/pasting contract addresses to your wallet. Add an asset and it'll appear in your wallet with just a click - tap the \U0001f98a and try it out for yourself! pic.twitter.com/u26BA29ubs

1/ Welcome to #DeFi Wednesday.

Let's talk about how interest-bearing cash on a blockchain is going to revolutionise boring corporate treasury management that concerns every company is is a larger business than all crypto trading in the world.

Enter the thread

👇👇👇

2/ Blockchain community is often seen as toxic maxis and redditors who shill other their weekly favourite shitcoin in the hope of getting Lambo.

Sometimes we also do things that progress humanity towards the better future and interest-bearing cash is one of those things.

3/ Less chad and more things that actually matter:

My incomplete theory of interest-bearing cash is also available also as a blog post:

https://t.co/uiG0fZiVyu

It is 15 pages. Pick your slow poison or die fast by continue reading here.

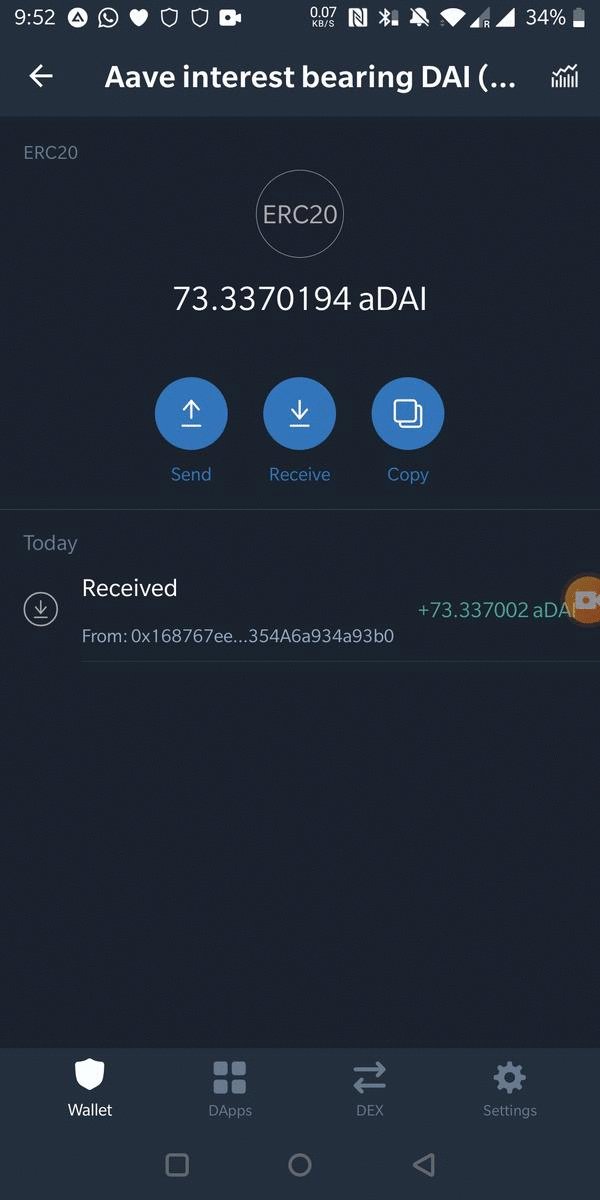

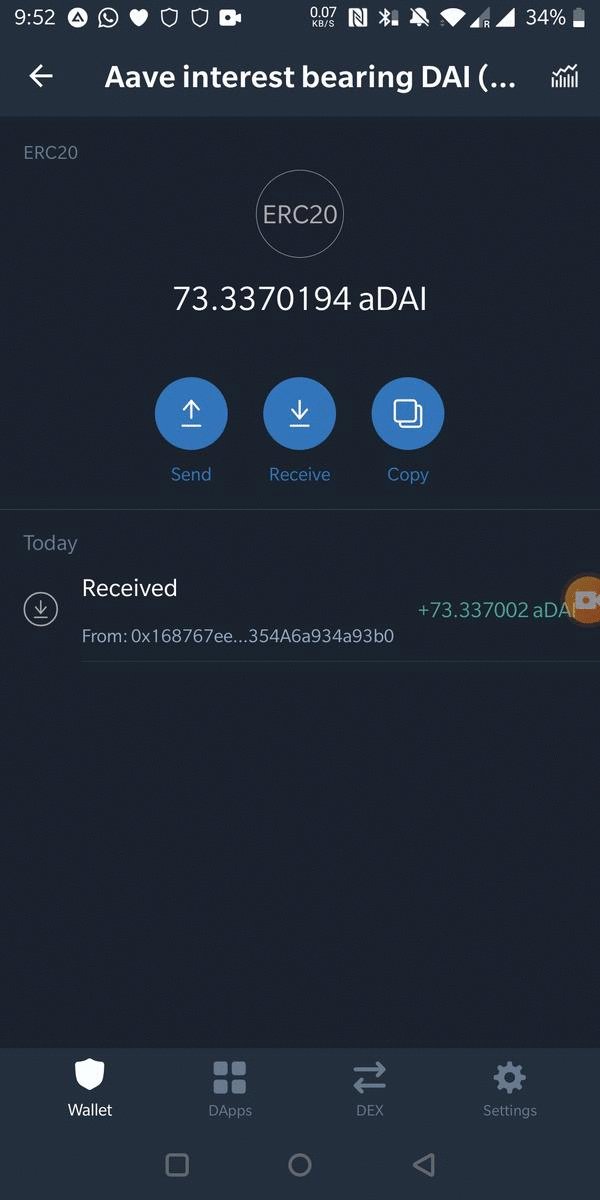

4/ First time in the history we have an ability to create interest-bearing cash-like instruments.

Interest-bearing cash ticks up dollar (euro) balance real-time in your wallet.

Here is a demonstration using @aaveaave aDAI, based on @makerdao DAI, and @TrustWalletApp

5/ Interest-bearing cash is not like your bank's saving account. Your money in a bank is not yours, but bank's. There are some flaws in the current banking system causing a headache for Chief Financial Officers (CFOs)

Let's talk about how interest-bearing cash on a blockchain is going to revolutionise boring corporate treasury management that concerns every company is is a larger business than all crypto trading in the world.

Enter the thread

👇👇👇

2/ Blockchain community is often seen as toxic maxis and redditors who shill other their weekly favourite shitcoin in the hope of getting Lambo.

Sometimes we also do things that progress humanity towards the better future and interest-bearing cash is one of those things.

3/ Less chad and more things that actually matter:

My incomplete theory of interest-bearing cash is also available also as a blog post:

https://t.co/uiG0fZiVyu

It is 15 pages. Pick your slow poison or die fast by continue reading here.

4/ First time in the history we have an ability to create interest-bearing cash-like instruments.

Interest-bearing cash ticks up dollar (euro) balance real-time in your wallet.

Here is a demonstration using @aaveaave aDAI, based on @makerdao DAI, and @TrustWalletApp

5/ Interest-bearing cash is not like your bank's saving account. Your money in a bank is not yours, but bank's. There are some flaws in the current banking system causing a headache for Chief Financial Officers (CFOs)

You May Also Like

**Thread on Bravery of Sikhs**

(I am forced to do this due to continuous hounding of Sikh Extremists since yesterday)

Rani Jindan Kaur, wife of Maharaja Ranjit Singh had illegitimate relations with Lal Singh (PM of Ranjit Singh). Along with Lal Singh, she attacked Jammu, burnt - https://t.co/EfjAq59AyI

Hindu villages of Jasrota, caused rebellion in Jammu, attacked Kishtwar.

Ancestors of Raja Ranjit Singh, The Sansi Tribe used to give daughters as concubines to Jahangir.

The Ludhiana Political Agency (Later NW Fronties Prov) was formed by less than 4000 British soldiers who advanced from Delhi and reached Ludhiana, receiving submissions of all sikh chiefs along the way. The submission of the troops of Raja of Lahore (Ranjit Singh) at Ambala.

Dabistan a contemporary book on Sikh History tells us that Guru Hargobind broke Naina devi Idol Same source describes Guru Hargobind serving a eunuch

YarKhan. (ref was proudly shared by a sikh on twitter)

Gobind Singh followed Bahadur Shah to Deccan to fight for him.

In Zafarnama, Guru Gobind Singh states that the reason he was in conflict with the Hill Rajas was that while they were worshiping idols, while he was an idol-breaker.

And idiot Hindus place him along Maharana, Prithviraj and Shivaji as saviours of Dharma.

(I am forced to do this due to continuous hounding of Sikh Extremists since yesterday)

Rani Jindan Kaur, wife of Maharaja Ranjit Singh had illegitimate relations with Lal Singh (PM of Ranjit Singh). Along with Lal Singh, she attacked Jammu, burnt - https://t.co/EfjAq59AyI

Tomorrow again same thing happens bcoz fudus like you are creating a narrative oh Khalistan. when farmers are asking MSP. (RSS ki tatti khane wale Kerni sena ke kutte).

— Ancient Economist (@_stock_tips) December 5, 2020

U kill sikhs in 1984 just politics. To BC low IQ fudu Saale entire history was politics.

Hindu villages of Jasrota, caused rebellion in Jammu, attacked Kishtwar.

Ancestors of Raja Ranjit Singh, The Sansi Tribe used to give daughters as concubines to Jahangir.

The Ludhiana Political Agency (Later NW Fronties Prov) was formed by less than 4000 British soldiers who advanced from Delhi and reached Ludhiana, receiving submissions of all sikh chiefs along the way. The submission of the troops of Raja of Lahore (Ranjit Singh) at Ambala.

Dabistan a contemporary book on Sikh History tells us that Guru Hargobind broke Naina devi Idol Same source describes Guru Hargobind serving a eunuch

YarKhan. (ref was proudly shared by a sikh on twitter)

Gobind Singh followed Bahadur Shah to Deccan to fight for him.

In Zafarnama, Guru Gobind Singh states that the reason he was in conflict with the Hill Rajas was that while they were worshiping idols, while he was an idol-breaker.

And idiot Hindus place him along Maharana, Prithviraj and Shivaji as saviours of Dharma.