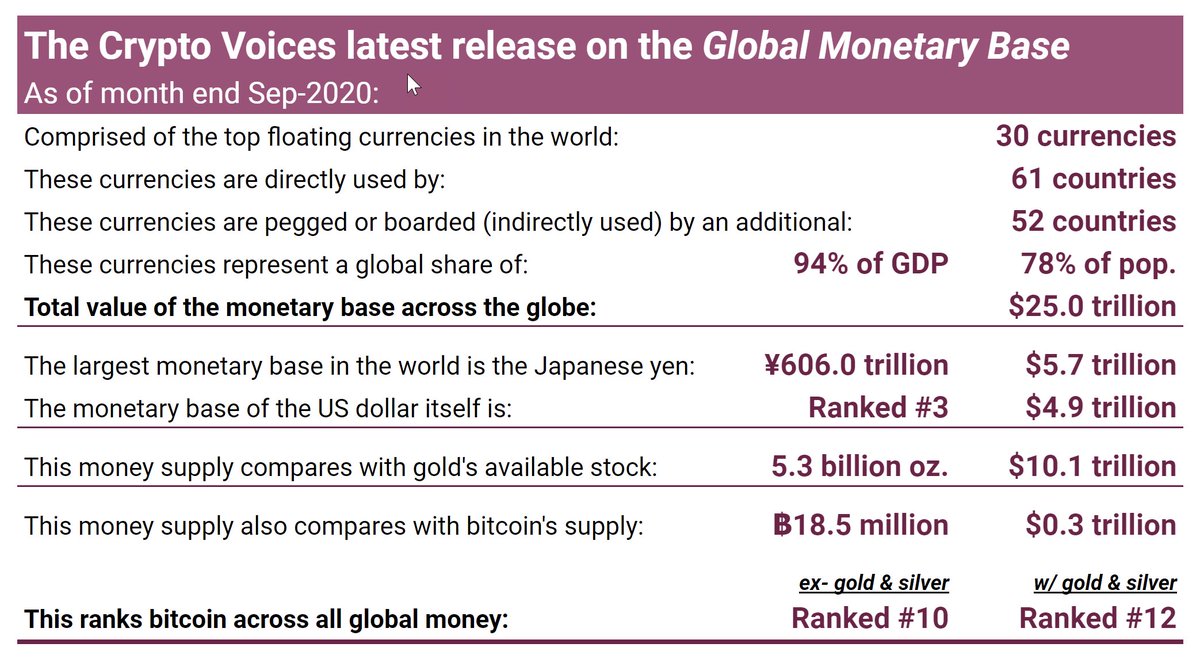

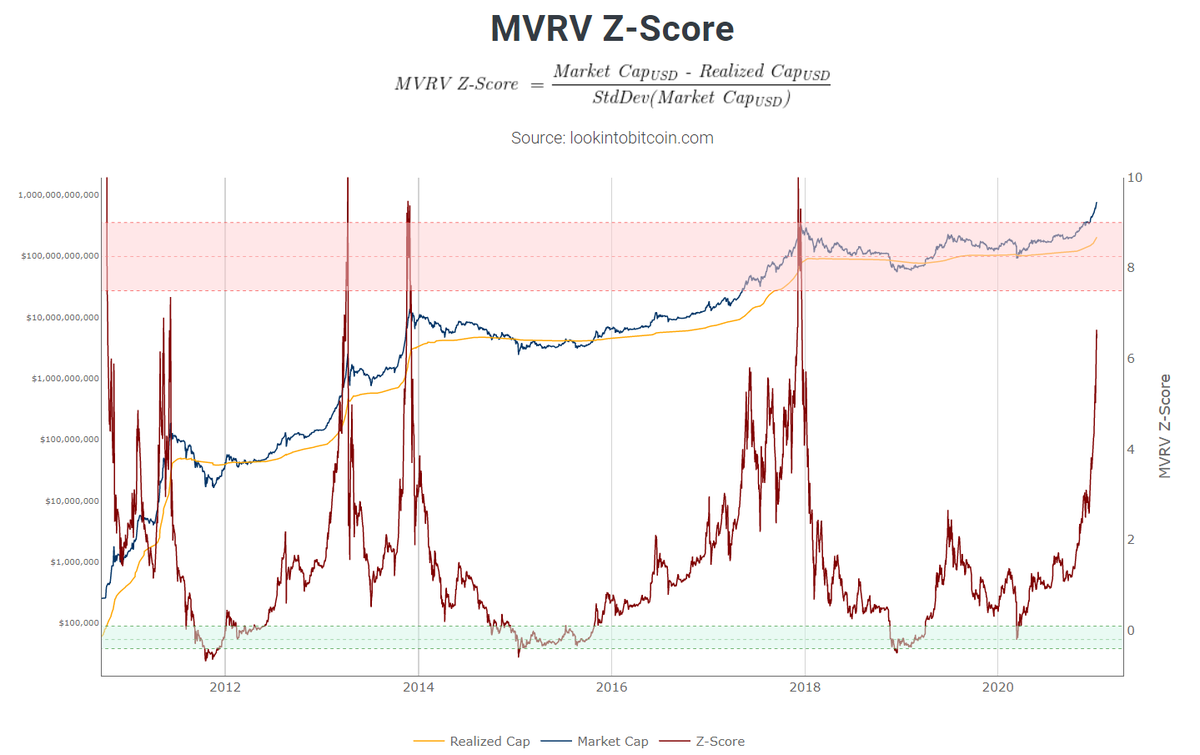

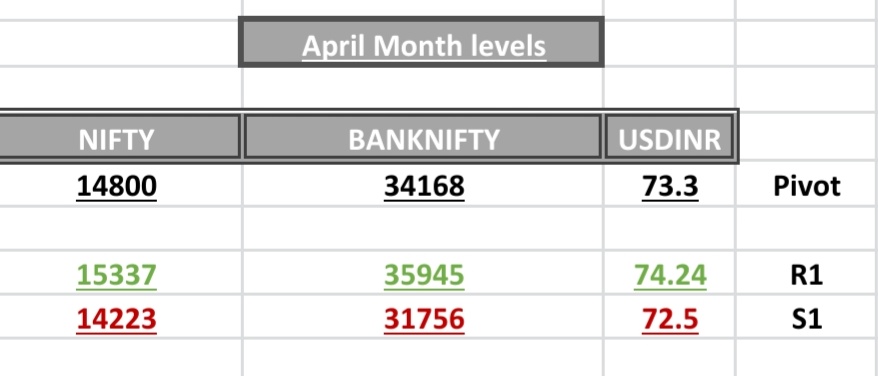

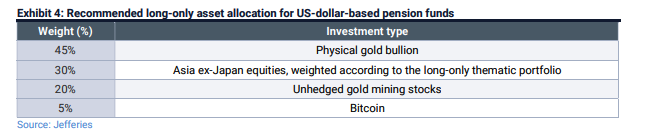

0/ It's been a big 2 weeks for $BTC as it hits a new ATH, $MSTR completes a $650M convert, Mass Mutual invests $100M, Ruffer Management buys $745M, Jeffries recommends a 5% allocation, Guggenheim's CIO gives a $400K PT, OneRiver, FinCen rules better than feared & Coinbase S1

"We see this BTC investment as a small but potent insurance policy against the continuing devaluation of the world’s major currencies,”

"Bitcoin has a lot of the attributes of gold and at the same time has an unusual value in terms of transactions," Minerd told Bloomberg TV.

More from Crypto

You May Also Like

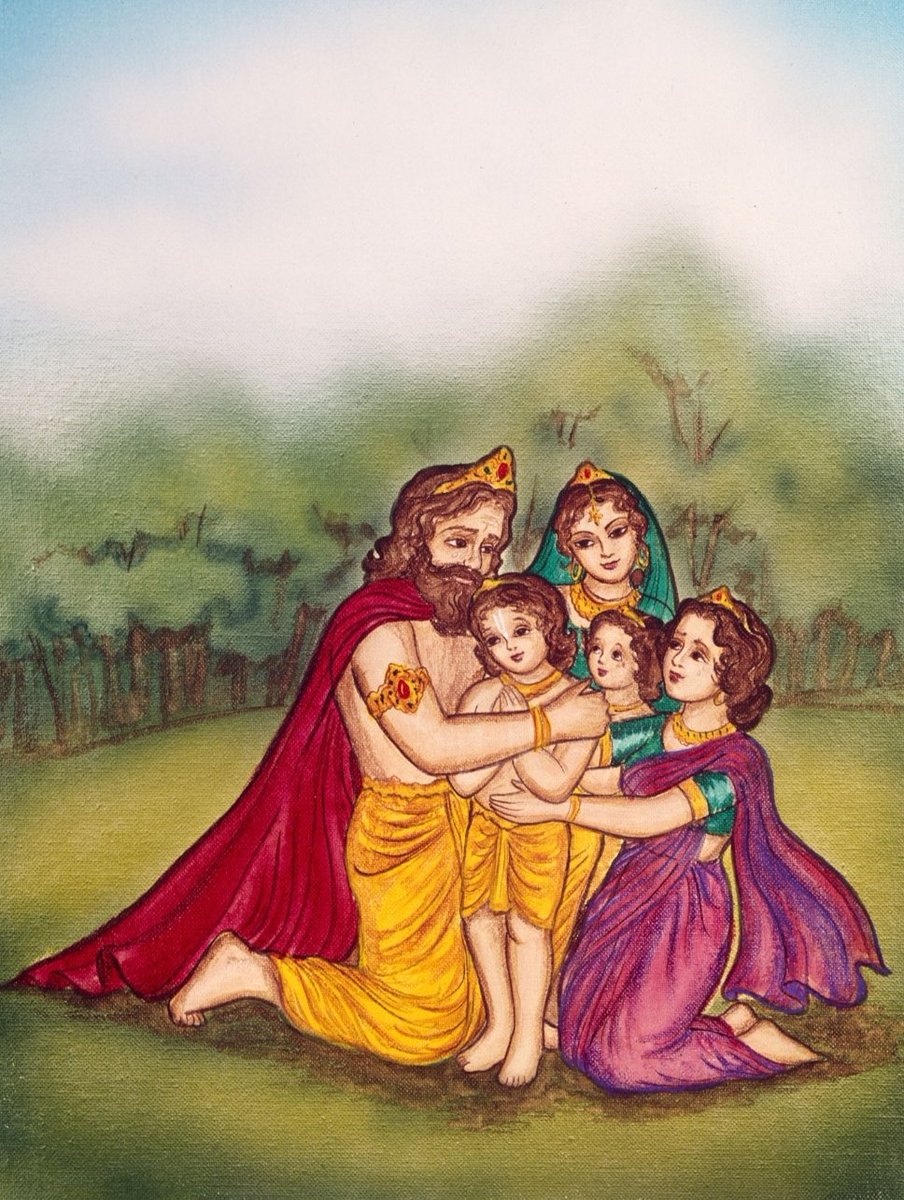

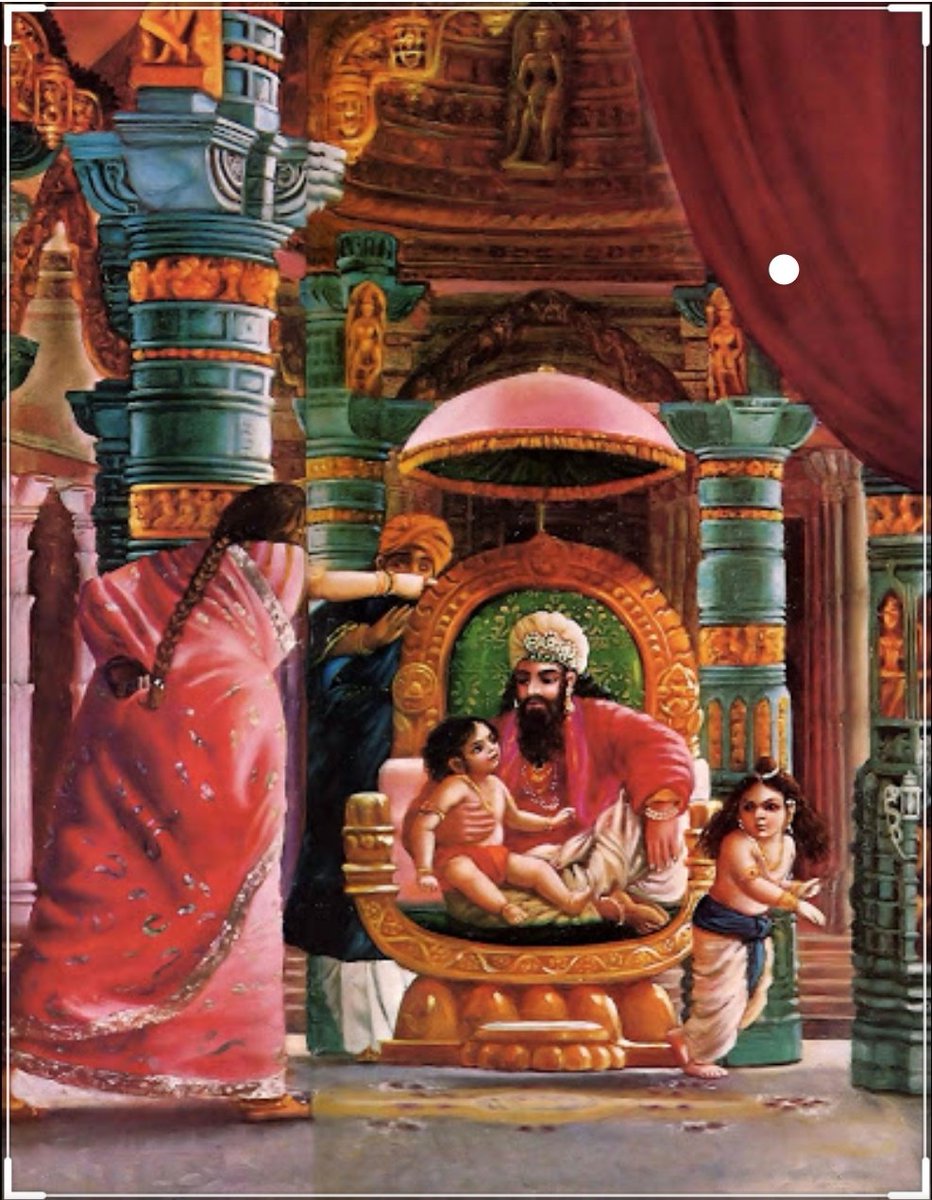

🌿𝑻𝒉𝒆 𝒔𝒕𝒐𝒓𝒚 𝒐𝒇 𝒂 𝑺𝒕𝒂𝒓 : 𝑫𝒉𝒓𝒖𝒗𝒂 & 𝑽𝒊𝒔𝒉𝒏𝒖

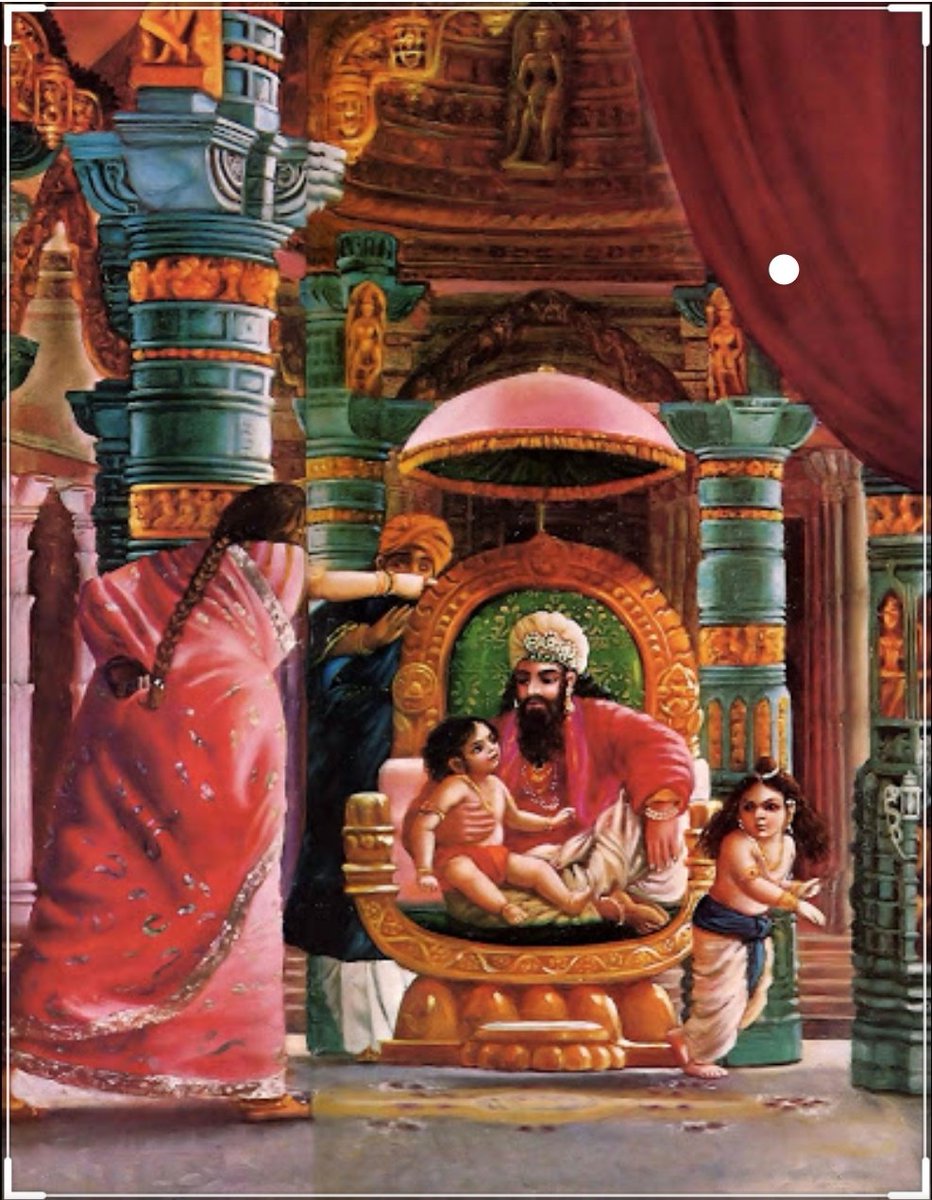

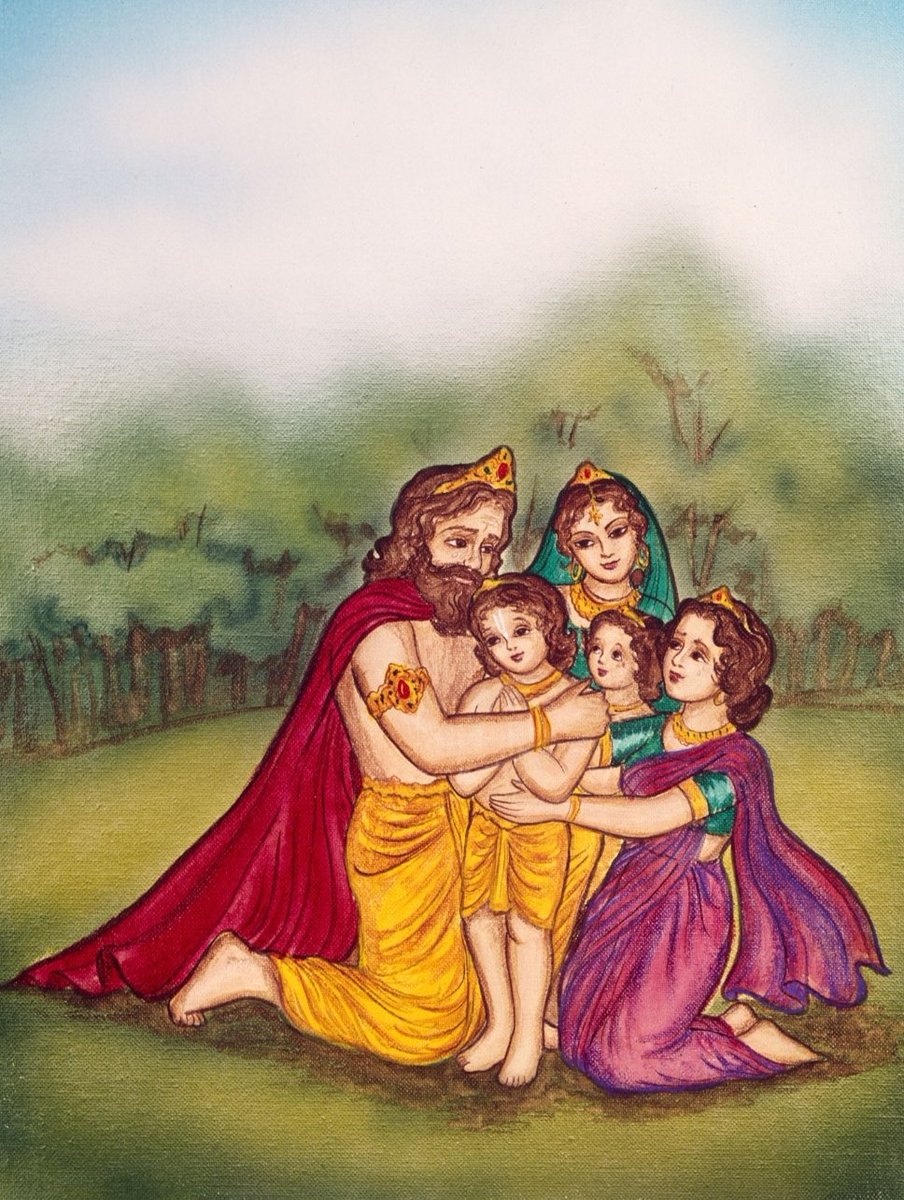

Once upon a time there was a Raja named Uttānapāda born of Svayambhuva Manu,1st man on earth.He had 2 beautiful wives - Suniti & Suruchi & two sons were born of them Dhruva & Uttama respectively.

#talesofkrishna https://t.co/E85MTPkF9W

Now Suniti was the daughter of a tribal chief while Suruchi was the daughter of a rich king. Hence Suruchi was always favored the most by Raja while Suniti was ignored. But while Suniti was gentle & kind hearted by nature Suruchi was venomous inside.

#KrishnaLeela

The story is of a time when ideally the eldest son of the king becomes the heir to the throne. Hence the sinhasan of the Raja belonged to Dhruva.This is why Suruchi who was the 2nd wife nourished poison in her heart for Dhruva as she knew her son will never get the throne.

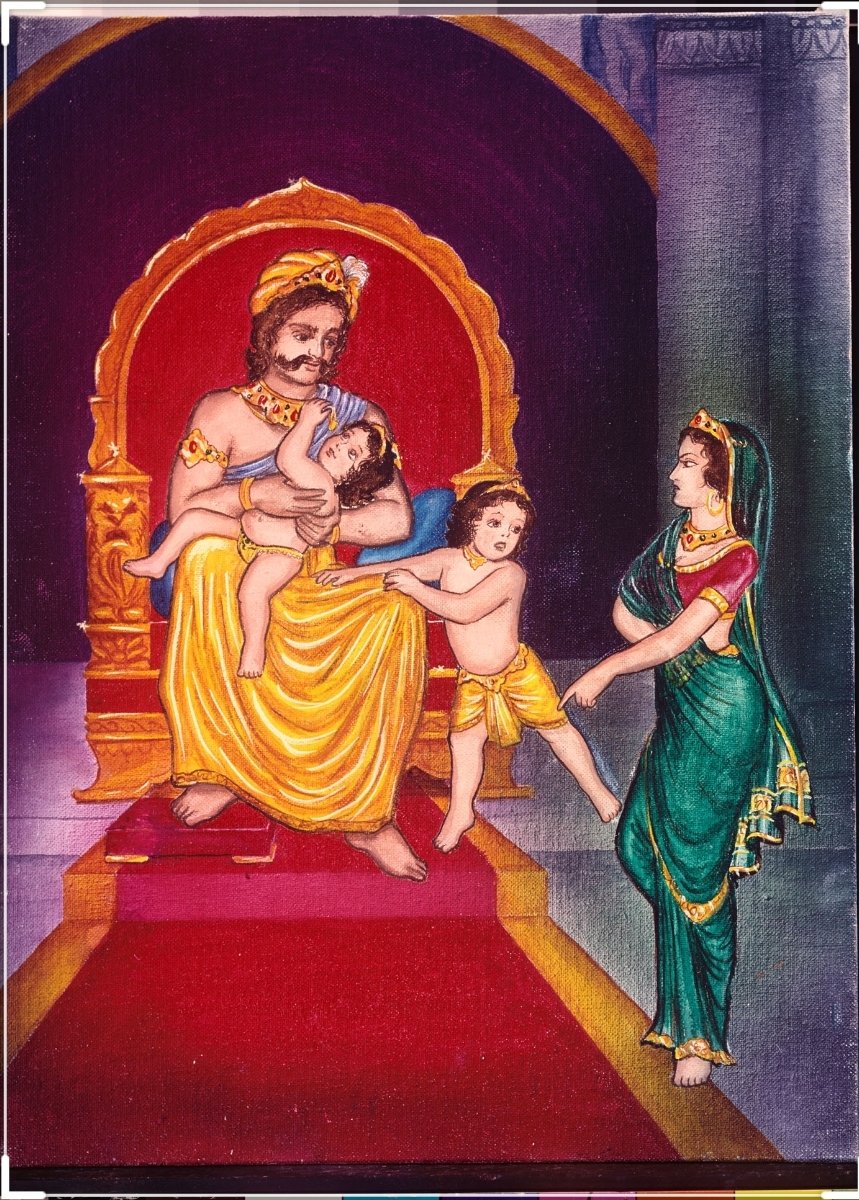

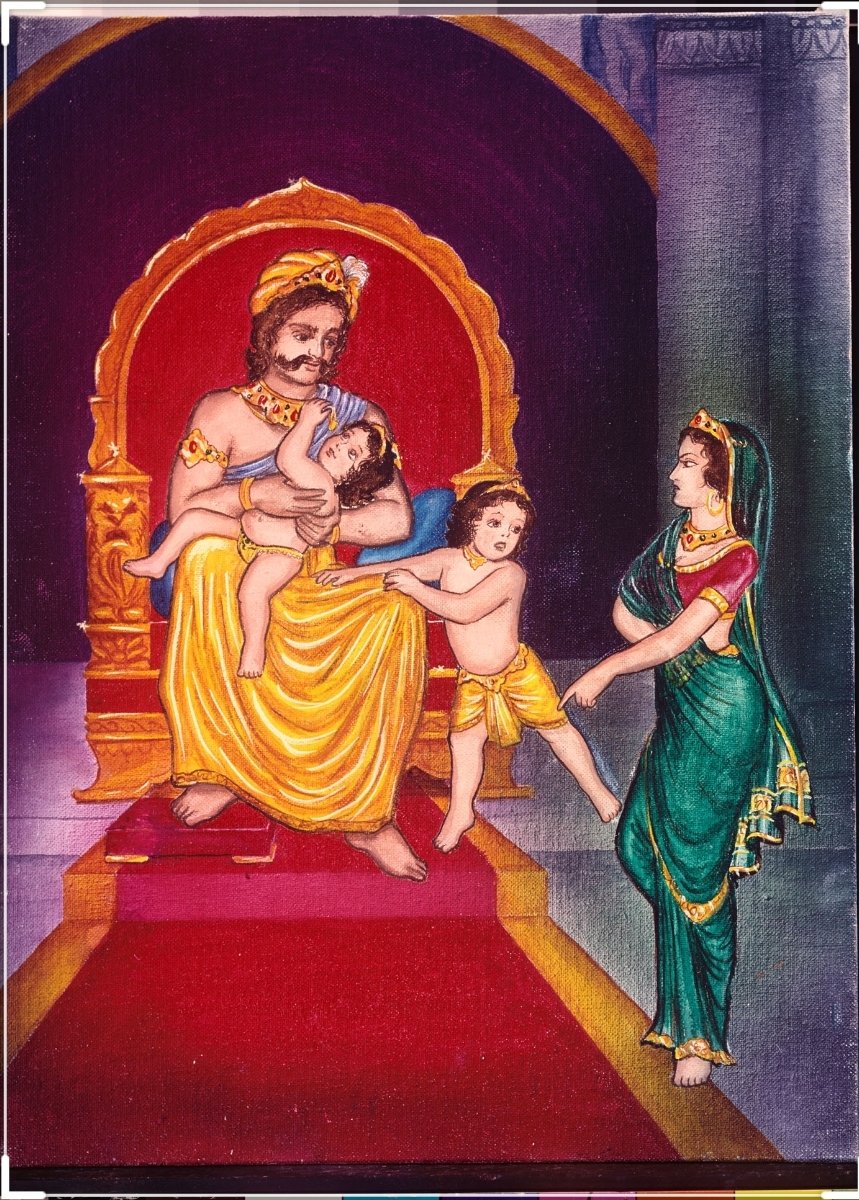

One day when Dhruva was just 5 years old he went on to sit on his father's lap. Suruchi, the jealous queen, got enraged and shoved him away from Raja as she never wanted Raja to shower Dhruva with his fatherly affection.

Dhruva protested questioning his step mother "why can't i sit on my own father's lap?" A furious Suruchi berated him saying "only God can allow him that privilege. Go ask him"

Once upon a time there was a Raja named Uttānapāda born of Svayambhuva Manu,1st man on earth.He had 2 beautiful wives - Suniti & Suruchi & two sons were born of them Dhruva & Uttama respectively.

#talesofkrishna https://t.co/E85MTPkF9W

Prabhu says i reside in the heart of my bhakt.

— Right Singh (@rightwingchora) December 21, 2020

Guess the event. pic.twitter.com/yFUmbfe5KL

Now Suniti was the daughter of a tribal chief while Suruchi was the daughter of a rich king. Hence Suruchi was always favored the most by Raja while Suniti was ignored. But while Suniti was gentle & kind hearted by nature Suruchi was venomous inside.

#KrishnaLeela

The story is of a time when ideally the eldest son of the king becomes the heir to the throne. Hence the sinhasan of the Raja belonged to Dhruva.This is why Suruchi who was the 2nd wife nourished poison in her heart for Dhruva as she knew her son will never get the throne.

One day when Dhruva was just 5 years old he went on to sit on his father's lap. Suruchi, the jealous queen, got enraged and shoved him away from Raja as she never wanted Raja to shower Dhruva with his fatherly affection.

Dhruva protested questioning his step mother "why can't i sit on my own father's lap?" A furious Suruchi berated him saying "only God can allow him that privilege. Go ask him"