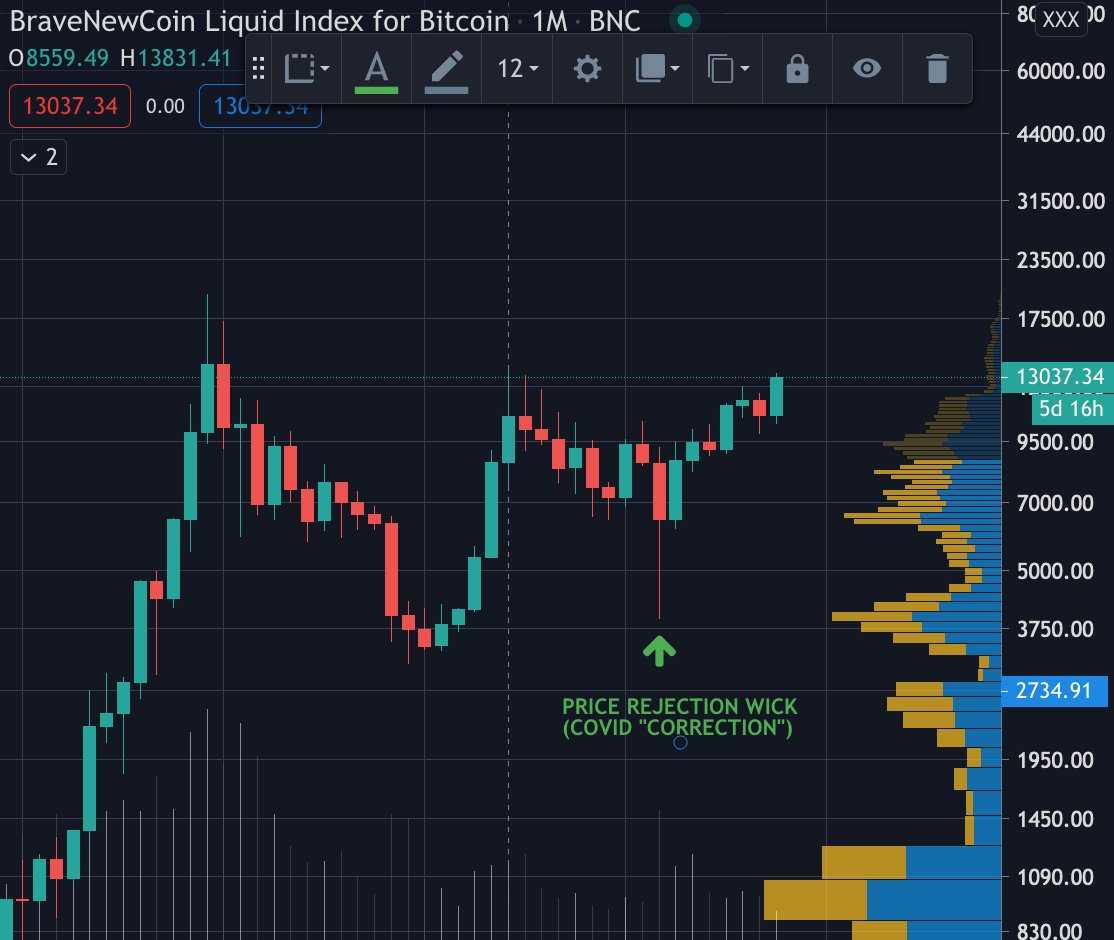

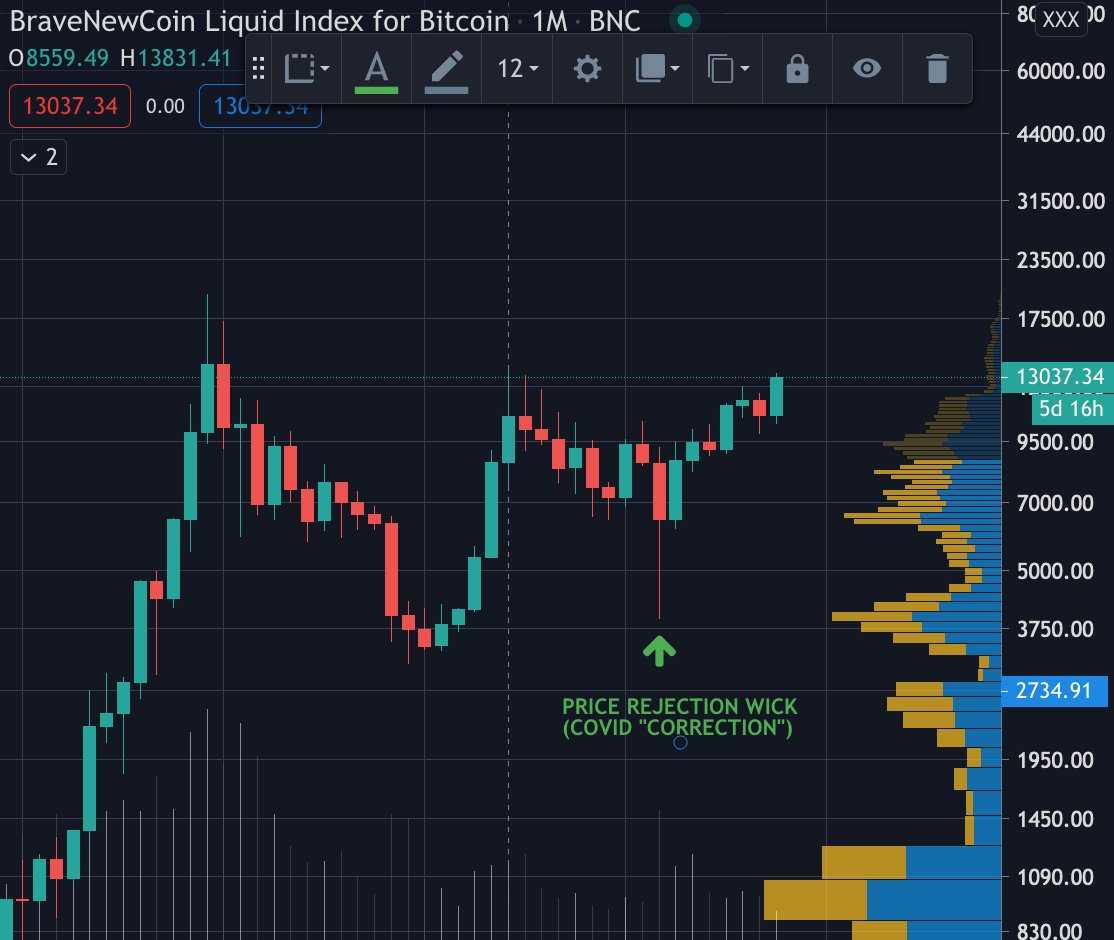

#analysis THREAD

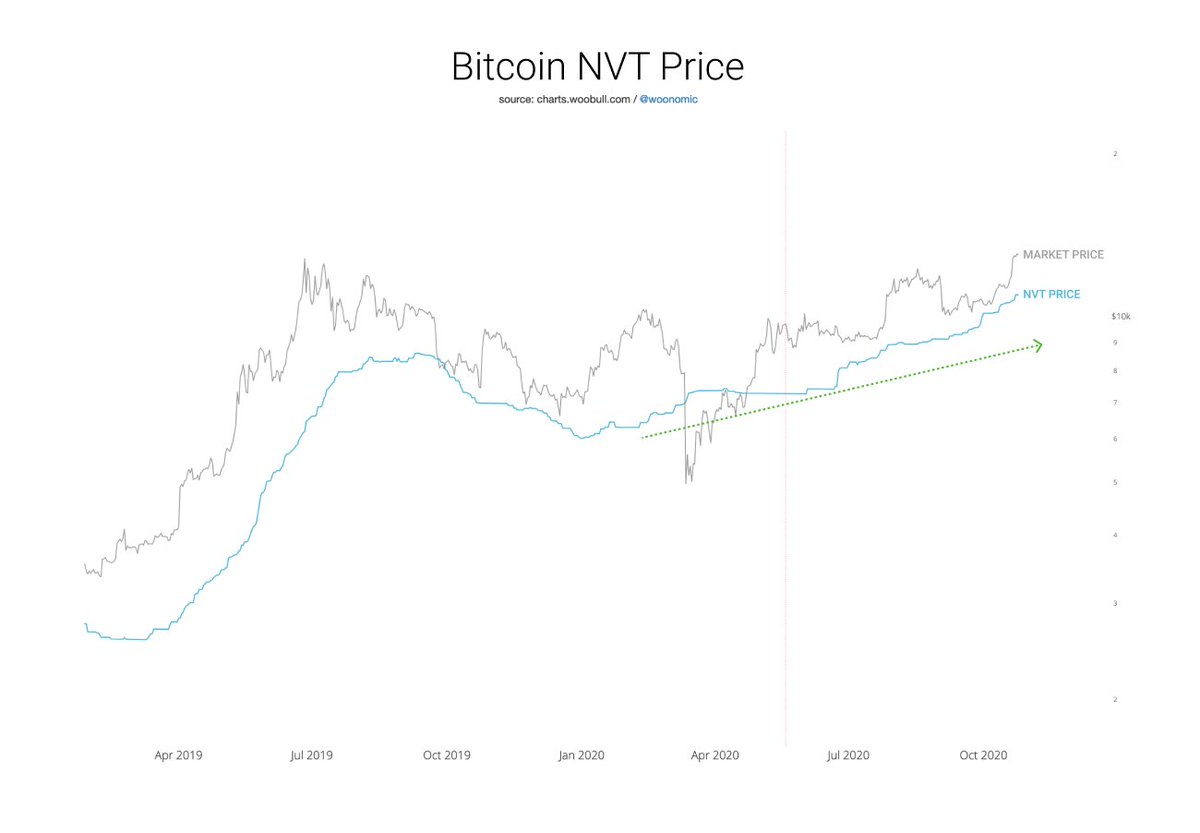

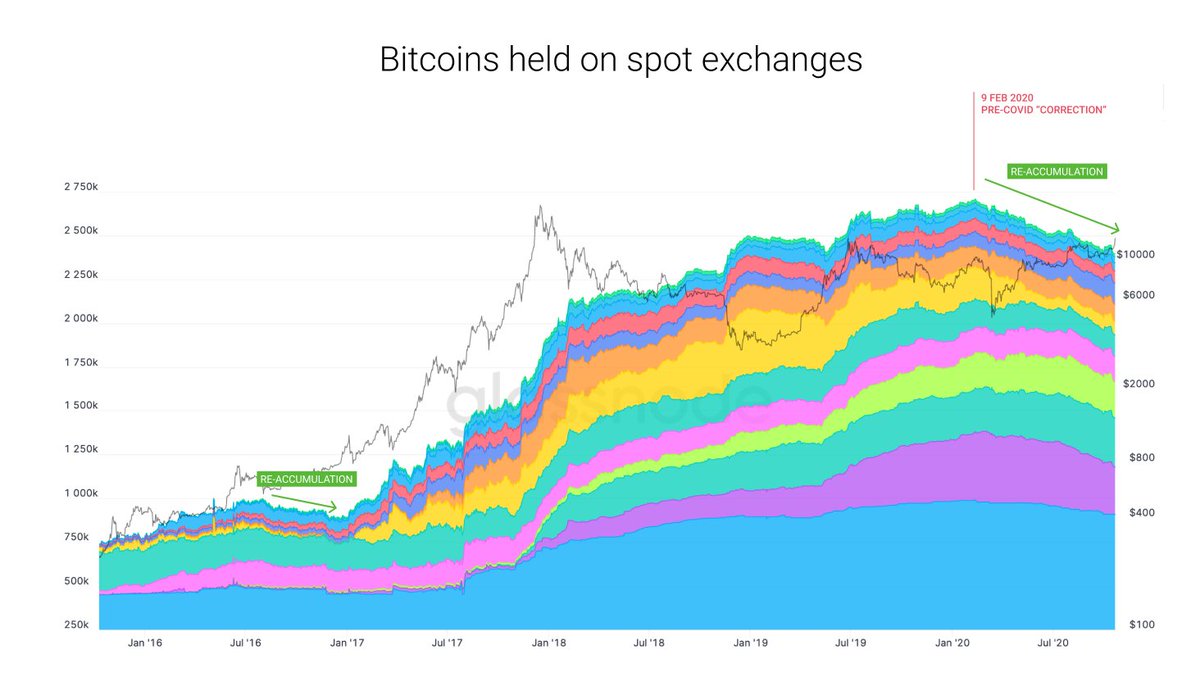

Here I'll show that investors already consider BTC a safe haven under on-chain capital flows.

Common wisdom that BTC is "risk-on" is a fallacy; solely a consequence of trader liquidations on derivative exchanges.

While traders were selling Bitcoins, investors were accumulating. It's investors that determine the long term price.

Price is a laggy indicator of quantitative fundamentals.

Price follows fundamentals. It's a safe haven already.

Use code https://t.co/CsivmaFiQP for 20% off during the remainder of launch month.

It supports the free analysis work I do for the community.

More from Crypto

1/ ERC-20 token standard approve() has caused an unnecessary cost of $53.8M for #Ethereum and #DeFi users

This is bad. Continue reading why and how to avoid this in the future.

👇👇👇

2/ Before you go all rage on the flaws of my analysis, please read the whole Twitter thread for disclaimers and caveats.

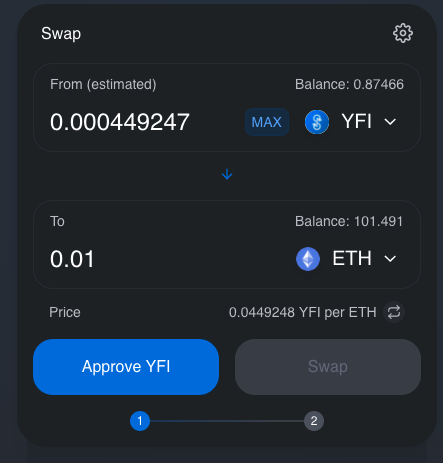

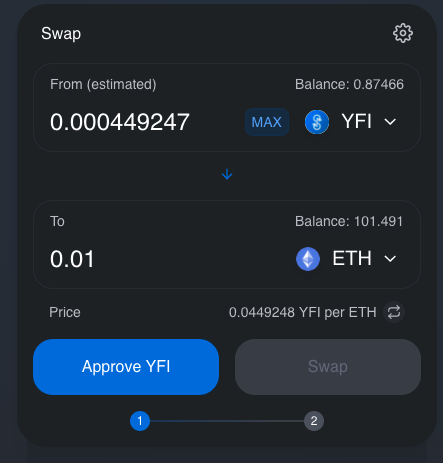

3/ approve() is an unnecessary step of ERC-20 tokens when they interact with smart contracts.

You know this because when you do a Uniswap trade you need press two transaction buttons instead of one.

4/ Why there is approve() - you can read the history in this Twitter

5/ I queried all approve() transactions on Google BigQuery public dataset and calculated their ETH cost and then converted this to the USD with the current ETH price.

This is bad. Continue reading why and how to avoid this in the future.

👇👇👇

2/ Before you go all rage on the flaws of my analysis, please read the whole Twitter thread for disclaimers and caveats.

3/ approve() is an unnecessary step of ERC-20 tokens when they interact with smart contracts.

You know this because when you do a Uniswap trade you need press two transaction buttons instead of one.

4/ Why there is approve() - you can read the history in this Twitter

1/ I just spend my Saturday morning on a call with a crypto fund explaining to them how #Ethereum ERC-20 token approve() function works

— \U0001f42e Mikko Ohtamaa (@moo9000) August 29, 2020

I am too old for this shit. pic.twitter.com/7EYfOaRP5L

5/ I queried all approve() transactions on Google BigQuery public dataset and calculated their ETH cost and then converted this to the USD with the current ETH price.