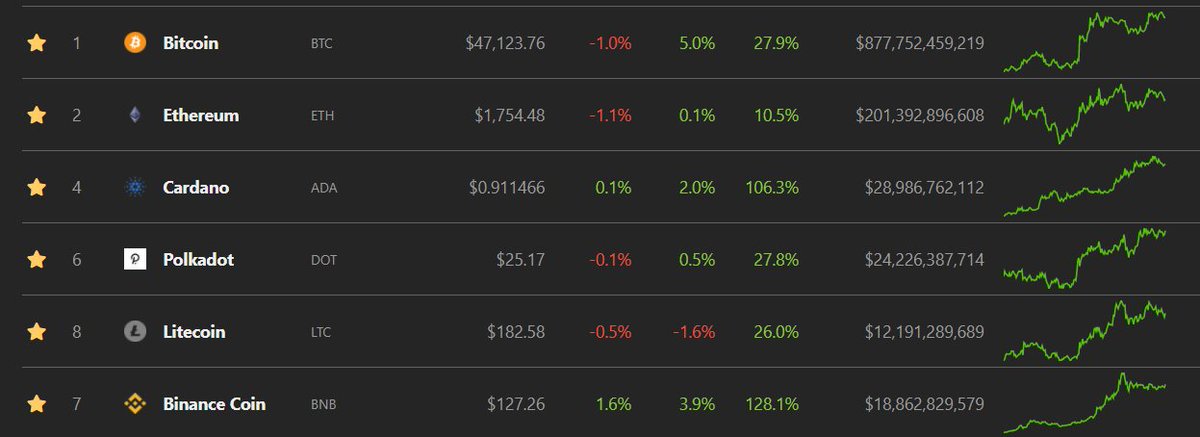

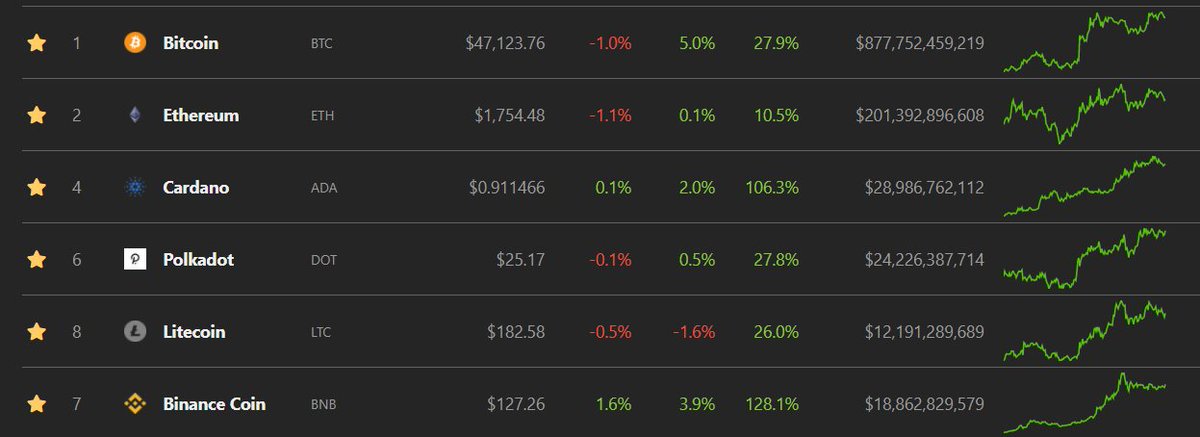

- Bitcoin (BTC)

- Ethereum (ETH)

- Polka Dot (DOT)

- Cardano (ADA)

- Binance (BNB)

- Litecoin (LTC)

I choose these 6 bcs they are all TOP 10 Coins, they have the biggest market cap which means less risky than other coins.

5 simple steps to buy #Bitcoin and other crypto currency using Luno! pic.twitter.com/xeHvOKB5py

— Dr. Liyana Mohtar (@LiyanaMohtar) January 12, 2021

I started investing in crypto using Luno but sekarang I mostly guna Binance.

— Dr. Liyana Mohtar (@LiyanaMohtar) February 2, 2021

Thread on how to use Binance and their awesome features that enables you to grow more coins on top of your coin\U0001f447\U0001f447\U0001f447 pic.twitter.com/cagTDzGyYp

Should you invest in Polygon (Matic)?

— LearnApp (@LearnApp_co) June 12, 2021

\U0001f4a1 Here's @PrateekLearnapp's take on #Matic, as shared on @CNBCTV18News.

What are your thoughts on #Polygon (Matic)? \U0001f4ac

Read the full article here \U0001f449 https://t.co/rmLTV0WFo2#crypto #cryptocurrencies pic.twitter.com/9k1lclN7oL

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0