[1/13] It may be initially confusing to fully grasp how deposits and withdrawals from L1 to @optimismPBC are actually implemented, and it helps to see the on-chain action of what is happening behind the scenes.

More from Crypto

0/ The Great Crypto Reversal

Key difference between the '17 and roaring 20s in crypto is that back then everyone was aping a16z and Naval.

Today everyone apes 3AC wanting to be the next Degen.

'17 was an idealistic *saving the world* kind of thing

20s is *me against the world*

1/ The financialization of crypto means more volatility but pretty long ascend to the top.

Multi-year bull and an ATH surprising even to the biggest bulls as the infinite Cantillon "wealth" is pumped into crypto

Crypto becomes the ultimate Cantillon insider circle-jerk.

2/ This will be one the most iconic ideological reversals in history, comparable to Google who was firmly against advertising but turned into the most powerful ad company ever.

3/ This scenario reminds me of the 90s privatization period in the post-socialist countries.

The regime transition allowed the communist party elite to benefit from the wild west form of "capitalism" that ensued, transferring (and multiplying) their wealth into the new regime.

4/ We are far from Satoshi's original vision . But words and intentions of *prophets* were used to manipulate and corrupt all throughout human history and this time it is no

Key difference between the '17 and roaring 20s in crypto is that back then everyone was aping a16z and Naval.

Today everyone apes 3AC wanting to be the next Degen.

'17 was an idealistic *saving the world* kind of thing

20s is *me against the world*

1/ The financialization of crypto means more volatility but pretty long ascend to the top.

Multi-year bull and an ATH surprising even to the biggest bulls as the infinite Cantillon "wealth" is pumped into crypto

Crypto becomes the ultimate Cantillon insider circle-jerk.

2/ This will be one the most iconic ideological reversals in history, comparable to Google who was firmly against advertising but turned into the most powerful ad company ever.

3/ This scenario reminds me of the 90s privatization period in the post-socialist countries.

The regime transition allowed the communist party elite to benefit from the wild west form of "capitalism" that ensued, transferring (and multiplying) their wealth into the new regime.

4/ We are far from Satoshi's original vision . But words and intentions of *prophets* were used to manipulate and corrupt all throughout human history and this time it is no

At "forever" Cantillon insiders are infinitely wealthy. Everybody else lives in pods & eats what the livestock eats, or joins the harem or household staff of an infinitaire.

— Nick Szabo (@NickSzabo4) January 21, 2020

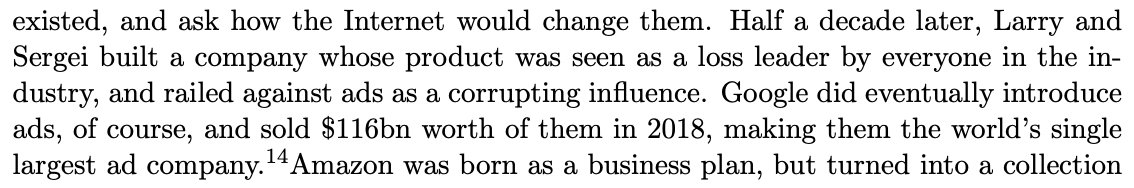

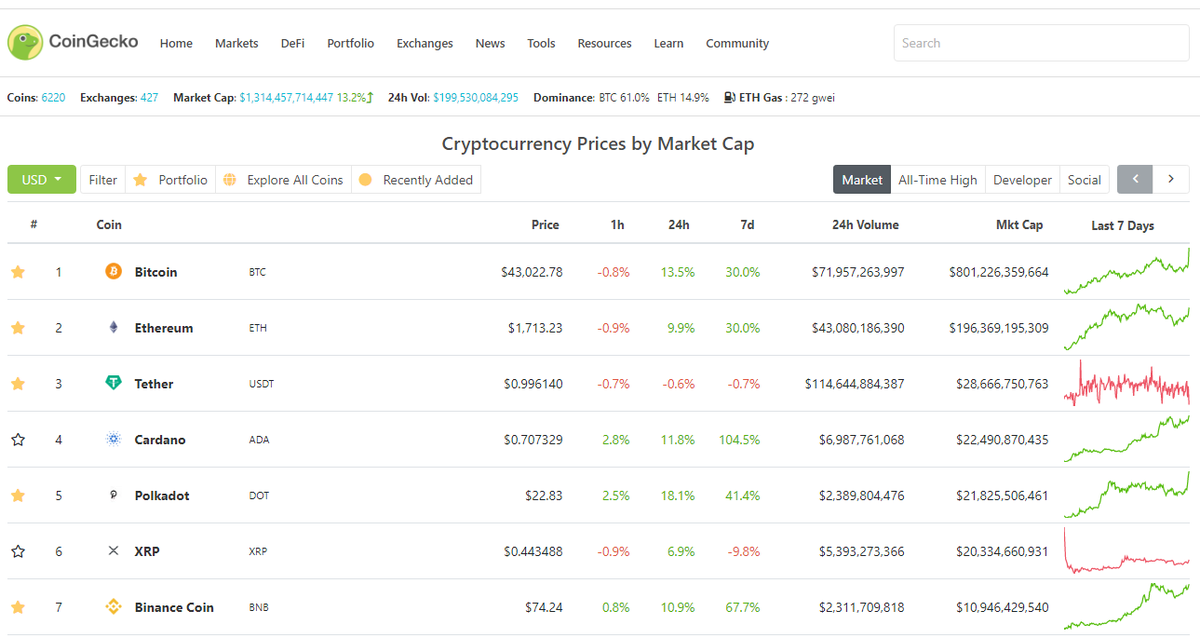

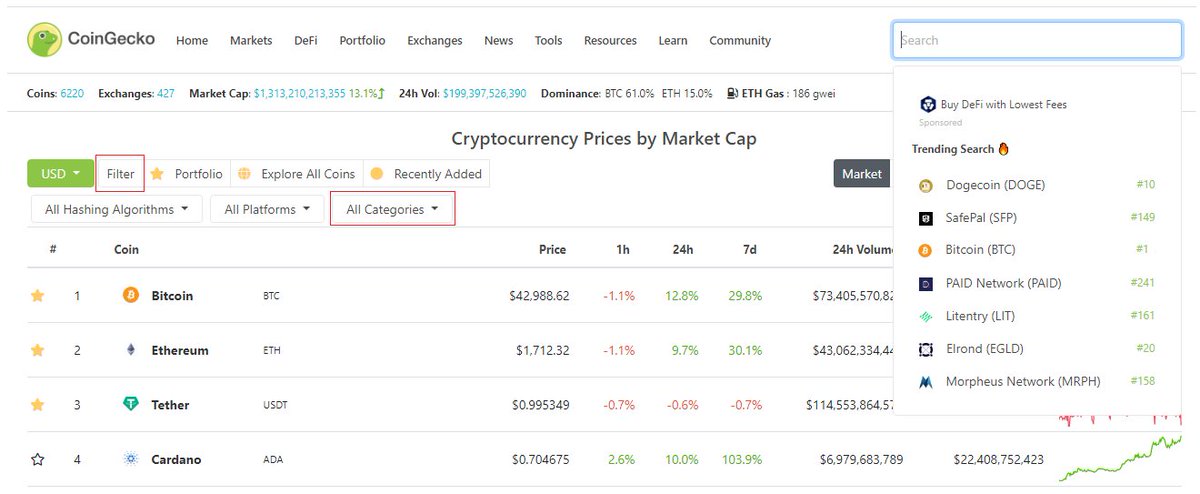

A primer on how to use @coingecko for your crypto data/research/trading needs.

Share it with a friend who needs it!

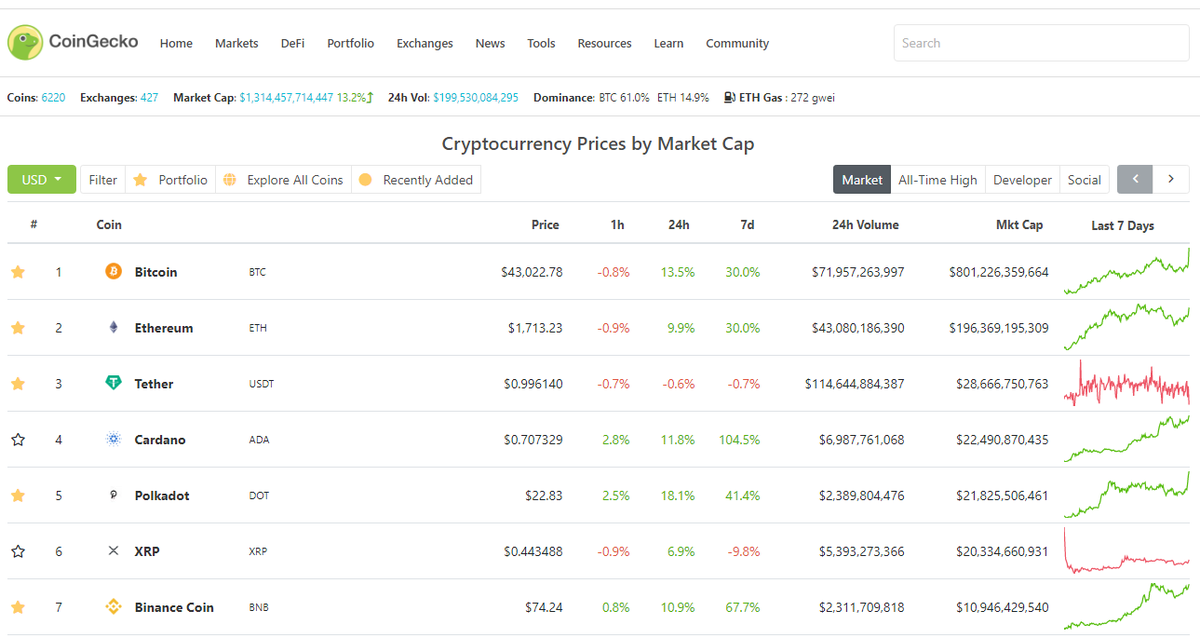

1/ Getting started with crypto and want to check prices/projects? https://t.co/LFnk4vukxj has info on just about every crypto you'll need :)

2/ Search over 6000+ cryptocurrencies available on the market. You can see what's trending in the space as well.

Researching by categories? Filter (left side) -> Select categories -> DeFi, DOT ecosystem, Exchange-based tokens, NFTs - anything!

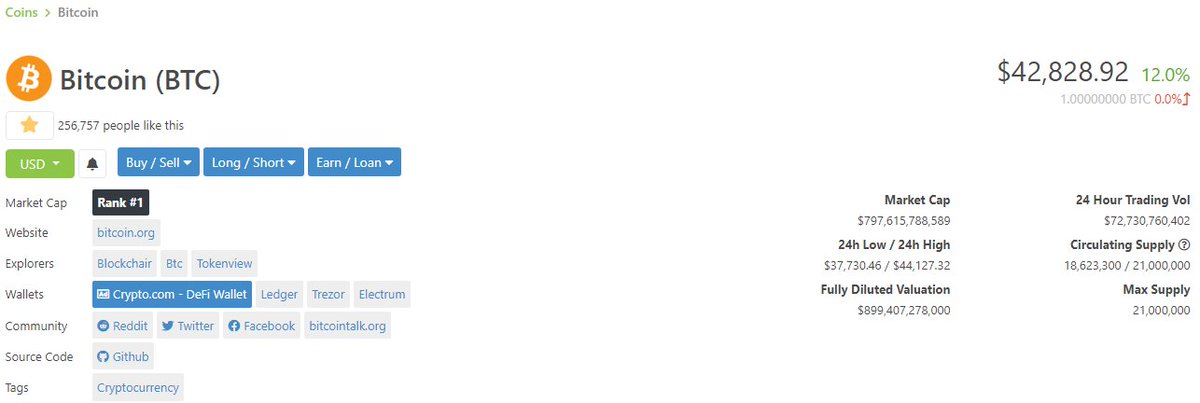

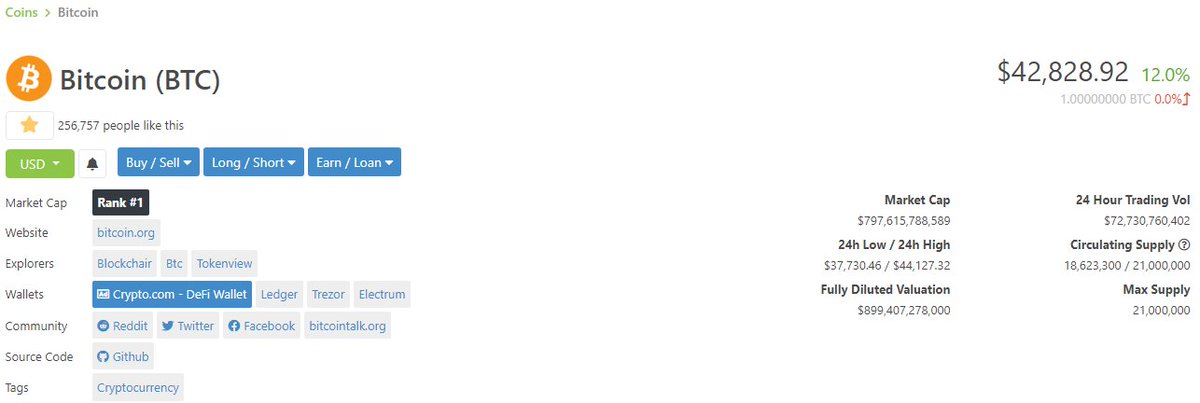

3/ Lets say you're looking at #Bitcoin https://t.co/g205lj03pG

At a glance you get:

- Price

- Mkt Capitalization (valuation)

- Circulating/Total supply

- 24h trading volume

- Links to websites, social media, block explorers

- Calculator

Next - check valuation?

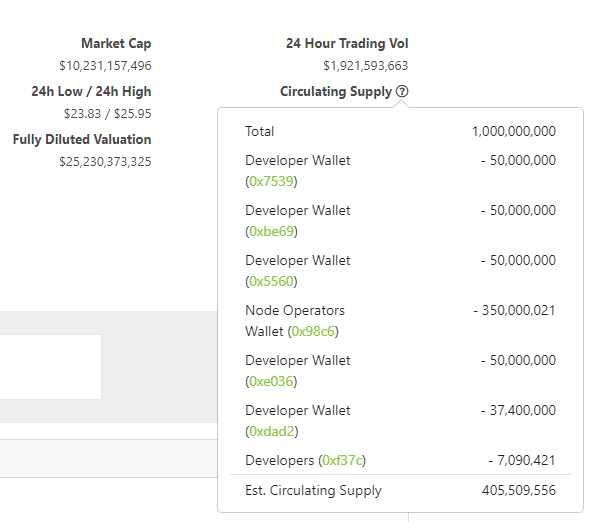

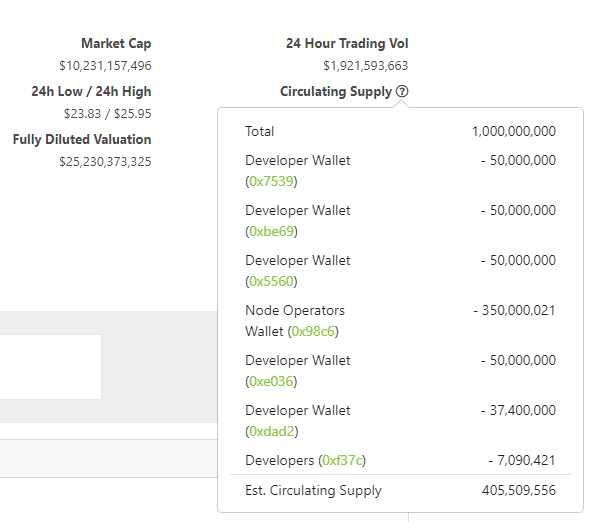

4/ Market cap is used to rank coins, and we'll show you how its calculated - Hover over Circulating Supply (?) for breakdown.

Note: used @chainlink as example here - https://t.co/Jc46fe79Ag

While MC is important also consider product fit, narrative, team, community etc.

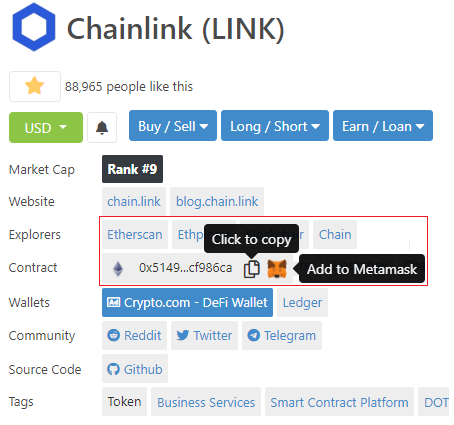

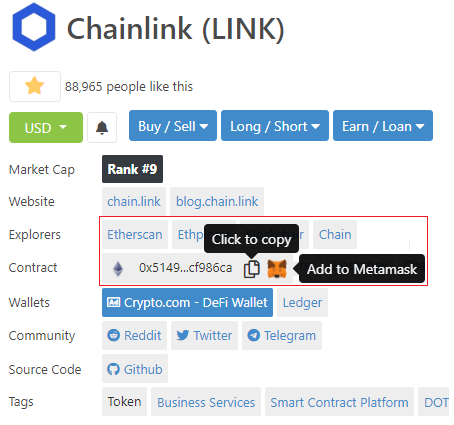

5/ If you're trading on AMMs like @Uniswap or @SushiSwap, you can copy the contract address directly to your clipboard.

Using @metamask_io? Add the token directly so it shows as one of the "Assets" that you own in the wallet.

See: https://t.co/94XihMf5oz

Share it with a friend who needs it!

1/ Getting started with crypto and want to check prices/projects? https://t.co/LFnk4vukxj has info on just about every crypto you'll need :)

2/ Search over 6000+ cryptocurrencies available on the market. You can see what's trending in the space as well.

Researching by categories? Filter (left side) -> Select categories -> DeFi, DOT ecosystem, Exchange-based tokens, NFTs - anything!

3/ Lets say you're looking at #Bitcoin https://t.co/g205lj03pG

At a glance you get:

- Price

- Mkt Capitalization (valuation)

- Circulating/Total supply

- 24h trading volume

- Links to websites, social media, block explorers

- Calculator

Next - check valuation?

4/ Market cap is used to rank coins, and we'll show you how its calculated - Hover over Circulating Supply (?) for breakdown.

Note: used @chainlink as example here - https://t.co/Jc46fe79Ag

While MC is important also consider product fit, narrative, team, community etc.

5/ If you're trading on AMMs like @Uniswap or @SushiSwap, you can copy the contract address directly to your clipboard.

Using @metamask_io? Add the token directly so it shows as one of the "Assets" that you own in the wallet.

See: https://t.co/94XihMf5oz

Introducing an effortless way to add tokens to your @metamask_io wallet \U0001f4e5

— CoinGecko (@coingecko) February 8, 2021

Skip the hassle of copying/pasting contract addresses to your wallet. Add an asset and it'll appear in your wallet with just a click - tap the \U0001f98a and try it out for yourself! pic.twitter.com/u26BA29ubs

You May Also Like

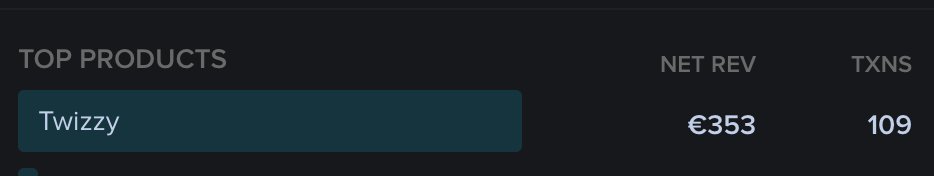

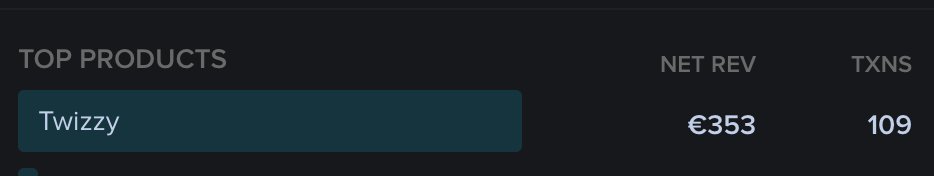

To people who are under the impression that you can get rich quickly by working on an app, here are the stats for https://t.co/az8F12pf02

📈 ~12000 vistis

☑️ 109 transactions

💰 353€ profit (285 after tax)

I have spent 1.5 months on this app. You can make more $ in 2 days.

🤷♂️

I'm still happy that I launched a paid app bcs it involved extra work:

- backend for processing payments (+ permissions, webhooks, etc)

- integration with payment processor

- UI for license activation in Electron

- machine activation limit

- autoupdates

- mailgun emails

etc.

These things seemed super scary at first. I always thought it was way too much work and something would break. But I'm glad I persisted. So far the only problem I have is that mailgun is not delivering the license keys to certain domains like https://t.co/6Bqn0FUYXo etc. 👌

omg I just realized that me . com is an Apple domain, of course something wouldn't work with these dicks

📈 ~12000 vistis

☑️ 109 transactions

💰 353€ profit (285 after tax)

I have spent 1.5 months on this app. You can make more $ in 2 days.

🤷♂️

I'm still happy that I launched a paid app bcs it involved extra work:

- backend for processing payments (+ permissions, webhooks, etc)

- integration with payment processor

- UI for license activation in Electron

- machine activation limit

- autoupdates

- mailgun emails

etc.

These things seemed super scary at first. I always thought it was way too much work and something would break. But I'm glad I persisted. So far the only problem I have is that mailgun is not delivering the license keys to certain domains like https://t.co/6Bqn0FUYXo etc. 👌

omg I just realized that me . com is an Apple domain, of course something wouldn't work with these dicks

#ஆதித்தியஹ்ருதயம் ஸ்தோத்திரம்

இது சூரிய குலத்தில் உதித்த இராமபிரானுக்கு தமிழ் முனிவர் அகத்தியர் உபதேசித்ததாக வால்மீகி இராமாயணத்தில் வருகிறது. ஆதித்ய ஹ்ருதயத்தைத் தினமும் ஓதினால் பெரும் பயன் பெறலாம் என மகான்களும் ஞானிகளும் காலம் காலமாகக் கூறி வருகின்றனர். ராம-ராவண யுத்தத்தை

தேவர்களுடன் சேர்ந்து பார்க்க வந்திருந்த அகத்தியர், அப்போது போரினால் களைத்து, கவலையுடன் காணப்பட்ட ராமபிரானை அணுகி, மனிதர்களிலேயே சிறந்தவனான ராமா போரில் எந்த மந்திரத்தைப் பாராயணம் செய்தால் எல்லா பகைவர்களையும் வெல்ல முடியுமோ அந்த ரகசிய மந்திரத்தை, வேதத்தில் சொல்லப்பட்டுள்ளதை உனக்கு

நான் உபதேசிக்கிறேன், கேள் என்று கூறி உபதேசித்தார். முதல் இரு சுலோகங்கள் சூழ்நிலையை விவரிக்கின்றன. மூன்றாவது சுலோகம் அகத்தியர் இராமபிரானை விளித்துக் கூறுவதாக அமைந்திருக்கிறது. நான்காவது சுலோகம் முதல் முப்பதாம் சுலோகம் வரை ஆதித்ய ஹ்ருதயம் என்னும் நூல். முப்பத்தி ஒன்றாம் சுலோகம்

இந்தத் துதியால் மகிழ்ந்த சூரியன் இராமனை வாழ்த்துவதைக் கூறுவதாக அமைந்திருக்கிறது.

ஐந்தாவது ஸ்லோகம்:

ஸர்வ மங்கள் மாங்கல்யம் ஸர்வ பாப ப்ரநாசனம்

சிந்தா சோக ப்ரசமனம் ஆயுர் வர்த்தனம் உத்தமம்

பொருள்: இந்த அதித்ய ஹ்ருதயம் என்ற துதி மங்களங்களில் சிறந்தது, பாவங்களையும் கவலைகளையும்

குழப்பங்களையும் நீக்குவது, வாழ்நாளை நீட்டிப்பது, மிகவும் சிறந்தது. இதயத்தில் வசிக்கும் பகவானுடைய அனுக்ரகத்தை அளிப்பதாகும்.

முழு ஸ்லோக லிங்க் பொருளுடன் இங்கே உள்ளது https://t.co/Q3qm1TfPmk

சூரியன் உலக இயக்கத்திற்கு மிக முக்கியமானவர். சூரிய சக்தியால்தான் ஜீவராசிகள், பயிர்கள்

இது சூரிய குலத்தில் உதித்த இராமபிரானுக்கு தமிழ் முனிவர் அகத்தியர் உபதேசித்ததாக வால்மீகி இராமாயணத்தில் வருகிறது. ஆதித்ய ஹ்ருதயத்தைத் தினமும் ஓதினால் பெரும் பயன் பெறலாம் என மகான்களும் ஞானிகளும் காலம் காலமாகக் கூறி வருகின்றனர். ராம-ராவண யுத்தத்தை

தேவர்களுடன் சேர்ந்து பார்க்க வந்திருந்த அகத்தியர், அப்போது போரினால் களைத்து, கவலையுடன் காணப்பட்ட ராமபிரானை அணுகி, மனிதர்களிலேயே சிறந்தவனான ராமா போரில் எந்த மந்திரத்தைப் பாராயணம் செய்தால் எல்லா பகைவர்களையும் வெல்ல முடியுமோ அந்த ரகசிய மந்திரத்தை, வேதத்தில் சொல்லப்பட்டுள்ளதை உனக்கு

நான் உபதேசிக்கிறேன், கேள் என்று கூறி உபதேசித்தார். முதல் இரு சுலோகங்கள் சூழ்நிலையை விவரிக்கின்றன. மூன்றாவது சுலோகம் அகத்தியர் இராமபிரானை விளித்துக் கூறுவதாக அமைந்திருக்கிறது. நான்காவது சுலோகம் முதல் முப்பதாம் சுலோகம் வரை ஆதித்ய ஹ்ருதயம் என்னும் நூல். முப்பத்தி ஒன்றாம் சுலோகம்

இந்தத் துதியால் மகிழ்ந்த சூரியன் இராமனை வாழ்த்துவதைக் கூறுவதாக அமைந்திருக்கிறது.

ஐந்தாவது ஸ்லோகம்:

ஸர்வ மங்கள் மாங்கல்யம் ஸர்வ பாப ப்ரநாசனம்

சிந்தா சோக ப்ரசமனம் ஆயுர் வர்த்தனம் உத்தமம்

பொருள்: இந்த அதித்ய ஹ்ருதயம் என்ற துதி மங்களங்களில் சிறந்தது, பாவங்களையும் கவலைகளையும்

குழப்பங்களையும் நீக்குவது, வாழ்நாளை நீட்டிப்பது, மிகவும் சிறந்தது. இதயத்தில் வசிக்கும் பகவானுடைய அனுக்ரகத்தை அளிப்பதாகும்.

முழு ஸ்லோக லிங்க் பொருளுடன் இங்கே உள்ளது https://t.co/Q3qm1TfPmk

சூரியன் உலக இயக்கத்திற்கு மிக முக்கியமானவர். சூரிய சக்தியால்தான் ஜீவராசிகள், பயிர்கள்