Boss is always Boss @Mitesh_Engr

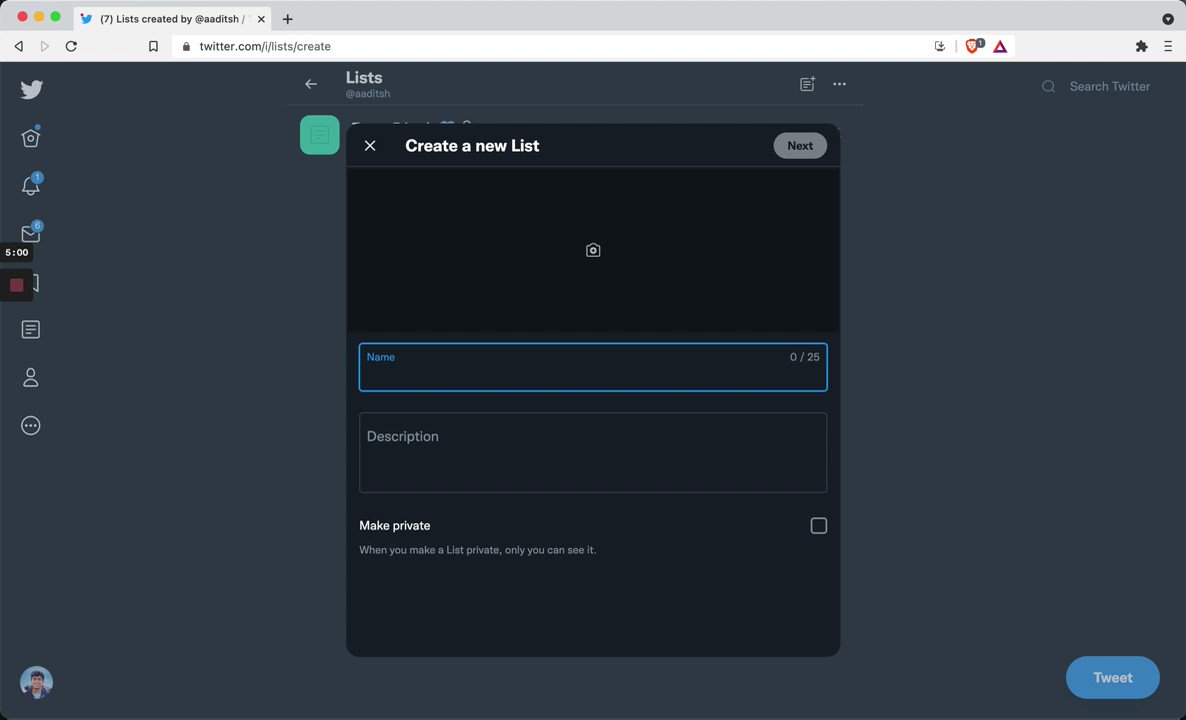

Mitesh Sir's FUTURES BREAKOUT TRADES 101:

• How to pick stocks at right time?

• What to look for?

• Importance of BO post consolidation

• How to manage SL

• How to get huge profits

• Multiple Examples

In collaboration with @niki_poojary

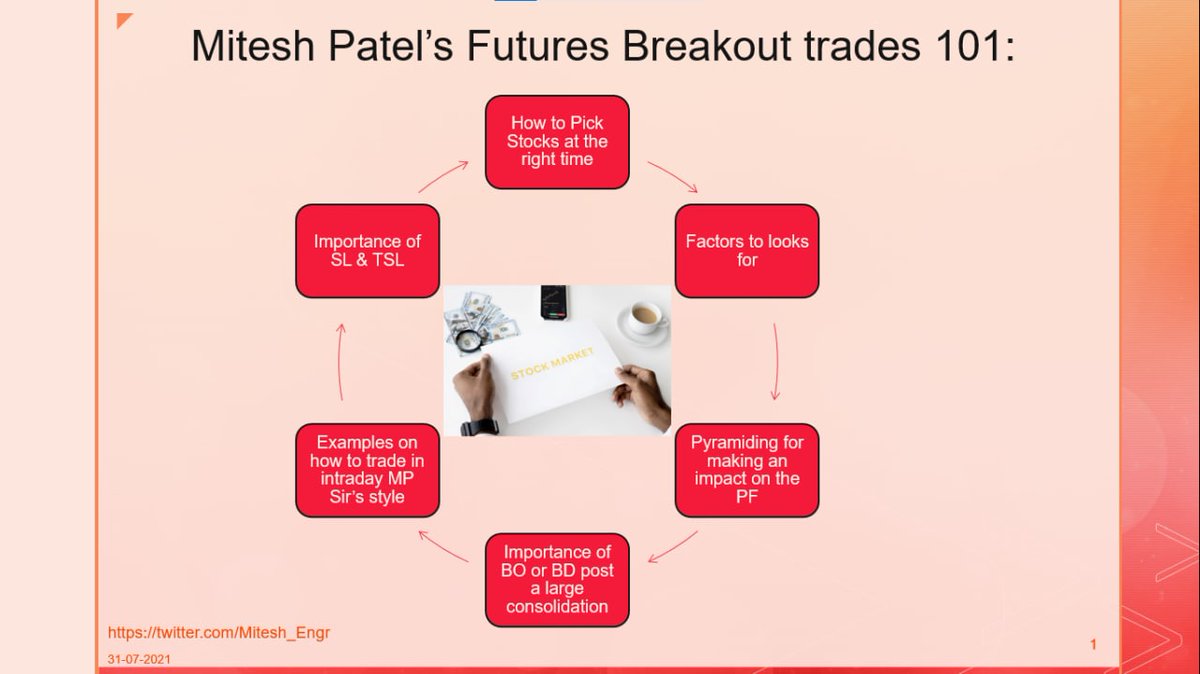

Importance of Trading only BO or BD stocks by @Mitesh_Engr Sir: 👇

•Two questions to always ask:

~Why stock is going up/down and when?

~ Who is behind big up/down and when?

• Trade only stocks with Momentum

• Instant results

• Small SL or huge profits

Sir's take on how to Trade: 👇

• Observe fight between buyer & seller

• Position will be created within first 3 hours

• Operators will win

• Just find BO or BD

• Look for huge volume support

• Give company to operators

• ATP importance explained

How to take trade in Breakout/Breakdown stocks by @Mitesh_Engr Sir: 👇

• Check Support & Resistance

• Wait for 2-3 months consolidation

• Surge in volumes

• Trade on 3 min charts

• Small SL

• Keep trailing

• Always pyramid in profit

When and Why to Pyramid? By @Mitesh_Engr Sir

• Adding to winning positions

• Signals of continued strength

• Potentially large profits

• An Example of pyramiding in one of his trades