A thread on how real estate investors, developers and operators can make millions a year and pay almost nothing in TAXES by using depreciation, bonus depreciation, and 1031 exchanges.

How it works:

It makes 30% of our cashflow tax free.

Very powerful but there is much more to it...

We'll have a cost segregation study done to split up the depreciable lifespan of different parts of the building. The raw land can't be depreciated so you have to give that a value.

The IRS has a depreciation schedule for each type. Some parts are 5 yrs. Others 15 years...

Now you can get 5 or 6% of the value as a deduction in the early years...

But wait... theres more.

So the doors, sidewalks, HVAC, walls, latches, curbs, security, gates, etc.

A % of this stuff goes in Yr 1

But then Trump got elected and he enacted the Tax Cuts and Jobs act. Moving this percentage to 100% from 2017 to 2023

So now 30% of your asset cost can be DEPRECIATED IN THE FIRST YEAR.

The cost segregation study came back. 30% of the asset cost can be depreciated on a 15 yr or faster timeframe. This is 100% deductible THIS YEAR...

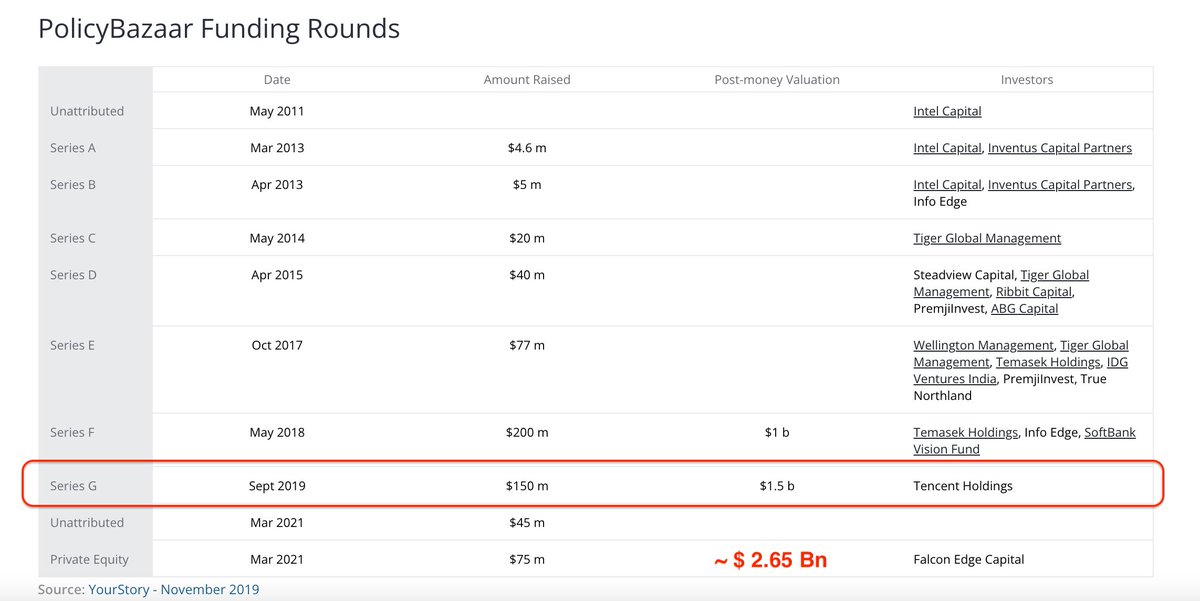

https://t.co/FEt1sBoSWS

A $900k tax deduction. In year 1.

The facility will produce about $260k in NOI and $200k in free cashflow after interest expense.

So while $200k goes into the bank account the tax LOSS is $700k.

But wait there is more...

You can also carry these losses forward into eternity.

On these new properties we won't have a tax liability for 4+ years because of Bonus Depreciation...

INSANITY.

This is how real estate owners, operators, developers make millions a year and pay 0 taxes.

But if you've owned it longer than 12 months its taxed at capital gains...

And you can do whats called a "like-kind exchange" (1031 exchange) which allows you to use the proceeds to buy a new asset and shield the taxes and push them further down the line.

Powerful stuff.

You can even cost seg your vacation homes or small rental properties and its often very cost-effective.

Thanks for following along!

More from Nick Huber

More from Business

You May Also Like

It's all in French, but if you're up for it you can read:

• Their blog post (lacks the most interesting details): https://t.co/PHkDcOT1hy

• Their high-level legal decision: https://t.co/hwpiEvjodt

• The full notification: https://t.co/QQB7rfynha

I've read it so you needn't!

Vectaury was collecting geolocation data in order to create profiles (eg. people who often go to this or that type of shop) so as to power ad targeting. They operate through embedded SDKs and ad bidding, making them invisible to users.

The @CNIL notes that profiling based off of geolocation presents particular risks since it reveals people's movements and habits. As risky, the processing requires consent — this will be the heart of their assessment.

Interesting point: they justify the decision in part because of how many people COULD be targeted in this way (rather than how many have — though they note that too). Because it's on a phone, and many have phones, it is considered large-scale processing no matter what.

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020

Always. No, your company is not an exception.

A tactic I don’t appreciate at all because of how unfairly it penalizes low-leverage, junior employees, and those loyal enough not to question it, but that’s negotiation for you after all. Weaponized information asymmetry.

Listen to Aditya

"we don't negotiate salaries" really means "we'd prefer to negotiate massive signing bonuses and equity grants, but we'll negotiate salary if you REALLY insist" https://t.co/80k7nWAMoK

— Aditya Mukerjee, the Otterrific \U0001f3f3\ufe0f\u200d\U0001f308 (@chimeracoder) December 4, 2018

And by the way, you should never be worried that an offer would be withdrawn if you politely negotiate.

I have seen this happen *extremely* rarely, mostly to women, and anyway is a giant red flag. It suggests you probably didn’t want to work there.

You wish there was no negotiating so it would all be more fair? I feel you, but it’s not happening.

Instead, negotiate hard, use your privilege, and then go and share numbers with your underrepresented and underpaid colleagues. […]