1. Smart Money &

2. Dumb Money

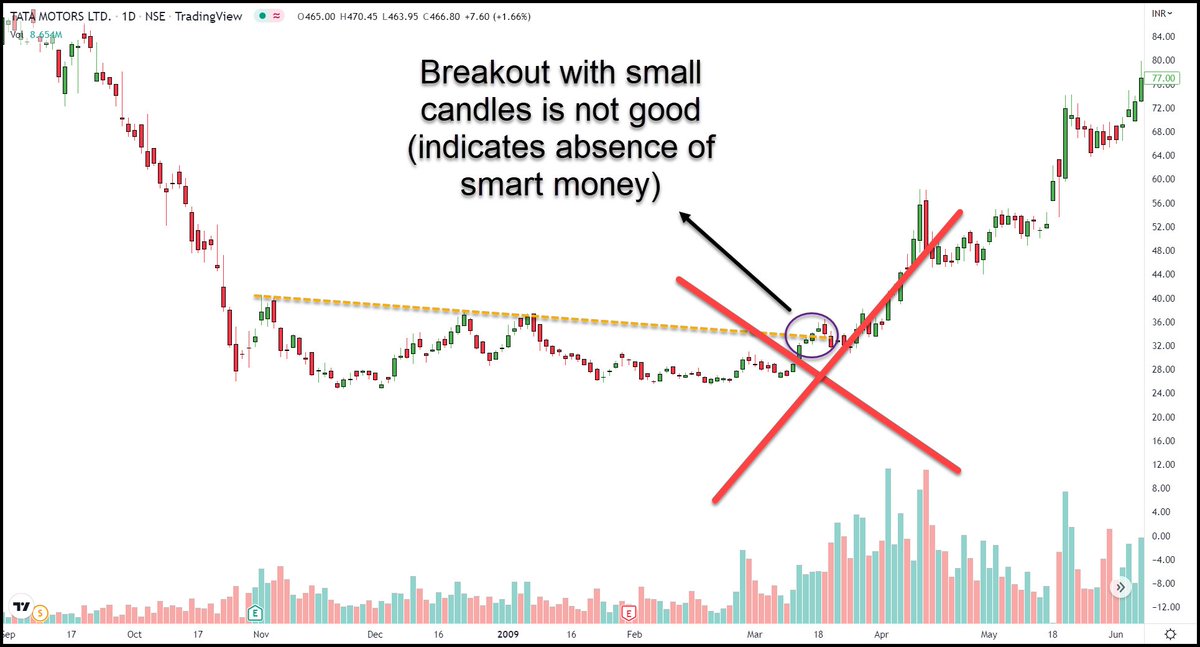

‘Smart Money’ refers to big sharks who have money & information power who give direction & momentum.

‘Dumb Money’ refers to retail traders who often try to make quick money.

(2/N)

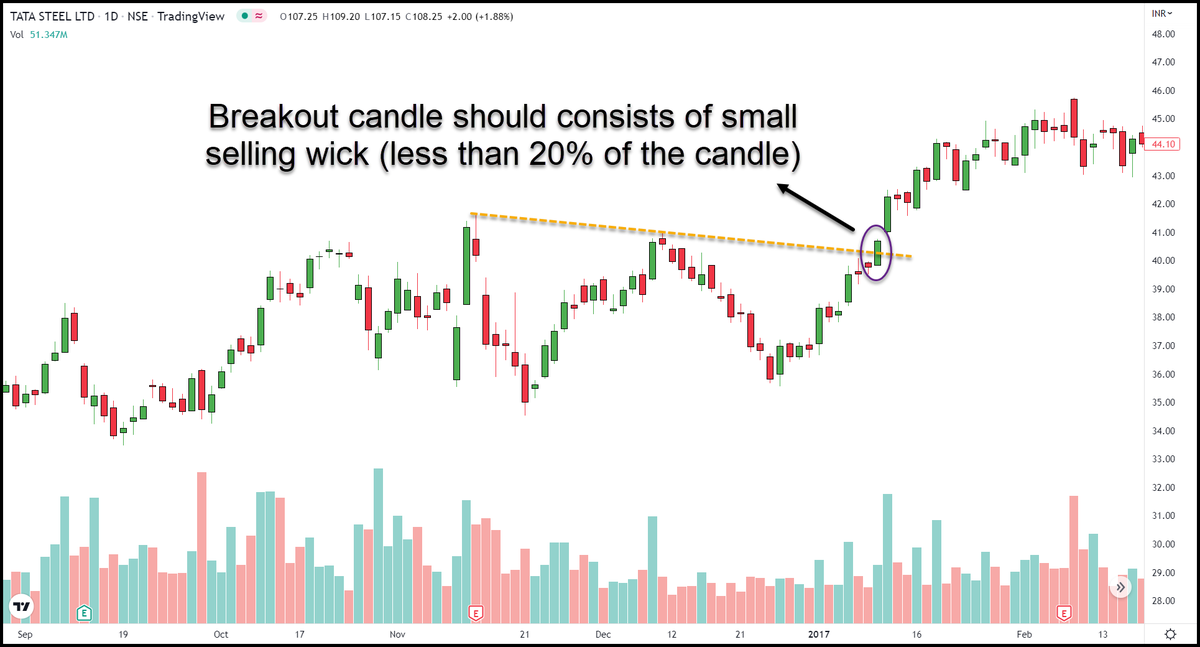

VOLUME is the ultimate Trading cheat code.

— Indrazith Shantharaj (@indraziths) August 6, 2022

But, most people never use it in the right way \u2013 because no one ever taught them how.

Here are 10 psychological triggers to knowing Volume in a better way :