It's amongst the very few banks that have survived for over 100 years and has remained profitable.

A thread 🧵about a bank whose 2nd name is "Consistency" and it's name is - CITY UNION BANK

Grab a cup of water and relax because it's gonna be a verryyyy long thread.

And don't forget to Re-tweet for wider reach.

It's amongst the very few banks that have survived for over 100 years and has remained profitable.

So banking is a realllly simple business but at the same time it's not.

So why would a person deposit it's money in a bank?

Because 1st of all, you can't keep that much amount lying at your house and 2nd of all you get some interest on the money that you've deposited with them.

So let's try to understand it with an example - Bank is giving 4% on deposits & charges 7% on the loans that they've given.

So 7% - 4% = 3%

(Interest received - Interest paid/Average assets = Net Interest Margin)

Think of it as Net Profit Margin in any other business.

What if someone doesn't pay the money back? How will the bank pay the depositors back in case they want to withdraw their money?

They're called NPA or Non Performing Asset.

Suppose if somebody hasn't paid any EMI or the principle amount for 90 days they're classified as NPA.

So the amount of money that has to be set aside is knows as "Provision".

So as I said earlier if somebody hasn't paid the interest or principle amount back for 90 days that is known as Gross Non performing Asset or GNPA.

And remember we set aside some money in case of potential loss?

GNPA - Provisions = NNPA

So now that've understood what Net Interest Margin, GNPA, NNPA & provision are let's try to understand few other important concepts like - CASA, CRAR, Treasury operations, Provision Coverage Ratio etc

So CASA means = Current Account - Saving Account

So in bank we can open two types of accounts (Broadly speaking) - Savings account or current account.

And we normal people open saving account to keep the extra money somewhere safe.

There are many other types of accounts in a bank like - Business accounts, Salary accounts etc etc.

Because on current account banks doesn't have to pay any interest & on saving account they have to say low interest as compared to fixed deposits or bonds and it's stick in nature.

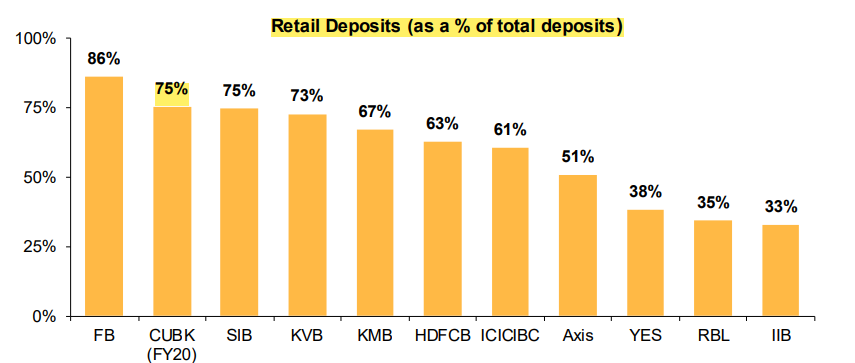

That's why banks with high CASA ratio can earn more money because their interest out go is lower as compared to a bank who has more raised money

In CASA also, the higher the retail deposits the better as compared to a single customer with a large account.

CASA RATIO = CASA DEPOSTIS/TOTAL DEPOSITS (As a thumb rule - Higher the better)

So if you remember I told you about something called NPA, right?

That if someone hasn't paid back the interest or principle amount for more than 90 days, they're qualified as NPA.

But what if someone hasn't paid back for say 30 days or 60 days

Here comes the concept of SMA or Special Mentioned Accounts.

We have SMA 0 - If the stress has remained overdue for 0 - 30 days

SMA 1 - If the stress has remained overdue for 30-60 days

SMA 2 - If the stress has remained overdue for 6- -90 days.

It means - Capital Adequacy Ratio (CAR) is the ratio of a bank’s capital in relation to its risk-weighted assets and current liabilities.

I has two components - Tier 1 & Tier 2 capital.

Tier 1 - Tier 1 capital can be used to absorb losses without a bank having to stop its operations.

And the combination of both Tier 1 + Tier 2 should be more than 10.5% including the buffer.

It's simple - Tier 1 + Tier 2/Risk Weighted Assets = Risk weighted Assets.

You don't need to calculate this, you can find it in their investor presentation.

As for the thumb rule remember one thing, For a bank it should be above 10.5%

And for high risk Microfinance NBFCs etc, it should be around 20-25%.

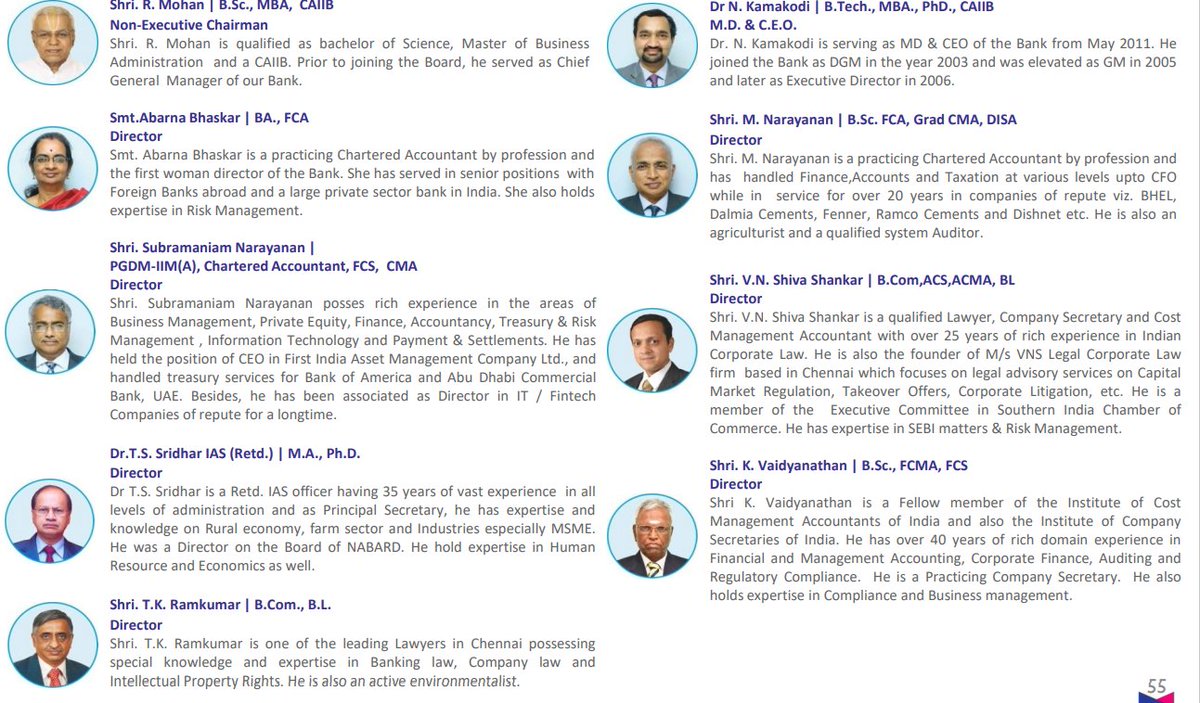

One really interesting thing about this bank is that, in it's history of more than 110 years, it has seen only 7 CEO's till date. Yes you heard it right, Only 7 CEO's

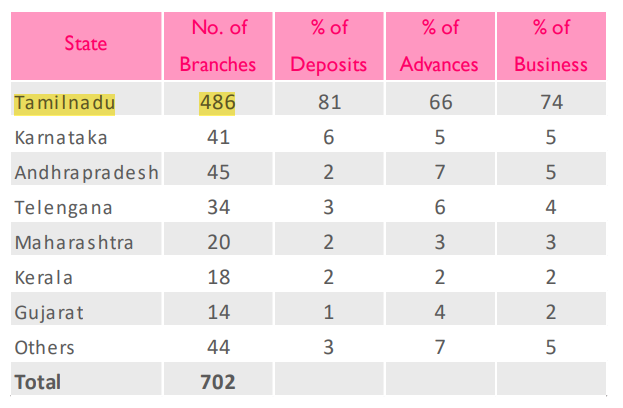

As i said earlier, it's a regionally focused bank with 486 branches out of 700 in just Tamil nadu.

66% Of the advances are from Tamil Nadu

81% Deposits are from Tamil Nadu

(High geographical Concentration)

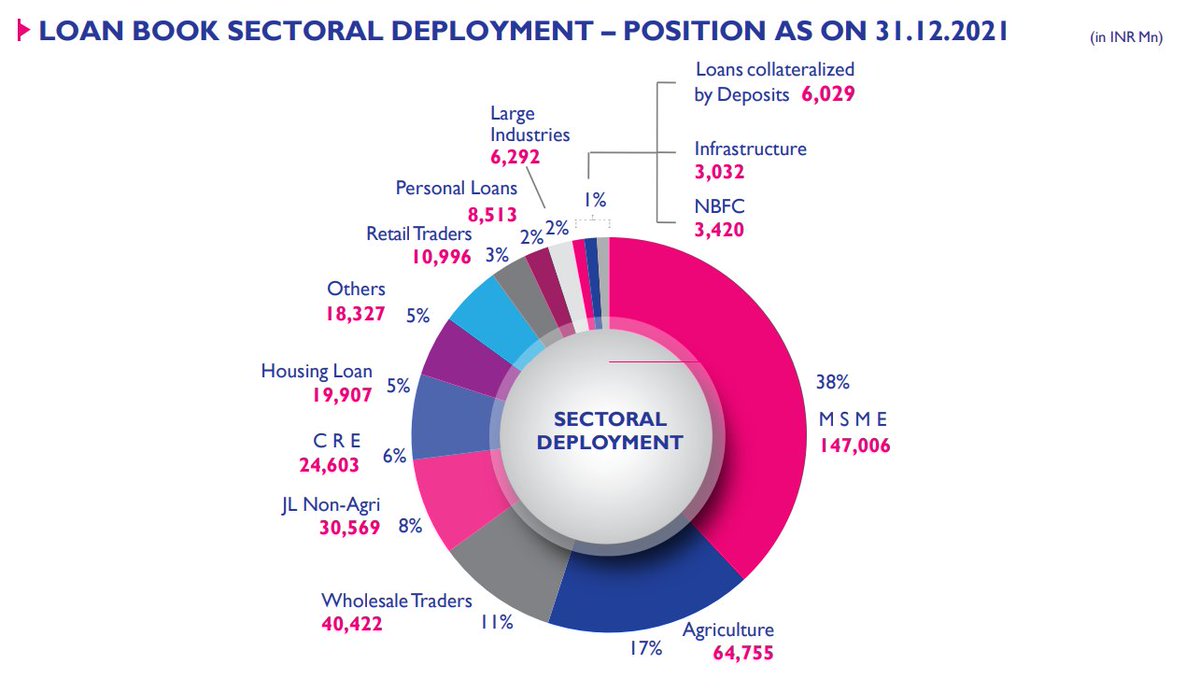

66% loan book is to these segments (High risk as these segments are very vulnerable to economic condition)

38% - MSME

17% - Agriculture

11% - Wholesale Traders

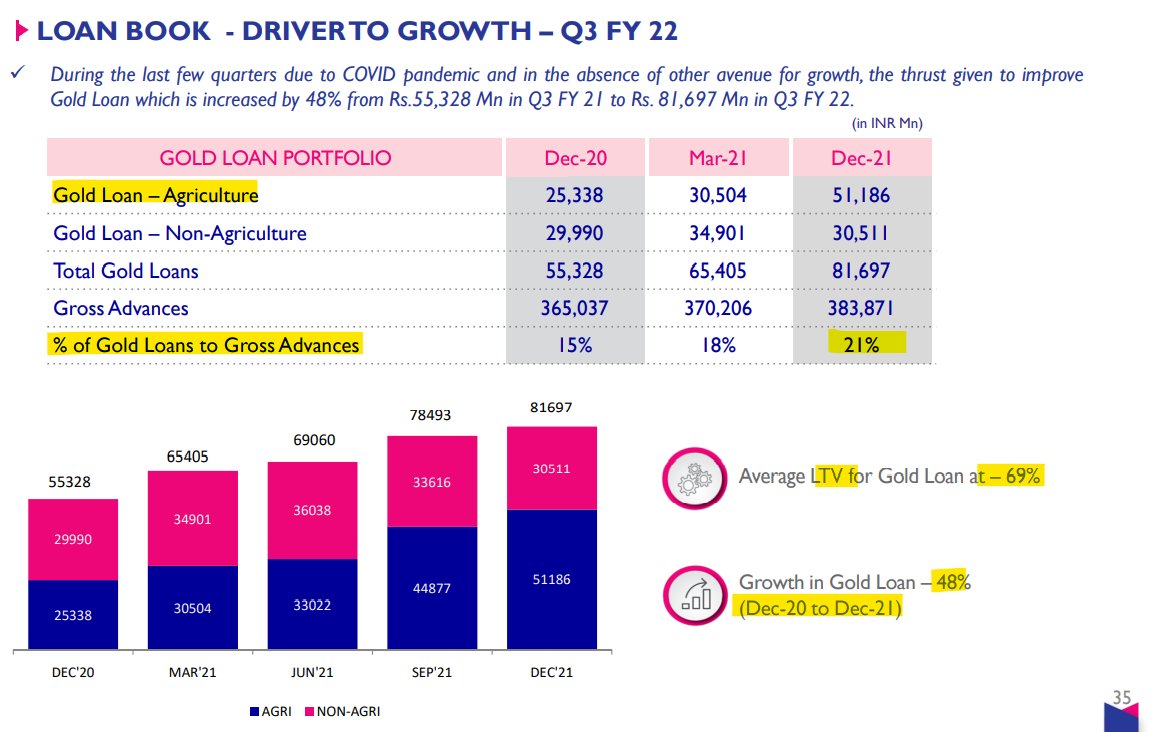

For past one year, gold loans have grown at - 48%

And LTV (Loan to Value) ratio for them is - 69%

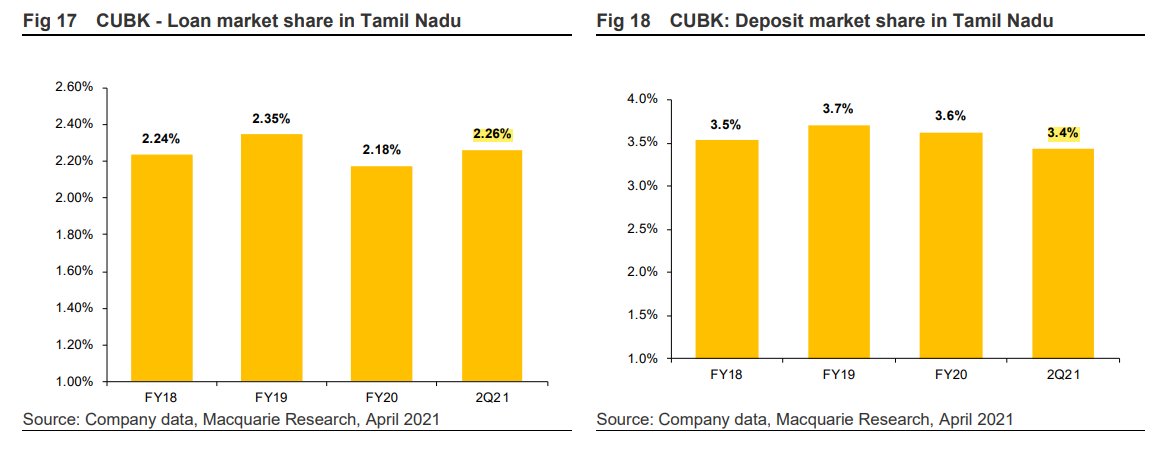

Their total market share in Tamil Nadu in Advances is 2.26% & in deposits its - 3.4%

Huge Runway for growth in the state itself if they can capture market share.

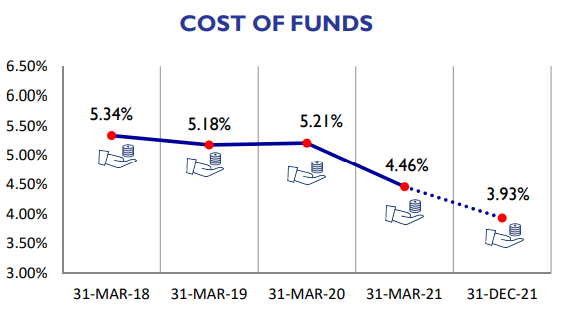

COF is high as compared to peers due to lower CASA - 32% (In the latest quarterly update, Q4FY22)

Concentration of top 20 Depositos is low around - 9%

and concentration of top 20 Advances is also low around - 5.4%

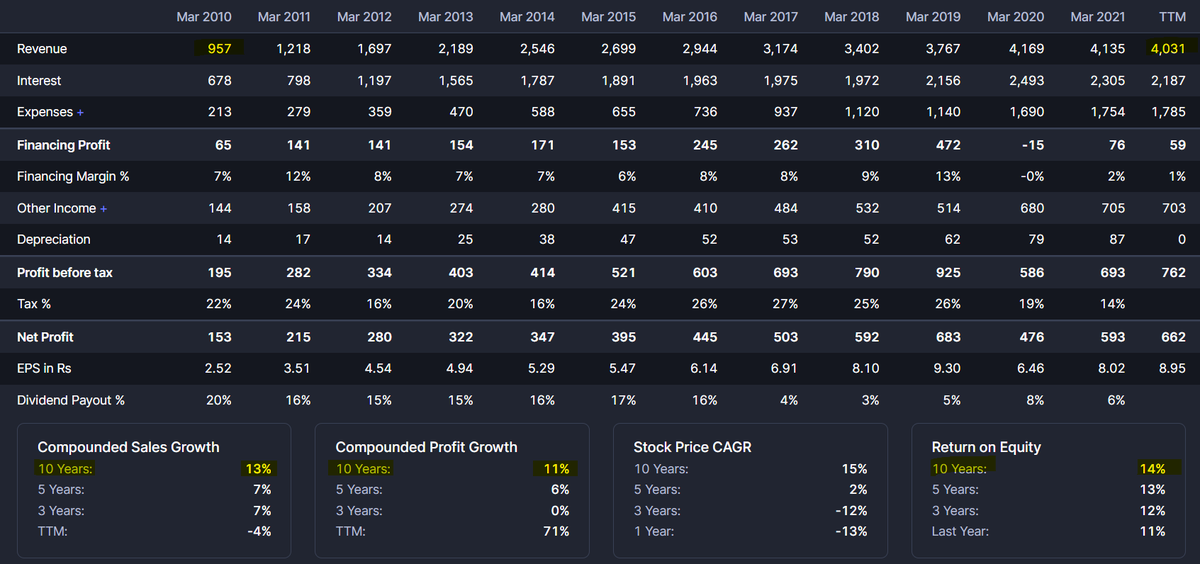

And since 2018 it has been around 11%

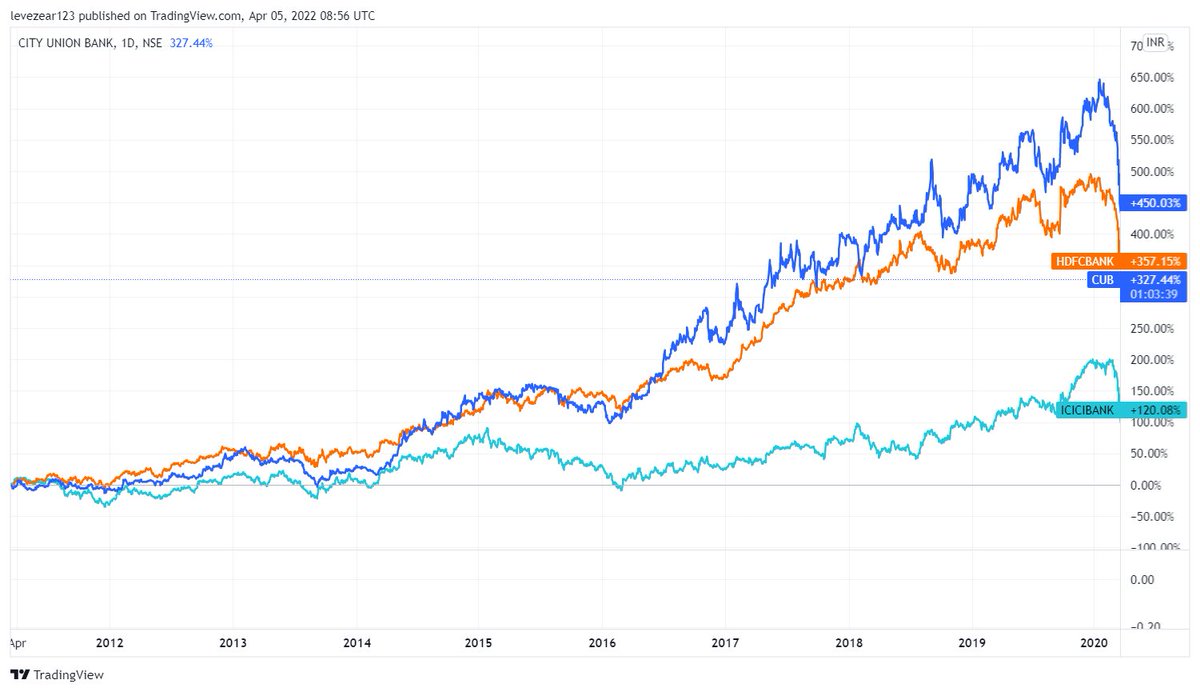

The has successfully maintained ROE of 14% from past 10 years, even in the downcycle.

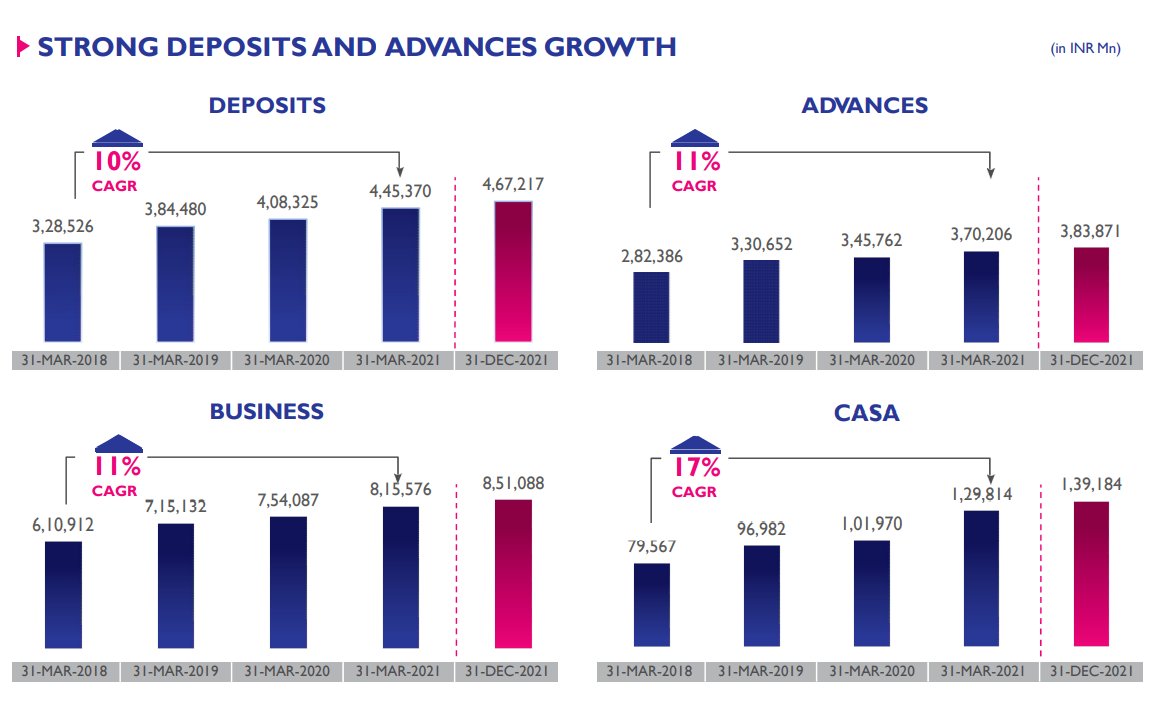

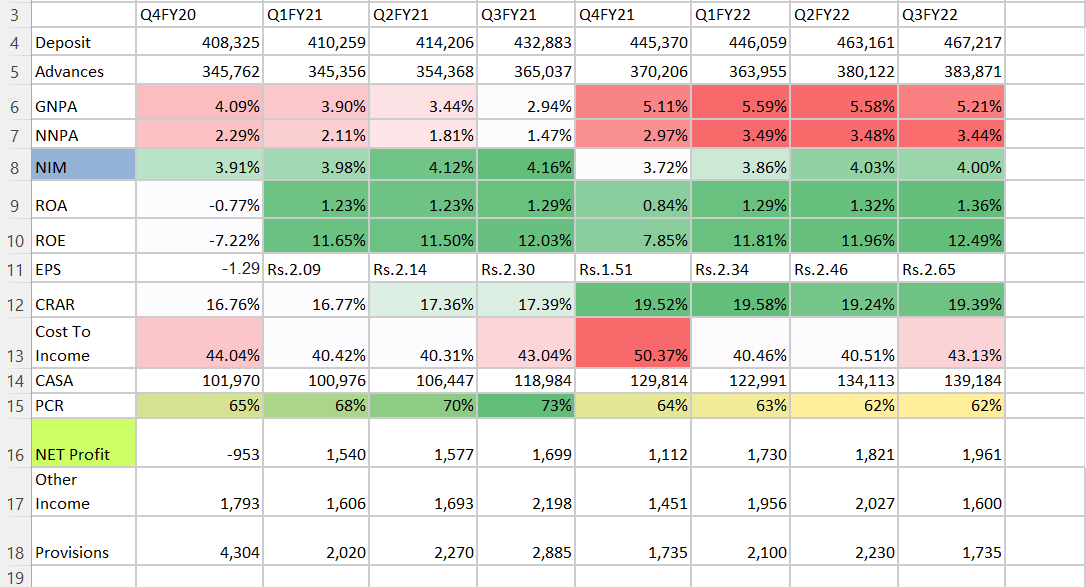

Deposits grew from 40k Cr in Q4 FY20 to 46K Cr in Q3FY22

Advances grew from 34k Cr to 38K Cr.

NIMs have remained stable around 4%

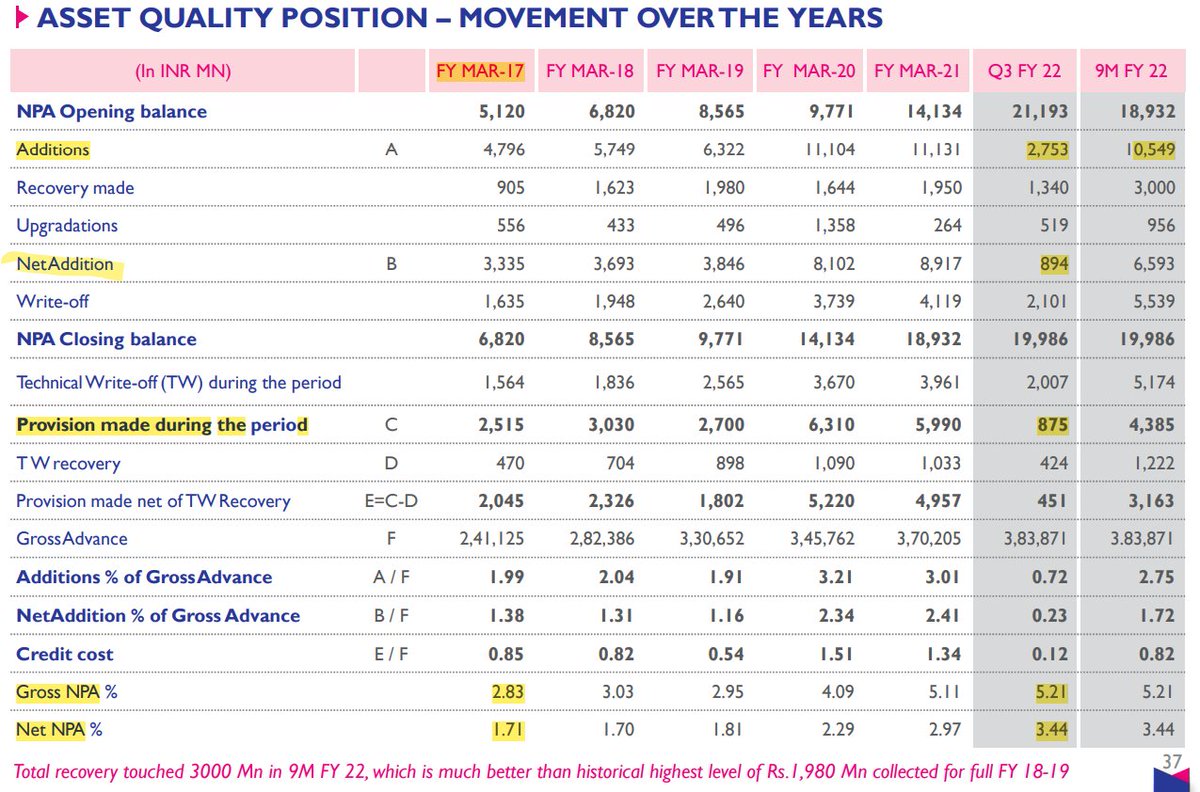

NPA shot up from 3% to >5%.

ROE dipped to 10-11%

ROA has been below 1.5%

But after hitting a high of 5.59% in Q1FY22, NPAs have been coming down as thing are getting stable.

- Have maintained ROA of > 1.5% from 2010-2020

- ROE >14%

- Around 1-1.2% Credit Cost ( Even after giving high risk loans like MSME & Agriculture Loans)

- 89% directors on board are independent directors

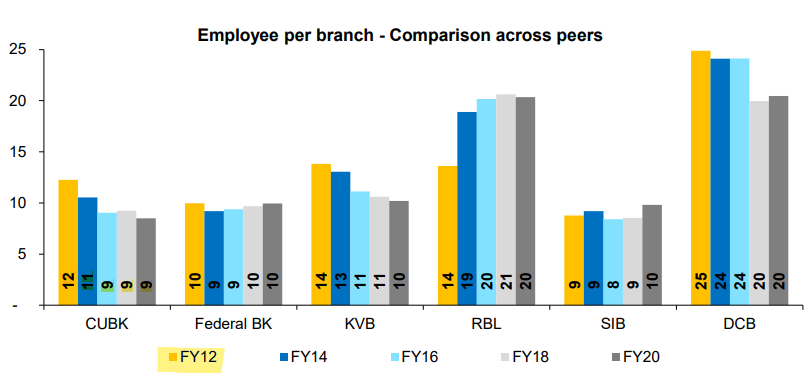

- Has added 45 branches & 300 employees every year from 2010-2020

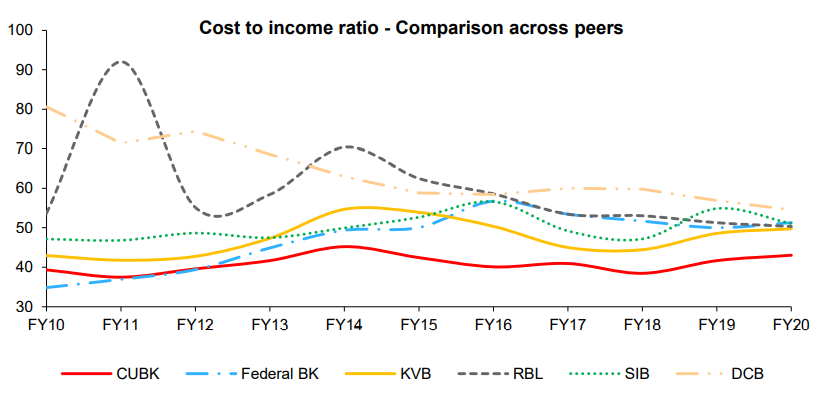

- Cost to income Ratio has been lower around 40-43% , which is lower than it's peers.

- Lower staff expense as compared to peers.

- Fully integrated mobile banking App

- Key chain debit card & Smart watch payment system

- Was amongst the earliest bank to embark on digital journey, hired TCS for Core Banking Solutions back in around 2001.

Mr N kamakodi one of the most trusted and respected banker have been the CEO since 2011

Good thing is, provisions have come down & new additions are also coming down.

Gold loan portfolio is strong with <1% NPA.

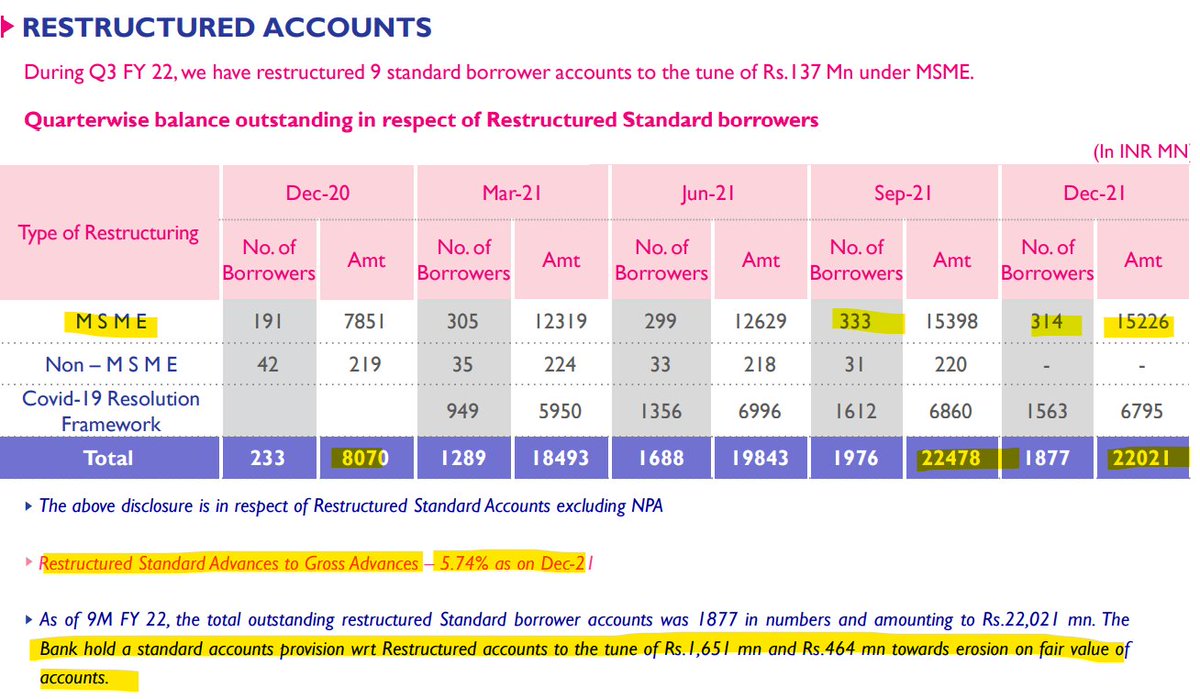

Total no. of restructured accounts have come down QoQ.

Bank holds around 1400 Cr provision for restructures accounts.

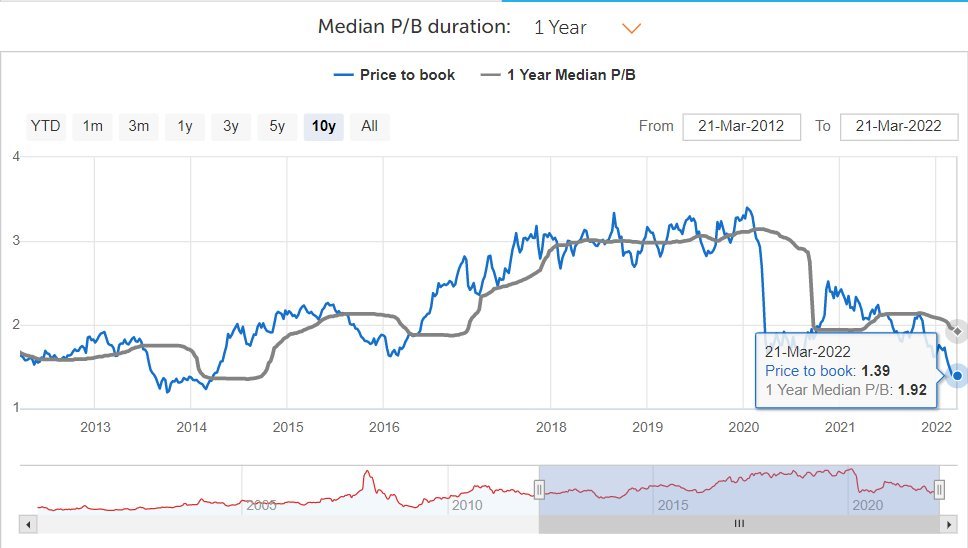

Currently available near decade low p/b can be a good opportunity.

Disclosure - Invested, Not a recommendation

@suru27 @shubhfin @saketreddy @ishmohit1 @soicfinance @sahil_vi @DrdhimanBhatta1 @Arthavruksha12 @badola_arjun

https://t.co/hTp6BSDF8r

A thread \U0001f9f5about a bank whose 2nd name is "Consistency" and it's name is - CITY UNION BANK

— The Average Trader. (@icanseeyourpix2) April 5, 2022

Grab a cup of water and relax because it's gonna be a verryyyy long thread.

And don't forget to Re-tweet for wider reach. pic.twitter.com/mfSgSBfLNc