The European Monetary System, set up in 1979, was an attempt to stabilise fx rates.

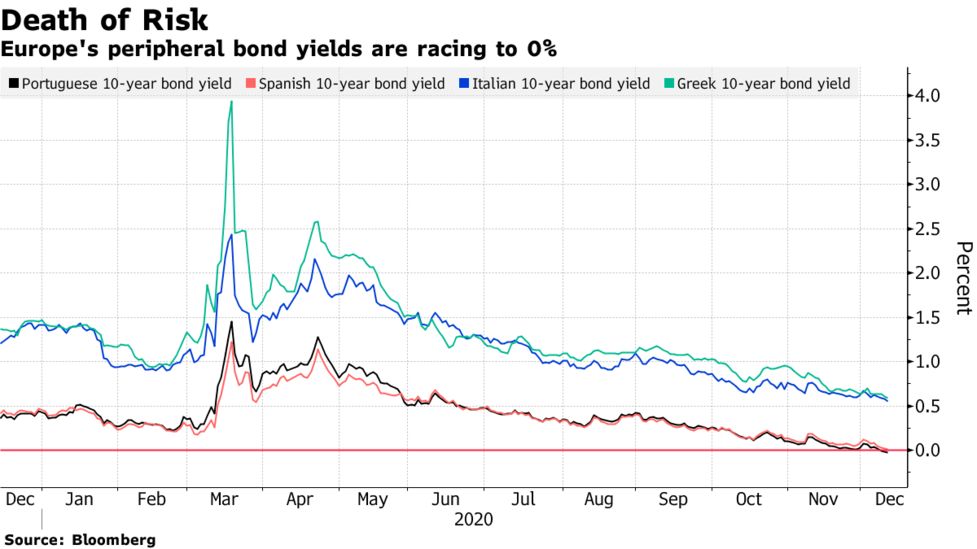

Last week the @ECB extended its current asset purchase program, now totalling €1.8 tn. Several EU states can borrow at negative interest rates.

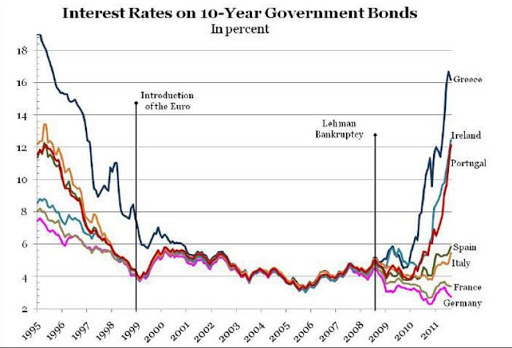

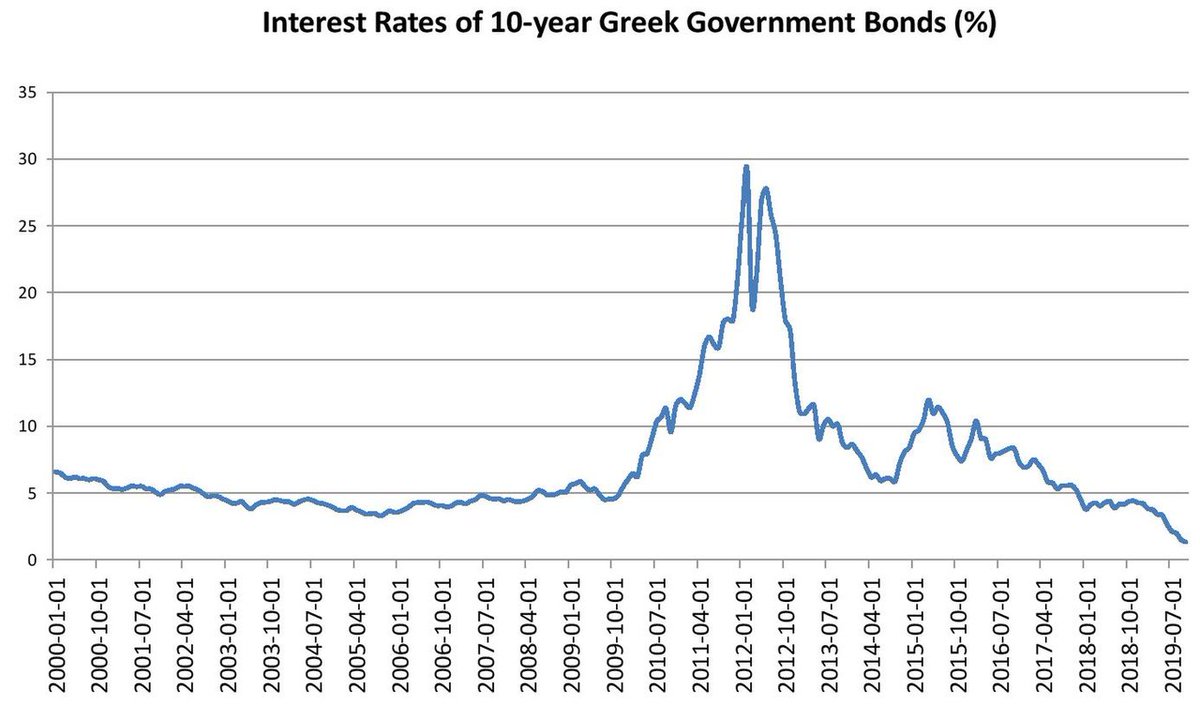

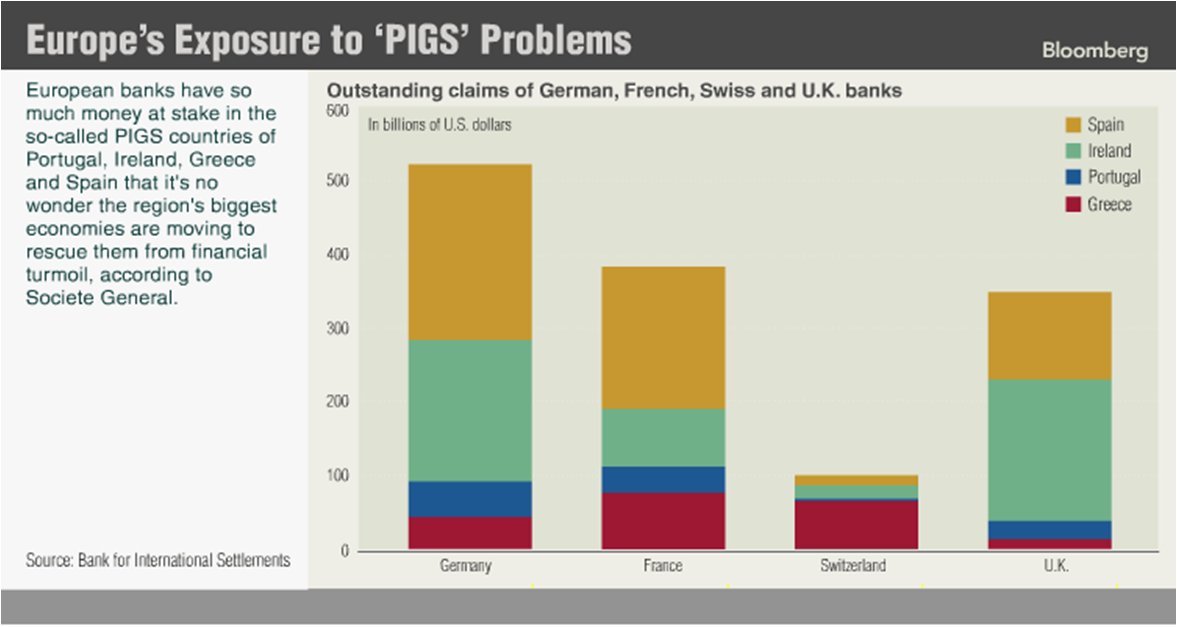

10 years ago, the eurozone almost collapsed, a result of a misconstructed currency that was meant to fail from the outset.

A thread👇

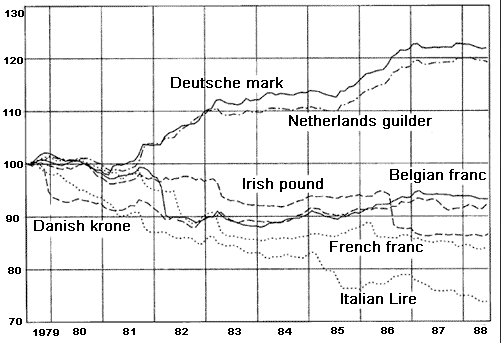

The European Monetary System, set up in 1979, was an attempt to stabilise fx rates.

The German Bundesbank refused to devalue the Mark when other centr. banks inflated their currencies - strengthening the Mark by comparison.

Northern countries like Germany & the Netherlands typically had more prudent monetary & fiscal policies.

Saturday marks the 30th anniversary of German reunification.

— HODLdax (@HODLdax) September 30, 2020

Did you that Germany had to sacrifice its national currency for it?

Let\u2019s look back at the fateful decisions leading to the Euro, a secretive project driven by much political interest and little economic reason.\U0001f447 pic.twitter.com/XcWgBOr29O

- Public deficit not higher than 3% of GDP

- Public debt not higher than 60% of GDP

Regardless of the stability criteria, the European Council could decide with a qualitative majority to admit countries to the eurozone.

https://t.co/EGPXDJygb7

Greece revealed a public debt of 113% of GDP & deficit of 13.6% of GDP as opposed to the reported 6.7%.

https://t.co/EkUfWTrKoy

In 2014, the ECB started an unprecedented monetary experiments with catastrophic side effects. Time to sum up what happened & the impact on various aspects of the economy, especially in my home country Germany.

— HODLdax (@HODLdax) August 27, 2020

\U0001f447\U0001f447\U0001f447

More from Bank

You May Also Like

Imagine for a moment the most obscurantist, jargon-filled, po-mo article the politically correct academy might produce. Pure SJW nonsense. Got it? Chances are you're imagining something like the infamous "Feminist Glaciology" article from a few years back.https://t.co/NRaWNREBvR pic.twitter.com/qtSFBYY80S

— Jeffrey Sachs (@JeffreyASachs) October 13, 2018

The article is, at heart, deeply weird, even essentialist. Here, for example, is the claim that proposing climate engineering is a "man" thing. Also a "man" thing: attempting to get distance from a topic, approaching it in a disinterested fashion.

Also a "man" thing—physical courage. (I guess, not quite: physical courage "co-constitutes" masculinist glaciology along with nationalism and colonialism.)

There's criticism of a New York Times article that talks about glaciology adventures, which makes a similar point.

At the heart of this chunk is the claim that glaciology excludes women because of a narrative of scientific objectivity and physical adventure. This is a strong claim! It's not enough to say, hey, sure, sounds good. Is it true?

If everyone was holding bitcoin on the old x86 in their parents basement, we would be finding a price bottom. The problem is the risk is all pooled at a few brokerages and a network of rotten exchanges with counter party risk that makes AIG circa 2008 look like a good credit.

— Greg Wester (@gwestr) November 25, 2018

The benign product is sovereign programmable money, which is historically a niche interest of folks with a relatively clustered set of beliefs about the state, the literary merit of Snow Crash, and the utility of gold to the modern economy.

This product has narrow appeal and, accordingly, is worth about as much as everything else on a 486 sitting in someone's basement is worth.

The other product is investment scams, which have approximately the best product market fit of anything produced by humans. In no age, in no country, in no city, at no level of sophistication do people consistently say "Actually I would prefer not to get money for nothing."

This product needs the exchanges like they need oxygen, because the value of it is directly tied to having payment rails to move real currency into the ecosystem and some jurisdictional and regulatory legerdemain to stay one step ahead of the banhammer.